TIDMCTO

RNS Number : 4419H

TClarke PLC

01 August 2019

TClarke plc

Half Year Results for the six months ended 30th June 2019

TClarke plc ("the Group" or "TClarke"), the Building Services

Group, announces its half year results for the six months ended

30th June 2019.

Business Highlights:

-- Revenue up 12% to GBP171.3 million.

-- Underlying operating margin increased to 2.9% from 2.6%.

-- Cash of GBP3.6 million.

-- 14% increase in interim dividend to 0.75p per share (30th June 2018: 0.66p per share).

-- GBP370 million forward order book maintained (30th June 2018: GBP370 million).

Financial Highlights: Change 2019 2018

Revenue +12% GBP171.3m GBP153.5m

------------- ------------- -------------

Operating profit - underlying(1) (EBIT) +25% GBP5.0m GBP4.0m

------------- ------------- -------------

Operating profit - underlying(1,3) See (3) below GBP6.0m GBP4.2m

before depreciation and amortisation

(EBITDA)

------------- ------------- -------------

Operating profit - reported +11% GBP4.9m GBP4.4m

------------- ------------- -------------

Operating margin - underlying(1) +12% 2.9% 2.6%

------------- ------------- -------------

Profit before tax - underlying(1) +24% GBP4.6m GBP3.7m

------------- ------------- -------------

Profit before tax - reported +10% GBP4.5m GBP4.1m

------------- ------------- -------------

Net cash -23% GBP3.6m GBP4.7m

------------- ------------- -------------

Earnings per share - underlying(2) +23% 8.67p 7.06p

------------- ------------- -------------

Earnings per share - underlying (diluted)(2) +19% 8.24p 6.91p

------------- ------------- -------------

Earnings per share - basic +8% 8.46p 7.83p

------------- ------------- -------------

Interim dividend per share +14% 0.75p 0.66p

------------- ------------- -------------

Forward order book GBP370m GBP370m

------------- ------------- -------------

(1) Underlying profit is operating profit before amortisation of

intangible assets and non-underlying items.

(2) Underlying earnings per share is calculated by dividing

underlying profit after tax by the weighted average number of

shares in issue.

(3) 2019 EBITDA calculated in accordance with IFRS16; 2018 has

not been restated in accordance with the standard

Mark Lawrence, Chief Executive, commented

"The Board is pleased with these results which demonstrate that

TClarke is in excellent shape. The success of our strategy of

targeting repeat work for blue chip clients, balanced with sensible

growth, focusing on improving margins and seeking new markets

aligned to our core business, is firmly reflected in our

results.

Looking ahead, the Board is confident that the Group will

deliver a performance for the full year in line with current market

expectations. We remain very selective about the quality of the

work that we take on and despite some competitive pressures, our

order book has been maintained at GBP370 million.

September will see our annual intake of apprentices commencing

their training with TClarke and yet again the business is making

this important investment in our future workforce. We wish the 50

apprentices joining us across the UK all the success for their

future years with TClarke."

Date: 1st August 2019

For further information contact:

TClarke plc

Mark Lawrence Trevor Mitchell David Lanchester

Group Chief Executive Finance Director Company Secretary

Tel: 020 7997 7400 Tel: 020 7997 7400 Tel: 020 7997 7400

www.tclarke.co.uk

N+1 Singer (Financial Adviser and Broker) RMS Partners

Sandy Fraser Simon Courtenay

Rachel Hayes Tel: 020 3735 6551

Tel: 020 7496 3000

www.nplus1singer.com

Trading

The Group has had a strong first six months of 2019 and the

results we have delivered are in line with the Board's expectations

for the period.

Underlying operating profit for the six months was GBP5.0

million (2018: GBP4.0 million), with revenues of GBP171.3 million

(2018: GBP153.5 million). Underlying operating margin across the

Group improved to 2.9% (2018: 2.6%).

TClarke has reorganized into three Operating Regions; UK North,

UK South and London. Both London and UK South have reported strong

underlying operating margins for the first six months of 4.3% and

3.8% respectively.

At 30th June 2019 the Group had cash of GBP3.6 million and

unutilised bank facilities of GBP25 million. The half year net cash

position reflects the Group's typical working capital profile and

the cycle of our contracts, with absorption of cash during the

first half of the financial year a normal pattern.

Dividend

The Board proposes an increased interim dividend of 0.75p (2018:

0.66p). This will be paid on 4th October 2019 to shareholders on

the register at 6th September 2019.

