TIDMAPQ

RNS Number : 2198B

APQ Global Limited

29 January 2020

29 January 2020

APQ Global Limited

("APQ Global" or the "Company")

Acquisition of Parish Group Limited

Issue of Warrants and Convertible Preference Shares

APQ Global, an emerging markets growth company based in

Guernsey, is pleased to announce that it has acquired the entire

issued share capital of Parish Group Limited ("Parish") (the

"Acquisition") a Guernsey incorporated non-cellular limited

company.

Parish is a fiduciary and corporate services provider, based in

Guernsey and Alderney and offers the following services:

-- Corporate Services - A full suite of corporate services including incorporation and set up, administration, provision of corporate directors, nominee shareholders, corporate secretarial work, provision of Company Secretary, Registered Office, Resident Agent.

-- Trust Services - Parish provides a comprehensive range of

services for the establishment and administration of Trusts.

-- Pension Services - Including RATS (Retirement Annuity Trust

Schemes), QROPS (Qualifying Retirement Overseas Pension Schemes),

QNUPS (Qualifying Non-UK Pension Schemes) and International Pension

Plans.

-- Intellectual Property - As a licensed fiduciary, Parish

assists with registering trademarks, patents and image rights in

accordance with Guernsey law.

-- Foundations - establishment and administration of

Foundations, provision of enforcer, resident agent, council members

etc.

-- Support Services - Provision of all kinds of administration

support, business planning, accountancy, bookkeeping, payroll and

Guernsey tax computations and returns.

-- Legal Services - Provision of legal guidance and advice to a

portfolio of clients covering all areas of business by in-house

legal counsel for non-reserved legal matters. Parish also provides

guidance in relation to more complex legal affairs and makes

external referrals, particularly in relation to reserved legal

activity including litigation, probate and administration of

oaths.

The Acquisition is an excellent strategic fit for APQ Global and

will accelerate the Company's growth plan in the corporate services

sector with a focus on emerging markets. Parish Group currently

offers its services to clients in over 30 jurisdictions, including

Israel, South Africa, the United Arab Emirates and Qatar.

For the year to 31 December 2018, Parish generated revenues of

approximately GBP1.0 million and profit before tax of approximately

GBP0.4 million. As at 31 December 2018, Parish has gross assets of

approximately GBP1.4 million.

In consideration to the sellers for the acquisition:

-- The Company will pay a net amount of approximately

GBP2,700,000 cash consideration to the Sellers;

-- APQ Capital Services Limited, a wholly owned subsidiary of

the Company, will issue 268,000 Convertible Preference Shares

(convertible into ordinary shares in APQ Global) to the Sellers

(the "Convertible Preference Shares") at price of $10 per share;

and

-- The Company will issue 1.0 million warrants in APQ Global

("Warrants"), with an exercise price equal to the most recently

announced book value per share of 70.94 pence, to the Sellers.

The Convertible Preference Shares and Warrants will be listed on

TISE, however will not be admitted to trading on the AIM

Market.

Convertible Preference Shares

As part consideration for the Acquisition, APQ Capital Services

Limited, a wholly owned subsidiary of the Company, will issue

268,000 Convertible Preference Shares (convertible into ordinary

shares in APQ Global) at a price of $10 per share).

The Convertible Preference Shares will pay a preferred dividend

of 6 per cent. per annum.

The Convertible Preference Shares can be converted into Ordinary

Shares in the Company on the fifth anniversary of the date on which

they were issued and every two years thereafter.

The Convertible Preference Shares will be convertible with

reference to the Convertible Preference Share Book Value (as

adjusted by movements in the Book Value of the Company's Ordinary

Shares).

Holders of the Convertible Preference Shares rank for dividends

in priority to the other shareholders (save for, for the avoidance

of doubt, interest payable to holders of CULS).

On a winding-up or other return of capital (other than a

redemption, purchase or conversion by the Company of any of its

share capital permitted by the Articles and under applicable law),

each Convertible Preference Share shall confer on the holder the

right to receive out of assets of the Company, (after, for the

avoidance of doubt, the payment of amounts due to holders of CULS),

an amount in respect of each Convertible Preference Share equal to

the Preference Share Book Value, calculated down to the date of

commencement of the winding up or an administration order.

