Biotechnology & Drugs

-

Modificato il 31/8/2012 11:55

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

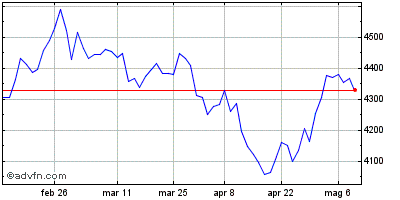

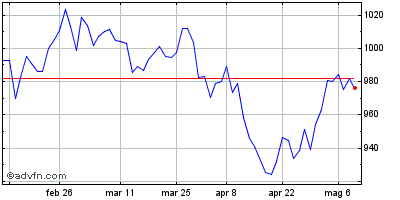

| Grafico Intraday: NASDAQ Biotechnology Index | Grafico Storico: NASDAQ Biotechnology Index |  |  |

| Grafico Intraday: Nasdaq Health Care Index | Grafico Storico: Nasdaq Health Care Index |  |  |

Biotecnologie: scommessa o investimento?

La richiesta di attrezzature mediche, di nuovi farmaci, di terapie innovative per combattere le malattie legate all’invecchiamento aumenta senza sosta.

Se affrontato con cognizione e professionalità, e soprattutto con una visione di medio-lungo termine, l’investimento in biotecnologia permette senza dubbio sonni tranquilli: le sottolineo come nel 1989 il fatturato della biotecnologia era US$ 2,7 miliardi. Nel 2008 le case biotech hanno incassato US$ 90 miliardi. Questi numeri, uniti al fatto che attualmente vi sono più di 800 i farmaci biotech nelle varie fasi di sviluppo per malattie come cancro, alzheimer, malattie cardiovascolari, diabete, sclerosi multipla ed artrite dovrebbero far capire agli investitori come i titoli biotech rappresentino un’opportunità d’investimento paragonabile agli investimenti fatti nelle case farmaceutiche tradizionali nei anni ’60-’80. Un investimento sicuro fondato su solide basi.

estratto di un articolo comparso su Soldionline al link

http://www.soldionline.it/notizie/economia-politica/biotecnologie-scommessa-o-investimento

sono aperte discussioni, ricerche, riflessioni!

Indici: Nasdaq Biotechnology e Nasdaq Health Care

http://www.google.com/finance?catid=us-52981623&start=0&num=20

|

|

Lista Commenti

4211 Commenti

...

|

21 di 4211

-

10/2/2010 22:58

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

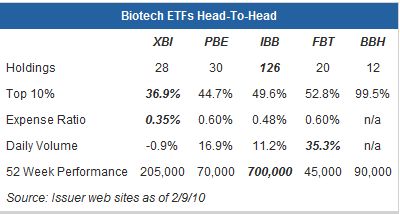

ho scoperto un articolo che riporta alcuni etf sul settore. da approfondire

Which Biotech ETF Is Best? Five Ideas

by: Michael Johnston February 10, 2010

You are no longer following Michael Johnston

As the ETF industry has grown by leaps and bounds in recent years, continued innovation has enabled investors to achieve more granular exposure than ever through exchange-traded products. Diversified ETFs targeting relatively narrow sectors of the domestic and global economy have multiplied, including funds targeting the airline, gaming, insurance, gold mining, timber, and food and beverage industries.

But the expansion of the ETF industry has also presented investors with more and more options for achieving their desired exposure within a particular asset class of industry. The large cap blend equities ETFdb Category contains almost 30 ETFs, while there are more than a dozen funds targeting emerging markets.

Even within relatively targeted biotechnology industry, there are a handful of ETFs available, including products from iShares, State Street, PowerShares, and First Trust. Some covering the ETF industry point to the presence of five biotech funds as a clear indication of over-saturation in the industry. But while these funds are similar in many ways–including significant overlap in holdings in some cases–they are far from identical.

