TIDMRSE

RNS Number : 3559B

Riverstone Energy Limited

30 January 2020

- THIS ANNOUNCEMENT INCLUDES INSIDE INFORMATION -

Riverstone Energy Limited Announces 4Q19 Quarterly Portfolio

Valuations

London, UK (30 January 2020) - Riverstone Energy Limited ("REL")

announces its quarterly portfolio summary as of 31 December 2019,

inclusive of updated quarterly unaudited fair market

valuations:

Current Portfolio

Gross

Realised

Gross Gross Gross Capital 30 Sep 31 Dec

Investment Committed Invested Realised Unrealised & 2019 2019

(Initial Investment Capital Capital Capital Value Unrealised Gross Gross

Date) Target Basin ($mm) ($mm) ($mm)[1] ($mm) Value ($mm) MOIC2 MOIC(2)

Centennial Permian

(6 Jul 2016) (U.S.) $268 $268 $172 $70 $242 0.9x 0.9x

Deepwater

ILX III (8 GoM

Oct 2015) (U.S.) 200 155 5 181 186 1.2x 1.2x

Hammerhead

Resources Deep Basin

(27 Mar 2014) (Canada) 307 295 23 81 104 0.4x 0.4x

RCO3 (2 Feb North

2015) America 80 80 79 2 81 1.0x 1.0x

Permian &

Carrier II Eagle Ford

(22 May 2015) (U.S.) 133 110 29 48 77 0.7x 0.7x

Liberty II Bakken, PRB

(30 Jan 2014) (U.S.) 142 142 - 57 57 0.5x 0.4x

Fieldwood GoM Shelf

(17 Mar 2014) (U.S.) 89 88 8 39 47 0.6x 0.5x

Onyx (30 Nov

2019) Europe 66 31 - 31 31 n/a 1.0x

CNOR (29 Aug Western

2014) Canada 90 90 16 15 31 0.3x 0.3x

Vaca Muerta

Aleph (9 Jul (Argentina

2019) ) 100 23 - 23 23 1.0x 1.0x

Ridgebury

(19 Feb 2019) Global 22 18 2 20 22 1.2x 1.2x

Gulf Coast

Castex 2014 Region

(3 Sept 2014) (U.S.) 67 52 - 19 19 0.3x 0.4x

Total Current Portfolio(4) $1,564 $1,352 $332 $587 $919 0.7x 0.7x

------------------------------------- ---------- --------- ---------- ---------- ----------- ------- --------

Realisations

Gross

Realised

Capital

Gross Gross Gross & 30 Sep 31 Dec

Investment Committed Invested Realised Unrealised Unrealised 2019 2019

(Initial Investment Capital Capital Capital Value Value Gross Gross

Date) Target Basin ($mm) ($mm) ($mm)(1) ($mm) ($mm) MOIC(2) MOIC(2)

Rock Oil5 (12

Mar 2014) Permian (U.S.) 114 114 231 6 237 2.1x 2.1x

Three Rivers

III (7 Apr

2015) Permian (U.S.) 94 94 204 - 204 2.2x 2.2x

Meritage III6 Western

(17 Apr 2015) Canada 40 40 83 - 83 2.1x 2.1x

Sierra (24

Sept 2014) Mexico 18 18 39 - 39 2.1x 2.1x

Total Realisations(4) $267 $267 $558 $6 $565 2.1x 2.1x

------------------------------------------ ---------- --------- ---------- ---------- ---------- --------- --------

Withdrawn Commitments

and Impairments7 121 121 1 - 1 0.0x 0.0x

------------------------------------------ ---------- --------- ---------- ---------- ---------- --------- --------

Total Investments(4) $1,952 $1,739 $892 $593 $1,485 0.9x 0.9x

------------------------------------------ ---------- --------- ---------- ---------- ---------- --------- --------

Cash and Cash Equivalents $183

------------------------------------------ ---------- --------- ---------- ---------- ---------- --------- --------

Total Investments & Cash

and Cash Equivalents(4) $776

------------------------------------------ ---------- --------- ---------- ---------- ---------- --------- --------

Quarterly Performance Commentary

During the fourth quarter, the West Texas Intermediate ("WTI")

spot prices and S&P Oil & Gas Exploration & Production

Index increased by approximately 14 per cent. and 10 per cent.,

respectively, largely due to geopolitical instability related to

tensions between the U.S. and Iran. However, energy valuations

especially within E&P, continued to face macro headwinds as the

forward curve as well as capital markets and M&A activity

remained at muted levels. Further detail on REL's five largest

positions, which account for 74per cent. of the portfolio's gross

unrealised value, is set forth below:

ILX III

The Gross MOIC for ILX III remained unchanged during the fourth

quarter and was marked at a 1.2x. To date, the company has

participated in nine commercial discoveries, of which four are

currently producing oil, and expects to bring an additional 3

assets online during 2020.