Order Book

Our forward order book, which only reflects contracts where we

have a firm commitment to proceed, has remained resilient and of

high quality, standing at GBP370 million (2018: GBP370 million).

Revenues secured for delivery in the current year total GBP327

million, representing 96% of our expected revenue for the year.

GBP182 million is secured for 2020 and GBP34 million for 2021 and

beyond.

Operational Review

The Group is managed in three operational areas, London, UK

South and UK North, providing nationwide coverage from nineteen

locations across the UK. Our new subsidiary, TClarke Europe is

actively tendering Data Centre opportunities in Europe, leveraging

our UK Data Centre knowledge and track record.

We focus on repeat customers and framework contracts in the

following key markets

-- Infrastructure

-- Residential & Accommodation

-- Facilities Management & Frameworks

-- Technologies

-- M&E Contracting

TClarke - London

30 06 2019 30 06 2018

(GBPm) (GBPm)

Revenue 101.1 92.5

----------- -----------

Underlying operating profit 4.3 3.7

----------- -----------

Underlying operating profit margin 4.3% 4.0%

----------- -----------

Order book 236 238

----------- -----------

London is the most significant of our three operating divisions

in terms of size and profitability and includes our combined

M&E London business, our London technology business (Eton and

Intelligent Buildings) and our off-site prefabrication facility at

Stansted.

Operating margins improved to 4.3%, continuing the strong

performance in London over the last three years.

We are on site at a number of high-profile London schemes

including

-- 22 Bishopsgate

-- 100 Bishopsgate

-- 1 Bishopsgate Plaza

-- Battersea Power Station

-- KGX1 at Kings Cross

-- 1 Triton Square

-- The Minories Hotel

-- South Bank Place

-- The Peninsular Hotel.

TClarke - UK South

30 06 2019 30 06 2018

(GBPm) (GBPm)

Revenue 36.4 35.8

----------- -----------

Underlying operating profit 1.4 0.8

----------- -----------

Underlying operating profit / (loss) margin 3.8% 2.2%

----------- -----------

Order book 66 59

----------- -----------

UK South operates from our offices at Birmingham, Derby,

Kimbolton, Peterborough, Portishead, Plymouth and St Austell, and

is able to target a vast range of construction and facilities

management opportunities across the region. During 2018 we added a

specialist air conditioning capability, which has increased the

range of services we can offer to clients.

Our strategy of targeting medium sized projects has produced a

strong first half performance, with profits increasing by 75%.

Current Schemes include:

-- Dyson Technology Centre, Wiltshire

-- Aspire Defence, accommodation upgrade programme

-- Bath Spa University, new Art & Design campus

-- Various John Lewis and Waitrose Stores

-- Hendon, residential development

-- Colston Hall, concert venue redevelopment, Bristol

TClarke - UK North

30 06 2019 30 06 2018

(GBPm) (GBPm)

Revenue 33.8 28.1

----------- -----------

Underlying operating profit 0.8 1.1

----------- -----------

Underlying operating profit margin 2.4% 3.9%

----------- -----------

Order book 68 73

----------- -----------

UK North division operates from eight locations; Liverpool,

Manchester, Chorley, Leeds, Newcastle, Falkirk, Aberdeen and

Dumfries.

Underlying operating profit has fallen by GBP0.3 million partly

due to the investment in the Liverpool and Manchester offices ahead

of securing work in those areas. We are actively pursuing a number

of exciting opportunities in those areas which are due to commence

at the end of 2019 or early 2020.

Current Schemes include:

-- Springfields Nuclear Fuels

-- BAE systems at Samlesbury and Warton.

-- Sedburgh new leisure centre, Bradford

-- Maiden Castle Sports Centre, Durham University

-- Forth Valley College, Falkirk

-- Various residential schemes for Cala Homes, Taylor Wimpey, Barrett Homes

Pensions

An actuarial loss of GBP2.6 million, net of tax, has been

recognised in reserves during the period, with the pension scheme

deficit increasing to GBP26.1 million (30th June 2018: GBP18.9

million). The increase in the deficit is the result of the discount

rate falling by 0.6% to 2.4%; the effect of which has been

partially offset by investment performance in the period exceeding

the long term assumption. In accordance with the Group's agreed

deficit reduction plan, described in detail in the most recent

annual report, the annual deficit reduction contribution is set at

GBP1.5 million for the current year, and will remain at this amount

until the review of the next triennial actuarial valuation of the

scheme currently being undertaken.