Price Drivers

Biotechnology ETFs can be impacted by a wide variety of factors, including:

* New Product Pipeline: Biotech companies often invest heavily in research and development of products that ultimately prove to be unsuccessful commercially or that never make it to market. As such, the industry relies on a few “home run” products to drive significant revenue and earnings. In July 2009, for example, Human Genome Sciences surged more than 450% in a week after its lupus drug Benlysta showed late-stage success in a clinical trial.

* Regulatory Environment: The biotech sector is heavily dependent on protection of patents and intellectural property rights. To the extent that new regulation altering existing patent laws in passed, the outlook for the industry could change change dramatically.

* Takeover Activity: The biotechnology space has historically been a hotbed or merger and acquisition activity, as larger firms have sought to snap up smaller companies with promising but unproven product pipelines. Last year, biotech ETFs got a big boost when Bristol-Myers Squibb Co. announced plans to acquire antibody technology specialist Medarex at a premium of close to 90%.

Biotech ETF Options

Because the success of biotech firms often depends on unproven revenue streams, companies in this industry can be extremely risky. As such, many investors have prefer to gain diversified exposure to the sector through ETFs that maintain well-diversified holdings. Currently, there are five primary options for U.S. investors looking to achieve exposure to biotechnology companies.

Below, we profile these five biotech ETFs, highlighting potential strengths and weaknesses of each.

SPDR S&P Biotech ETF (XBI)

This fund is linked to the S&P Biotechnology Select Industry Index, a benchmark that represents the biotechnology sub-industry portion of the U.S. market. XBI includes biotech stocks traded on the NYSE, AMEX, and NASDAQ exchanges.

Pros: Because the index underlying XBI is an equal-weighted benchmark, XBI avoids excessive exposure to any one biotech company (as evidenced by the lowest aggregate allocation given to the top ten holdings). XBI is also the cheapest biotech ETF option, charging an expense ratio of just 0.35%.

Cons: With 28 component companies, XBI offers less depth of exposure than the PowerShares and iShares biotech ETFs.

PowerShares Dynamic Biotechnology & Genome Portfolio (PBE)

This ETF is based on the Dynamic Biotechnology & Genome Intellidex Index, an “intelligent” benchmark that seeks to identify stocks poised for outperformance. The Intellidex methodology analyzes potential index constituents on a variety of investment merit criteria, including fundamental growth, stock valuation, investment timeliness and risk factors.

Pros: This ETF is based on a modified equal-weighted index, meaning that the largest companies don’t necessarily receive the biggest weightings. PBE has also delivered strong performance over the last year, adding more than 15% during that period.

Cons: PBE’s expense ratio is at the high end of the range for biotech ETFs, 25 basis points above XBI.

iShares Nasdaq Biotechnology Index Fund (IBB)

This ETF is linked to the NASDAQ Biotechnology Index, a benchmark that includes biotechnology and pharmaceutical companies listed on the NASDAQ exchange.

Pros: This ETF offers by far the most depth of exposure, investing in more than 125 individual stocks. With average daily volume of about 700,000 shares, IBB is also the most liquid of the group.

Cons: Despite its broad base, IBB is relatively top-heavy: the top ten components account for almost half of total holdings while 60 companies have an allocation of 0.25% or less.

First Trust NYSE Arca Biotechnology Index Fund (FBT)

This ETF seeks to replicate the performance of the NYSE Arca Biotechnology Index, an equal dollar weighted benchmark composed of companies primarily involved in the use of biological processes to develop products or provide services. Such processes include recombinant DNA technology, molecular biology, genetic engineering, monoclonal antibody-based technology, lipid/liposome technology, and genomics.

Pros: This ETF has outperformed the other biotech ETFs by a wide margin over the last year, adding about 35% during this period.

Cons: The expense ratio of 0.60% is higher than both IBB and XBI. Although FBT has the lowest average daily volume of the group, the liquidity shouldn’t be a concern for most traders.

Biotech HOLDRS (BBH)

Like most other HOLDRS products, BBH concentrates its assets in a handful of individual stocks. At present Amgen, Gilead Sciences, and Biogen account for more than 80% of holdings, with the remainder of assets spread across fewer than ten stocks.