Further information and the terms of the Warrants are provided

in an appendix to this announcement. The full TISE Listing Document

for the Convertible Preference Shares is available on the Company's

website: https://www.apqglobal.com/investors/aim-rule-26/

Warrants

As part consideration for the Acquisition, the Company will

issue 1.0 million Warrants to the sellers.

The Exercise Price of the Warrants will be equal to the most

recently announced book value per share of 70.94 pence.

The Warrants will be exercisable on the third anniversary of the

admission to TISE and every three months until 30 August 2026.

Further information and the terms of the Warrants are provided

in an appendix to this announcement. The full TISE Listing Document

for the Warrants is available on the Company's website:

https://www.apqglobal.com/investors/aim-rule-26/

There are not expected to be any changes to the Board of the

Company as a result of the Acquisition.

Bart Turtelboom, Chief Executive Officer and Executive Director

of APQ Global, commented:

"We are delighted that we have agreed to acquire Parish Group

Limited. We are proposing to acquire a business which has a

long-standing track record of delivering strong revenue and

profitability and has expanded confidently since establishment.

Furthermore, by adding Parish Group to our portfolio of companies,

we believe that there is a clearly defined opportunity to achieve

strong shareholder return."

For further enquiries, please contact:

APQ Global Limited

Bart Turtelboom - Chief Executive

Officer 020 3478 9708

N+1 Singer - Nominated Adviser

and Broker

James Maxwell / Justin McKeegan 020 7496 3000

Carey Group - TISE sponsor

Claire Torode 01481 737 279

Investor Relations

IR@APQGlobal.com

APPIX

INFORMATION AND TERMS OF THE CONVERTIBLE PREFERENCE SHARES

Conversion

A holder of Convertible Preference Shares may on (i) the fifth

anniversary of the first date on which Convertible Preference

Shares were issued and/or (ii) the date falling each two years

thereafter, on giving written notice to the Issuer at least 30 (but

no more than 60) days prior to such date, exchange in whole or in

part its holding of the Convertible Preference Shares into Ordinary

Shares at the Conversion Rate.

Fractions of Ordinary Shares will not be issued on Conversion

and a holder's entitlement to Ordinary Shares on Conversion will be

rounded down to the nearest Ordinary Share.

Ordinary Shares issued upon Conversion will be credited as fully

paid and will in all respects rank equally with the Ordinary Shares

in issue on the relevant Conversion date except that Ordinary

Shares so issued will not rank for any dividend or other

distribution which has been announced, declared, recommended or

resolved prior to the Conversion date by the Directors or by the

Issuer in general meeting to be paid or made if the record date for

such dividend or other distribution is on or prior to the

Conversion date.

Conversion Rate

Such number of Ordinary Shares for each Convertible Preference

Share as is calculated as A / B where:

A is the Convertible Preference Share Book Value in US$ as at

the immediately preceding Book Value Reference Date, divided by the

number of Convertible Preference Shares in issue as at the date of

calculation; and

B is the Book Value less the Convertible Preference Share Book

Value, each in US$ and as at the immediately preceding Book Value

Reference Date, divided by the number of Ordinary Shares in the

Parent in issue as at the date of calculation,

(rounded to four decimal places).

Convertible Preference Share Book Value

US$10 multiplied by the number of Convertible Preference Shares

in issue,

(a) increased with effect from each Book Value Reference Date by

50 per cent. of the amount by which the Book Value exceeds the Book

Value on the previous Book Value Reference Date multiplied by the

CPS Participation Rate, save where the Book Value is less than the

Initial Book Value in which case the Convertible Preference Share

Book Value shall be increased by 100 per cent. of such excess

multiplied by the CPS Participation Rate; or

(b) decreased with effect from each Book Value Reference Date by

50 per cent. of the amount by which the Book Value is less than the

Book Value on the previous Book Value Reference Date multiplied by

the CPS Participation Rate, save where the Book Value is less than

the Initial Book Value in which case the Convertible Preference

Share Book Value shall be decreased by 100 per cent. of such

shortfall multiplied by the CPS Participation Rate.

