TIDMSLPE

RNS Number : 2921Q

Standard Life Private Eqty Trst PLC

18 June 2020

STANDARD LIFE PRIVATE EQUITY TRUST PLC

Legal Entity Identifier (LEI): 2138004MK7VPTZ99EV13

HALF YEARLY FINANCIAL REPORT FOR THE SIX MONTHSED 31 MARCH

2020

-- NAV performance - The NAV total return ("NAV TR") for the

first 6 months of the year was -6.3% versus -22.0% for the FTSE

All-Share Index.

-- COVID-19 - Valuations at 31 March 2020 reflected the initial

impact of the outbreak on the Company's portfolio and NAV. The

quarterly movement was -12.5% excluding the impact of FX. This was

the first quarter that the Company's NAV began to reflect the

impact of COVID-19. Going forward, we expect that private equity

valuations will continue to be impacted negatively by COVID-19,

which could lead to further reductions in NAV in the second half of

FY20.

-- New commitments - In total, four primary fund commitments,

one secondary transaction and one co-investment were completed in

the period. We will reduce the overall pace of deployment in the

second half of FY20 given the uncertainty surrounding COVID-19.

-- Realisations - The portfolio continued to generate strong

realisations during the period, with distributions of GBP93.8m.

This includes the realisation of the Company's position in 3i

Eurofund V, which was its largest fund exposure at 30 September

2019 .

-- Outstanding commitments - Total outstanding commitments of

GBP451.2m (30 September 2019: GBP450.3m). The value of outstanding

commitments in excess of liquid resources as a percentage of net

assets is 42.2% (30 September 2019: 42.6%). This remains

comfortably within our long-term target range of 30%-75%. We

estimate that GBP64.4 million of the Company's existing outstanding

commitments are unlikely to be drawn.

-- Balance sheet - The Company had resources available for

investment of GBP74.8m at 31 March 2020 (30 September 2019:

GBP67.7m). In addition, the Company has an undrawn GBP100m

syndicated revolving credit facility, provided by Citibank and

Société Générale, which expires in December 2024.

For further information please contact:

Alan Gauld

Investment Director, Aberdeen Standard Investments

Tel: 0 131 528 4424

Luke Mason

Head of Business Development, Investment Trusts, Aberdeen

Standard Investments

Tel: 0207 463 5971

Evan Bruce-Gardyne

Client Director, Investment Trusts, Aberdeen Standard

Investments

Tel: 0131 372 1692

FINANCIAL HIGHLIGHTS

Six months ended Six months ended

31 March 2020 31 March 2019

--------------------------------------- ----------------- -----------------

Net asset value total return per

Ordinary Share(+) -6.3% 0.4%

--------------------------------------- ----------------- -----------------

Share price total return per Ordinary

Share(+) -25.9% 4.1%

--------------------------------------- ----------------- -----------------

(+) Source: Aberdeen Standard Investments and Refinitiv

Datastream

Performance (capital only) As at 31 As at 30 September % Change

March 2020 2019

------------------------------------------ ------------ ------------------- ---------

Net Asset Value per share 426.4p 461.9p -7.7%

------------------------------------------ ------------ ------------------- ---------

Share price 254.0p 352.0p -27.8%

------------------------------------------ ------------ ------------------- ---------

FTSE All-Share Index 3,107.4 4,061.7 -23.5%

------------------------------------------ ------------ ------------------- ---------

Discount (difference between share price

and net asset value) 40.4% 23.8%

------------------------------------------ ------------ ------------------- ---------

CHAIR'S STATEMENT

COVID-19

The purpose of the Chair's Statement is typically to summarise

the outcomes from the period under review. While this can never be

done without having an eye on activity since the end of the period,

we have witnessed some of the most extreme economic changes for

generations since 31 March 2020, as governments around the world

and markets react to the impact of the COVID pandemic. It should be

acknowledged that the numbers in this report are taken at a point

in time when the full effects of COVID-19 have still to be

established. As the Company invests in funds holding unlisted

companies, there is always a time lag in the reporting of

valuations.

Against such a backdrop, the Board has increased the frequency

of its discussions with the Manager, to ensure that it is being

kept informed of developments on a timely basis. In considering its

response, the Board has confidence that the Company's diversified

portfolio has a good measure of resilience to cope with the

economic fall-out resulting from the lock-downs instigated by

various governments around the world to curb the spread of this

virus. The Board is pleased to note that the Manager has confirmed

that, despite the challenging market conditions, the Manager is

continuing to require adherence to the established ESG principles

by the underlying portfolio managers and the management of the

invested companies. The Board also considers that the Company is

entering this new crisis with a relatively stronger balance sheet

with greater liquidity than was the case in the global financial

crisis of 2008.

Performance

For the six months to 31 March 2020, the Company's NAV total

return was -6.3%. The total shareholder return was -25.9%. For

comparison, the return on the FTSE All-Share Index was -22.0% in

the same period. The significant discrepancy between the share

price return and that of the NAV, which is a feature of a private

investment trust, is in part a timing issue as it is the result of

investors attempting to estimate how much valuations are likely to

fall as a consequence of the crisis.

A review of the Company's performance, market background and

investment activity during the period under review, as well as the

Manager's investment outlook, are provided in the Manager's Report

below.

Investments & realisation activity

During the period, the Company made commitments totalling

GBP83.9m (31 March 2019: GBP99.2m) into its unquoted portfolio.

Funds were committed to four new primary investments, one secondary

and one co-investment. The Company received net realisations of

GBP93.8m (31 March 2019: GBP49.5m). The realised return from

divestments in the Company's core portfolio equated to 5.0 times

cost (30 September 2019: 2.2 times cost). The return was enhanced

by the proceeds from the realisation of 3i Eurofund V. Excluding

the 3i Eurofund V transactions, the realised return was 2.3 times..

Outstanding commitments at 31 March 2020 amounted to GBP451.2m (30

September 2019: GBP450.3m).

Key Performance Indicators ("KPIs")

Last year, the Board reviewed and revised the KPIs by which the

Manager is measured in order to better align the KPIs with the

interests of shareholders. The Company's performance against each

of its KPIs, during the six months to 31 March 2020, is set out

below.

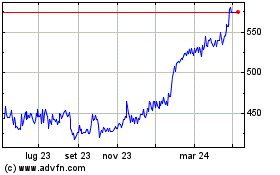

Net asset value total return ("NAV TR") relative to the

Company's comparator index

I am happy to report that the Company has delivered returns in

excess of the wider UK market over all timeframes. A comparison of

the annualised total returns of the share price and NAV with that

of the FTSE All-Share Index, the Company's comparator index, over

various time frames, is included in the Half Yearly Report.

Total shareholder return ("TSR") relative to the Company's

comparator index

The chart in the Half Yearly Report also shows a wide disparity

between the NAV total return and the TSR over 6 and 12 months,

highlighting how the market adjusted the valuation of the Company

very quickly. This fed into a material widening of the discount.

Over the longer term, the TSR has exceeded the comparator

index.

Discount or premium of the ordinary share price to the net asset

value per share of the Company in absolute terms and compared to

the discounts of the close peers* on a rolling 12 month basis

Closing discount Narrowest discount Widest discount

As at 31 March 2020 (%) (%) (%)

----------------------------- ---------------- ------------------ ---------------

Standard Life Private Equity

Trust -40.4 -7.2 -56.7

============================= ================ ================== ===============

Close peer group average -37.4 -6.0 -54.3

----------------------------- ---------------- ------------------ ---------------

Source: Aberdeen Standard Investments and Refinitiv

Datastream

* Sterling denominated UK listed private equity fund of

funds.