Banking Facilities

The Group has a GBP10 million overdraft facility, repayable on

demand, and a GBP15 million revolving credit facility expiring 31st

August 2022. At the half year point, these facilities were

unutilised and remain available to support the Group's work flows

and funding demands during the course of the year.

Summary and Outlook

TClarke has made a strong start to the year and we are pleased

to report that we continue to expect revenues and profits for 2019

to be in line with current market expectations. To put those in

context, for the year ending 31st December 2019, these are forecast

to be revenues of GBP340 million, underlying EBIT of GBP10.2

million, underlying PBT of GBP9.3 million and underlying EPS of

17.5p.

Our long-standing client base, particularly in the London

market, is frustrated by the ongoing political uncertainty and we

are seeing some new schemes being held back as a result. Despite

this, we remain busy and there are many active discussions with our

clients indicating that schemes could be accelerated once the

political situation becomes clearer.

The strength of TClarke has been our focus for delivery across a

broad range of target markets. We are investing in new geographical

regions in the UK, in particular Manchester and Liverpool,

leveraging our UK Data Centre knowledge and track record entering

European markets in addition to promoting our broader Technologies

offering.

In conclusion, the Board remains cautiously optimistic about the

Group's future prospects and we look forward to updating

shareholders on the progress that we make during the second half of

the financial year.

Condensed consolidated income statement

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

to to to

30 06 2019 30 06 2018 31 12 2018

GBPm GBPm GBPm

Revenue 171.3 153.5 326.8

Cost of sales (149.5) (136.1) (287.6)

----------- ----------- -----------

Gross profit 21.8 17.4 39.2

Other operating income - -

Administrative expenses:

----------- ----------- -----------

Amortisation of intangible assets (0.1) (0.1) (0.2)

Non-underlying costs - 0.5 -

Other administrative expenses (16.8) (13.4) (30.4)

----------- ----------- -----------

Total administrative expenses (16.9) (13.0) (30.6)

Operating profit 4.9 4.4 8.6

Finance costs (0.4) (0.3) (0.8)

----------- ----------- -----------

Profit before taxation 4.5 4.1 7.8

Taxation (0.9) (0.8) (1.6)

----------- ----------- -----------

Profit for the period 3.6 3.3 6.2

Earnings per share

Attributable to owners of TClarke

plc

Basic 8.46p 7.83p 14.99p

Diluted 8.03p 7.67p 14.61p

----------- ----------- -----------

Condensed consolidated statement of comprehensive income

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

to to to

30 06 2019 30 06 2018 31 12 2018

GBPm GBPm GBPm

Profit for the period 3.6 3.3 6.2

Other comprehensive expense

Items that will not be reclassified

to profit or loss

Actuarial profit/(loss) on defined

benefit pension scheme, net of tax (2.6) 3.7 0.7

Other comprehensive expense for the

period, net of tax (2.6) 3.7 0.7

Total comprehensive income for

the period 1.0 7.0 6.9

----------- ----------- -----------

Condensed consolidated statement of financial position

Unaudited Unaudited Audited

30 06 2019 30 06 2018 31 12 2018

GBPm GBPm GBPm

Non-current assets

Intangible assets 25.5 25.8 25.7

Property, plant and equipment 8.7 4.8 4.9

Deferred taxation 4.5 3.1 3.9

----------- ----------- -----------

Total non-current assets 38.7 33.7 34.5

----------- ----------- -----------

Current assets

Inventories 0.3 - 0.3

Amounts due from customers under construction

contracts 39.2 22.5 26.4

Trade and other receivables 67.2 59.0 68.7

Cash and cash equivalents 3.6 9.7 12.4

----------- ----------- -----------

Total current assets 110.3 91.2 107.8

----------- ----------- -----------

Total assets 149.0 124.9 142.3

----------- ----------- -----------

Current liabilities

Borrowings - - -

Amounts due to customers under construction

contracts (7.9) (2.7) (8.4)

Trade and other payables (88.4) (75.1) (87.8)

Current tax liabilities (1.0) (0.8) (1.0)

Obligations under finance leases (4.1) (0.1) -

----------- ----------- -----------

Total current liabilities (101.4) (78.7) (97.2)

----------- ----------- -----------

Net current assets 8.9 12.5 10.6

----------- ----------- -----------

Non-current liabilities

Bank loans - (5.0) -

Retirement benefit obligation (26.1) (18.9) (23.0)

Total non-current liabilities (26.1) (23.9) (23.0)

----------- ----------- -----------

Total liabilities (127.5) (102.6) (120.2)