CPS Participation Rate

A percentage rate calculated as X / Y where:

X is the Convertible Preference Share Book Value in US$ as at

the immediately preceding Book Value Reference Date; and

Y is the Book Value in US$ as at the immediately preceding Book

Value Reference Date,

(rounded to four decimal places).

Preference Dividends

Cumulative preferential dividends will accrue on the Convertible

Preference Shares at a fixed rate of 6 per cent. per annum on the

amount of US$10, such dividend to accrue from day to day on the

basis of a 365 day year from (and including) the date of issue and

be payable, subject to the approval of the Directors in their sole

discretion, quarterly in equal instalments in arrears on 31 March,

30 June, 30 September and 31 December (or the next Business Day) in

each year, save that in respect of the first payment the dividend

will be paid on 31 March 2020 and calculated on a pro rata basis

(the "Preference Dividend").

A Convertible Preference Share will cease to entitle the holder

to receive Preference Dividends from and including the date it is

redeemed, converted or repurchased.

Preference Dividends will be paid only to the extent that the

Directors approve such payment and that payment of the same can be

made lawfully as at each dividend payment date.

The Parent has given an undertaking for the benefit of the

Issuer and the holders of the Convertible Preference Shares not to

declare or pay a dividend in respect of the Ordinary Shares in the

event that, at the relevant time, there are outstanding arrears of

the preferred dividend to which the holders of the Convertible

Preference Shares are entitled.

The holders of the Convertible Preference Shares shall not be

entitled to participate in any further profits, dividends or bonus

share issue of the Issuer. The holders of the Convertible

Preference Shares shall rank for dividends in priority to the

holders of any other class of shares of the Issuer and if there are

any arrears of the Preference Dividend outstanding the Issuer may

not pay any distribution (as defined in section 301 of the

Companies Law but excluding for these purposes distributions

falling within sections 302(1)(a), (d) and (e) of the Companies

Law) in respect of the Ordinary Shares or any other shares ranking

for distribution after the Convertible Preference Shares.

Scrip Preference Dividend

Holders of Convertible Preference Shares will not be offered the

right to elect to receive further Convertible Preference Shares

instead of cash in respect of all or part of the Preference

Dividend.

Redemption

Subject to being permitted to do so by law, the Convertible

Preference Shares may be redeemed by the Issuer on 31 December 2024

and the date falling each two years thereafter (or, if any such

date is not a Business Day, the following Business Day) (a

"Redemption Date"). The amount to be paid per Convertible

Preference Share on a Redemption Date will be an amount equal to

the Convertible Preference Share Book Value, increased by 1 per

cent. for each two years that have elapsed since the first

Redemption Date, and divided by the number of Convertible

Preference Shares in issue. On redemption, a holder of Convertible

Preference Shares shall not be entitled to receive any arrears of

the Preference Dividend.

Save as set out above, the Convertible Preference Shares will

not be capable of being redeemed although the Issuer will have the

ability to buy back the Convertible Preference Shares in the usual

manner.

Capital

On a winding-up or other return of capital (other than a

redemption, purchase or conversion by the Issuer of any of its

share capital permitted by the Articles and under applicable law),

each Convertible Preference Share shall confer on the holder

thereof the right to receive out of assets of the Issuer, in

priority to other shareholders, in respect of each Convertible

Preference Share held an amount equal to the Convertible Preference

Share Book Value, together with a sum equal to any arrears of the

6% Preference Dividend in respect of such Convertible Preference

Share.

The Convertible Preference Shares shall not have any further

right to participate in the assets of the Issuer on any such return

of capital.

Voting Rights

Holders of Convertible Preference Shares will be entitled to

receive notice of and to attend any general meeting of shareholders

of the Issuer but not to speak or vote upon any resolution proposed

at such meeting unless the business of the meeting includes a

resolution varying, abrogating or modifying any of the rights

attached to the Convertible Preference Shares or to wind-up the

Issuer pursuant to Part XXII of the Companies Law (and then the

holders of the Convertible Preference Shares shall only have the

right to speak and vote upon any such resolution).