In line with peers in the sector, the discount widened very

sharply in late February / early March 2020. Since the end of the

period, the discount has stabilised around the 40% mark.

Ongoing charges ratio

The Ongoing charges ratio ("OCR") is an annual ratio and as such

we only provide an estimate in these accounts. The forecast to 30

September 2020 as at 31 March 2020 is 1.11%, a small increase on

1.09% as at 30 September 2019.

Dividends

The Company paid the first interim dividend for the current year

in April 2020 of 3.3 pence per share. The Board has declared a

second interim dividend of 3.3 pence per share which will be paid

on 31 July 2020 to shareholders on the Company's share register at

26 June 2020. These two payments will make a total for the period

of 6.6 pence per share, compared to 6.4 pence per share for the

equivalent period in 2019, representing a 3.1% increase on the

payments in 2019.

The rapid development of the COVID-19 crisis has put an

unprecedented strain on most aspects of the economies in which the

portfolio is invested. In view of the continuing uncertain economic

outlook, the Board will monitor the portfolio's prospects closely

and will keep the level of future dividends under review.

Discount

Over the period, , the discount of the Company's share price to

its net asset value fluctuated significantly, ranging between 7.2%

and 56.7%. At 31 March 2020, the discount to reported NAV was

40.4%. This widening is unsurprising as it reflected the fact that

valuations of unlisted companies take time to flow through. Against

this backdrop, the Board has not considered it appropriate to buy

in shares. However, the Board will keep this under ongoing review,

particularly as general market conditions show signs of stabilising

and the outlook for valuations becomes clearer.

Bank facilities and liquidity

Since the financial year ended 30 September 2019, the Board has

increased the Company's GBP80m syndicated multi-currency revolving

credit facility with Citibank and Société Générale to GBP100m and

has extended the expiry date to December 2024. The facility is

currently undrawn (2019: GBPnil). In addition, at the end of March,

the Company had cash balances of GBP59.6m (30 September 2019:

GBP66.3m).

Outlook

There is no doubt that the future will be determined by how the

COVID-19 pandemic develops and in particular the scale of impact

that it has on the economic landscape. The challenges that this

creates on economies across the world will put pressure on most

aspects of the Company's investments. The Board takes comfort from

the diversification of the portfolio including, for example, the

exposure to companies in the IT and healthcare sectors. But we do

expect that there will be further negative pressure on all

valuations during the rest of the financial year which will feed

through to the Company's NAV. We also anticipate that there will be

a lower level of distributions than we have experienced in recent

years and the Board will assess the impact that this may have on

future dividends as the situation evolves.

Against this backdrop, the Board considers that the Company is

in a stronger financial position than it was ahead of the Global

Financial Crisis in 2008/09. Private equity investing requires a

long-term perspective and periods of disruption, such as that which

we are currently experiencing, are something that have to be

weathered. Whilst we expect that the number of new primary

investment opportunities will reduce in the short term, we also

take the view that the market adjustment is likely to present

investment opportunities that will provide returns over the long

term for shareholders.

Christina McComb OBE, Chair

Chair

17 June 2020

INTERIM BOARD REPORT

Directors' Responsibility Statement

The Directors are responsible for preparing the Half Yearly

Report, in accordance with applicable laws and regulations. The

Directors confirm that, to the best of their knowledge:

- The condensed set of financial statements has been prepared in

accordance with Financial Reporting Standard 104 (Interim Financial

Reporting) and gives a true and fair view of the assets,

liabilities, financial position and profit or loss of the

Company;

- The Interim Board Report (constituting the interim management

report) includes a fair review of the information required by DTR

4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first

months of the financial year and their impact on the condensed set

of financial statements, and a description of the principal risks

and uncertainties for the remaining six months of the year; and

- The financial statements include a fair review of the

information required by DTR 4.28R of the Disclosure Guidance and

Transparency Rules, being related party transactions that have

taken place in the first six months of the financial year and that

have materially affected the financial position or performance of

the Company during that period, and any changes in the related

party transactions described in the last Annual Report that could

do so.

Principal Risk and Uncertainties

The Board has an ongoing process for identifying, evaluating and

managing the principal risks, emerging risks and uncertainties of

the Company. The principal risks faced by the Company relate to the

Company's investment activities and are set out in the Strategic

Report contained within the Annual Report for the year ended 30

September 2019. They comprise the following risk categories:

- market risk

- currency risk

- over-commitment risk

- liquidity risk

- credit risk

- interest rate risk

- operating and control environment risk

The Board notes that the principal risks may be impacted by the

economic uncertainty stemming from the COVID-19 pandemic. This

includes risks surrounding the performance of the companies in the

portfolio such as employee absence, reduced demand, supply chain

breakdowns and suspension of distributions. The Board and Manager

expect that there will be more pressure on valuations and further

impact on the Company's NAV in the current financial year, as well

as a decline in mergers and acquisitions ("M&A") activity,

followed by a decrease in drawdowns. The Board has been proactive

in engaging with the Manager to ensure that the Company continues

to be managed in accordance with the investment objective and

policy, and in the best interest of shareholders. Operationally,

COVID-19 is affecting the suppliers of services to the Company

including the Manager and other key third party suppliers. To date,

these services have continued to be supplied seamlessly and the

Board will continue to monitor arrangements in the form of regular

updates from the Manager.

In all other respects, the Company's principal risks, emerging

risks and uncertainties have not changed materially since the date

of that Annual Report.

Going Concern

In accordance with the FRC's Guidance on Risk Management,

Internal Control and Related Financial and Business Reporting, the

Directors have undertaken a rigorous review of the Company's

ability to continue as a going concern as a basis for preparing the

financial statements.

The Board has taken into account; the GBP100 million committed,

syndicated revolving credit facility which matures in December

2024; the level of liquid resources, including cash and cash

equivalents ; the future cash flow projection; the Company's cash

flows during the period, the effectiveness of the Manager's

operational resilience processes; and the impact of potential

downside scenarios on asset valuations and liquidity, including

potential management actions.

The Directors are mindful of the principal risk and

uncertainties disclosed above, including the impact of COVID-19.

Having reviewed these matters, the Directors believe that the

Company has adequate financial resources to continue its

operational existence for the foreseeable future and for at least

12 months from the date of this Half Yearly Report. Accordingly,

they continue to adopt the going concern basis in preparing the

Half Yearly Report.

On behalf of the Board,

Christina McComb OBE, Chair

17 June 2020

INVESTMENT STRATEGY

Investment strategy

Standard Life Private Equity Trust provides exposure to:

- A diversified portfolio of leading private companies.

- A carefully selected range of private equity managers, built

from years of established relationships and proprietary

research.

- Investments principally focused on European mid-market private companies.

With the objective of delivering strong, long-term total returns

for Shareholders through a combination of capital growth and a

progressive dividend.

Investment policy and guidelines

The principal focus of the Company is to invest in leading

private equity funds through the primary and secondary funds

markets. The Company's policy is to maintain a broadly diversified

portfolio by country, industry sector, maturity and number of

underlying investments. In terms of geographic exposure, a majority

of the Company's portfolio will have a European focus. The

objective is for the portfolio to comprise around 50 "active"

private equity fund investments; this excludes funds that have

recently been raised, but have not yet started investing, and funds

that are close to or being wound up. The Company may also invest up

to 20% of its assets in co-investments.

