London Stock Exchange Raises GBP20 Million for Derivatives Challenger Curve -Financial News

12 Dicembre 2019 - 4:53PM

Dow Jones News

By Samuel Agini

Of Financial News

London Stock Exchange Group PLC (LSE.LN) and a group of banks

have put another 20 million pounds ($26.3 million) into a

derivatives-trading venture they hope can challenge the dominant

forces in European interest-rate futures.

CurveGlobal has raised the money to provide working capital and

fund future growth, the LSE confirmed. It is CurveGlobal's first

funding round since February 2018, when it also raised GBP20

million.

The LSE, which owns around 43.4% of CurveGlobal, launched the

joint venture with a number of major banks and Chicago-based

exchange Cboe Global Markets Inc. (CBOE) in September 2016.

According to LSE data, roughly 5.6 million interest-rate

derivative contracts changed hands on CurveGlobal in the first 11

months of 2019--an 85% year-on-year increase despite weaker volumes

in October and November.

However, Curve is dwarfed by U.S.-headquartered Intercontinental

Exchange Inc.'s (ICE) ICE Futures Europe and Deutsche Boerse AG's

(DB1.XE) Eurex.

London-based ICE Futures Europe traded 489.4 million

interest-rate derivative contracts in the first 11 months of 2019,

while the figure for Eurex was just under 518.0 million, according

to their websites.

Andy Ross, chief executive of CurveGlobal, told Financial News:

"It would be churlish to say that when you're competing against

some of the biggest exchanges in the world that it isn't difficult.

I'm delighted by the number of people joining our market, buy-side

and sell-side."

Mr. Ross added that the majority of shareholders contributed to

the latest fundraising; partner banks on the project are Bank of

America, Barclays, BNP Paribas, Citigroup, Goldman Sachs, JPMorgan

and Societe Generale.

The LSE lacks a derivatives-trading operation with scale, having

lost out to Euronext N.V. (ENX.FR) in 2001 in a battle to acquire

Liffe, a London-based futures and options exchange. Liffe now sits

within U.S.-based ICE following a number of subsequent deals in the

exchange sector.

Now into its fourth year, CurveGlobal has sought to grow

activity on its market by introducing an "all you can eat" fee

model. Typically, exchanges charge commission on trades rather than

offering unlimited trading for a subscription fee. CurveGlobal

offers both options.

The platform also started with the promise of helping banks use

their capital more efficiently. Its contracts clear at LCH, the

LSE's majority-owned clearing house, which offers them access to a

single default fund across over-the-counter and listed trades.

Banks have been hit by tougher capital requirements since the

financial crisis, increasing the cost of trading.

Website: www.fnlondon.com

(END) Dow Jones Newswires

December 12, 2019 10:38 ET (15:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

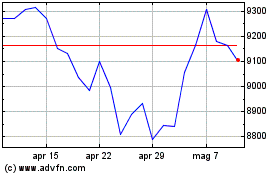

Grafico Azioni London Stock Exchange (LSE:LSEG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni London Stock Exchange (LSE:LSEG)

Storico

Da Apr 2023 a Apr 2024