During the fourth quarter, ILX III announced the sale of its

working interest in 18 exploration prospects to Talos Energy

("Talos"; NYSE: TALO) in 4Q 2019 and finalised the sale of its

remaining 20 per cent. working interest in Mt. Ouray to Murphy Oil

Corporation. These transactions did not have a material impact on

the valuation of ILX III.

Hammerhead

The Gross MOIC for Hammerhead remained unchanged during the

fourth quarter and was marked at a 0.4x. While capital markets and

macro conditions continue to remain challenging for Canadian oil

producers, Hammerhead continues to focus on the development of its

core Upper/Middle Montney acreage. During 2019, the company

significantly improved drilling and completion cost efficiencies as

it executed on pad development. Hammerhead is currently producing

29,000 boepd, in line with its 2019 targeted production levels.

During the year, Hammerhead tabled discussions regarding a

midstream financing transaction. However, the Company's borrowing

base did not change during 2019, and the Company signed a farm-out

agreement on a portion of its acreage to accelerate development

without impacting near-term liquidity.

Centennial

The Gross MOIC for Centennial remained unchanged during the

fourth quarter and was marked at a 0.9x, reflecting the ending

share price for the period. Even though the share price continues

to trade at low levels, the company continues to operationally

outperform with capital efficiency being a top focus to maintain a

strong balance sheet and financial flexibility in the current

commodity price environment. Operational efficiencies have resulted

in Centennial accomplishing its drilling program with 5.5 rigs

compared to the budgeted 6 rigs. The company is targeting crude oil

production growth of 22 per cent. based on FY 2019 guidance, with

the ability to ramp down rig pace to generate additional

free-cash-flow if macro-environment conditions decline.

Liberty II

The Gross MOIC for Liberty II was reduced from 0.5x to 0.4x

during the fourth quarter due to difficult capital markets

conditions and higher discount rates applied to its NAV valuation

methodology. The company has adjusted its development plan to

improve production efficiencies while proving the quality of its

East Nesson position. Liberty II continues to evaluate external

financing options in order to grow production volumes and cash

flows. In the interim, the company will commence a four-well

drilling contract using existing sources of capital.

Carrier II

The Gross MOIC for Carrier II remained unchanged during the

fourth quarter and was marked at a 0.7x. During the quarter, the

company successfully completed the sale of its Southern Midland

Basin assets and had six additional Eagle Ford wells brought

online, resulting in a total of 34 new wells in 2019. Carrier II

continues to generate free cash flow from its Eagle Ford assets,

which were producing approximately 6,180 boepd at the end of 2019.

The company has distributed $29 million, representing approximately

26 per cent. of REL's invested capital.

Other Investments

During the fourth quarter, the Gross MOIC for Fieldwood was

reduced from 0.6x to 0.5x due to existing shelf production

underperformance, an increase in capital expenditures due to a

shift in focus towards higher impact deepwater prospects, and

increased regulatory scrutiny. This reduction was partially offset

by the increase in valuation for Castex 2014 from a Gross MOIC of

0.3x to 0.4x. In early December, Talos announced the acquisition of

Castex 2014 in exchange for cash proceeds and shares of Talos

stock. Since the announcement of the transaction through to 30

December 2019, Talos' share price increased by approximately 17 per

cent., resulting in an increase in Castex 2014's valuation.

Onyx Power

On 30 November 2019, REL invested an initial $31 million of its

$66 million commitment to Onyx Power. The capital was used to fund

the acquisition of 2,350MW of gross installed capacity (1,941MW of

net installed capacity) across five coal- and biomass-fired power

plants in Germany and the Netherlands from Engie SA. Two of the

facilities in the acquired portfolio are among Europe's most

recently constructed thermal plants, which benefit from high

efficiencies, substantial environmental controls, very low

emissions profiles and the potential use of sustainable

biomass.

About Riverstone Energy Limited:

REL is a closed-ended investment company that invests

exclusively in the global energy industry across all sectors. REL

aims to capitalise on the opportunities presented by Riverstone's

energy investment platform. REL's ordinary shares are listed on the

London Stock Exchange, trading under the symbol RSE. REL has 12

active investments spanning oil and gas, midstream, and energy

services in the Continental U.S., Western Canada, Gulf of Mexico,

Latin America, Europe and credit.