The Company may also hold direct private equity investments or

quoted securities as a result of distributions in specie from its

portfolio of fund investments. The Company's policy is normally to

dispose of such assets where they are held on an unrestricted

basis. This is in addition to the 20% that can be held in

co-investments.

To maximise the proportion of invested assets, it is the

Company's policy to follow an over-commitment strategy by making

commitments which exceed its uninvested capital. In making such

commitments, the Manager, together with the Board, will take into

account the uninvested capital, the value and timing of expected

and projected cashflows to and from the portfolio and, from time to

time, may use borrowings to meet drawdowns. The Company's maximum

borrowing capacity, defined in its articles of association, is an

amount equal to the aggregate of the amount paid up on the issued

share capital of the Company and the amount standing to the credit

of the reserves of the Company. However, it is expected that

borrowings would not normally exceed 30% of the Company's net

assets at the time of drawdown.

The Company's non-sterling currency exposure is principally to

the euro and US dollar. The Company does not seek to hedge this

exposure into sterling, although any borrowings in euros and other

currencies in which the Company is invested would have such a

hedging effect.

Cash held pending investment is invested in short-dated

government bonds, money-market instruments, bank deposits or other

similar investments. Cash held pending investment may also be

invested in other listed investment companies or trusts.

The Company will not invest more than 15% of its total assets in

such listed equities.

The investment limits described above are all measured at the

time of investment.

Strategy implementation

Aberdeen Standard Investments is one of the largest investors in

private equity funds in Europe. One of the key strengths of the

investment team is its extensive fund and direct deal experience,

which gives the Manager greater insight into the strategies,

processes and disciplines of the funds invested in and allows

better qualitative judgements to be made.

The investment strategy employed by the Manager in meeting the

investment objective involves a detailed and rigorous screening and

due diligence process to identify and then evaluate the best

private equity fund offerings.

The private equity asset class has historically exhibited a wide

dispersion of returns generated by fund investments and the Manager

believes that appropriate portfolio construction and manager

selection is vital to optimise investment performance. The Manager

focuses predominantly on investing in the European mid-market space

where it has a long track record. The number of potential

investment opportunities in that segment is vast and the Manager

continues to build a roster of blue chip, private equity firms

which has been developed from years of strong relationships and

proprietary research. In that regard, the objective is for the

Company's portfolio to comprise around 50 "active" private equity

fund investments at any one time.

INVESTMENTS MANAGER'S REVIEW

Summary

- NAV performance - The NAV total return ("NAV TR") for the

first 6 months of the year was -6.3% versus -22.0% for the FTSE

All-Share Index.

- COVID-19 - Valuations at 31 March 2020 reflected the initial

impact of the outbreak on the Company's portfolio and NAV. The

quarterly movement was -12.5% excluding the impact of FX. This was

the first quarter that the Company's NAV began to reflect the

impact of COVID-19. Going forward, we expect that private equity

valuations will continue to be impacted negatively by COVID-19,

which could lead to further reductions in NAV in the second half of

FY20.

- New commitments - In total, four primary fund commitments, one

secondary transaction and one co-investment were completed in the

period. We will reduce the overall pace of deployment in the second

half of FY20 given the uncertainty surrounding COVID-19.

- Realisations - The portfolio continued to generate strong

realisations during the period, with distributions of GBP93.8m.

This includes the realisation of the Company's position in 3i

Eurofund V, which was its largest fund exposure at 30 September

2019 .

- Outstanding commitments - Total outstanding commitments of

GBP451.2m (30 September 2019: GBP450.3m). The value of outstanding

commitments in excess of liquid resources as a percentage of net

assets is 42.2% (30 September 2019: 42.6%). This remains

comfortably within our long-term target range of 30%-75%. We

estimate that GBP64.4 million of the Company's existing outstanding

commitments are unlikely to be drawn.

- Balance sheet - The Company had resources available for

investment of GBP74.8m at 31 March 2020 (30 September 2019:

GBP67.7m). In addition, the Company has an undrawn GBP100m

syndicated revolving credit facility, provided by Citibank and

Société Générale, which expires in December 2024.

COVID-19

Valuations at 31 March 2020 reflected the initial impact of the

outbreak on the Company's portfolio and NAV. The quarterly movement

was -12.5% excluding the impact of FX. This was the first quarter

that the Company's NAV began to reflect the impact of COVID-19.

It is not possible to quantify the ultimate impact on the

Company with any certainty. We anticipate further declines in both

the NAV and the level of distributions over the remainder of the

financial year. However, we take comfort in the:

(i) Quality and operational capabilities of the private equity

managers that we have selected, all of whom successfully weathered

the global financial crisis in 2008;

(ii) Diversification of the underlying investment portfolio

within the funds, with over 400 companies spread across different

countries, sectors and vintages;

(iii) Available capital in the underlying funds, which will

allow our private equity managers to support underlying companies

through the crisis;

(iv) Greater flexibility of debt structures in underlying

companies compared to levels prior to the global financial crisis

in 2008, with higher equity as a percentage of enterprise value and

"covenant-lite" debt packages more commonplace;

(v) Level of liquid resources and the undrawn revolving credit

facility available to address the Company's funding requirements in

a range of different stressed scenarios.

Deep and established relationships matter more than ever in this

environment. We continue to stay in regular dialogue with the

Company's private equity managers, all of whom we have known for

over a decade. Our strong conviction in the Company's roster of

private equity managers hasn't changed. We are closely monitoring

developments at the underlying portfolio company level, but it

won't be until the second half of the financial year that we expect

that we will see the impact of COVID-19 on portfolio company

revenue, profitability and balance sheets.

Valuation

Of the 54 private equity interests in which the Company is

invested, 50 interests (97.6% of the portfolio by value) were

valued by their underlying managers at 31 March 2020 (31 March

2019: 95.4%).

Out of this 97.6%, 46 funds (86.9% of the portfolio value)

accounted for the initial impact of COVID-19. However four funds

valued at 31 March 2020 (10.7% of the portfolio by value) were

adjusted downward by the Manager to account more fully for the

initial impact of COVID-19. The underlying managers of these four

interests had not reflected the initial impact of COVID-19 within

their 31 March 2020 valuations and intend to undertake a full

review of their valuations as part of their 30 June 2020 valuation

process.

The remaining 2.4% by value of the portfolio has also been

adjusted downward by the Manager based on the valuation as at 31

December 2019, adjusted for subsequent cash flows. Valuation

adjustments were based on either (i) specific information from

underlying managers on the likely movement at 31 March 2020 or (ii)

the weighted average movement in the Company's portfolio.

The unrealised losses in the period are largely attributable to

the initial financial impact of COVID-19. The overall impact is

seen broadly across the Company's underlying fund portfolio.

Private equity managers in SLPET's portfolio have re-valued

underlying companies based largely on listed market comparables at

31 March 2020, when public markets were around recent lows. In

addition, the earnings of underlying companies may also reflect the

initial impact of COVID-19 during the first quarter of 2020.

Performance

The NAV TR for the first six months of FY20 was -6.3% versus

-22.0% for the FTSE All-Share Index.

The decrease in value of the Company on a per share basis was

35.5p. This was principally made up of unrealised losses at

constant FX from the unquoted portfolio of 74.8p, partially offset

by realised gains and income from the unquoted portfolio of

49.2p.

