TIDMTRAF

RNS Number : 5511X

Trafalgar Property Group PLC

19 December 2019

19th December 2019

TRAFALGAR PROPERTY GROUP PLC

("Trafalgar", the "Company" or "Group")

Interim Results

for the six months ended 30 September 2019

Trafalgar (AIM: TRAF), the AIM quoted residential property

developer operating in southeast England, announces its interim

results for the six months ended 30 September 2019 (the

"Period").

Key financials:

-- Turnover for the Period was GBP2,286,000 (H1 2018: GBP 1,780,000);

-- Gross loss of GBP145,000, giving a pre-tax loss of GBP528,000

after overheads (H1 2018: nil, pre-tax loss: GBP224,000);

-- EPS of (0.11p) (H1 2018: (0.05p)); and

-- Cash in bank at period end was GBP27,780 (2018: GBP16,178);

as at 18 December 2019 cash in bank was GBP14,000.

Copies of the interim report will be available later today on

the Company's website, www.trafalgarproperty.group

Enquiries:

Trafalgar Property Group Plc

Christopher Johnson +44 (0) 1732 700 000

Spark Advisory Partners Ltd -AIM Nominated

Adviser and Broker

Matt Davis +44 (0) 20 3368 3550

Notes to Editors:

Trafalgar Property Group Plc is the holding company of Trafalgar

New Homes Limited, a residential property developer operating in

the southeast of England and Trafalgar Retirement + Limited, a

property developer in the assisted living and extra care for the

elderly sector. The founders have a long track record of developing

new and refurbished homes, principally in Kent.

The Company's focus is on the select acquisition of land for

residential property development. The Company outsources all

development activities, for example the obtaining of planning

permission, design and construction, and uses fixed price build

contracts, enabling it to tightly control its development and

overhead costs.

For further information visit www.trafalgarproperty.group

CHIEF EXECUTIVE'S REPORT

I present the Company's Interim Results for the six month period

to 30(th) September 2019. Revenue for the period was GBP 2,286,000

and costs of sales was GBP 2,431,220, giving a gross loss for the

period of GBP145,220.

Other income amounted to GBP 43,131. Interest paid was GBP 5,319

and administrative expenses for the period amounted to GBP 420,636

(2018: GBP307,000). The increase in general administration expenses

related to the additional costs incurred following the acquisition

of Beaufort Homes Limited now known as Trafalgar Retirement +

Limited (Traf +) which took place during the previous 2018

financial year and the writing off in the current period of costs

incurred on sites inherited where options failed to

materialise.

The result of the above is an operating loss for the period of

GBP 528,045. This includes a loss of GBP 324,000 relating to the

abortive Camberley acquisition.

During the period due to the lack of activity in the market

generally it was decided to rent out the remaining unsold

properties, Orchard House, Hildenborough and Burnside Court,

Tunbridge Wells. These properties were transferred to Selmat

Limited, the wholly owned subsidiary, properties refinanced and the

bank loans repaid. All of the properties have been let out on

Assured Shorthold Tenancy Agreements.

There was retained within the development portfolio of Trafalgar

New Homes Limited, the executive detached house at Saxons,

Speldhurst, Tunbridge Wells and the six houses under construction

at Wellesley Road, Sheerness, Kent. Saxons has recently been sold

for GBP 1.58 million and the six properties at Sheerness are

complete and are now currently on the market.

At Staplehurst, Kent the Company appealed the refusal of its

Planning Application for an Extra Care/Assisted Living consent and

we currently await the result of the Appeal.

As regards the Options held by the group, planning consent has

been forthcoming on two of the sites, one of which (Ewell) was sold

during the period to generate a gross profit of GBP259,152;

Planning consent has also been granted for a three unit scheme in

Ashtead, Surrey and a sale has been agreed, which again, should

show a healthy return.

Other sites under Option are all in the Planning process.

Further development land opportunities are being explored and sites

with planning permission and sites subject to planning are under

consideration.