Pros: For investors looking to make a bet on some of the bigger names in the biotech industry, BBH may be the way to go.

Cons: For investors seeking diversified exposure to biotech companies, BBH may be too concentrated, and the price of this ETF may be impacted significantly by movements in its major component stocks.

Verdict

As shown by the wildly-diverging performances of these funds over the last year, biotechnology ETFs are far from identical products, and no one fund will be right for every investor. Because each ETF tracks a unique index, these funds have unique risk and return characteristics (see our Index Database for a way to browse through all the benchmarks available through ETFs).

Those looking to minimize costs will likely zero in on XBI, while those looking to diversify across the most individual components will be attracted to XBI. Investors who believe in the benefits of quantitative analysis may like PowerShares PBE, while those considering recent historical performance will likely be impressed by FBT.

Disclosure: No positions at time of writing

http://seekingalpha.com/article/187691-which-biotech-etf-is-best-five-ideas

|

22 di 4211

-

10/2/2010 23:05

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

tuttavia i dati (performance) della tabella non mi corrispondono

|

23 di 4211

-

11/2/2010 22:22

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

gl'indici parlano chiaro, hanno tenuto di più nel calo e guadagnano di più nelle giornate positive.

come l'investimento in paesi emergenti.

ho la sensazione che la strada è giusta...

|

24 di 4211

-

11/2/2010 22:34

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

altro titolo da seguire:StemCells Inc. (STEM)

portafoglio Biotech Usa attuale:

SNSS, RNN, GTF, GNBT

settore Healthcare attuale:

in ptf Italia AMPLIFON (abbastanza)

Biotech italia sotto stretta osservazione per entrata:

MolMed

|

25 di 4211

-

11/2/2010 22:46

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

altro titolo da seguire:

RegeneRx Biopharmaceuticals, Inc. (Public, AMEX:RGN)

ovviamente segnalo solo penny stocks

|

26 di 4211

-

12/2/2010 00:18

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

NASDAQ:BCRX

non è una penny ma sembra interessante, forse candidata a diventare grande

|

27 di 4211

-

15/2/2010 09:40

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

oggi wally chiusa, fanno festa.

pausa utile per riflettere.

|

28 di 4211

-

Modificato il 16/2/2010 08:54

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

breve riepilogo per chi segue il settore e la discussione:

titoli in portafoglio:

USA:

Generex Biotechnology GNBT

Cytomedix, Inc. GTF

Sunesis Pharmaceuticals SNSS

Rexahn Pharmaceuticals RNN

Italia:

biotech: nessuno

Healthcare: Amplifon

titoli sotto osservazione:

USA:

CEL-SCI Corporation CVM

Angiotech Pharmaceutical ANPI

Antigenics, Inc. AGEN

NovaBay Pharmaceuticals NBY 2

XOMA Limited XOMA

Hemispherx BioPharma HEB

Cerus Corporation CERS

StemCells, Inc. STEM

ADVENTRX Pharmaceuticals ANX

Oncothyreon Inc. ONTY

Cyclacel Pharmaceuticals CYCC

RegeneRx Biopharmaceutic RGN

BioCryst Pharmaceuticals BCRX

NexMed, Inc. NEXM

Italia:

Molmed

|

29 di 4211

-

15/2/2010 18:32

0

0

axel06

N° messaggi: 1866 -

Iscritto da: 13/2/2008

azzolina..quanti..

Ciappola, ma quanto investi su ogni titolo?

|

30 di 4211

-

16/2/2010 09:28

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

i titoli che ho acquistato sono solo quelli indicati in portafoglio, in tutto erano circa 8.000 usd iniziali in un solo titolo che poi ho distribuito.

Gli altri li seguo, per ora.

