Global Stocks Gain on Optimism Tied to China, Europe Economies

02 Dicembre 2019 - 1:06PM

Dow Jones News

By Anna Isaac

Global stocks moved higher Monday after China's economy showed

signs of stabilizing and a key European survey signaled

better-than-expected manufacturing conditions.

Futures tied to the Dow Jones Industrial Average rose 0.3%,

while the pan-continental Stoxx Europe 600 index edged up 0.2%.

Fresh manufacturing data globally is likely to dominate

sentiment on Monday. Two separate surveys of manufacturers in China

pointed to improving confidence and demand last month. Factory

activity in the euro area also gave cause for cautious optimism,

with the rate of contraction easing by more than markets had

expected for the 19-nation region.

While economists said it was too early to say that China, the

world's second-largest economy, has recovered, markets cheered the

fact that another major risk to the global economy seems to be

diminishing.

"The bears are receding," said Gregory Perdon, co-chief

investment officer at private bank Arbuthnot Latham. "Their

rationale for negativity is just getting picked off one after the

next."

Mr. Perdon also pointed to remarks made last week by U.S.

Federal Reserve Chairman Jerome Powell. "Look at Powell's comments

about the glass being more than half full."

Separately, People's Bank of China Gov. Yi Gang said the central

bank won't resort to "competitive" quantitative easing, even if

interest rates in other major economies approach zero. Growth

remains within a reasonable range and inflation is relatively mild

overall, Mr. Yi wrote in the Communist Party's main political

journal, Qiushi. The Shanghai Composite Index ended the day largely

flat.

Meanwhile, Brent crude, the global benchmark for oil prices,

rose 2.3% to $61.87 a barrel after Persian Gulf officials said

Saudi Arabia will push for an extension to oil-production cuts

through mid 2020 at an Organization of the Petroleum Exporting

Countries summit this week. The kingdom is targeting prices of at

least $60 a barrel, according to a Saudi oil adviser.

Later in the day, investors will ready themselves to parse the

U.S. Institute for Supply Management's manufacturing index for

November to for any signs of an improvement from October's

reading.

The new president of the European Central Bank, Christine

Lagarde, is also due to speak in Brussels later in the day.

Yields on U.S. Treasurys rose, with the 10-year at 1.848%, up

from 1.778% Friday.

Write to Anna Isaac at anna.isaac@wsj.com

(END) Dow Jones Newswires

December 02, 2019 06:51 ET (11:51 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

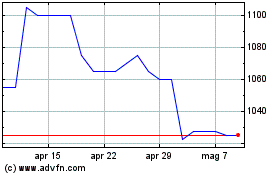

Grafico Azioni Arbuthnot Banking (LSE:ARBB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Arbuthnot Banking (LSE:ARBB)

Storico

Da Apr 2023 a Apr 2024