TIDMAOR

RNS Number : 0614V

AorTech International PLC

29 November 2019

AorTech International plc

("AorTech", the "Company" or the "Group")

Unaudited Interim Results 2019

AorTech International plc (AIM: AOR), the biomaterials and

medical device IP company, today announces its unaudited interim

results for the six months ended 30 September 2019.

Highlights :

-- 27% increase in Elast-Eon(TM) income to GBP299,000 (2018: GBP236,000)

-- Continued investment in Research and Development activities

-- 30% reduction in loss to GBP158,000 (2018: GBP225,000)

-- Period end cash balance remains strong at GBP2,331,000 (31 March 2019: GBP2,412,145)

-- New licence agreement with Medibrane allows expansion of Elast-Eon(TM) Enabled devices

-- Outstanding progress in development of Elast-Eon(TM) sealed graft

-- Continued improvements to Elast-Eon(TM) Heart Valve and

commitment to manufacture expected soon

Bill Brown, Executive Chairman of AorTech, said:

"Progress over the past six months has been very positive. The

polymer business is performing well and an ambitious plan is in

place to develop it further. The medical textiles development has

been quite incredible and much credit must go to our partners, RUA

Medical, who have surpassed our expectations. Progress on the heart

valve is very positive with the timing of significantly improving

past designs arising at a point when the industry has much more

interest in alternative materials. We look forward to 2020 with

both excitement and confidence."

For further information contact:

AorTech International plc Tel: +44 (0)7730 718296

Bill Brown, Executive Chairman

Shore Capital Tel: +44 (0)20 7408 4090

Tom Griffiths / David Coaten

A copy of this announcement will be available shortly at

www.aortech.net/investor-relations/regulatory-news-alerts.

CHAIRMAN'S STATEMENT

I am delighted to set out an overview of the key unaudited

financial results of AorTech for the six months to 30 September

2019 together with an update on the progress being made in the

three strands of the business.

Unaudited results for the six months to 30 September 2019

Our polymer business which derives its income from licensing the

rights to the world leading bio-polymer Elast-Eon(TM) performed

well in the period with revenues increasing by 27 per cent to

GBP299,000 (2018: GBP236,000).

As AorTech transitions to become a medical device development

company, it was anticipated that costs would start to increase as

research and development activities were undertaken. These

activities started half way through the first half of last year

and, as a result, in the period to 30 September 2019,

administration costs (which include all our research and

development activities) were 29 per cent up on the same period last

year at GBP451,000 (2018: GBP350,000)(1) . We continue to control

expenditure and the costs incurred in the first half of the year

were 7 per cent lower than those incurred during the second half of

last year.

(1) 2018 comparatives as restated (see note 6)

AorTech has not specifically disclosed the total amount spent

during the period on research and development activities for

commercial reasons, but I am pleased to highlight the tax credit

recognised in these results which represents the value of a R&D

Tax credit claim that has been submitted for last year and will

result in a cash repayment of GBP81,000 (2018: GBPnil).

Amortisation of intangible assets amounted to GBP93,000 (2018:

GBP109,000).

The net impact of the above resulted in a much reduced loss for

the half year of GBP158,000 (2018: GBP225,000).

Cash management has remained a key focus and I am pleased that

cash at 30 September 2019 amounted to GBP2,331,000 representing

cash burn during the period of only GBP81,000. Interestingly, if

the R&D tax credit had been received in the six months ended 30

September 2019, the cash position over the period would have been

neutral, which would have been a major achievement for a developing

business.

Elast-Eon(TM) - Polymer Business

Elast-Eon(TM) is without doubt the world's leading biostable

polyurethane. It is a very high silicone content co-polymer of

polyurethane and silicone macrodials which retains the physical and

mechanical properties of conventional polyurethanes whilst

demonstrating levels of biological stability that far surpasses

rigid biostable polyurethanes.

A number of major medical device companies utilise Elast-Eon(TM)

and are achieving outstanding clinical results with their products.