Amplifon ne ho tante da diverso tempo 2.500 azioni

i titoli americani giro gli stessi dollari spostandoli da uno all'altro con operazioni graduali. Voglio arrivare ad avere un portafoglio tipo fondo comune d'investimento da tenere possibilmente fermo o magari sfruttare le forti oscillazioni di questi titoli.

I titoli li ho inseriti in google finance che mi da l'aggiornamento di tutti comprese tutte le notizie che riguardano i titoli nella lista. E' molto comodo così perchè riesci a seguire tutto in maniera molto efficace

|

31 di 4211

-

16/2/2010 15:20

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

importante news su titolo in watch list CEL-SCI Corporation:

CEL-SCI Corporation Reports First Quarter 2010 Financial Results

Company Ends Quarter in Strongest Financial Condition Ever

VIENNA, Va., Feb. 16 /PRNewswire-FirstCall/ -- CEL-SCI Corporation (NYSE AMEX: CVM) reports financial results for the quarter ended December 31, 2009.

CEL-SCI reported that net income available to shareholders for the quarter ended December 31, 2009 was $19,159,517 versus a loss of ($2,173,513) during the same quarter in fiscal year 2009. Net income per share, basic was $0.10 for the quarter ended December 31, 2009 versus a loss of ($0.02) during the same quarter in fiscal year 2009. The operating loss for the quarter ended December 31, 2009 was ($4,252,849) versus an operating loss of ($2,551,823) during the same quarter in fiscal year 2009. The gain on net income available to shareholders for the quarter ended December 31, 2009 is due to derivative accounting.

R&D expenses for the quarter ended December 31, 2009 totaled $2,805,127 versus R&D expenses of $1,410,753 for the same quarter in fiscal year 2009. R&D expenses increased due to higher costs associated with preparing for the Company's upcoming Phase III clinical trial of its cancer drug Multikine®.

Geert Kersten, Chief Executive Officer said, "We concluded December 31, 2009 quarter in the strongest financial condition ever, with more than $36 million in cash and cash equivalents, allowing us to self-fund our upcoming pivotal Phase III study with our cancer drug Multikine. We are excited that we are in position to move Multikine through the clinic without losing rights to any of the major markets and to continue to develop our L.E.A.P.S.™ technology platform in areas such as H1N1 and Rheumatoid Arthritis."

Multikine is the first immunotherapeutic agent being developed as a first-line standard of care treatment for cancer. It is administered prior to any other cancer therapy because that is the period when the anti-tumor immune response can still be fully activated. Once the patient has advanced disease, or had surgery or has received radiation and/or chemotherapy, the immune system is severely weakened and is less able to mount an effective anti-tumor immune response. Other immunotherapies are administered after the patient has received chemotherapy and/or radiation therapy, which can limit their effectiveness.

In Phase II clinical trials Multikine was shown to be safe and well-tolerated, and to improve the patients' overall survival by 33% at a median of three and a half years following surgery. The U.S. Food and Drug Administration (FDA) gave the go-ahead for a Phase III clinical trial with Multikine in January 2007 and granted orphan drug status to Multikine in the neoadjuvant therapy of squamous cell carcinoma (cancer) of the head and neck in May 2007. Thereafter CEL-SCI built a dedicated manufacturing facility for Multikine which is now completed and fully validated.

About CEL-SCI Corporation

CEL-SCI Corporation is developing products that empower immune defenses. Its lead product Multikine is being readied for a global Phase III trial in advanced primary head and neck cancer. CEL-SCI is also developing an immunotherapy (LEAPS-H1N1-DC) to treat H1N1 hospitalized patients and a vaccine (CEL-2000) for Rheumatoid Arthritis using its L.E.A.P.S. technology platform. The LEAPS-H1N1-DC treatment involves non-changing regions of H1N1 Pandemic Flu, Avian Flu (H5N1), and the Spanish Flu as CEL-SCI scientists are very concerned about the creation of a new more virulent hybrid virus through the combination of H1N1 and Avian Flu, or maybe Spanish Flu. This investigational treatment is currently being tested in a clinical study at Johns Hopkins University. The Company has operations in Vienna, Virginia, and in/near Baltimore, Maryland.