Realised gains were derived from full or partial sales of

companies during the period. The material contributor to realised

gains in the period was 3i Eurofund V, as a result of the

realisation of its underlying company Action. Over the twelve

months to December 2019, the underlying portfolio exhibited average

revenue and EBITDA growth of 13% and 14% respectively. However, we

expect COVID-19 to have a negative impact on the underlying

performance during 2020.

Drawdowns

During the period GBP87.0m was invested into existing and new

underlying companies. Drawdowns were used to invest into a diverse

set of predominantly European headquartered companies. The largest

new investment was the GBP22.6m co-investment / re-investment into

Action. Other notably large new investments in the quarter

included:

- Recordati (CVC VII) - an international specialty pharmaceutical group;

- ConvergeOne (CVC VII) - an IT services provider of technology solutions;

- Orchid (Nordic Capital IX) - a global producer of orthopaedic implant devices;

- Froneri (PAI SPs) - an international ice cream manufacturer; and

- Transporeon (HgCapital 8) - a European cloud-based logistics platform.

We expect that drawdowns will continue in the second half of the

current financial year at similar rates to previous years, largely

owing to underlying private equity funds repaying their credit

facilities in the course of normal business. We estimate that the

Company had around GBP57m held on credit facilities of underlying

funds at 31 March 2020 (30 September 2019: GBP48m), and we expect

that this will all be drawn over the next 12 months.

Distributions

GBP93.8m of distributions were received during the period. Exit

activity from the private equity funds was driven by the strong

market appetite for high quality private companies in 2019, both

from trade / strategic buyers and other private equity firms.

However, as we move into the second half of the financial year, we

expect that distributions will reduce, as a result of market

dislocation during the COVID-19 pandemic.

The headline realised return from the ongoing investment

operations of the Company's core portfolio equated to 5.0 times

cost (30 September 2019: 2.2 times cost). The return was enhanced

by the proceeds from the realisation from 3i Eurofund V. If this

transaction is excluded, then the realised return was 2.3

times.

3i Eurofund V was the most significant realisation in the

period, with gross proceeds of GBP51.1m coming from the liquidity

transaction facilitated by 3i Group plc ("3i"). The 3i Eurofund V

holding largely related to the underlying company Action. The

Company then reinvested GBP22.6m of realised proceeds into a new

co-investment in Action. Accounting for this co-investment, net

cash proceeds to the Company from the overall 3i Eurofund V

transaction amounted to GBP28.5m.

The majority of portfolio company realisations were at a premium

to the last relevant valuation. This premium paid at exit at the

portfolio level has persisted since 2010.

Commitments

During the period, the Company completed four primary fund

commitments, one secondary transaction and one co-investment. In

total, new commitments in the period equated to GBP83.9m. The total

outstanding commitments at 31 March 2020 were GBP451.2m (30

September 2019: GBP450.3m).

The value of outstanding commitments in excess of liquid

resources as a percentage of net assets is broadly flat at its

current level of 42.2% (30 September 2019: 42.6%). Despite the

initial impact of COVID-19 at 31 March 2020, this figure remains

within our long-term target range of 30%-75%. We estimate that

GBP64.4m of the reported outstanding commitments are unlikely to be

drawn down, which is normal for private equity investing.

INVESTMENT ACTIVITY

Primary funds

GBP37.4m was committed to new private equity primary funds

focused on Europe and GBP17.0m to a North American-based fund. The

new commitments were with two core private equity relationships (Hg

and Seidler Equity Partners), with whom Aberdeen Standard

Investments has an established relationship of more than 10

years.

In last year's Annual Report, we stated that we expected that

the Company would commit less capital to primary funds in the

current year compared to FY19. In light of COVID-19, we plan to

further reduce new primary fund commitment activity during the rest

of the year as we take stock of the developing situation.

Investment GBPm Description Rationale for investing

-------------- ---- ---------------------------------------- ----------------------------------------

Hg Saturn 12.2 $4.9bn fund focused primarily on The leading European software-specialist

2 upper mid-market and large software investor with strong sourcing

companies headquartered in Europe and value creation capabilities

and US. that it can use to further

scale its portfolio companies.

============== ==== ======================================== ========================================

Hg Genesis 13.8 EUR4.4bn fund focused primarily As above.

9 on mid-market software and tech-enabled

services companies based in Europe.

============== ==== ======================================== ========================================

Hg Mercury 11.4 c. EUR1.3bn fund investing in lower As above.

3 mid-market

software and tech-enabled services

companies across Europe.

============== ==== ======================================== ========================================

Seidler Equity 17.0 $800m fund focused primarily on Growth-oriented US investor

Partners VII lower with a strong track record

mid-market North American companies. of working discretely with

founder-led businesses, helping

them further professionalise

and scale.

-------------- ---- ---------------------------------------- ----------------------------------------

Secondary investments

During the period, the Company acquired GBP6.7m of secondary

exposure(1) . It purchased a position consisting of the two

remaining assets in PAI Fund V. Going forward the assets will be

managed in a new vehicle called PAI Strategic Partnerships SCSp.

The underlying companies are Froneri (international ice cream

manufacturer) and Marcolin (Italian eyewear manufacturer).

The market dislocation arising out of the COVID-19 crisis could

lead to some attractive investment opportunities in the secondary

market. The Manager has an established track record in secondaries

and a team of nine investment professionals dedicated to this area,

and is well positioned to identify opportunities for the

Company.

1 Exposure acquired equals purchase price plus any unfunded

commitment

Co-investments

During the period, the Company made a GBP22.6m co-investment

into Action alongside the latter's long-term private equity sponsor

3i Group plc ("3i"). The Company's co-investment will be made via

the newly created 3i Venice Partnership SCSp vehicle.

As background, SLPET has held Action since 2011 through its fund

commitment to 3i Eurofund V. Following the announcement by 3i on 14

November 2019 that it was facilitating a transaction for Action on

behalf of 3i Eurofund V investors, the Company elected to realise

part of its position in Action and re-invest part of the proceeds

as a new co-investment. The Company received net cash proceeds of

GBP28.5m from the transaction.

In light of COVID-19, we expect co-investment opportunities to

decrease in the short-term, in line with general M&A trends. At

31 March 2020 there were two co-investments in the Company's

portfolio, namely Action and Mademoiselle Desserts, equating to 5%

of Portfolio NAV.

Portfolio construction

The underlying portfolio consists of over 400 private companies,

largely within the European mid-market and spread across different

countries, sectors and vintages. At 31 March 2020, only 8 companies

equated to more than 1% of Portfolio NAV, with the largest single

underlying company exposure equating to 3.7% (Action).

Geographic exposure (1)

We believe that the portfolio is diversified and well positioned

to mitigate the impact of deteriorating macroeconomic conditions

resulting from of the COVID-19 crisis. At 31 March 2020, 86% of

SLPET's underlying private companies were headquartered in Europe.

The Company's underlying portfolio remains largely positioned to

North Western Europe, with only 6% of Portfolio NAV in Italy and

Spain. SLPET is well diversified by region across North Western

Europe, with the UK the highest exposure at 19%. North America

equates to 12% of the portfolio.

Sector exposure (1)

Over recent years the portfolio's sector exposure has moved more

towards high growth areas, such as Information Technology and

Healthcare, which are also likely to be more resilient in the

current environment. The first six months of the financial year has

seen a continuation of this trend as private equity managers have

been positioning their portfolios for more volatile macroeconomic

conditions. Technology and Healthcare represent a combined 35% of

the portfolio (30 September 2019: 31%).