Net assets 21.5 22.3 22.1

----------- ----------- -----------

Equity attributable to owners of the

parent

Share capital 4.3 4.2 4.3

Share premium 3.8 3.1 3.7

ESOT share reserve (2.0) (0.8) (1.4)

Revaluation reserve 0.5 0.5 0.5

Retained earnings 14.9 15.3 15.0

----------- ----------- -----------

Total equity 21.5 22.3 22.1

----------- ----------- -----------

Condensed consolidated statement of cash flows

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

to to to

30 06 2019 30 06 2018 31 12 2018

GBPm GBPm GBPm

Net cash (used in) / generated by operating

activities (see note 6A) (6.1) (5.4) 3.5

----------- ------------- -----------

Investing activities

Acquisition of subsidiary, net of cash

acquired - (0.3) (0.5)

Purchase of property, plant and equipment (0.1) (0.1) (0.5)

Receipts on disposal of property, plant

and equipment - - -

Net cash used in investing activities (0.1) (0.4) (1.0)

----------- ------------- -----------

Financing activities

New shares issuance 0.1 0.7

Facility fee (0.1) (0.2)

Repayment of bank borrowing - - (5.0)

Equity dividends paid (1.4) (1.2) (1.5)

Acquisition of shares by ESOT (0.6) - (0.7)

Repayment of HP and finance lease obligations (0.6) - (0.1)

Net cash used in financing activities (2.6) (1.2) (6.8)

----------- ------------- -----------

Net decrease in cash and cash equivalents (8.8) (7.0) (4.3)

Cash and cash equivalents at beginning

of period 12.4 16.7 16.7

----------- ------------- -----------

Cash and cash equivalents at end of period

(see note 6) 3.6 9.7 12.4

----------- ------------- -----------

Condensed consolidated statement of changes in equity

For the six months ended 30th June 2019

ESOT

Share Share share Revaluation Retained

capital premium reserve reserve earnings Total

GBPm GBPm GBPm GBPm GBPm GBPm

At 1st January 2019 4.3 3.7 (1.4) 0.5 15.0 22.1

---------- ---------- --------- ------------ ----------- --------

Comprehensive income

Profit for the period - - - - 3.6 3.6

Other comprehensive income

Actuarial loss on retirement

benefit obligation - - - - (3.1) (3.1)

Deferred income tax on

actuarial loss on retirement

benefit obligation - - - - 0.5 0.5

Total other comprehensive

expense - - - - (2.6) (2.6)

---------- ---------- --------- ------------ ----------- --------

Total comprehensive income - - - - 1.0 1.0

---------- ---------- --------- ------------ ----------- --------

Transactions with owners

New shares - 0.1 - - - 0.1

Dividends paid - - - - (1.4) (1.4)

Shares based payment credit - - - - 0.3 0.3

Shares acquired by ESOT - - (0.6) - - (0.6)

Total transactions with owners - 0.1 (0.6) - (1.1) (1.6)

---------- ---------- --------- ------------ ----------- --------

At 30th June 2019 4.3 3.8 (2.0) 0.5 14.9 21.5

---------- ---------- --------- ------------ ----------- --------

Condensed consolidated statement of changes in equity

For the six months ended 30th June 2018

ESOT

Share Share share Revaluation Retained

capital premium reserve reserve earnings Total

GBPm GBPm GBPm GBPm GBPm GBPm

At 1st January 2018 4.2 3.1 (0.8) 0.5 9.4 16.4

---------- ---------- --------- ------------ ----------- --------

Comprehensive income

Profit for the period - - - - 3.3 3.3

Other comprehensive income

Actuarial gain on retirement

benefit obligation - - - - 4.5 4.5

Deferred income tax on

actuarial gain on retirement

benefit obligation - - - - (0.8) (0.8)

Total other comprehensive

expense - - - - 3.7 3.7

---------- ---------- --------- ------------ ----------- --------

Total comprehensive income - - - - 7.0 7.0

---------- ---------- --------- ------------ ----------- --------

Transactions with owners

Dividends paid - - - - (1.2) (1.2)

Shares based payment credit - - - - 0.1 0.1

Total transactions with owners - - (0.8) - (1.1) (1.1)