As an example, Abbott has used Elast-Eon(TM) as an insulation

material on cardiac rhythm leads since 2006, thus providing unique

long term data on Elast-Eon(TM). This data shows that the presence

of Elast-Eon(TM) dramatically reduces the probability of abrasion

malfunction in tachycardia leads at 146 months by 83 per cent.

This business area has seen good growth over the past six

months, but historically, AorTech has not enjoyed the success with

Elast-Eon(TM) that Elast-Eon(TM) deserves, due to years of poor

management. The outstanding benefits of Elast-Eon(TM) are now being

increasingly recognised. I am pleased to report that, having been

able to review and analyse this business opportunity in proper

detail, we look forward to a much higher level of promotion and

marketing of Elast-Eon(TM), particularly focused on having

Elast-Eon(TM) "designed into" products that will become

"Elast-Eon(TM) Enabled".

With this in mind, we are delighted to have recently signed a

very important licence agreement with Medibrane Limited, experts in

encapsulation technology for medical devices but stents in

particular. This licence is all about Medibrane designing

Elast-Eon(TM) into devices and promoting the benefits to device

manufacturers.

Elast-Eon(TM)Enabled Textile Devices

The value added by Elast-Eon(TM) to medical devices is

significantly more than can be charged for through material supply

and licensing. In order to capture more of the value added, AorTech

has decided to develop medical devices which are "Enabled" by the

key properties of Elast-Eon(TM).

The recent pace of development of the large bore grafts and

resulting prototype devices has been outstanding. Major

developments have been achieved in the textile construction, heat

setting and crimping technology, together with the application of

Elast-Eon(TM) coating and sealant. Bringing all of this together

has resulted in the recent production of a 100 per cent sealed,

superb handling Aortic Root graft that retains its shape and form

without being pressurised.

We have kept the industry appraised of our developments and have

received some very positive feedback on our product portfolio. We

have little doubt that once we achieve regulatory approval for the

grafts, there will be ready buyers for the devices, including

significant OEM interest.

The development time frame anticipates all animal testing and

ISO device testing being undertaken over the next year, allowing

application for initial FDA approval.

Elast-Eon(TM) Enabled Heart Valve

A highly significant event over the past six months in the field

of heart valve technology was the "first in man" of a polymer

leaflet heart valve as part of an early stage study. Despite this

having been achieved by a team which includes former employees of

AorTech and with a valve that looks similar to the previous

generation of AorTech's valve, we are delighted and encouraged by

this development.

From a regulatory perspective, a furrow has now been ploughed

and protocols for human testing of polymeric valves have clearly

been agreed by the FDA. From a commercial perspective, the change

in attitude and level of interest in alternative leaflet technology

has been remarkable and we have recently had a number of very

interesting discussions.

We hope the valve study is successful, primarily for the

patients receiving this new technology, but it would also increase

our confidence on the likely success of our own improved design.

Furthermore, we would prefer to have to explain the superior

benefits of our own valve over a successful competitor polymer

valve, rather than needing to convince the market that our design

will address any failures if the competitor product is

unsuccessful.

We are continuing to make good progress on both valve design and

design for manufacture and feedback from the process is currently

driving further improvements. We hope to commit soon to the

manufacture of early proof of concept prototypes. This should

confirm the capabilities of the novel manufacturing technology we

are looking to adopt before finalising the design. The objective

being to have design freeze quality valves under testing next

year.

Conclusion

Progress over the past six months has been very positive. The

polymer business is performing well and an ambitious plan is in

place to develop it further. The medical textiles development has

been quite incredible and much credit must go to our partners, RUA

Medical, who have surpassed our expectations. Progress on the heart

valve is very positive with the timing of significantly improving

past designs arising at a point when the industry has much more

interest in alternative materials. We look forward to 2020 with

both excitement and confidence.