For more information, please visit www.cel-sci.com .

|

32 di 4211

-

Modificato il 16/2/2010 15:54

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

non sembra abbia sortito grandi effetti... anzi

tuttavia 0,1 eps/share su 0,6 di prezzo non mi sembra male

oltre al cash che ha attualmente in ptf.

sicuramente il IV trim ha beneficiato dell'influenza H1N1 e probabilmente il beneficio non si ripeterà, ma gli ha portato soldini senza aumenti di capitale e non è poco

difficile capire questo settore

|

33 di 4211

-

16/2/2010 16:37

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

Adeona Pharmaceuticals, Inc. ("Adeona") AMEX: AEN

molto interessante, market cap. 19 mln

sulla home page la tabella dei prodotti e delle fasi di avanzamento delle varie sperimentazioni. 3 prodotti in fase III

http://www.adeonapharma.com/

|

34 di 4211

-

16/2/2010 16:49

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

vecchio articolo ma interessante

Investing in Biotech: How to Profit from the 3 “Phases” of Clinical Trials

by Marc Lichtenfeld, Healthcare Expert

Wednesday, August 27, 2008: Issue #845

Investing in biotech can be incredibly exciting and rewarding. After all, there’s nothing like getting in early on a company with a novel drug for cancer, diabetes or any other debilitating disease – watching the drug successfully navigate clinical trials and then get approved.

Not only do we get richer when it works, but it actually feels good to be involved, in some small way, in the development of badly needed medicines and therapies.

For the biotech companies discovering and creating these treatments, it’s a long haul, but one that’s certainly worth the journey. Allow me to briefly walk you through the process:

When a biotech company comes up with a new drug it believes will work on a specific disease, they will usually test it on animals such as mice before introducing it to humans.

Before a drug is approved by the FDA, it goes through clinical trials. This process is costly and can take years to complete.

According to the New England Journal of Medicine, only 11% of all drugs (and only 6% of cancer drugs) that enter clinical trials will ultimately get approved.

Lets look at each phase in more detail…

Investing in Biotech – Phase I

The first trial involving humans is a Phase I trial. The study typically consists of a small number (under 100) of healthy volunteers. Researchers study how the drug interacts inside the human body. Safety is an important component as well.

Phase I trials are so early in the process that biotech investors should not get too excited about any results coming out of these studies.

Investing in Biotech - Phase II

Phase II trials are often the first time the company will attempt to prove that the drug works, inside a human, against the intended disease. A typical Phase II study will consist of anywhere from a few dozen to a few hundred patients who have the particular condition in which the drug is being studied to combat. Some companies will run several Phase II studies at once in different diseases.

Scientists basically want to see the drug works and if it is safe.

Phase II trials can be conducted in many different ways. Sometimes the data is blinded, meaning patients, their doctors and/or the company will not be aware of which patients are taking the drug and which are receiving a placebo. Other times, the trial will be a study of different doses of the drug, in which case patients and their doctors will know that they are receiving the treatment.

Phase II is also when many early investors start to get excited.

Often, after a company reports positive Phase II data, the stock price will jump.

Strong data will be the first real indication that the drug works.

After a price spike, many early investors will take profits. You’ll often see some of the venture capitalists and insiders sell shares.

Since so few drugs actually get approved, taking the money and running is not a bad strategy when the share price climbs.

But trying to figure out which Phase I candidates will eventually report good Phase II data is a tough game to play and involves a lot of risk.

Investing in Biotech - Phase III

This is considered a pivotal trial where the company will prove or confirm in a large patient population that the drug is safe and effective. Between several hundred and several thousand patients will be enrolled in the trial, usually in various testing centers. The drug is usually tested against a placebo, with the data blinded from doctors, patients and the company, until the trial is over.

Typically, after a Phase III trial, the company will apply to the FDA for the drug’s approval.