For further details, see www.RiverstoneREL.com

Neither the contents of Riverstone Energy Limited's website nor

the contents of any website accessible from hyperlinks on the

websites (or any other website) is incorporated into, or forms part

of, this announcement.

Media Contacts

For Riverstone Energy Limited:

Natasha Fowlie

Brian Potskowski

+44 20 3206 6300

Note:

The Investment Manager is charged with proposing the valuation

of the assets held by REL through the Partnership. The Partnership

has directed that securities and instruments be valued at their

fair value. REL's valuation policy follows IFRS and IPEV Valuation

Guidelines. The Investment Manager values each underlying

investment in accordance with the Riverstone valuation policy, the

IFRS accounting standards and IPEV Valuation Guidelines. The

Investment Manager has applied Riverstone's valuation policy

consistently quarter to quarter since inception. The value of REL's

portion of that investment is derived by multiplying its ownership

percentage by the value of the underlying investment. If there is

any divergence between the Riverstone valuation policy and REL's

valuation policy, the Partnership's proportion of the total holding

will follow REL's valuation policy. There were no valuation

adjustments recorded by REL as a result of differences in IFRS and

U.S. Generally Accepted Accounting Policies for the period ended 31

December 2019 or in any period to date. Valuations of REL's

investments through the Partnership are determined by the

Investment Manager and disclosed quarterly to investors, subject to

Board approval.

Riverstone values its investments using common industry

valuation techniques, including comparable public market valuation,

comparable merger and acquisition transaction valuation, and

discounted cash flow valuation.

For development-type investments, Riverstone also considers the

recognition of appreciation or depreciation of subsequent financing

rounds, if any. For those early stage privately held companies

where there are other indicators of a decline in the value of the

investment, Riverstone will value the investment accordingly even

in the absence of a subsequent financing round.

Riverstone reviews the valuations on a quarterly basis with the

assistance of the Riverstone Performance Review Team ("PRT") as

part of the valuation process. The PRT was formed to serve as a

single structure overseeing the existing Riverstone portfolio with

the goal of improving operational and financial performance.

The Audit Committee reviews the valuations of the Company's

investments held through the Partnership, and makes a

recommendation to the Board for formal consideration and

acceptance.

[1] Gross realised capital is total gross proceeds realised on

invested capital. Of the $892 million of capital realised to date,

$600 million is the return of the cost basis, and the remainder is

profit.

2 Gross Unrealised Value and Gross MOIC (Gross Multiple of

Invested Capital) are before transaction costs, taxes

(approximately 21 to 27.5 per cent. of U.S. sourced taxable income)

and 20 per cent. carried interest on applicable gross profits in

accordance with the revised terms announced on 3 January 2020, but

effective 30 June 2019. Since there was no netting of losses

against gains before the aforementioned revised terms, the

effective carried interest rate on the portfolio as a whole will be

greater than 20 per cent. In addition, there is a management fee of

1.5 per cent. of net assets (including cash) per annum and other

expenses. Given these costs, fees and expenses are in aggregate

expected to be considerable, Total Net Value and Net MOIC will be

materially less than Gross Unrealised Value and Gross MOIC. Local

taxes, primarily on U.S. assets, may apply at the jurisdictional

level on profits arising in operating entity investments. Further

withholding taxes may apply on distributions from such operating

entity investments. In the normal course of business, REL may form

wholly-owned subsidiaries, to be treated as C Corporations for US

tax purposes. The C Corporations serve to protect REL's public

investors from incurring U.S. effectively connected income. The C

Corporations file U.S. corporate tax returns with the U.S. Internal

Revenue Service and pay U.S. corporate taxes on its taxable

income.

3 Credit investment.

4 Amounts may vary due to rounding.

5 The unrealised value of the Rock Oil investment consists of

rights to mineral acres.

6 Midstream investment.

7 Withdrawn commitments consist of Origo ($9 million) and CanEra

III ($1 million), and impairments consist of Eagle II ($62 million)

and Castex 2005 ($48 million).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PFUBIGDBIUDDGGC

(END) Dow Jones Newswires

January 30, 2020 02:01 ET (07:01 GMT)

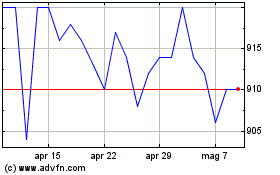

Grafico Azioni Riverstone Energy (LSE:RSE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Riverstone Energy (LSE:RSE)

Storico

Da Apr 2023 a Apr 2024