---------- ---------- --------- ------------ ----------- --------

At 30th June 2018 4.2 3.1 (0.8) 0.5 15.3 22.3

---------- ---------- --------- ------------ ----------- --------

Condensed consolidated statement of changes in equity

For the year ended 31st December 2018

ESOT

Share Share share Revaluation Retained

capital premium reserve reserve earnings Total

GBPm GBPm GBPm GBPm GBPm GBPm

At 1st January 2018 4.2 3.1 (0.8) 0.5 9.4 16.4

---------- ---------- --------- ------------ ----------- --------

Comprehensive income

Profit for the year - - - - 6.2 6.2

Other comprehensive income

Actuarial gain on retirement

benefit obligation - - - - 0.8 0.8

Deferred income tax on

actuarial gain on retirement

benefit obligation - - - - (0.1) (0.1)

Total other comprehensive

income - - - - 0.7 0.7

---------- ---------- --------- ------------ ----------- --------

Total comprehensive income - - - - 6.9 6.9

---------- ---------- --------- ------------ ----------- --------

Transactions with owners

New shares 0.1 0.6 - - - 0.7

Share based payment credit - - - - 0.2 0.2

Shares acquired by ESOT - - (0.7) - - (0.7)

Shares distributed to ESOT - - 0.1 - - 0.1

Dividends paid - - - - (1.5) (1.5)

--------- ------------

Total transactions with owners 0.1 0.6 (0.6) - (1.3) (1.2)

---------- ---------- --------- ------------ ----------- --------

At 31st December 2018 4.3 3.7 (1.4) 0.5 15.0 22.1

---------- ---------- --------- ------------ ----------- --------

Notes to the condensed consolidated financial statements for the

six months to 30th June 2019

Note 1 - Basis of preparation

TClarke plc (the 'company') is a company incorporated and

domiciled in the United Kingdom. The nature of the Group's

operations and its principal activities are set out in Note 2 below

and in the interim management report. The consolidated interim

financial statements comprise the condensed financial statements of

the company and its subsidiaries (together the 'Group').

These condensed interim financial statements do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The statutory accounts for the year ended 31st

December 2018 were approved by the Board of Directors on 26th March

2019 and have been delivered to the Registrar of Companies and a

copy has been made available on the company's website at

www.tclarke.co.uk. The auditors' report on those accounts was

unqualified and did not contain any statement under section 498 of

the Companies Act 2006.

These interim financial statements have been prepared in

accordance with International Accounting Standard 34 'Interim

Financial Reporting' ('IAS 34) as adopted by the European Union,

and the Disclosure and Transparency Rules ('DTR') of the Financial

Conduct Authority. They do not include all the information required

for the full annual financial statements and should be read in

conjunction with the financial statements of the Group as at and

for the year ended 31st December 2018.

The interim financial statements have not been audited or

reviewed by the company's auditors.

Accounting policies

Except as described below, the financial statements have been

prepared using the accounting policies and presentation that were

applied in the audited financial statements for the year ended 31st

December 2018.

Taxes on income in the interim periods are accrued using the

estimated effective tax rate that would be applicable to expected

total annual earnings.

Estimates and financial risk management

The preparation of interim financial statements requires the

Directors to make judgements, estimates and assumptions about the

carrying amounts of assets and liabilities at the reporting date

and the amounts of revenue and expense incurred during the period

that may not be readily apparent from other sources. The estimates

and associated assumptions are based on historical experience and

other factors that are considered to be relevant. Actual results

may differ from these estimates.

In preparing these interim financial statements, the significant

judgements made by the Directors in applying the Group's accounting

policies and the key sources of uncertainty together with the

Group's financial risk management objectives and policies were the

same as those that applied to the financial statements as at and

for the year ended 31st December 2018. The principal risks and

uncertainties continue to be those which are set out on pages 31-33

of the Group's annual report and accounts for the year ended 31st

December 2018, under the following headings: Political, economic

and market conditions; Financial strength; Reputation; Winning new

work; Contract delivery; People and skills; Health and safety;

Supply chain; Pensions; and Cyber security.

Going concern

Our banking facilities comprised a GBP15 million revolving

credit facility committed to 31st August 2022, all of which was

undrawn at 30th June 2019, and a GBP10 million overdraft facility.

The Group draws on the overdraft facility as and when needed to

meet working capital requirements. As with all such facilities the

overdraft is subject to annual review and is repayable on

demand.

To support the Group's operations we also have available bonding

facilities of GBP40.1 million, of which GBP22.5 million is

currently unutilised.

After making appropriate enquiries, the Directors are satisfied

that the Company and Group have adequate resources to continue

their operations for the foreseeable future. Accordingly, the

Directors continue to adopt the going concern basis in preparing

the financial statements.