Like in Phase II, a positive outcome in Phase III will frequently result in a surge in stock price as investors in biotech anticipate FDA approval and the sales and profits to follow.

Trying to figure out which drugs will work and whose stock will benefit as a result is both difficult and lucrative. But understanding when to invest in biotech based off what stage a company’s drug is in can be just as important. Those who do it well can be richly rewarded.

Good investing,

Marc

http://www.investmentu.com/IUEL/2008/August/investing-in-biotech.html

|

35 di 4211

-

16/2/2010 17:18

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

StemCells, Inc. Launches Cell Culture Medium Enabling the Derivation and Maintenance of True Mouse iPS Cells

February 16, 2010: 09:00 AM ET

PALO ALTO, Calif., Feb. 16, 2010 (GLOBE NEWSWIRE) -- StemCells, Inc. (Nasdaq:STEM) announced today the launch of GS2-M™, a new cell culture medium that enables the derivation and long-term maintenance of true (germline competent) mouse induced pluripotent stem (iPS) cells. GS2-M, the latest addition to the Company's growing SC Proven® line of specialty cell culture products, has been shown to increase the efficiency of reprogramming 'pre-iPS' cells to derive fully pluripotent stem cells, and to maintain mouse iPS cells in a definitive pluripotent state in long-term culture.1,2

The majority of preclinical iPS cell research being done today involves the use of mouse cells. For this reason, GS2-M is expected to be of significant interest to scientists in the expanding field of iPS cell research.

"GS2-M will allow researchers to reprogram somatic cells and achieve fully pluripotent mouse stem cells with greater efficiency than ever before," said Stewart Craig, senior vice president, development and operations at StemCells, Inc. "Unlike other media formulations, GS2-M does not contain any undefined factors such as serum, and it does not require the use of feeder cells, making it faster and easier to consistently generate and maintain pure mouse iPS cell lines."

GS2-M is the second new SC Proven® product to launch this year. Last month, StemCells launched GS1-R™, the first commercially available cell culture medium to enable the derivation, maintenance and growth of true rat embryonic stem (ES) cells. GS2-M and GS1-R, together with the Company's other SC Proven products, enable leading edge stem cell research, which is expected to play an increasingly important role in the future of medicine.

The defined, serum- and feeder-free GS2-M media formulation is based on the '2i' technology recently developed by prominent academic researchers in the United Kingdom, which has been exclusively licensed to StemCells, Inc. GS2-M contains selective small molecule inhibitors that block differentiation-inducing signals and promote cell survival, enabling the long-term maintenance of germline competent mouse iPS cells in a pluripotent state. Additionally, in the presence of leukemia inhibitory factor (LIF), GS2-M facilitates the conversion of partially reprogrammed, or 'pre-iPS', cells into fully pluripotent stem cells. For more information about GS2-M and the Company's other SC Proven cell culture products, interested parties are invited to visit www.scproven.com.

About StemCells, Inc.

StemCells, Inc. is focused on the development and commercialization of cell-based technologies. In its cellular medicine programs, StemCells is targeting diseases of the central nervous system and liver. StemCells' lead product candidate, HuCNS-SC® cells (purified human neural stem cells), is in clinical development for the treatment of two fatal neurodegenerative disorders that primarily affect young children. StemCells also markets specialty cell culture products under the brand SC Proven®, and is developing its cell-based technologies for use in drug screening and drug development. The Company has exclusive rights to approximately 55 issued or allowed U.S. patents and approximately 200 granted or allowed non-U.S. patents. Further information about StemCells is available at www.stemcellsinc.com.

|

36 di 4211

-

Modificato il 16/2/2010 22:14

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

vedo stasera con piacere che Adeona Pharmaceuticals AEN che avevo agiunto al volo in ptf quando faceva +15% segnA oltre +40%

malino invece CEL-SCI che ho acquistato poco dopo l'apertura dopo aver letto la trimestrale. Il titolo è comunque inserito nel Cancer Index creato dal fondo Mentor Capital, Inc.'s che investe sui titoli che ha inserito nell'indice (c'è anche Generex)

molto bene ancora Rnn (sono al raddoppio)

male Cytomedics ma con 470.000 pezzi scambiati, 17mln mark cap e una media di 170.000.000 di azioni scambiate non mi preoccupa molto.