We expect a negative COVID-19 impact to be particularly felt in

the Consumer Discretionary and Industrials sectors. Together they

represent 33% of the portfolio at 31 March 2020 (30 September 2019:

43%).

(1) Based on the latest information from underlying managers

Maturity analysis

We expect distributions to decrease materially in the near-term

due to the negative impact that COVID-19 is having on M&A

activity. However, with 45% of the portfolio being in vintages of

four years and older (30 September 2019: 50%), we would expect that

distributions will come back strongly once market activity returns

to more normal average levels.

The chart in the Half Yearly Report shows the maturity analysis

of the portfolio. The outer ring shows the percentage exposure to

each vintage as at 31 March 2020 and the inner ring shows the

weighted average valuation of each vintage.

Outlook

COVID-19 and its impact on the Company has been the main focus

of our attention in 2020. Clearly we have only seen the initial

impact of the global pandemic on the portfolio and NAV. Looking

forward, it remains difficult to predict how this will progress

and, importantly, for how long. We are approaching this

unprecedented situation with caution.

Scenario planning is especially important in times of crisis. We

have stress-tested the portfolio in a number of scenarios,

incorporating our experience of what happened to the Company during

the global financial crisis. We believe that the Company has

sufficient liquidity to service its commitments and has comfortable

headroom on covenants relating to its revolving credit facility.

However, the COVID-19 crisis is a unique, fast-moving situation and

we will continue to regularly model out different scenarios for the

portfolio as new developments arise.

We expect that there will be more pressure on valuations and

that the Company's NAV could see a further decline in the current

financial year. In addition, we are seeing little M&A activity

in the market, as sales processes are postponed until late 2020 and

beyond. This will have a knock-on impact on the level of

distributions (i.e. cash) that the Company receives in the short

term.

The decline in M&A activity will be followed by a decrease

in drawdowns, albeit at a later stage in the cycle than

distributions. This time lag is due to (i) the widespread usage of

bridging facilities to fund investments ahead of capital being

drawn from investors; (ii) new deals signed before the impact of

COVID-19 became evident and not yet formally completed; and (iii)

the need for managers to inject further capital to support some of

their existing portfolio companies in the near-term. As a result,

we expect that the Company will draw on its revolving credit

facility within the next 12 months.

We believe it is prudent to slow down new investment activity in

the second half of the financial year. New primary fund commitments

and co-investments are likely to be pursued only on an

opportunistic basis as we take stock of the effects of COVID-19. We

expect that activity levels in the secondary market will not

recover significantly until the latter part of 2020 or early 2021,

as potential sellers assess their own position and wait until

private equity valuations stabilise.

We are also not forgetting about responsible investment at this

time of difficulty. Investments made by the Company have been

subject to due diligence around Environment, Social and Governance

("ESG") factors and that remains the case for all future

investments the Company will make. We are watching the behaviours

of our private equity managers and underlying portfolio companies

closely at this time and expect them to act responsibly. We will be

quick to raise issues with private equity managers that are falling

short of acceptable standards.

Despite the unprecedented situation around COVID-19 and the

strong headwinds that we are currently facing, we remain confident

that private equity continues to offer significant opportunity for

long-term value creation. All of the Company's private equity

managers weathered the global financial crisis and can apply their

lessons from that time period to the COVID-19 situation. In the

short-term their experience and expertise will be largely deployed

in helping their existing portfolio companies to mitigate the

impact of COVID-19. However, private equity has shown time and time

again that it thrives on the opportunities that present themselves

during periods of market dislocation. We expect this time will be

no different and are confident that strong investment performance

will resume once the world returns to a more stable situation.

Alan Gauld

Lead Portfolio Manager

17 June 2020

CONDENSED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

For the six months For the six months

ended 31 March 2020 ended 31 March 2019

Notes Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total capital (losses)

/ gains on investments - (41,624) (41,624) - 4,166 4,166

Currency gains / (losses) - 254 254 - (695) (695)

Income 4 2,131 - 2,131 4,796 - 4,796

Investment management

fee 5 (326) (2,933) (3,259) (311) (2,802) (3,113)

Administrative expenses (533) - (533) (506) - (506)

-------- --------- --------- -------- -------- --------

Profit / (loss) before finance

costs and taxation 1,272 (44,303) (43,031) 3,979 669 4,648

Finance costs (118) (477) (595) (86) (316) (402)

-------- --------- --------- -------- -------- --------

Profit / (loss) before

taxation 1,154 (44,780) (43,626) 3,893 353 4,246

Taxation (1,222) 167 (1,055) (187) 222 35

-------- --------- --------- -------- -------- --------

(Loss) / profit after

taxation (68) (44,613) (44,681) 3,706 575 4,281

-------- --------- --------- -------- -------- --------

(Loss) / earnings per

share - basic and diluted 7 (0.04)p (29.02)p (29.06)p 2.41p 0.37p 2.78p

-------- --------- --------- -------- -------- --------

The Total column of this statement represents the profit and loss account

of the Company.

There are no items of other comprehensive income, therefore this statement

is the single statement of comprehensive income of the Company.

All revenue and capital items in the above statement are derived from

continuing operations.

No operations were acquired or discontinued in the period.

CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED)

As at As at

31 March 2020 30 September 2019

Notes GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Investments 8 580,334 638,733

Receivables falling due after

one year - 15,173

-------- -------- ---------- --------

580,334 653,906

Current assets

Receivables 18,144 10,640

Cash and cash equivalents 59,599 66,315

-------- -------- ---------- --------

77,743 76,955

Creditors: amounts falling due

within one year

Payables (2,516) (20,778)

-------- -------- ---------- --------

Net current assets 75,227 56,177

Total assets less current liabilities 655,561 710,083

-------- -------- ---------- --------

Capital and reserves

Called-up share capital 307 307

Share premium account 86,485 86,485

Special reserve 51,503 51,503

Capital redemption reserve 94 94

Capital reserves 517,240 571,694

Revenue reserve (68) -

-------- -------- ---------- --------

Total shareholders' funds 655,561 710,083

-------- -------- ---------- --------

Net asset value per equity share 9 426.4p 461.9p

The Financial Statements of Standard Life Private Equity Trust PLC,

registered number SC216638 were approved and authorised for issue

by the Board of Directors on 17 June 2020 and were signed on its behalf

by Christina McComb OBE, Chair.

