TIDMASAI

RNS Number : 9581D

ASA International Group PLC

25 February 2020

ASA International Group plc announces 2019 Year End Trading

Update

Amsterdam, 25 February 2020 - ASA International Group plc, ("ASA

International", the "Company" or the "Group"), one of the world's

largest international microfinance institutions, today releases its

trading update for the twelve-month period from 1 January 2019 to

31 December 2019.

Key highlights:

FY2019 FY2018 % Change % Change

(UNAUDITED) (UNAUDITED) (constant

currency)

Number of clients (mn) 2.5 2.2 14%

Number of branches 1,898 1,665 14%

OLP (1) (USD mn) 466.8 378.5 23% 28%

Average OLP per client (USD) 189 174 8% 12%

(1) Outstanding loan portfolio ("OLP") includes off-book

Business Correspondence ("BC") loans and excludes interest

receivable and the unamortized loan processing fee

-- Full year 2019 operating results slightly below expectations

driven by adverse market conditions in India, Nigeria and Sri Lanka

and resulting in a slightly higher PAR>30

-- Overall loan portfolio quality remains good with PAR>30 at 1.5%

-- Significant currency depreciation in Pakistan and Ghana

-- Strong underlying operating performance across all segments

with East Africa operations continuing to outperform

Dirk Brouwer, Chief Executive Officer of ASA International Group

plc, commented:

"The operational performance of the Group has been strong during

2019, with continued client and loan portfolio growth in all our

markets. We realized higher than expected growth in East Africa

which was offset by lower than expected growth in India, Nigeria

and Sri Lanka due to adverse market conditions. As a result, and

combined with significant currency depreciation in Pakistan and

Ghana, 2019 USD earnings growth is now expected to be around

5%.

We expect continued sustainable growth of our operations through

2020 with mid-to-high single digit USD earnings growth."

Regional performance:

South Asia

-- Number of clients grew to over 1.1mn, up by 11%

-- Number of branches increased to 753, up by 18%

-- Despite substantial currency depreciation in Pakistan (PKR

down 11% against USD in 2019), OLP portfolio expanded to USD

253.2mn, up by 20% (up 25% on a constant currency basis)

-- BC portfolio in India expanded to USD 49.7mn, up by 36% (up 39% on constant currency basis)

-- OLP/Client averaged USD 219 up by 9% (up 13% on a constant currency basis)

-- Due to signs that markets in North East India are

overheating, we have taken a more cautious approach to the growth

of our operations

-- Adverse political and regulatory conditions in Sri Lanka

curbed operational growth and caused a substantial increase of

PAR>30 to 10%

South East Asia

-- Number of clients grew to over 491k, up by 11%

-- Number of branches increased to 406, up by 10%

-- OLP grew to USD 84.3mn, up by 36% (up 31% on a constant currency basis)

-- OLP/Client averaged USD 173, up by 22% (up 18% on a constant currency basis)

-- Loan growth in the Philippines and Myanmar was higher than

expected in both local currency and USD terms

West Africa

-- Number of clients grew to over 459k, up by 5%

-- Number of branches increased to 423, up by 2%

-- OLP grew to USD 77.2mn, up by 8% (up 18% on a constant

currency basis). This was lower than expected due to:

o higher than expected depreciation of the Ghanaian Cedi (GHS

down 17% in 2019) and;

o difficult market conditions in Nigeria slowing the growth of

operations, due to weak economic growth and increased security

concerns

-- OLP/Client averaged USD 170, up by 3% (up 13% on a constant currency basis)

East Africa

-- Number of clients grew to over 348k, up by 44%

-- Number of branches increased to 316, up by 30%

-- OLP grew to USD 51.6mn, up by 56% (up 56% on a constant

currency basis), which was higher than expected, due to continued

expansion of operations in all countries across the region

-- OLP/Client averaged USD 149, up by 9% (9% up on constant currency basis)

-- Operations continued to grow at a high pace in Kenya, Tanzania, and Uganda

Impact of foreign exchange rates

During H2 2019, currency movements in Asia and Africa remained

fairly stable against the US dollar with some gains recorded in the

Philippines and Myanmar. However, the USD strengthened more than

expected against currencies in two of our major markets, Ghana and

Pakistan. The weakening of these currencies against the USD in 2019

is expected to dampen USD year-on-year OLP and OLP/Client growth

during H1 2020.

Outlook

We expect to continue to grow branch and client numbers across

all regions in 2020.

We remain cautious in our growth outlook given increased

competition and risk of client over-indebtedness in the North

eastern regions of India, and the weak economic conditions and

security concerns in Nigeria. This is expected to be partially

mitigated by faster growth in our East African markets.

We expect continued sustainable growth of our operations through

2020 with mid-to-high single digit USD earnings growth.

Notice of Full Year Results

The Company will announce its 2019 Full Year Results on Tuesday,

21 April 2020.

Enquiries:

ASA International Group plc

Investor Relations +31 20 846 3554 / +31 6 2030 0139

Véronique Schyns vschyns@asa-international.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUSONRRBUUUAR

(END) Dow Jones Newswires

February 25, 2020 02:00 ET (07:00 GMT)

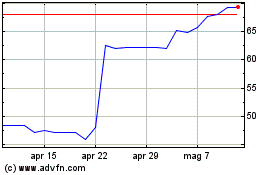

Grafico Azioni Asa (LSE:ASAI)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Asa (LSE:ASAI)

Storico

Da Apr 2023 a Apr 2024