In circumstances where the Convertible Preference Shares shall

entitle the holders to vote on a show of hands, every holder shall

have one vote and on a poll every holder shall have one vote for

each Convertible Preference Share he holds.

Information Rights

The Parent shall send to the holders of Convertible Preference

Shares a copy of its annual report and accounts or any other

document which is sent to the holders of Ordinary Shares.

Form

The Convertible Preference Shares will be issued in certificated

form or uncertificated form in CREST.

Transfer

The Convertible Preference Shares may be transferred on the same

basis as the Ordinary Shares.

The Convertible Preference Shares are transferable in CREST.

Ordinary Shares

Ordinary Shares of no par value in the capital of the

Parent.

The Ordinary Shares are admitted to trading on AIM and are

listed on TISE. The ISIN of the Ordinary Shares is GG00BZ6VP173.

Issuer announcements are released by RNS.

No shares will be issued at a fraction but if so required will

be rounded down to the nearest whole share.

Ordinary Shares shall be fully paid, rank pari passu with fully

paid shares of the same class and entitle the holder to receive

dividends.

Restrictions

Without the consent or sanction of the requisite majority of

holders of the Convertible Preference Shares as is required for a

variation of the rights attached to them:

(i) the Issuer will not to pass a voluntary winding up resolution;

(ii) there shall not take place a conversion/migration or

voluntary strike off of the Issuer under Guernsey law;

(iii) no shares ranking ahead of the Convertible Preference Shares will be issued; and

(iv) the Issuer shall not make a distribution by way of a

reduction of share capital as referred to in section 302(1)(c) of

the Companies Law in respect of Convertible Preference Shares

INFORMATION AND TERMS OF THE WARRANTS

Subscription Rights

Any Warrantholder, during the Exercise Period, shall have the

right (but not the obligation) to subscribe in cash for Ordinary

Shares.

Each Warrant entitles the Warrantholder to subscribe in cash for

one Ordinary Share at the Exercise Price, subject to any

Adjustments.

Exercise Price

The Exercise Price is 70.94 pence per Warrant, being an amount

equal to the most recently announced Book Value per Ordinary Share

on the date of issue of the Warrants.

Exercise Period

The period in which a holder of a Warrant can exercise its

Subscription Right, such period commencing on the third anniversary

of the admission of the Warrants to TISE and expiring on 30 August

2026.

If any Subscription Rights remain unexercised following

expiration of the Exercise Period they shall automatically lapse

and cease to be exercisable.

Exercise Point

The points during the Exercise Period when a Warrantholder can

exercise a Subscription Right are:

(i) the third anniversary of the admission of the Warrants to

TISE;

(ii) each date falling three months thereafter during the

Exercise Period; or

(iii) 30 August 2026,

and in each case if such day is not a Business Day then the

following Business Day.

Exercise Notice

A notice in writing from any holder of Warrants to the Company

of their intention to subscribe for Ordinary Shares, which should

include the number of Ordinary Shares to be subscribed for and the

aggregate Exercise Price payable for such Warrant Shares.

An Exercise Notice is irrevocable once lodged with the Company

save with consent of the Board.

Exercise Procedure

Subscription Rights may be exercised in whole or in part and on

any number of occasions, however, no rights are exercisable in

respect of a faction of an Ordinary Share.

A Warrantholder who wishes to exercise its Subscription Rights

should lodge with the Company a duly completed Exercise Notice, the

certificate(s) corresponding to the relevant Warrants (if

applicable) and any information requested by the Company which is

required by law to be obtained by the Company prior to issuing

shares to any person.