Paul Treadaway

Chief Executive

CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE

SIX MONTHSED 30 SEPTEMBER 2019

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 month 6 month Year

period ended period ended ended

30 September 30 September 31 March

(Unaudited) (Unaudited) (Audited)

Note 2019 2018 2019

GBP'000 GBP'000 GBP'000

Revenue 2,286 1,780 2,123

Cost of sales (2,431) (1,717) (2,392)

Gross (loss)/profit (145) 63 (269)

Administrative expenses (421) (307) (473)

Underlying operating (loss)* (566) (244) (742)

Other interest receivable and similar

income 43 - 5

Exceptional items - - (1,559)

Interest payable and similar charges (5) - -

(Loss) before taxation (528) (244) (2,296)

Tax payable on profit on ordinary 4 - - -

activities

(Loss) after taxation for the period (528) (244) (2,296)

Other comprehensive income

Total comprehensive (loss) for

the period (528) (244) (2,296)

(Loss) attributable to:

Equity holders of the parent (528) (244) (2,296)

Total comprehensive (loss) for

the period attributable to:

Equity holders of the parent (528) (244) (2,296)

(LOSS) PER ORDINARY SHARE;

Basic/Diluted 5 (0.11)p (0.05)p (0.54)p

* Operating (loss) before non-recurring items, costs of

acquisition and deemed cost of listing

All results in the current and preceding financial period derive

from continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 September 2019

30 September 30 September 31 March

(Unaudited) (Unaudited) (Audited)

Note 2019 2018 2019

GBP'000 GBP'000 GBP'000

Non-current assets

Tangible fixed assets 1 2 1

1 2 1

Current assets

Inventory 4,928 6,624 4,481

Trade and other receivables 62 115 92

Cash at bank and in hand 28 16 32

5,018 6,755 4,605

Total assets 5,019 6,757 4,606

EQUITIES AND LIABILITIES

Current liabilities

Trade and other payables 463 415 442

Borrowings 2,535 1,731 2,502

2,998 2,146 2,944

Non-current liabilities

Borrowings 4,947 5,170 4,273

Total liabilities 7,945 7,316 7,217

Equity attributable to equity

holders of the company

Called up share capital 6 2,632 2,570 2,570

Share premium account 2,661 2,510 2,510

Reverse acquisition reserve (2,818) (2,818) (2,818)

Profit and loss account (5,401) (2,821) (4,873)

Total Equity (2,926) (559) (2,611)

Total Equity and Liabilities 5,019 6,757 4,606

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six month period ended 30 September 2019

Share Share Reverse Retained Total

capital premium acquisition profits equity

reserve /(losses)

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2019 2,570 2,510 (2,818) (4,873) (2,611)

Loss for period - - - (528) (528)

Other comprehensive income - - - - -

for the period

--------- --------- ------------- ----------- --------

Total comprehensive income

for the period - - - (528) (528)

--------- --------- ------------- ----------- --------

Issue of shares 62 188 - - 250

Share issue costs - (37) - - (37)

--------- --------- ------------- ----------- --------

At 30 September 2019 2,632 2,661 (2,818) (5,401) (2,926)

--------- --------- ------------- ----------- --------

For the purpose of preparing the consolidated financial

statement of the Group, the share capital represents the nominal

value of the issued share capital of 1p per share. Share premium

represents the excess over nominal value of the fair value

consideration received for equity shares net of expenses of the

share issue.

The reverse acquisition reserve related to the reverse

acquisition between Trafalgar Property Group plc and Trafalgar New

Homes Limited on 11 November 2011.

On 31(st) May 2019, 62,500,000 addional shares were issued being

ordinary 0.01p shares and 0.03p share premium.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six month period ended 30 September 2019

6 month 6 month Year

period ended period ended ended

30 September 30 September 31 March

(Unaudited) (Unaudited) (Audited)

2019 2018 2019

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Operating (loss) (528) (244) (2.296)

Depreciation charges - - -

(Increase)/decrease in stocks (447) 1,170 3,494

(Increase)/decrease in debtors 30 (23) 3

(Decrease)/Increase in creditors (38) 21 48

Interest paid 5 - 145

Net cash outflow/(inflow) from operating

activities (978) 924 1,394

Investing activities

Purchase of tangible fixed assets - - -

Net cash used in investing activities - - -

Taxation - - (291)

Financing activities

Issue of shares 250 - -

Net new loans/(loan repayments) in

period 707 (1,384) (1,521)

Share issue costs (37) - -

Amount injected/(withdrawn) by directors 59 18 320

Interest paid (5) - (328)

Net cash flow from financing 974 (1,366) (1,529)

(Decrease)/increase in cash and cash

equivalents in the period ( 4) (442) 426

Cash and cash equivalents at the

beginning of the year 32 458 458

Cash and cash equivalents at the

end of the period 28 16 32

NOTES TO THE FINANCIAL INFORMATION

For the period ended 30 September 2019

1. GENERAL INFORMATION

This financial information is for Trafalgar Property Group Plc

("the Company") and its subsidiary undertakings. The Company is

incorporated in England and Wales.