Bill Brown, Chairman

28 November 2019

CONDENSED CONSOLIDATED INTERIM INCOME STATEMENT

Six months ended 30 September 2019

Unaudited Unaudited Audited

(restated)

Six months Six months Twelve months

to 30 Sept to 30 Sept to 31 March

2019 2018 2019

Note GBGBP000 GBGBP000 GBGBP000

------------ ------------ --------------

Revenue 3 299 236 463

Other income 6 - 7

Administrative expenses (451) (350) (835)

Exceptional administrative

(expenses) / income (net) 2 - (2) (6)

Other expenses - share-based

payments - - (42)

Other expenses - depreciation

& amortisation (93) (109) (218)

------------ ------------ --------------

Operating loss (239) (225) (631)

Finance income/(expense) - - 22

Loss attributable to owners

of the parent company (239) (225) (609)

------------ ------------ --------------

Taxation 81 - -

------------ ------------ --------------

Loss attributable to equity

holders of the parent

company 6 (158) (225) (609)

------------ ------------ --------------

Loss per share (basic

and diluted) - GB Pence (1.08) (2.01) (4.72)

CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE

INCOME

Six months ended 30 September 2019

Unaudited Unaudited Audited

(restated)

Six months Six months Twelve months

to 30 Sept to 30 Sept to 31 March

2019 2018 2019

GBGBP000 GBGBP000 GBGBP000

Loss for the period (158) (225) (609)

------------ ------------ --------------

Total comprehensive income

for the period, attributable

to owners of the parent company (158) (225) (609)

------------ ------------ --------------

CONDENSED CONSOLIDATED INTERIM BALANCE SHEET

At 30 September 2019

Unaudited Unaudited Audited

(restated)

30 Sept 30 Sept 31 March

2019 2018 2019

Note GBGBP000 GBGBP000 GBGBP000

Assets

Non-current assets

Intangible assets 4 355 557 448

Tangible assets 5 2 1 1

---------- ------------ ----------

Total non-currents assets 357 558 449

Current assets

Trade and other receivables 234 233 238

Cash and cash equivalents 2,331 2,593 2,412

---------- ------------ ----------

Total current assets 2,565 2,826 2,650

---------- ------------ ----------

Total assets 2,922 3,384 3,099

---------- ------------ ----------

Liabilities

Current liabilities

Trade and other payables (80) (42) (99)

---------- ------------ ----------

Total current liabilities (80) (42) (99)

---------- ------------ ----------

Net assets 2,842 3,342 3,000

---------- ------------ ----------

Equity

Issued capital 7 12,574 12,574 12,574

Share premium 7 4,550 4,595 4,550

Other reserve (1,916) (2,003) (1,916)

Profit and loss account 6 (12,366) (11,824) (12,208)

---------- ------------ ----------

Total equity attributable

to equity holders of

the parent company 2,842 3,342 3,000

---------- ------------ ----------

CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENT

Six months ended 30 September 2019

Unaudited Unaudited Audited

Six months Six months Twelve months

to 30 to 30 to 31 March

Sept 2019 Sept 2018 2019

GBGBP000 GBGBP000 GBGBP000

Cash flows from operating

activities

Group loss after tax (158) (225) (609)

Adjustments for:

Depreciation of tangible

assets and amortisation

of intangible assets 93 109 218

Share-based payments - - 42

(Increase) / decrease in

trade and other receivables 4 (100) (104)

Increase / (Decrease) in

trade and other payables (19) (26) 31

----------- ----------- --------------

Net cash flow from operating

activities (80) (242) (422)

----------- ----------- --------------

Cash flows from investing

activites

Purchase of equipment (1) (1) (1)

Acquisition of subsidiary,

net of cash acquired - (139) (139)

Purchase of intangible assets - - -

----------- ----------- --------------

Net cash flow from investing

activities (1) (140) (140)