Adjustment of the Subscription Rights

If, while any Subscription Rights remain exercisable, there

is:

(i) a subdivision or consolidation of the Ordinary Shares;

(ii) a reduction of capital (of whatever nature, but excluding a

cancellation of capital that is lost or not represented by

available assets or a buyback or redemption of shares), or any

other reduction in the number of Ordinary Shares in issue from time

to time;

(iii) an issue of Ordinary Shares by way of dividend or

distribution;

(iv) an issue of Ordinary Shares by way of capitalisation of

profits or reserves (including share premium account and any

capital redemption reserve); or

(v) a consolidation, amalgamation or merger of the Company with

or into another entity (other than a consolidation, amalgamation or

merger following which the Company is the surviving entity and

which does not result in any reclassification of, or change in, the

Ordinary Shares) (the "Adjustments"),

the Company shall adjust the Subscription Rights and/or the

Exercise Price, conditional on any such event occurring, but with

effect from the date of the relevant event or, if earlier, the

record date for the event so that, after such Adjustment:

(i) the total number of outstanding unexercised Warrant Shares

have the same proportion of voting rights and same entitlement to

participate in the profits as if no such Adjustment had occurred;

and

(ii) the aggregate price payable for all outstanding unexercised

Warrant Shares shall equal the same aggregate price as would be

payable for the number of outstanding unexercised Warrant Shares

immediately before the occurrence of the event giving rise to the

Adjustment.

Dividends

The Warrants do not confer any right to receive dividends.

Voting Rights

The Warrants do not confer voting rights save in certain

circumstances in respect of the variation or abrogation of the

terms of the Warrant Instrument or of all or any of the rights for

the time being attached to the Warrants.

Information Rights

While any Subscription Rights remain exercisable, the Company

shall send to the Warrantholders a copy of its annual report and

accounts or any other document which is sent to the holders of

Ordinary Shares

Ordinary Shares

Ordinary Shares of no par value in the capital of the

Company.

The Ordinary Shares are admitted to trading on AIM and are

listed on TISE. The ISIN of the Ordinary Shares is GG00BZ6VP173.

Company announcements are released by RNS.

No shares will be issued at a fraction but if so required will

be rounded down to the nearest whole share.

Ordinary Shares shall be fully paid, rank pari passu with fully

paid shares of the same class and entitle the holder to receive

Dividends.

The maximum number of Ordinary Shares that could be issued on

the exercise of the Subscription Rights attaching to the Warrants

is 1 million.

Form

The Ordinary Shares issued on exercise of Warrants will be

issued in uncertificated form in CREST.

Transfer of Warrants

The Warrants shall be transferable by means of an instrument of

transfer or a form approved by the Board which must be signed by

the holder of the relevant Warrants.

The Warrants are transferable in CREST.

Transmission of Warrants

If a Warrantholder dies, the Company may only recognise:

(i) the survivor or survivors where he was a joint holder;

(ii) his personal representatives where he was a sole holder or

the only survivor of joint holders,

as having any title to his Warrants.

Any person becoming entitled to a Warrant in consequence of the

death or bankruptcy of a Warrantholder or otherwise than by

transfer who produces such evidence of entitlement to Warrants as

the Board may require may either choose to become the holder of

that Warrant or to have it transferred to another person capable of

receiving a transfer of Warrants

Winding Up of the Company

Upon an effective resolution for the winding up of the Company

being passed the Subscription Rights and the Warrants shall expire.

Notwithstanding such expiration, each Warrantholder with

unexercised Subscription Rights shall be treated as if it had,

immediately before the passing of the resolution, fully exercised

such outstanding Subscription Rights and shall be entitled to

receive out of the assets available in the liquidation pari passu

with the holders of the Ordinary Shares such sum as it would have

received had it been the holder of such Ordinary Shares. The sum

entitled shall include a deduction of an amount equal to the sum

which would have been payable on exercise of the Warrants.

