Infrastructure India plc Facility Draw Down (2353X)

18 Dicembre 2019 - 8:00AM

UK Regulatory

TIDMIIP TIDMTTM

RNS Number : 2353X

Infrastructure India plc

18 December 2019

18 December 2019

Infrastructure India plc

("IIP", the "Company and together with its subsidiaries the

"Group")

Facility Draw Down

Infrastructure India plc, an AIM quoted infrastructure fund

investing directly into assets in India, announces that the Group

has drawn down the final US$30 million (approximately GBP22.8

million) under the financing with IIP Bridge Facility LLC announced

by the Company on 2 April 2019 (the "Facility"). Following the

latest draw down, the Facility of $105 million is now fully drawn

down.

The funds drawn down will be utilised primarily to progress

construction at Distribution Logistics Infrastructure Private

Limited's ("DLI") terminals and to meet ongoing DLI debt service

and operational overheads as well as general working capital for

DLI and the Group.

Works at Nagpur, including a Private Freight Terminal ("PFT")

and additional warehousing should be completed before the calendar

year end. DLI is actively marketing the PFT and DLI expects an

uptick in bulk cargo volumes as these facilities ramp up. Nagpur

has expanded commodity freight with the addition of sugar and

cotton exports during the period and the terminal maintains strong

market share of the export-import market of around 40%.

The terminals at Bangalore and Palwal are both expected to be

completed and to commence initial commercial operations by the end

of the current fiscal year. Completion of the terminal at Chennai,

along with its Free Trade Warehousing Zone, is expected to be later

in 2020, as the team work through the regulatory approvals required

for the facility.

DLI is a supply chain transportation and container

infrastructure company headquartered in Bangalore and Gurgaon with

a material presence in central, northern and southern India. DLI

provides a broad range of logistics services including rail

freight, trucking, handling, customs clearing and bonded

warehousing with terminals located in the strategic locations of

Nagpur, Bangalore, Palwal (in the National Capital Region) and

Chennai. DLI is the largest asset in the Company's portfolio and

one of the largest privately-owned logistics businesses in

India.

Enquiries:

Infrastructure India plc www.iiplc.com

Sonny Lulla Via Novella

Cenkos Securities plc

Nominated Adviser & Joint Broker

Azhic Basirov / Ben Jeynes +44 (0) 20 7397 8900

Nplus1 Singer Advisory LLP

Joint Broker

James Maxwell - Corporate Finance

James Waterlow - Investment Fund Sales +44 (0) 20 7496 3000

Novella +44 (0) 20 3151 7008

Financial PR

Tim Robertson / Fergus Young

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGGGMWPUPBGRM

(END) Dow Jones Newswires

December 18, 2019 02:00 ET (07:00 GMT)

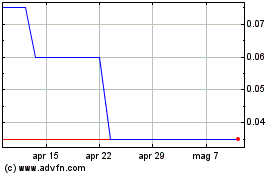

Grafico Azioni Infrastructure India (LSE:IIP)

Storico

Da Mar 2024 a Apr 2024

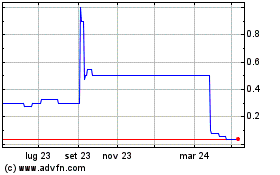

Grafico Azioni Infrastructure India (LSE:IIP)

Storico

Da Apr 2023 a Apr 2024