IFRS 16

IFRS 16 was adopted by the Group from 1st January 2019. In

accordance with the standard, the Group now recognises a lease

liability reflecting future lease payments and a 'right of use

asset' for almost all lease contracts, whereas, previously a

distinction was drawn between finance leases and operating leases

depending on whether substantially all the risk and reward of

ownership have been transferred to the lessee.

The quantitative impact of the initial application of the

standard is outlined on page 83 of the Group's annual report and

accounts for the year ended 31stDecember 2018.

The group has elected to adopt the modified retrospective

approach whereby the standard is applied from the beginning of the

current period and, as a result, prior-period financial information

is not restated.

Note 2 - Segmental information

The Group provides electrical and mechanical contracting and

related services to the construction industry and end users.

For management and internal reporting purposes the Group is

organised geographically into three regional divisions; London, UK

South and UK North, reporting to the Chief Executive, who is the

chief operating decision maker. This segmentation differs from that

which was present in the most recent annual accounts in which there

were four geographical segments. Prior period information has been

restated in accordance with the current reporting segment

lines.

30th June 2019

Group costs

and Unallocated

London UK South UK North GBPm Total

GBPm GBPm GBPm GBPm

Revenue from contracts with

customers 101.1 36.4 33.8 - 171.3

--------- ----------- ----------- ------------------ --------

Underlying operating profit 4.3 1.4 0.8 (1.5) 5.0

Non-underlying costs - - - - -

Amortisation of intangibles - - (0.1) - (0.1)

Operating profit 4.3 1.4 0.7 (1.5) 4.9

Finance costs - - - (0.4) (0.4)

--------- ----------- ----------- ------------------ --------

Profit before tax 4.3 1.4 0.7 (1.9) 4.5

--------- ----------- ----------- ------------------

Taxation expense (0.9)

--------

Profit for the period 3.6

--------

London UK South UK North Total

GBPm GBPm GBPm GBPm

Business sector

--------- ----------- ----------- --------

Facilities Management and Frameworks 1.7 4.6 7.1 13.4

Infrastructure 7.9 13.1 8.2 29.2

M&E Contracting 59.5 13.2 5.3 78.0

Residential & Accommodation 7.9 4.0 11.5 23.4

Technologies 24.1 1.5 1.7 27.3

Total revenue 101.1 36.4 33.8 171.3

--------- ----------- ----------- --------

30th June 2018

Group costs

and Unallocated

London UK South UK North GBPm Total

GBPm GBPm GBPm GBPm

Revenue from contracts with

customers 92.5 35.8 25.2 - 153.5

--------- ----------- ----------- ------------------ --------

Underlying operating profit 3.7 0.8 1.1 (1.6) 4.0

Non-underlying costs 0.5 - - - 0.5

Amortisation of intangibles - - (0.1) - (0.1)

Operating profit 4.2 0.8 1.0 (1.6) 4.4

Finance costs - - - (0.3) (0.3)

--------- ----------- ----------- ------------------ --------

Profit before tax 4.2 0.8 1.0 (1.9) 4.1

--------- ----------- ----------- ------------------

Taxation expense (0.8)

--------

Profit for the period 3.3

--------

London UK South UK North Total

GBPm GBPm GBPm GBPm

Business sector

--------- ----------- ----------- --------

Facilities Management and Frameworks 0.8 5.9 3.0 9.7

Infrastructure 7.9 4.1 12.8 24.8

M&E Contracting 74.3 6.4 10.9 91.6

Residential & Accommodation 0.4 7.6 8.2 16.2

Technologies 9.1 1.2 0.9 11.2

Total revenue 92.5 25.2 35.8 153.5

--------- ----------- ----------- --------

31st December 2018

Group costs

and Unallocated Total

London UK South UK North GBPm GBPm

GBPm GBPm GBPm

Revenue from contracts with

customers 196.5 73.0 57.3 - 326.8

--------- ----------- ----------- ------------------ --------

Underlying operating profit 7.2 1.8 2.8 (3.0) 8.8

Amortisation of intangibles - - (0.2) - (0.2)

Operating profit 7.2 1.8 2.6 (3.0) 8.6

Finance costs - - - (0.8) (0.8)

--------- ----------- ----------- ------------------ --------

Profit before tax 7.2 1.8 2.6 (3.8) 7.8

--------- ----------- ----------- ------------------

Taxation expense (1.6) (1.6)

--------

Profit for the period 6.2

--------

London UK South UK North Total

GBPm GBPm GBPm GBPm

Business sector

--------- ----------- ----------- --------

Facilities Management and Frameworks 1.6 7.0 14.0 22.6

Infrastructure 13.8 29.6 12.5 55.9

M&E Contracting 137.7 26.1 10.5 174.3

Residential & Accommodation 1.4 10.0 19.7 31.1

Technologies 42.0 0.3 0.6 42.9

Total revenue 196.5 73.0 57.3 326.8

--------- ----------- ----------- --------

Note 3 - Taxation expense

The effective income tax rate applied for the period is 20.0%

(30th June 2018: 20.0%).