DEFINITIONS

The following definitions apply throughout the information and

terms of the Convertible Preference Shares and Warrants contained

in this appendix, unless the context otherwise requires:

"Admission" admission of the Convertible Preference

Shares to listing on the Official

List of TISE;

"AIM" the AIM market of the London Stock

Exchange;

"Articles" the articles of incorporation of

the Issuer;

"Auditors" the auditors for the time being

of the Group;

"Authority" the International Stock Exchange

Authority Limited;

"Issuer Board" the Issuer Directors;

"Issuer Directors" the directors of the Issuer as at

the date of this document and "Issuer

Director" means any one of them;

"Book Value" the net asset value of the Parent

(including its subsidiaries) determined

in accordance with the accounting

principles adopted by the Parent

from time to time;

"Book Value per Ordinary the Book Value divided by the total

Share" number of Ordinary Shares in issue

(excluding any Ordinary Shares held

in treasury);

"Book Value Reference Date" the last calendar day of each month;

"certificated" or "in certificated not in uncertified form (that is

form" not in CREST);

"Companies Law" the Companies (Guernsey) Law, 2008,

as amended, in force at the date

of the Listing Documents;

"Conversion" the exchange of Convertible Preference

Shares for Ordinary Shares at the

Conversion Rate;

"Conversion Date" has the meaning set out in the CPS

Listing Document;

"Convertible Preference cumulative convertible non-voting

Shares" 6 per cent. preference shares of

US$10 each in the capital of the

Parent carrying the rights and subject

to the obligations that are summarised

in the CPS Listing Document, including

the right to convert to Ordinary

Shares;

"Convertible Preference has the meaning set out in the CPS

Share Book Value" Listing Document;

"Corporate Services Agreement" the corporate services agreement

dated 10 August 2016 between the

Parent and the Corporate Services

Provider, details of which are set

out in the CPS Listing Document;

"Corporate Services Provider" Active Services (Guernsey) Limited;

"CPS Listing Document" Listing document relating to the

Convertible Preference Shares;

"CPS Participating Rate" has the meaning set out in the CPS

Listing Document;

"CREST" the relevant system (as defined

in the CREST Regulations) for the

paperless settlement of share transfers

and the holding of shares in uncertificated

form which is administered by Euroclear;

"CREST Guernsey Regulations" the Uncertificated Securities (Guernsey)

Regulations 2009 (as amended from

time to time);

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001 No. 3755) (as amended

from time to time);

"CULS" 3.5 per cent. convertible unsecured

loan stock 2024 of the Parent, with

the rights described in the admission

particulars published by the Parent

on 15 August 2017;

"Directors" as the context requires, the Issuer

Directors and the Parent Directors;

"ERISA" the US Employment Retirement Income

Security Act of 1974, as amended;

"ERISA Plan Investors" a plan investor as defined by ERISA;

"EU" or "European Union" the European Union first established

by the treaty made at Maastricht

on 7 February 1992;

"Euroclear" Euroclear UK & Ireland Limited;

"Exercise Price" 70.94 pence per Warrant, being an

amount equal to the most recently

announced Book Value per Ordinary

Share on the date of issue of the

Warrants;

"FATCA" the US Foreign Account Tax Compliance

Act;

"FCA" the UK Financial Conduct Authority;

"FSMA" the Financial Services and Markets

Act 2000, (as amended from time

to time), including any regulations

made pursuant thereto;

"Group" the Parent and its subsidiaries

from time to time or, where the

context requires, any one or more

of them;

"Guernsey" the Island of Guernsey;

"IFRS" International Financial Reporting

Standards, as adopted by the EU;

"Initial Book Value" the Book Value on the date of issue

of the relevant Convertible Preference

Shares;

"Issue" the issue by the Issuer of 268,000

Convertible Preference Shares as

described in Part 3 of the CPS Listing

Document;

"Issuer" means APQ Capital Services Limited;

"Listing Documents" the CPS Listing Document and Warrants

Listing Document

"Listing Rules" the listing rules issued by TISE;

"London Stock Exchange" London Stock Exchange plc;

"Memorandum" the memorandum of incorporation

of the Issuer as amended from time

to time;

"N+1 Singer" Nplus1 Singer Advisory LLP;

"Orderly Market Deed" the deed dated 10 August 2016 between

the Parent, N+1 Singer and Bart

Turtelboom, details of which are

set out in the Listing Documents;

