Standard Life Private Eqty Trst PLC Quarterly Trading Statement (0071O)

27 Settembre 2019 - 3:44PM

UK Regulatory

TIDMSLPE

RNS Number : 0071O

Standard Life Private Eqty Trst PLC

27 September 2019

Standard Life Private Equity Trust PLC

1. Investment update for the quarter ended 30 June 2019

-- The net asset value ("NAV") per ordinary share of Standard

Life Private Equity Trust PLC ("the Company") increased by 6.1% to

452.8 pence for the quarter ended 30 June 2019.

-- Realised gains and income on the unquoted portfolio during

the quarter ended 30 June 2019 totalled GBP12.6 million (1.9% of

NAV). The unrealised gain on a constant exchange rate basis was

GBP10.9 million (1.7% of NAV). In addition, there were unrealised

foreign exchange gains of GBP20.0 million (3.1% of NAV).

-- The first quarter dividend for the financial year ending 30

September 2019 of 3.2 pence per share was paid on 26 April 2019

-- 100.0% by value of the portfolio was valued by the respective

underlying managers at 30 June 2019

-- NAV total return was 6.8% for the three months from 1 April 2019 to 30 June 2019

-- Outstanding commitments were GBP450.2 million at 30 June 2019

-- Resources available for investment were GBP67.9 million at 30 June 2019

For the quarter ended 30 June 2019, the Company's NAV increased

by 6.1% to 452.8 pence per share, from 426.7 pence per share at 31

March 2019. At 30 June 2019, the Company's net assets were GBP696.2

million (31 March 2019 - GBP656.1 million). NAV total return was

6.8% for the three months from 1 April 2019 to 30 June 2019.

The closing value of the Company's unquoted portfolio, which,

included 62 private equity interests, was GBP628.0 million at 30

June 2019 (31 March 2019 - GBP571.2 million and 59 private equity

interests). The total unrealised gain on the unquoted portfolio for

the quarter ended 30 June 2019 was GBP30.9 million (5.4%),

comprising GBP10.9 million (1.9%) of unrealised gain on a constant

exchange rate basis and GBP20.0 million (3.5%) of unrealised

foreign exchange gains. The MSCI Europe Index (in sterling) and the

FTSE All Share Index (in sterling) both increased by 5.4% and 2.0%

respectively during the quarter. The unrealised foreign exchange

gains were driven by the euro and the US Dollar appreciating by

3.7% and 2.3% respectively, relative to sterling over the

quarter.

During the quarter ended 30 June 2019, the unquoted portfolio

generated GBP22.4 million of distributions (quarter ended 31 March

2019 - GBP20.5 million). The Company funded GBP29.4 million of

drawdowns (quarter ended 31 March 2019 - GBP24.9 million) into the

unquoted portfolio. The unquoted portfolio distributions received

during the quarter generated GBP12.6 million (2.2%) of net realised

gains and income. This was equivalent to a return of 2.3 times the

acquisition cost of the realised investments.

The Company made new primary fund commitments to Cinven 7

(EUR25.0 million), Advent International Global Private Equity IX

(EUR25.0m) and Great Hill Partners VII ($12.0m). The Company also

acquired, through a secondary purchase, an original commitment of

EUR9.0m to 3i Eurofund V. In addition, as part of active portfolio

management and to improve the quality of the Company's exposure by

vintage year, the Manager agreed the portfolio sale of 3 older

vintage commitments at a modest discount (total 31 December 2018

valuation of GBP5.0m).

The Company had total outstanding commitments to its 62 private

equity interests of GBP450.2 million at 30 June 2019 (31 March 2019

- GBP419.6 million to 59 private equity interests). The Manager

believes that around GBP85 million of the Company's outstanding

commitments at 30 June 2019 are unlikely to be drawn.

At 30 June 2019, the Company had resources available for

investment of GBP67.9 million (31 March 2019 - GBP84.6 million).

The Company continues to have an undrawn GBP80 million syndicated

revolving credit facility provided by Citibank and Societe Generale

that expires in December 2020.

2. Activity since 30 June 2019

On 26 July 2019, the Company paid the second quarter dividend

for the year ending 30 September 2019 of 3.2 pence per ordinary

share. The cost of the final dividend was GBP4.9 million. In

addition, the Company declared a third quarter dividend for the

year ending 30 September 2019 of 3.2 pence per ordinary share, to

be paid on 25 October 2019, to shareholders on the Company's share

register as at 20 September 2019.

During the period from 1 July 2019 to 13 September 2019 the

Company received GBP27.2 million of distributions and funded

GBP11.6 million of drawdowns.

A new primary fund commitment of EUR25.0m was made to IK IX in

July. Two secondary fund commitments were made/acquired: a EUR21.5m

investment in Vitruvian I CF (a concentrated portfolio of five

companies) in August; and a EUR25.0m investment in a portfolio of

European buyout interests (including IK VII and IK VIII) in

September.

In early September, as part of active portfolio management and

to improve its exposure by vintage year, the Company also agreed

the future sale of 14 older vintage commitments. The sale price is

equivalent to a 5% discount as at the 31 December 2018 valuation

(GBP44.9m), adjusted for subsequent cash flows. These fund

interests held outstanding commitments of GBP23.4m as at 30 June

2019, and the implied sale price of these interests has been

reflected in the Company's 30 June 2019 NAV.

At 13 September, the Company had resources available for

investment of GBP78.3 million. The Company also had total

outstanding commitments of GBP465.4 million. The Manager believes

that around GBP60 million of the Company's outstanding commitments

are unlikely to be drawn.

The Company's estimated NAV at 31 August 2019 is also being

announced today. It is anticipated that the Company will release

its results for the year ending 30 September 2019 on or around 11

December 2019.

For further information please contact:-

Merrick McKay at SL Capital Partners LLP (0131 245 2345)

Note:-

Standard Life Private Equity Trust PLC is an investment company

managed by SL Capital Partners LLP, the ordinary shares of which

are admitted to listing by the UK Listing Authority and to trading

on the Stock Exchange and which seeks to conduct its affairs so as

to qualify as an investment trust under sections 1158-1165 of the

Corporation Tax Act 2010. The Board of Standard Life Private Equity

Trust PLC is independent of Standard Life Aberdeen plc and Phoenix

Group Holdings.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTXDLFLKKFZBBF

(END) Dow Jones Newswires

September 27, 2019 09:44 ET (13:44 GMT)

Grafico Azioni Abrdn Private Equity Opp... (LSE:APEO)

Storico

Da Mar 2024 a Apr 2024

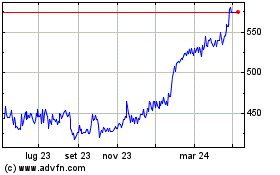

Grafico Azioni Abrdn Private Equity Opp... (LSE:APEO)

Storico

Da Apr 2023 a Apr 2024