Atalaya Mining PLC Third Quarter 2019 Operations Update (1364Q)

17 Ottobre 2019 - 8:00AM

UK Regulatory

TIDMATYM

RNS Number : 1364Q

Atalaya Mining PLC

17 October 2019

17 October 2019

Atalaya Mining Plc. ("Atalaya" or "the Company")

Third Quarter 2019 Operations Update

Atalaya Mining Plc (AIM:ATYM, TSX:AYM), is pleased to announce

its operational update for the third quarter of 2019.

Proyecto Riotinto

Q3 Q2 Year-to-date Updated full

year

2019 2018 2019 2019 2019 Guidance

------- ------- ------- ------------- ----------------

Ore mined (M tonnes) 2.7 2.8 2.8 8.0 11.4

------------ ------- ------- ------- ------------- ----------------

Waste mined (M tonnes) 4.4 3.2 3.6 11.8 17.8

------------ ------- ------- ------- ------------- ----------------

Ore milled (M tonnes) 2.6 2.5 2.6 7.6 10.6

------------ ------- ------- ------- ------------- ----------------

Cu grade (%) 0.47 0.50 0.48 0.47 0.48

------------ ------- ------- ------- ------------- ----------------

Cu recovery (%) 87.38 88.40 88.72 88.77 85 - 87

------------ ------- ------- ------- ------------- ----------------

Cu production (tonnes) 10,568 11,055 10,888 31,675 44,000 - 45,000

------------ ------- ------- ------- ------------- ----------------

Q3 2019 copper production was 10,568 tonnes, in line with

expectations but slightly lower than Q2 2019 due to lower recovery

levels and copper head grade. An average copper head grade of 0.47%

and a recovery rate of 87.38% for the 2.6 Mt of ore processed have

resulted in copper production being 2.9% lower than Q2 2019.

On 19 August 2019, the Company reached full mechanical

completion of its 15Mtpa expansion ("Expansion Project") and

commenced ramping up. As explained in the mechanical completion

announcement of 19 August 2019, the increase in throughput capacity

and full completion relied on additional electricity supply to be

provided by power supplier, Endesa. While Endesa has begun the

necessary work to provide the additional electricity supply, it has

not yet completed it and consequently the ramp-up of the Expansion

Project is slightly delayed. As a result, the Company has reviewed

its existing production guidance and now expects ore processed in

2019 to be 10.6Mt with copper produced expected to be in the range

of 44,000 to 45,000 tonnes compared to the 45,000 to 46,500 tonnes

previously reported. All other key production metrics remain as

previously guided. The Company remains confident that the Expansion

Project will reach nameplate capacity by the end of 2019 with

production in 2020 expected to be in the range of 55,000 to 58,000

tonnes.

Mining operations are progressing according to plan and up from

previous quarters. On a combined basis, ore and waste increased to

2.6 million m3 in Q3 2019 versus 2.3 million m3 in Q2 2019.

On-site concentrate inventories at the end of the quarter were

approximately 2,186 tonnes. All concentrate in stock at the

beginning of the quarter and produced during the quarter was

delivered to the port at Huelva.

The realised copper price during Q3 2019 was lower than the

previous quarter, with an average realised price per pound of

copper payable, including the QPs closed in the period, of $2.76/lb

compared with $2.81/lb in Q2 2019. The average copper spot price

during the quarter was $2.61/lb. The realised price during the

quarter excluding QPs, was approximately $2.74/lb, well above the

spot price but we anticipate lower realised prices in coming

months.

Cash operating costs and AISC for Q3 2019 are expected to be

below budget. Further details on costs will be provided with the Q3

Financial Statements to be reported in November 2019.

Exploration and infill drilling continue to progress with two

rigs at Filón Sur-Cerro Colorado. One deep hole is being drilled in

Cerro Colorado in order to explore a rich Cu stockwork zone that

occurs under the Salomon zone. The RC drilling continues the infill

drilling programme in order to better define the occurrence of

penalty elements in the mining pit.

Expansion to 15Mtpa at Proyecto Riotinto

The Expansion Project has completed the cold mechanical

commissioning of all sections and the last new installation (Sag

Mill and auxiliary mills installation) has now begun processing

ore. The delay in the availability of electrical energy is

currently being addressed by the power provider and the Company

continues to plan for an expanded throughput rate of 15Mtpa by the

end of 2019. To achieve full commissioning, three stages of

production ramp-up are expected - the first in October reaching 65%

of 15Mtpa, a second in November up to 85% and one final stage

during December up to 100%.

The new primary crusher has been steadily working during the

quarter with waste material for testing and commissioning. The new

flotation and concentrate handling areas are finished and running

as expected.

Proyecto Touro

During the quarter, the Company continued addressing additional

information requests from administrative bodies. Atalaya addressed

comments from Aguas de Galicia, Natural Heritage and the General

Directorate of Mines.

Alberto Lavandeira, CEO, commented:

"The Expansion Project is ramping up towards full production

and, despite delays to the increased electricity supply, the

Company expects the new plant to achieve its full 15Mtpa capacity

by December 2019. Despite a slight reduction in production this

quarter, we remain confident that our guidance levels for the

remainder of the year will be met."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) no 596/2014.

Contacts:

Elisabeth Cowell / Adam + 44 20 3757

Newgate Communications Lloyd / Tom Carnegie 6880

+44 20 3170

4C Communications Carina Corbett 7973

------------------------------- -------------

Canaccord Genuity (NOMAD Henry Fitzgerald-O'Connor +44 20 7523

and Joint Broker) / James Asensio 8000

------------------------------- -------------

Jeffrey Couch / Tom Rider

BMO Capital Markets (Joint / Michael Rechsteiner / +44 20 7236

Broker) Neil Elliot 1010

------------------------------- -------------

+44 20 7418

Peel Hunt LLP (Joint Broker) Ross Allister / David McKeown 8900

------------------------------- -------------

About Atalaya Mining Plc

Atalaya is an AIM and TSX-listed mining and development group

which produces copper concentrates and silver by-product at its

wholly owned Proyecto Riotinto site in southwest Spain. In

addition, the Group has a phased, earn-in agreement for up to 80%

ownership of Proyecto Touro, a brownfield copper project in the

northwest of Spain which is currently in the permitting stage. For

further information, visit www.atalayamining.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDEQLFFKBFXFBK

(END) Dow Jones Newswires

October 17, 2019 02:00 ET (06:00 GMT)

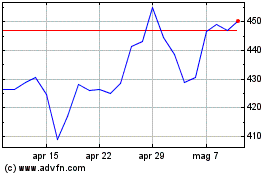

Grafico Azioni Atalaya Mining (LSE:ATYM)

Storico

Da Mar 2024 a Apr 2024

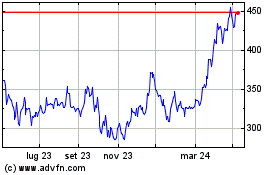

Grafico Azioni Atalaya Mining (LSE:ATYM)

Storico

Da Apr 2023 a Apr 2024