Capital & Counties Properties Plc 2019 Final Dividend Exchange Rate & Scrip Prices (7356I)

03 Aprile 2020 - 10:53AM

UK Regulatory

TIDMCAPC

RNS Number : 7356I

Capital & Counties Properties Plc

03 April 2020

CAPITAL & COUNTIES PROPERTIES PLC (the "Company" or

"Capco")

2019 FINAL DIVIDEND - EXCHANGE RATE AND SCRIP CALCULATION

PRICES

Capital & Counties Properties PLC confirms that exchange

control approval for the offering of a scrip dividend alternative

has been obtained from the South African Reserve Bank and

shareholders are accordingly entitled to elect to receive new

ordinary shares in the Company, credited as fully paid in lieu of

cash, in respect of the 2019 final dividend of 1.0 pence per

ordinary share.

Exchange Rate for Final Dividend:

The Company confirms that the ZAR exchange rate for the 2019

final dividend of 1.0 pence per ordinary share to be paid on

Thursday 14 May 2020 to all shareholders registered on Friday 17

April 2020 will be 22.84680 ZAR to 1 GBP, which is the rate

determined on 2 April 2020.

On this basis, shareholders who hold their shares via the South

African register will receive a cash dividend of 22.84680 ZAR cents

per ordinary share.

Scrip Calculation Price:

The Scrip Calculation prices, which are based on the UK and SA

prices of Capco shares for the period 27 March 2020 to 2 April 2020

less the amount of the dividend, are as follows:

UK (principal register): 154.40 pence (GBP)

South Africa: 3,425.08220 cents (ZAR)

The same share prices will be used for calculating residual

payments under the Scrip Dividend Scheme.

Scrip Ratio:

The number of shares in issue is 848,239,163 ordinary shares of

25p each.

UK (principal register): 1 new ordinary share for every 154.40 ordinary shares held

South Africa: 1 new ordinary share for every 149.91518 ordinary

shares held (3,425.08220/ 22.84680 = 149.91518)

As no fraction of a share can be issued, the number of shares to

be issued will be rounded down to the nearest whole number and any

residual cash balance will be paid immediately to the relevant

shareholder (unless a UK shareholder has made an "evergreen

election") .

By way of illustration of the above, a shareholder who holds

1,000 shares on the South African exchange and who elects to

receive the scrip dividend alternative would be entitled to 1,000/

149.91518 = 6.67044 shares which would be rounded down to 6 shares,

and the residual payment would be 0.67044 x 3,425.08220 ZAR cents =

2,296.31211 ZAR cents, payable in cash .

Further details of the scrip dividend alternative are contained

in the Scrip Dividend Scheme Booklet, Supplemental Notices and the

related mandate forms, which are available on Capco's website at

www.capitalandcounties.com and from Capco's share Registrars.

Important Information for South African Shareholders:

The 2019 final cash dividend declared to South African

shareholders will comprise a foreign dividend (declared in respect

of a share listed on the exchange operated by the JSE) and will be

subject to dividends tax. Dividends tax will therefore be withheld

at a rate of 20 per cent. unless a shareholder qualifies for an

exemption and the prescribed requirements for effecting the

exemption, as set out in the rules of the Scrip Dividend Scheme,

are in place by the requisite date. After Dividends Tax has been

withheld, the net final dividend will be 18.27744 cents per

ordinary share. The funds are sourced from the UK.

It is the Company's understanding that the issue and receipt of

shares pursuant to the scrip dividend alternative will not have any

dividends tax nor income tax implications. The new shares which are

acquired under the scrip dividend alternative should not comprise

of a "foreign dividend" nor a "foreign return of capital" and will

be treated as having been acquired for nil consideration.

Any residual cash payments to account for fractional share

payments will be subject to dividends tax, which will be withheld

from the residual payment to South African shareholders at a rate

of 20 per cent, unless a shareholder qualifies for an exemption and

the prescribed requirements for effecting the exemption (as set out

in the Scrip Dividend Scheme Booklet) are in place by the requisite

date.

This information is included only as a general guide to taxation

for shareholders resident in South Africa and is based on Capco's

understanding of the law and the practice currently in force. Any

shareholder who is in any doubt regarding their tax position should

seek independent professional advice.

The salient dates in the revised dividend timetable published in

the announcement dated 26 February 2020 remain unchanged and no

element of the 2019 final dividend will be treated as a Property

Income Distribution for tax purposes.

Enquiries

Leigh McCaveny

Acting Company Secretary

Capital & Counties Properties PLC

+ 44 (0 ) 20 3214 9170

3 April 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGIGDSRSGDGGX

(END) Dow Jones Newswires

April 03, 2020 04:53 ET (08:53 GMT)

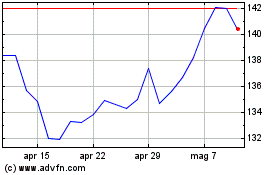

Grafico Azioni Shaftesbury Capital (LSE:SHC)

Storico

Da Mar 2024 a Apr 2024

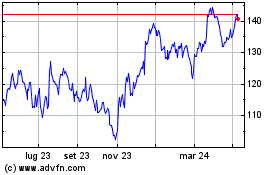

Grafico Azioni Shaftesbury Capital (LSE:SHC)

Storico

Da Apr 2023 a Apr 2024