Note 4 - Earnings per share

A. Basic earnings per share

The earnings per share represent the profit for the period

divided by the weighted average number of ordinary shares in

issue.

Unaudited Unaudited Audited

30 06 2019 30 06 2018 31 12 2018

GBPm GBPm GBPm

Earnings

Profit attributable to owners of the

Company 3.6 3.3 6.2

Weighted average number of ordinary

shares (000s) 42,077 41,542 41,531

------------ ------------ -------------

Basic earnings per share 8.46 7.83 14.99

------------ ------------ -------------

B. Diluted earnings per share

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The company

has three categories of dilutive potential ordinary shares: share

options granted under the Savings Related Share Option Scheme, and

conditional share awards and options granted under the Equity

Incentive Plan. Further details of these schemes are given in note

19 of the 2018 annual report and financial statements.

Unaudited Unaudited Audited

30 06 2019 30 06 2018 31 12 2018

GBPm GBPm GBPm

Earnings

Profit attributable to owners of the

Company 3.6 3.3 6.2

3.6 3.3 6.2

------------ ------------ -------------

Weighted average number of ordinary

shares in issue (000s) 42,077 41,542 41,531

Adjustments

Savings Related Share Options (000s) 520 193 218

Equity Incentive Plan

Conditional share awards (000s) 1,691 666 873

Options (000s) 80 - -

------------ ------------ -------------

Weighted average number of ordinary

shares for diluted earnings per share

(000s) 44,368 42,401 42,622

------------ ------------ -------------

C. Underlying earnings per share

Underlying earnings per share represents the profit for the

period for the period adjusted for amortisation of intangible

assets and non-underlying costs and the tax effects of these items,

divided by the weighted average number of ordinary shares in issue.

Underlying earnings is the basis on which the performance of the

operating divisions is measured.

The underlying profit for the period is calculated as

follows:

Unaudited Unaudited Audited

30 06 2019 30 06 2018 31 12 2018

GBPm GBPm GBPm

Profit attributable to owners of the

company 3.6 3.3 6.2

Adjustments

Amortisation of intangible assets 0.1 0.1 0.2

Non-underlying items - (0.5) -

Tax effect of adjustments - 0.1 -

------------ ------------ -------------

Underlying profit after tax 3.7 3.0 6.4

------------ ------------ -------------

Weighted average number of ordinary

shares in issue (000s) 42,077 41,542 41,531

Adjustments

Savings Related Share Options (000s) 520 193 218

Equity Incentive Plan

Conditional share awards (000s) 1,691 666 649

Options (000s) 80 -

------------ ------------ -------------

Weighted average number of ordinary

shares for diluted earnings per share

(000s) 44,368 42,401 42,622

------------ ------------ -------------

Underlying earnings per share 8.67p 7.06p 14.98p

------------ ------------ -------------

Diluted underlying earnings per share 8.24p 6.91p 15.38p

------------ ------------ -------------

Note 5 - Interim dividend

An interim dividend of 0.75p per share (30th June 2018: 0.66p)

was approved by the board on 31st July 2019 and has not been

included as a liability as at 30th June 2019. The shares will go

ex-dividend on 5th September 2019 and the dividend will be paid on

4th October 2019 to shareholders on the register as at 6th

September 2019. A dividend reinvestment plan is available for

shareholders. Those shareholders who have not elected to

participate in this plan, and who would like to participate with

respect to the 2019 interim dividend, may do so by contacting Link

Asset Services on 0371 664 0381. The last day for election for the

interim dividend reinvestment is 13th September 2019 and any

requests should be made in good time ahead of that date.