"Ordinary Shares" ordinary shares of no par value

in the Parent (and, for the avoidance

of doubt, not ordinary shares in

the Issuer);

"Parent" APQ Global Limited;

"Parent Articles" the articles of incorporation of

the Parent;

"Parent Board" the Parent Directors;

"Parent Directors" the directors of the Parent as at

the date of the Listing Documents

and "Parent Director" means any

one of them;

"Register" the register of members of the Issuer;

"Registrar" Link Registrars (Guernsey) Limited;

"Registrar Agreement" the registrar agreement between

the Registrar and the Parent, details

of which are set out in the Listing

Documents;

"Regulation S" Regulation S promulgated under the

Securities Act;

"Relationship Agreement" the agreement dated 10 August 2016

between the Parent, N+1 Singer,

the Sponsor and Bart Turtelboom,

details of which are set out in

the Listing Documents;

"Restricted Jurisdiction" each of Australia, Canada, Japan

and the United States;

"SEC" the US Securities and Exchange Commission;

"Securities Act" the US Securities Act of 1933, as

amended;

"Shareholder" a holder of a Shares;

"Shares" shares in the capital of the Issuer

and/or the Parent, as the context

requires;

"Sponsor" Carey Commercial Limited;

"Sponsorship Agreement" the sponsorship agreement between

the Sponsor and the Parent, details

of which are set out in the Listing

Documents;

"Takeover Code" The City Code on Takeovers and Mergers;

"TISE" The International Stock Exchange;

"UK" or "United Kingdom" the United Kingdom of Great Britain

and Northern Ireland;

"US Investment Company Act" the US Investment Company Act of

1940, as amended;

"uncertificated" or "in recorded on a register of securities

uncertificated form" maintained by Euroclear in accordance

with the CREST Regulations as being

in uncertificated form in CREST

and title to which, by virtue of

the CREST Regulations, may be transferred

by means of CREST;

"Undertaking Agreement" the agreement between the Issuer

and the Parent dated 2 January 2020,

details of which are set out in

the Listing Documents;

"US Code" the US Internal Revenue Code of

1986, as amended;

"US Person" has the meaning ascribed to it under

Regulation S;

"US" or "United States" the United States of America, its

territories and possessions, any

state of the United States of America

and the District of Columbia;

"Warrants" the warrants issued by the Parent

pursuant to the Warrant Instrument,

carrying the rights and subject

to the obligations that are summarised

in the Warrants Listing Document;

"Warrant Instrument" the warrant instrument of the Parent

dated 2 January 2020 constituting

the Warrants, details of which are

set out in the Warrants Listing

Document;

"Warrantholders" Holders of Warrants; and

"Warrants Listing Document" Listing document relating to the

Warrants.

- End -

Notes to Editors

APQ Global Limited

APQ Global (ticker: APQ LN) is an AIM- and TISE-listed company

with interests across Asia, Latin America, Eastern Europe, the

Middle East and Africa. The Company's objective is to steadily grow

earnings to deliver attractive returns and capital growth to

shareholders. This objective is achieved through a combination of

revenue generating operating activities and investing in growing

businesses across emerging markets. APQ Global run a

well-diversified and liquid portfolio, take strategic stakes in

selected businesses and plan to take operational control of

companies through the acquisition of minority and majority stakes

in companies with a focus on emerging markets.

For more information, please visit www.apqglobal.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFLFVTLFITFII

(END) Dow Jones Newswires

January 29, 2020 02:00 ET (07:00 GMT)

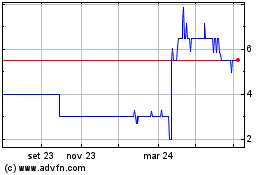

Grafico Azioni Apq Global (LSE:APQ)

Storico

Da Mar 2024 a Apr 2024

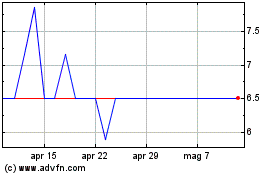

Grafico Azioni Apq Global (LSE:APQ)

Storico

Da Apr 2023 a Apr 2024