----------- ----------- --------------

Cash flows from financing

activities

Proceeds of issue of share

capital, net of issue costs - 2,553 2,552

----------- ----------- --------------

Net cash flow from financing

activities - 2,553 2,552

----------- ----------- --------------

Net increase / (decrease)

in cash and cash equivalents (81) 2,171 1,990

Cash and cash equivalents

at beginning of period 2,412 422 422

----------- ----------- --------------

Cash and cash equivalents

at end of period 2,331 2,593 2,412

----------- ----------- --------------

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN

EQUITY

Share Share Other Profit and Total

capital premium reserve loss account Equity

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

---------- ---------- ---------- -------------- ----------

Balance at 01 April

2018 12,118 2,500 (2,003) (11,599) 1,016

---------- ---------- ---------- -------------- ----------

Issue of equity

share capital (net

of issue costs) 456 2,095 - - 2,551

Loss for the period - - - (225) (225)

Total comprehensive

income for the

period - - - (225) (225)

---------- ---------- ---------- -------------- ----------

Balance at 30 September

2018 12,574 4,595 (2,003) (11,824) 3,342

---------- ---------- ---------- -------------- ----------

Share-based payments 42 42

Share warrants -45 45 -

---------- ---------- ---------- -------------- ----------

Transactions with

owners - -45 87 - 42

---------- ---------- ---------- -------------- ----------

Loss for the period - - - (384) (384)

Total comprehensive

income for the

period - - - (384) (384)

---------- ---------- ---------- -------------- ----------

Balance at 31 March

2019 12,574 4,550 (1,916) (12,208) 3,000

---------- ---------- ---------- -------------- ----------

Transactions with - - - - -

owners

Loss for the period - - - (158) (158)

Total comprehensive

income for the

period - - - (158) (158)

---------- ---------- ---------- -------------- ----------

Balance at 30 September

2019 12,574 4,550 (1,916) (12,366) 2,842

---------- ---------- ---------- -------------- ----------

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. BASIS OF PREPARATION

These condensed consolidated interim financial statements are

for the six months ended 30 September 2019 and have been prepared

with regard to the requirements of IAS 34 on "Interim Financial

Reporting". They do not include all of the information required for

full financial statements and should be read in conjunction with

the consolidated financial statements of the Group for the year

ended 31 March 2019.

These condensed consolidated interim financial statements have

been prepared in accordance with the accounting policies set out

below which are based on the recognition and measurement principles

of IFRS in issue as adopted by the European Union (EU) and

effective at 31 March 2019. They were approved for issue by the

Board of Directors on 28 November 2019.

After considering the period end cash position, making

appropriate enquiries and reviewing budgets and profit and cash

flow forecasts for a period of at least twelve months from the date

of signing these interim financial statements, the Directors have

formed a judgement at the time of approving the interim financial

statements that there is a reasonable expectation that the Group

has sufficient resources to continue in operational existence for

the foreseeable future. For this reason the Directors consider the

adoption of the going concern basis in preparing the condensed

consolidated interim financial statements is appropriate.

The financial information for the six months ended 30 September

2019 and the comparative figures for the six months ended 30

September 2018 are unaudited and have been prepared on the basis of

the accounting policies set out in the consolidated financial

statements of the Group for the year ended 31 March 2019.

These extracts do not constitute statutory accounts under

section 434 of the Companies Act 2006. The financial statements for

the year ended 31 March 2019, prepared under IFRS, received an

unqualified audit report, did not contain statements under sections

498(2) and 498(3) of the Companies Act 2006 and have been delivered

to the Registrar of Companies.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of these

condensed consolidated interim financial statements.

The functional and presentational currency of AorTech

International Plc is GBGBP as this is where all sales arise and

from where the majority of costs now emanate. Previously, to

reflect the substance of transactions, the Directors chose to use

US$ as the Company's presentational currency. Exchange differences

therefore arose in each prior period representing the retranslation

of reserves from a functional currency of GBGBP to their

presentational currency at the time of US$. The exchange

differences have been eliminated by this change in presentational

currency.

Loss per share has been calculated on the basis of the result

for the period after tax, divided by the number of ordinary shares

in issue in the period of 14,686,608. The comparatives are

calculated by reference to the weighted average number of ordinary

shares in issue which were 12,910,847 for the year ended 31 March

2019.