CONDENSED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

For the six months

ended 31 March

2020

Called-up Share Capital

share premium Special redemption Capital Revenue

capital account reserve reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 October

2019 307 86,485 51,503 94 571,694 - 710,083

Profit after taxation - - - - (44,613) (68) (44,681)

Dividends paid - - - - (9,841) - (9,841)

---------- --------- --------- ------------ --------- --------- ---------

Balance at 31 March

2020 307 86,485 51,503 94 517,240 (68) 655,561

---------- --------- --------- ------------ --------- --------- ---------

For the six months

ended 31 March

2019

Called-up Share Capital

share premium Special redemption Capital Revenue

capital account reserve reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 October

2018 307 86,485 51,503 94 522,974 - 661,363

Profit after taxation - - - - 575 3,706 4,281

Dividends paid - - - - (5,826) (3,706) (9,532)

---------- --------- --------- ------------ --------- --------- ---------

Balance at 31 March

2019 307 86,485 51,503 94 517,723 - 656,112

---------- --------- --------- ------------ --------- --------- ---------

CONDENSED STATEMENT OF CASH FLOWS (UNAUDITED)

For the six months For the six months

ended ended

31 March 2020 31 March 2019

Note GBP'000 GBP'000 GBP'000 GBP'000

Cashflows from operating activities

(Loss) / profit before taxation (43,626) 4,246

Adjusted for:

Finance costs 595 402

Gains on disposal of investments (74,076) (19,614)

Revaluation of investments 115,389 15,447

Currency (gains) / losses (254) 695

Increase in debtors (1,812) (238)

Increase in creditors 1,290 119

Tax (deducted) / rebates from non-UK

income (1,055) 35

Interest paid (595) (341)

---------- --------- ---------- ---------

Net cash (outflow) / inflow from

operating activities (4,144) 751

Investing activities

Purchase of investments (106,533) (42,914)

Distributions of capital proceeds

by funds 92,810 44,974

Disposal of quoted investments 14,065 1,461

Receipt of proceeds from disposal

of unquoted investments 6,673 -

---------- --------- ---------- ---------

Net cash inflow from investing

activities 7,015 3,521

Financing activities

Ordinary dividends paid 6 (9,841) (9,532)

---------- --------- ---------- ---------

Net cash outflow from financing

activities (9,841) (9,532)

Net decrease in cash and cash equivalents (6,970) (5,260)

Cash and cash equivalents at the

beginning of the period 66,315 57,441

Currency gains / (losses) on cash

and cash equivalents 254 (695)

---------- --------- ---------- ---------

Cash and cash equivalents at the

end of the period 59,599 51,486

---------- --------- ---------- ---------

Cash and cash equivalents consist

of:

Money-market funds 38,362 23,649

Cash 21,237 27,837

---------- --------- ---------- ---------

Cash and cash equivalents 59,599 51,486

---------- --------- ---------- ---------

NOTES TO THE FINANCIAL STATEMENTS

1 Financial Information. The financial information for the year ended

30 September 2019 within the report is considered non-statutory

as defined in sections 434-436 of the Companies Act 2006. The financial

information for the year ended 30 September 2019 has been extracted

from the published accounts that have been delivered to the Registrar

of Companies and on which the report of the auditor was unqualified

under section 498 of the Companies Act 2006.

2 Basis of preparation and going concern. The condensed financial

statements for the six months ended 31 March 2020 have been prepared

in accordance with Financial Reporting Standard 104 (Interim Financial

Reporting) and with the Statement of Recommended Practice for 'Financial

Statements of Investment Trust Companies and Venture Capital Trusts'.

The condensed financial statements for the six months ended 31 March

2020 have been prepared using the same accounting policies as the

preceding annual financial statements. This is available at www.slpet.co.uk

or on request from the Company Secretary.

The Directors have made an assessment of the Company's ability to

continue as a going concern and is satisfied that the Company has

the resources to continue in business for a period of at least 12

months from the date of these condensed financial statements. In

preparing these condensed financial statements, the Directors have

also considered the uncertainty created by COVID-19, taking into

account of:

-- the GBP100 million committed, syndicated revolving credit facility

with a maturity date in December 2024 that is presently undrawn;

-- the level of liquid resources, including cash and cash equivalents.

The Manager regularly monitors the Company's cash position to

ensure sufficient cash is held to meet liabilities as they fall

due;

-- the future cash flow projections (including the level of expected

realisation proceeds, the expected future profile of investment

commitments and the terms of the revolving credit facility);

-- the Company's cash flows during the period;

-- the effectiveness of the Manager's operational resilience processes,

including the ability of key outsourcers to continue to provide

services; and

-- the impact of potential downside scenarios on asset valuations

and liquidity, including potential management actions.

Based on a review of the above, the Directors are satisfied that

the Company has, and will maintain, sufficient resources to continue

to meet its liabilities as they fall due for at least 12 months

from the date of approval of the condensed financial statements.

Accordingly, the condensed financial statements have been prepared

on a going concern basis.

3 Exchange rates

-------------------------- ---------- ---------------------------------

Rates of exchange to sterling were:

-------------------------------------------------------------------------

As at 31 March As at 30 September

2020 2019

--------------------------------- ----------------- -------------------

Canadian dollar 1.7649 1.6316

Euro 1.1301 1.1304

US dollar 1.2400 1.2323

4 Income

--------------------------------- ----------------- -----------------

Six months ended Six months ended

31 March 2020 31 March 2019

GBP'000 GBP'000

--------------------------------- ----------------- -----------------

Income from fund investments 1,963 4,498

Interest from cash balances and

money-market funds 168 298

----------------- -----------------

Total income 2,131 4,796

5 Investment management

fees

----------------------- ---------- --------------- ----------- -------- ------------- -------------------

Six months ended 31 March Six months ended 31 March

2020 2019

----------------------- ---------------------------------------- --------------------------------------------

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------------- ----------- ----------- -------------- ------------- -------------

Investment management

fee 326 2,933 3,259 311 2,802 3,113

--------------------------- -------------- ----------- ----------- -------------- ------------- -------------

The Manager of the Company is SL Capital Partners LLP. In order to

comply with the Alternative Investment Fund Managers Directive, the

Company appointed SL Capital Partners LLP as its Alternative Investment

Fund Manager from 1 July 2014.

The investment management fee payable to the Manager is 0.95% per

annum of the NAV of the Company. The investment management fee is

allocated 90% to the realised capital reserve and 10% to the revenue

account. The management agreement between the Company and the Manager

is terminable by either party on twelve months written notice.

Investment management fees due to the Manager as at 31 March 2020

amounted to GBP709,000 (30 September 2019: GBP799,000).

6 Dividend on ordinary shares. In respect of the year ended 30 September

2019, the third quarterly dividend of 3.2p per ordinary share was

paid on 25 October 2019 (2019: dividend of 3.1p per ordinary share

paid on 26 October 2019). The fourth quarterly dividend of 3.2p per

ordinary share was then paid on 24 January 2020 (2019: dividend of

3.1p per ordinary share paid on 25 January 2019).

For the financial period ending 31 March 2020, the first quarterly

dividend of 3.3p per ordinary share was paid on 24 April 2020 (2019:

dividend of 3.2p was paid on 26 April 2019). A proposed dividend

of 3.3p per share is due to be paid on 31 July 2020 (2019: dividend

of 3.2p was paid on 26 July 2019).

7 Earnings per share - basic and diluted

---------------------------------------- -------------- ------------ ----- ------------

Six months ended Six months ended

31 March 2020 31 March 2019

---------------------------------------- ---------------------------- -------------------

p GBP'000 p GBP'000

---------------------------------------- -------- ------------------ ----- ------------

The net return per ordinary share

is based on the following figures:

Revenue net (loss) / return (0.04) (68) 2.41 3,706

Capital net (loss) / return (29.02) (44,613) 0.37 575

--------------------------------------------

Total net (loss) / return (29.06) (44,681) 2.78 4,281

-------------------------------------------- -------- ------------------ ----- ------------

Weighted average number of ordinary

shares in issue: 153,746,294 153,746,294

There are no diluting elements to the earnings per share calculation

in the six months ended 31 March 2020 (2019: none).

