SQN Asset Finance Income Fund Ltd Net Asset Value(s) (6776N)

22 Maggio 2020 - 8:00AM

UK Regulatory

TIDMSQN

RNS Number : 6776N

SQN Asset Finance Income Fund Ltd

22 May 2020

22 May 2020

SQN Asset Finance Income Fund Limited

Monthly Net Asset Value

SQN Asset Finance Income Fund Limited (the "Company"), provides

the following monthly net asset value ("NAV").

Net Asset Value and Performance

As at 30 April 2020, the unaudited estimated NAV per Ordinary

Share was 69.09 pence.

As at 30 April 2020, the unaudited estimated NAV per C Share was

96.98 pence .

The Company also announces the cumulative NAV total return(1)

performance as at 30 April 2020, as follows:

Share class Month-to-month 1 year return 3 year return Return since

return inception

Ordinary shares (1.05)% (22.67)% (13.30)% 3.63%

C shares (0.02)% 5.92% 14.15% 14.04%

Shareholders should note that the hedging of non-Sterling

balances into Sterling has been lifted and, therefore, the returns

during March contain some foreign exchange impacts.

Performance Footnote(1)

The NAV total return details the change in NAV from the start of

the relevant period and assumes that dividends paid to shareholders

are reinvested at NAV.

Factsheet

The Company's factsheet for April 2020 will shortly be available

on the website:

https://www.sqncapital.com/managed-funds/sqn-asset-finance-income-fund/documents-and-downloads/

For further information please contact:

SQN Capital Management, LLC 01932 575 888

Jeremiah Silkowski jsilkowski@sqncapital.com

Nicola Bird nbird@sqncapital.com

Catherine Halford Riera chalford@sqncapital.com

Winterflood Securities Limited 020 3100 0000

Neil Langford

Chris Mills

Buchanan

Charles Ryland

Victoria Hayns

Henry Wilson 020 7466 5000

Notes to Editor

The Company invests in equipment lease and asset finance

arrangements across a diverse portfolio of assets and industries

predominantly in the UK, Northern Europe and US. The Company

focuses on business-essential, revenue-producing (or cost saving)

equipment and other assets with high in-place value and long

economic life relative to the investment term.

The Company's Investment Managers are SQN Capital Management,

LLC, a Registered Investment Advisor with the United States

Securities and Exchange Commission and its subsidiary, SQN Capital

Management (UK) Limited. The principal responsible for managing the

portfolio is Jeremiah Silkowski.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVPPURAAUPUGAG

(END) Dow Jones Newswires

May 22, 2020 02:00 ET (06:00 GMT)

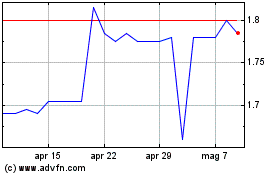

Grafico Azioni Slf Realisation (LSE:SLFR)

Storico

Da Mar 2024 a Apr 2024

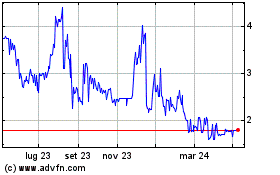

Grafico Azioni Slf Realisation (LSE:SLFR)

Storico

Da Apr 2023 a Apr 2024