2. EXCEPTIONAL ADMINISTRATIVE EXPENSES

This comprises the exceptional administrative expense of sundry

disbursement costs associated with the now resolved litigation

against the Company's former CEO.

3. SEGMENTAL REPORTING

The Company is an Intellectual Property (IP) holding company

whose principal activity is exploiting the value of its IP and

know-how.

All revenue and operating result originated in the United

Kingdom.

Analysis of revenue by income

stream

Unaudited Unaudited Audited

Six months Six months Twelve months

to 30 Sept to 30 Sept to 31 March

2019 2018 2019

GBGBP000 GBGBP000 GBGBP000

License fees - services 40 38 76

Royalty revenue 259 198 387

------------ ------------ --------------

Total 299 236 463

------------ ------------ --------------

Analysis of revenue by geographical

location

Unaudited Unaudited Audited

Six months Six months Twelve months

to 30 Sept to 30 Sept to 31 March

2019 2018 2019

GBGBP000 GBGBP000 GBGBP000

Europe 103 97 178

USA 174 121 251

RoW 22 18 34

------------ ------------ --------------

Total 299 236 463

------------ ------------ --------------

4. INTANGIBLE ASSETS

Intellectual Development Total

property costs GBGBP000

GBGBP000 GBGBP000

At 01 April 2018 413 114 527

Additions 139 139

Amortisation (79) (30) (109)

------------- ------------ ----------

At 30 September 2018 473 84 557

------------- ------------ ----------

Additions - - -

Amortisation (80) (29) (109)

------------- ------------ ----------

At 01 April 2019 393 55 448

------------- ------------ ----------

Additions - - -

Amortisation (80) (13) (93)

------------- ------------ ----------

At 30 September 2019 313 42 355

------------- ------------ ----------

Additions to Intellectual property arise on consolidation of

Cortech Medical Limited which was acquired during the period ended

30 September 2018. As previously disclosed to shareholders in the

fund-raising circular, Cortech was acquired from William Brown, a

director of the Company, and therefore represents a related party

transaction.

5. TANGIBLE ASSETS

GBGBP000

Cost

At 01 April 2019 1

Additions 1

--------------------

At 30 September 2019 2

--------------------

Depreciation

At 01 April 2019 -

Charge for the period -

--------------------

At 30 September 2019 -

--------------------

Net book value

At 01 April 2019 1

--------------------

At 30 September 2019 2

--------------------

6. RESTATEMENT OF SEPTEMBER 2018 RESULTS

The unaudited interim results for the six months ended 30

September 2018 have been restated to take account of a small audit

adjustment that was made at year-end, which reclassifed cGBP6k of

costs as administrative expenses, this expense had previously been

deducted from the share premium account.

7. ISSUED SHARE CAPITAL

During the 6 month period to 30 September 2018, the Company

undertook a fund-raising which included the issue of 9,128,913 new

ordinary shares of 5 pence each, thereby increasing Issued share

capital by GBP456,000 and the share premium account by

GBP2,095,000, net of costs.

8. INTERIM ANNOUNCEMENT

The interim results announcement was released on 29 November

2019. A copy of this Interim Report is also available on the

Company's website www.aortech.net.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FEUFMAFUSEIF

(END) Dow Jones Newswires

November 29, 2019 02:00 ET (07:00 GMT)

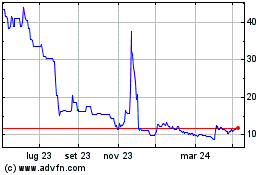

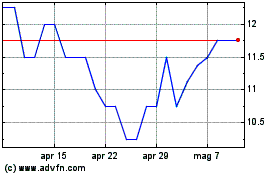

Grafico Azioni Rua Life Sciences (LSE:RUA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Rua Life Sciences (LSE:RUA)

Storico

Da Apr 2023 a Apr 2024