Palace Capital PLC 17 Lease Renewals and Rent Reviews

24 Ottobre 2019 - 8:01AM

RNS Non-Regulatory

TIDMPCA

Palace Capital PLC

24 October 2019

24 October 2019

PALACE CAPITAL SECURES 25.6% AVERAGE RENTAL UPLIFT ACROSS

17 LEASE RENEWALS AND RENT REVIEWS

Palace Capital plc (the "Company"), the UK REIT that has a

diversified portfolio of UK commercial real estate in carefully

selected locations outside of London, has completed 12 lease

renewals and five rent reviews at an average of 3% above ERV.

Altogether, the renewals and reviews have added GBP438,189 per

annum to the previous passing rent on the 17 assets, reflecting a

25.6% uplift, and increased the portfolio WAULT to 5.2 years to

break.

The renewals, which have been completed on 12 properties across

all portfolio sub-sectors, include the 77,787 sq ft warehouse at

Foleshill Enterprise Park in Coventry which is let to Brose Ltd,

the major industrial equipment supplier whose clients include

Jaguar Land Rover. The Company secured a more than 30% annual

rental uplift on a five year lease from July 2019.

Five rent reviews were also concluded, including a 36% rental

uplift with Rockwell Automation, the global industrial automation

and information specialists who occupy 38,331 sq ft of office

buildings at Kiln Farm in Milton Keynes, leased to December

2026.

Neil Sinclair, Chief Executive of Palace Capital commented,

"Through a combination of the quality of our assets and our skilled

active management process, we have secured the retention of 12

tenants and at the same time delivered a sustainable increase in

income to balance out our strategic investment in refurbishments

and potential developments.

"Generating income growth from our portfolio is part of our core

strategy and also underpins our approach to capital allocation,

including the significant commitments to our flagship development,

Hudson Quarter, York but also new investment in our assets at

Regency House, Winchester, Sol Northampton and St James' Gate,

Newcastle-on-Tyne. We anticipate a positive return from these

investments in the financial year commencing April 2020 and I look

forward to providing a positive update on our progress at Hudson

Quarter when we announce our interim results in November."

ENDS

For further information, contact:

FTI Consulting (Financial PR)

Claire Turvey / Methuselah Tanyanyiwa

palacecapital@fticonsulting.com

Tel. +44 (0)20 3727 1000

About Palace Capital plc (www.palacecapitalplc.com):

Palace Capital plc (LSE: PCA) is a UK REIT with a c. GBP275

million diversified portfolio of UK regional commercial property.

The Company maintains a disciplined investment strategy focused on

towns and cities outside of London that are characterised by

thriving local economies and strengthening fundamentals. Within

those locations, the highly experienced management team selects

assets that provide opportunity to drive both capital value and

long-term rental income through tailored active asset management

programmes, ultimately delivering attractive shareholder

returns.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NRAFELFFDFUSEIS

(END) Dow Jones Newswires

October 24, 2019 02:01 ET (06:01 GMT)

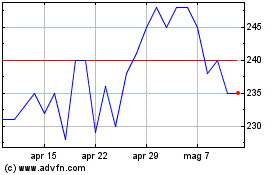

Grafico Azioni Palace Capital (LSE:PCA)

Storico

Da Mar 2024 a Apr 2024

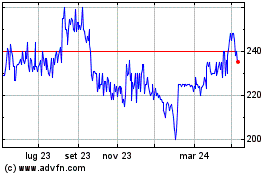

Grafico Azioni Palace Capital (LSE:PCA)

Storico

Da Apr 2023 a Apr 2024