8 Investments

---------------------------- -------------------------------------- --------------------------------------

Six months ended 31 March Year ended 30 September

2020 2019

---------------------------- -------------------------------------- --------------------------------------

Quoted Unquoted Quoted Unquoted

Investments Investments Total Investments Investments Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ------------ ------------ ---------- ------------ ------------ ----------

Fair value through

profit or loss:

Opening market value 11,435 627,298 638,733 29,020 574,689 603,709

Opening investment

holding (gains) /

losses (316) (120,569) (120,885) 26 (58,899) (58,873)

-------------------------------- ------------ ------------ ---------- ------------ ------------ ----------

Opening book cost 11,119 506,729 517,848 29,046 515,790 544,836

Movements in the period

/ year:

Additions at cost - 81,449 81,449 13,352 81,568 94,920

Secondary purchases - 5,532 5,532 - 36,063 36,063

Distribution of capital

proceeds by funds - (92,810) (92,810) - (132,541) (132,541)

Disposal of quoted

investments (11,257) - (11,257) (33,263) - (33,263)

--------------------------------

(138) 500,900 500,762 9,135 500,880 510,015

Gains on disposal

of underlying investments - 73,938 73,938 - 11,600 11,600

Gains on disposal

of quoted investments 138 - 138 1,984 - 1,984

Losses on liquidation

of fund investments{1} - - - - (5,751) (5,751)

-------------------------------- ------------

Closing book cost - 574,838 574,838 11,119 506,729 517,848

Closing investment

holding gains - 5,496 5,496 316 120,569 120,885

--------------------------------

Closing market value - 580,334 580,334 11,435 627,298 638,733

-------------------------------- ------------ ------------ ---------- ------------ ------------ ----------

{1}Relates to the write off of investments which were previously already

provided for.

The total capital loss on investments of GBP41,624,000 (2019: gain of

GBP4,166,000) for the six months ended 31 March 2020 also includes transaction

costs of GBP311,000 (2019: GBP69,000).

9 Net asset value per equity share

---------------------------------------- ---------------- ----------------

30 September

31 March 2020 2019

---------------------------------------- ---------------- ----------------

Basic and diluted:

Ordinary shareholders' funds GBP655,560,617 GBP710,082,563

Number of ordinary shares in issue 153,746,294 153,746,294

Net asset value per ordinary share 426.4p 461.9p

-------------------------------------------- ---------------- ----------------

The net asset value per ordinary share and the ordinary shareholders'

funds are calculated in accordance with the Company's articles of

association.

There are no diluting elements to the net asset value per equity

share calculation in the six months ended 31 March 2020 (2019: none).

10 Bank loans. At 31 March 2020, the Company had an GBP100 million

(30 September 2019: GBP80 million) committed, multi-currency syndicated

revolving credit facility provided by Citibank and Société

Générale of which GBPnil (30 September 2019: GBPnil)

had been drawn down. The facility expires on 6 December 2024.

11 Commitments and contingent liabilities

---------------------------------------- -------------- ------------------

31 March 2020 30 September 2019

GBP'000 GBP'000

---------------------------------------- -------------- ------------------

Outstanding calls on investments 451,186 450,272

--------------------------------------------- -------------- ------------------

This represents commitments made to fund and co-investment interests

remaining undrawn.

12 Fair value hierarchy. FRS 104 requires an entity to classify fair

value measurements using a fair value hierarchy that reflects the

significance of the inputs used in making the measurements. The

fair value hierarchy shall have the following classifications:

Level 1: The unadjusted quoted price in an active market for

identical assets or liabilities that the entity can access at

- the measurement date.

Level 2: Inputs other than quoted prices included within Level

1 that are observable (i.e., developed using market data) for

- the asset or liability, either directly or indirectly.

Level 3: Inputs are unobservable (i.e., for which market data

- is unavailable) for the asset or liability.

The Company's financial assets and liabilities, measured at fair

value in the Condensed Statement of Financial Position, are grouped

into the following fair value hierarchy at 31 March 2020:

Level 1 Level 2 Level 3 Total

Financial assets at fair value

through profit or loss GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------------------- -------- -------- -------- ---------------

Unquoted investments - - 580,334 580,334

Quoted investments - - - -

---------------------------------------------- ---

Net fair value - - 580,334 580,334

----------------------- --------------------- -------- -------- -------- -------- ---------------

As at 30 September 2019

---------------------------------------------- --- -------- -------- -------- ---------------

Level 1 Level 2 Level 3 Total

Financial assets at fair value

through profit or loss GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------------------- -------- -------- -------- ---------------

Unquoted investments - - 627,298 627,298

Quoted investments 11,435 - - 11,435

---------------------------------------- --------- -------- -------- -------- ---------------

Net fair value 11,435 - 627,298 638,733

----------------------- --------------- --------- -------- -------- -------- ---------------

Unquoted investments. Unquoted investments are stated at the directors'

estimate of fair value and follow the recommendations of the EVCA

and the BVCA (European Private Equity & Venture Capital Association

and British Private Equity & Venture Capital Association). The

estimate of fair value is normally the latest valuation placed

on a fund by its manager as at the Condensed Statement of Financial

Position date. The valuation policies used by the manager in undertaking

that valuation will generally be in line with the joint publication

from the EVCA and the BVCA, 'International Private Equity and Venture

Capital Valuation guidelines'. Fair value can be calculated by

the manager of the investment in a number of ways. In general,

the managers with whom the Company invests adopt a valuation approach

which applies an appropriate comparable listed company multiple

to a private company's earnings or by reference to recent transactions.

Where formal valuations are not completed as at the Condensed Statement

of Financial Position date, the last available valuation from the

manager is adjusted for any subsequent cash flows occurring between

the valuation date and the Condensed Statement of Financial Position

date. The Company's Manager may further adjust such valuations

to reflect any changes in circumstances from the last manager's

formal valuation date to arrive at the estimate of fair value.

Quoted investments. The Company's investments previously included

shares which were actively traded on recognised stock exchanges,

with their fair value being determined by reference to their quoted

bid prices at the close of business on the last trading day of

the Company's reporting date. As at 31 March 2020, the Company

held GBPnil (30 September 2019: GBP11,435,000) of quoted investments.

13 Parent undertaking and related party transactions. The ultimate

parent undertaking of the Company is Phoenix Group Holdings. The

results for the period from 1 October 2019 to 31 March 2020 are

incorporated into the group financial statements of Phoenix Group

Holdings, which will be available to download from the website

www.thephoenixgroup.com.

Standard Life Assurance Limited ("SLAL", which is 100% owned by

Phoenix Group Holdings), and the Company have entered into a relationship

agreement which provides that, for so long as SLAL and its Associates

exercise, or control the exercise, of 30% or more of the voting

rights of the Company, SLAL and its Associates, will not seek to

enter into any transaction or arrangement with the Company which

is not conducted at arm's length and on normal commercial terms,

take any action that would have the effect of preventing the Company

from carrying on an independent business as its main activity or

from complying with its obligations under the Listing Rules or

purpose or procure the proposal of any shareholder resolution which

is intended or appears to be intended to circumvent the proper

application of the Listing Rules. During the period ended 31 March

2020, SLAL received dividends from the Company totalling GBP5,512,000

(31 March 2019: GBP5,339,000).

As at 31 March 2020, the Company was invested in the Aberdeen Liquidity

Funds, managed by Aberdeen Standard Investments (Lux), ("ASI Lux")

who share the same ultimate parent as the Manager. As at 31 March

2020 the Company had invested GBP26,264,000 in the Aberdeen Liquidity

Funds (30 September 2019: GBP600,000) which are included within

cash and cash equivalents in the Condensed Statement of Financial

Position. During the period, the Company received interest amounting

to GBP15,000 (31 March 2019: GBP3,000) on sterling denominated

positions. The Company incurred GBPnil (31 March 2019: GBP22,000)

interest on euro denominated positions as a result of negative

interest rates. As at 31 March 2020, interest of GBP5,000 was due

to the Company on sterling denominated positions (30 September

2019: GBPnil). There was no interest payable on euro denominated

positions (30 September 2019: GBPnil). No additional fees are payable

to ASI (Lux) as a result of this investment.