Unaudited Unaudited Audited

30 06 2019 30 06 2018 31 12 2018

Dividends paid in period GBPm GBPm GBPm

Final dividends in respect of previous

year 1.4 1.2 1.2

Interim dividend in respect of the

current year - - 0.3

------------ ------------ -------------

Dividends recognised in the period 1.4 1.2 1.5

------------ ------------ -------------

Note 6 - Notes to the consolidated statement of cash flows

Unaudited Unaudited Audited

A. - Reconciliation of operating profit 30 06 2019 30 06 2018 31 12 2018

to net cash from operating activities GBPm GBPm GBPm

Operating profit 4.9 4.4 8.6

Depreciation charges 1.0 0.1 0.7

Profit on sale of property, plant

and equipment - - -

Equity settled share based payment

expense 0.2 0.1 0.3

Amortisation of intangible assets 0.1 0.1 0.2

Defined benefit pension scheme credit (0.3) (0.2) (0.2)

Operating cash flows before movements

in working capital 5.9 4.5 9.6

Decrease in inventories - 0.5 0.2

Decrease in contract balances (13.3) 1.1 2.9

Decrease / (Increase) in operating

trade and other receivables 1.6 8.6 (1.3)

(Decrease) / increase in operating

trade and other payables 0.6 (18.5) (5.2)

------------ ------------ ------------

Cash (used in) / generated by operations (5.2) (3.8) 6.2

Corporation tax paid (0.8) (1.5) (2.4)

Interest paid (0.1) (0.1) (0.3)

------------ ------------ ------------

Net cash (used in) / generated by

operating activities (6.1) (5.4) 3.5

------------ ------------ ------------

B. Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and other

short-term highly liquid investments that are readily convertible

into cash, less bank overdrafts.

C. Borrowings

At 30thJune 2019, the Group had unused overdraft facilities of

GBP10 million (30th June 2018: GBP5 million) and had drawn down

GBPNil (30th June 2018: GBP5 million) of its GBP15 million

committed three year Revolving Credit Facility.

Note 7 - Related party transactions

Transactions between the company and its subsidiary

undertakings, which are related parties, have been eliminated on

consolidation and are not disclosed in this note. Full disclosure

of the Group's other related party transactions is given in Note 22

to the Group's financial statements for the year ended 31st

December 2018. There have been no material changes in these

relationships in the six months ended 30th June 2019 that have

materially affected the financial position or performance of the

Group during that period.

Note 8 - Pension commitments

The present value of the defined benefit retirement benefit

scheme and the related past and current service costs were measured

using the projected unit credit method. The amount included in the

statement of financial position arising from the Group's

obligations in respect of its defined benefit retirement benefit

scheme is as follows:

Unaudited Unaudited Audited

30 06 2019 30 06 2018 31 12 2018

GBPm GBPm GBPm

Present value of defined benefit

obligations 68.0 59.2 58.7

Fair value of scheme assets (41.9) (40.3) (35.8)

------------- ------------- -------------

Deficit in scheme recognised

in the statement of financial

position 26.1 18.9 23.0

Key assumptions used

Rate of increase in salaries 2.65% 2.55% 2.65%

Rate of increase of pensions

in payment 3.10% 3.15% 3.10%

Discount rate 2.40% 2.80% 3.00%

Inflation assumption 3.35% 3.25% 3.35%

Unaudited Unaudited Audited

Mortality assumptions (years) 30 06 2019 30 06 2018 31 12 2018

Life expectancy at age 65 for

current pensioners:

Men 21.7 22.0 21.7

Women 23.9 24.4 23.9

Life expectancy at age 65 for

future pensioners

(current age 45)

Men 22.7 23.3 22.7

Women 25.2 25.8 25.2

Statement of Directors' responsibilities

The Directors confirm that the condensed interim financial

statements have been prepared in accordance with International

Accounting Standard 34 'Interim Financial Reporting' as adopted by

the European Union and that the interim management report includes

a fair review of the information required by DTR 4.2.7 and DTR

4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the year; and

-- material related party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report.

On behalf of the Board

Iain McCusker - Chairman

Mark Lawrence - Chief Executive

Trevor Mitchell - Finance Director

1st August 2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR DMGFNKMLGLZM

(END) Dow Jones Newswires

August 01, 2019 02:00 ET (06:00 GMT)

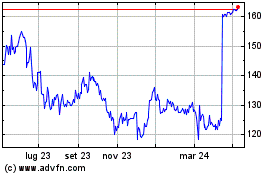

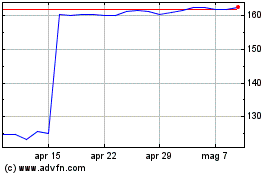

Grafico Azioni Tclarke (LSE:CTO)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tclarke (LSE:CTO)

Storico

Da Apr 2023 a Apr 2024