2. BASIS OF PREPARATION

The interim consolidated financial information has been prepared

in accordance with International Financial Reporting Standards

(IFRS) and interpretations adopted by the European Union and as

applied in accordance with the provisions of the Companies Act

2006. The interim financial information incorporates the results

for the group for the six month period from 1 April 2019 to 30

September 2019. The results for the year ended 31 March 2019 have

been extracted from the statutory financial statements for the

Company for the year ended 31 March 2019. The interim financial

information should be read in conjunction with the audited

financial statements for the group for the year ended 31 March

2019.

The same accounting policies, presentation and methods of

computation have been followed in these unaudited interim financial

statements as those which were applied in the preparation of the

group's annual financial statements for the year ended 31 March

2019.

The interim consolidated financial information incorporates the

financial statements of Trafalgar Property Group Plc and its

subsidiaries.

The interim financial information for the six months ended 30

September 2019 was approved by the directors on 18th December

2019.

3. SEGMENTAL REPORTING

For the purpose of IFRS 8, the chief operating decision maker

("CODM") takes the form of the Board of Directors. The Directors'

opinion of the business of the Group is that the principal activity

of the Group was property development and there is considered to be

one reportable segment, that of property development carried on in

the UK. The internal and external reporting is on a consolidated

basis with transactions between group companies eliminated on

consolidation. Therefore the financial information of the single

segment is the same as that set out in the consolidated statement

of comprehensive income, the consolidate statement of changes in

equity, the consolidated statement of financial position and

cash-flows.

NOTES TO THE FINANCIAL INFORMATION

For the period ended 30 September 2018

4. TAXATION

6 month 6 month Year

period ended period ended ended

30 September 30 September 31 March

(Unaudited) (Unaudited) (Audited)

2019 2018 2019

GBP'000 GBP'000 GBP'000

Current tax - - -

Tax charge/(credit) - - -

(Loss) on ordinary activities before

tax (528) (244) (2,296)

Based on profit for the period:

Tax at 20% - - -

Effect of:

Losses (not utilised)/utilised - - -

Tax charge for the period - - -

5. (LOSS) PER ORDINARY SHARE

The calculation of (loss) per ordinary share is based on the

following

(losses) and number of shares:

6 month 6 month Year

period ended period ended Ended

30 September 30 September 31 March

(Unaudited) (Unaudited) (Audited)

2019 2018 2019

GBP'000 GBP'000 GBP'000

(Loss) for the period (528) (244) (2,296)

Weighted average number of shares

for basic (loss) per share 487,690,380 425,190,380 425,190,380

Weighted average number of shares

for diluted (loss) per share 487,690,380 425,190,380 425,190,380

(LOSS) PER ORDINARY SHARE;

Basic (0.11)p (0.05)p (0.54)p

Diluted (0.11)p (0.05)p (0.54)p

NOTES TO THE FINANCIAL INFORMATION

For the period ended 30 September 2019

6. SHARE CAPITAL

Authorised Share Capital

30 September 31 March

2019 2019

Number Number

425,190,380 425,190,380

Ordinary shares of 1p each

Issued in period 62,500,000 -

487,690,380 425,190,380

Issued, allotted and fully paid

Authorised Share Capital

30 September 31 March

2019 2019

GBP'000 GBP'000

Ordinary shares 2,632 2,570

Share premium 2,661 2,510

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFLRFDLALIA

(END) Dow Jones Newswires

December 19, 2019 11:23 ET (16:23 GMT)

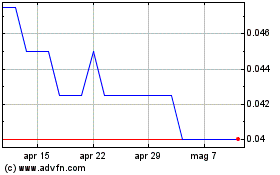

Grafico Azioni Trafalgar Property (LSE:TRAF)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Trafalgar Property (LSE:TRAF)

Storico

Da Apr 2023 a Apr 2024