During the period ended 31 March 2020 the Manager charged management

fees totalling GBP3,259,000 (31 March 2019: GBP3,113,000) to the

Company in the normal course of business. The balance of management

fees outstanding at 31 March 2020 was GBP709,000 (30 September

2019: GBP799,000). The Manager also charged promotion fees of GBP90,000

(31 March 2019: GBP30,000) during the period. The balance of promotion

fees outstanding was GBP180,000 (30 September 2019: GBP90,000).

The Company Secretarial services for the Company are provided by

Aberdeen Asset Management PLC, which shares the same ultimate parent

as the Manager. During the period ended 31 March 2020 the Company

incurred secretarial fees of GBP40,000 (31 March 2019: GBPnil)

which are included within payables in the Condensed Statement of

Financial Position.

No other related party transactions were undertaken during the

six months ended 31 March 2020.

14 Events after the reporting date. The initial impact of COVID-19

as at 31 March 2020 has been reflected within these condensed financial

statements, notably in the fair value of the Company's investments.

As COVID-19 progresses, it is expected to result in further adverse

impacts on the Company. This is likely to be significant to the

NAV of the Company in the near term.

As the full impact of COVID-19 has become more apparent after the

reporting period, the Manager consider this to be a non-adjusting

post balance sheet event. The Manager will continue to closely

analyse and review the continued impact of COVID-19 and will take

appropriate action as required.

15 Half Yearly Report. The financial information contained in this

Half Yearly Report does not constitute statutory accounts as defined

in Sections 434-436 of the Companies Act 2006. The financial information

for the six months ended 31 March 2020 and 31 March 2019 has not

been audited.

The information for the year ended 30 September 2019 has been extracted

from the latest published audited financial statements which have

been filed with the Registrar of Companies. The report of the auditors

on those accounts contained no qualification or statement under

Section 498 (2), (3) or (4) of the Companies Act 2006.

This Half Yearly Report was approved by the Board on 17 June 2020.

Glossary of Terms & Definitions

Alternative Performance Measures

Alternative performance measures ("APMs") are numerical measures

of the Company's current, historical or future performance,

financial position or cash flows, other than financial measures

defined or specified in the applicable financial framework. The

Company's applicable financial framework includes FRS 102 and the

AIC SORP. The directors assess the Company's performance against a

range of criteria which are viewed as particularly relevant for

closed-end investment companies. The APMs used by the Company are

marked with an * in this glossary and the underlying data used to

calculate them is provided.

Buy-out fund

A fund which acquires controlling stakes in established private

companies.

Co-investment

An investment made directly into a private company alongside

other private equity managers.

Commitment

The amount committed by the Company to an investment, whether or

not such amount has been advanced in whole or in part by or repaid

in whole or in part to the Company. (see also Over-commitment)

Comparator Index

A market index against which the overall performance of the

Company can be assessed. The manager does not manage the portfolio

with direct reference to any index or its constituents.

Discount*

The amount by which the market price per share is lower than the

net asset value per share of an investment trust. The discount is

normally expressed as a percentage of the net asset value per

share.

As at 31 March 2020 As at 30 September 2019

------------------------------ ------------------- -----------------------

Share price (p) 254.0 352.0

============================== =================== =======================

Net Asset Value per share (p) 426.4 461.9

============================== =================== =======================

(Discount) (%) 40.4 23.8

------------------------------ ------------------- -----------------------

Dividend yield*

The annual dividend per ordinary share divided by the share

price, expressed as a percentage, calculated at the year end.

2019 2018

----------------------- ----- -----

Dividend per share (p) 12.8 12.4

======================= ===== =====

Share price (p) 352.0 345.5

======================= ===== =====

Dividend yield (%) 3.6 3.6

----------------------- ----- -----

Distribution

A return that an investor in a private equity fund receives.

Within the Annual Report and Financial Statements, the terms "cash

realisations" and "distributions" are used interchangeably, the

figure being derived as follows: proceeds from disposal of

underlying investments by funds, plus income from those fund

investments less overseas withholding tax suffered.

Drawdown

A portion of a commitment which is called to pay for an

investment.

Dry powder

Capital committed by investors to private equity funds that has

yet to be invested.

EBITDA

Earnings before interest expense, taxes, depreciation and

amortisation.

Enterprise value ("EV")

The value of the financial instruments representing ownership

interests in a company plus the net financial debt

of the company.

IPO

Initial Public Offering, the first sale of stock by a private

company to the public market.

Net Asset Value (NAV)

The value of total assets less liabilities. Liabilities for this

purpose include current and long-term liabilities. The net asset

value divided by the number of shares in issue produces the net

asset value per share.

NAV total return*

NAV total return shows how the NAV has performed over a period

of time in percentage terms, taking into account both capital

returns and dividends paid to shareholders. This involves

reinvesting the net dividend into the NAV at the end of the quarter

in which the shares go ex-dividend. Returns are calculated to each

quarter end in the year and then the total return for the year is

derived from the product of these individual returns.

NAV per share (p) Dividend per share (p)

------------------ ----------------- ----------------------

30 September 2019 461.9

================== ================= ======================

31 December 2019 464.5 3.2

================== ================= ======================

31 March 2020 426.4 3.3

================== ================= ======================

NAV total return -6.3%

------------------ ----------------- ----------------------

Ongoing charges ratio*

Management fees and all other recurring operating expenses that

are payable by the Company excluding the costs of purchasing and

selling investments, incentive fee, finance costs, taxation,

non-recurring costs, and costs of share buy-back transactions,

expressed as a percentage of the average NAV during the period.

Ongoing charges and performance-related fees of the Company's

underlying investments are excluded. The ongoing charges ratio has

been calculated in accordance with guidance issued by the

Association of Investment Companies ("AIC").

Six months ended 31 March 2020 Year ended 30 September 2019

GBP'000 GBP'000

-------------------------- ------------------------------ ----------------------------

Investment management fee 3,259 6,463

========================== ============================== ============================

Administrative expenses 533 997

========================== ============================== ============================

Ongoing charges 7,582(+) 7,460

========================== ============================== ============================

Average net assets 682,852 685,723

========================== ============================== ============================

Ongoing charges ratio 1.11%(+) 1.09%

-------------------------- ------------------------------ ----------------------------

(+) As at 31 March 2020. The 2020 ratio is calculated using

actual costs and charges to 31 March 2020 and forecast costs and

charges for the remaining six months of the year dividend by

average net assets.

Over-commitment

Where the aggregate commitments to invest by the Company exceed

the sum of its resources available for investment plus the value of

any undrawn loan facilities.

Over-commitment ratio*

Outstanding commitments less resources available for investment

and the value of undrawn loan facilities divided

by net assets.

As at 31 March 2020 As at 30 September 2019

GBP000s GBP000s

---------------------------------------- ------------------- -----------------------

Undrawn Commitments 451,186 450,272

======================================== =================== =======================

Less resources available for investment (74,755) (67,748)

======================================== =================== =======================

Less undrawn loan facility (100,000) (80,000)

======================================== =================== =======================