devo togliere da qualche parte per aumenate Generex e Adeona (che come ho indicato) ha 3 farmaci in fase III

indecifrabile Snss

|

37 di 4211

-

16/2/2010 22:20

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

anzi, sorpresa per CEl-SCI che recupera nel finale e per me chiude positiva.

bene, recupera qualcosina anche Cytomedics

ci credo sempre di più in questo settore.

|

38 di 4211

-

17/2/2010 00:14

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

a proposito di CEL-SCI c'era il barbatrucco nel bilancio...

"Il guadagno sul reddito netto disponibile agli azionisti per il trimestre conclusosi il 31 dicembre 2009 è dovuta alla contabilità derivati"

tuttavia 0,1 usd su 0,6 di prezzo non son pochi e serviranno assai

il mercato vede un pò diversamente ma il recupero finale lascia magini di ripensamento

|

39 di 4211

-

17/2/2010 11:09

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

aggiornamento portafoglio Biotech Usa:

Generex Biotechnology GNBT

Cytomedix, Inc. GTF

Sunesis Pharmaceuticals SNSS

Rexahn Pharmaceuticals RNN

CEL-SCI Corporation CVM

Adeona Pharmaceuticals AEN

|

40 di 4211

-

17/2/2010 14:29

0

0

ciappola

N° messaggi: 4000 -

Iscritto da: 20/7/2007

RNN

http://it.advfn.com/notizie/Rexahn-Pharmaceuticals-Provides-Key-Goals-for-2010_41588651.html

|

|

4211 Commenti

...

|

|

Messaggi a seguire: (4211)

Ultimo messaggio: 02/Feb/2017 12:51

|

|

Torna alla Lista

Torna alla Lista Aggiorna Lista

Aggiorna Lista

Which Biotech ETF Is Best? Five Ideas

by: Michael Johnston February 10, 2010

You are no longer following Michael Johnston

As the ETF industry has grown by leaps and bounds in recent years, continued innovation has enabled investors to achieve more granular exposure than ever through exchange-traded products. Diversified ETFs targeting relatively narrow sectors of the domestic and global economy have multiplied, including funds targeting the airline, gaming, insurance, gold mining, timber, and food and beverage industries.

But the expansion of the ETF industry has also presented investors with more and more options for achieving their desired exposure within a particular asset class of industry. The large cap blend equities ETFdb Category contains almost 30 ETFs, while there are more than a dozen funds targeting emerging markets.

Even within relatively targeted biotechnology industry, there are a handful of ETFs available, including products from iShares, State Street, PowerShares, and First Trust. Some covering the ETF industry point to the presence of five biotech funds as a clear indication of over-saturation in the industry. But while these funds are similar in many ways–including significant overlap in holdings in some cases–they are far from identical.

Price Drivers

Biotechnology ETFs can be impacted by a wide variety of factors, including:

* New Product Pipeline: Biotech companies often invest heavily in research and development of products that ultimately prove to be unsuccessful commercially or that never make it to market. As such, the industry relies on a few “home run” products to drive significant revenue and earnings. In July 2009, for example, Human Genome Sciences surged more than 450% in a week after its lupus drug Benlysta showed late-stage success in a clinical trial.

* Regulatory Environment: The biotech sector is heavily dependent on protection of patents and intellectural property rights. To the extent that new regulation altering existing patent laws in passed, the outlook for the industry could change change dramatically.

* Takeover Activity: The biotechnology space has historically been a hotbed or merger and acquisition activity, as larger firms have sought to snap up smaller companies with promising but unproven product pipelines. Last year, biotech ETFs got a big boost when Bristol-Myers Squibb Co. announced plans to acquire antibody technology specialist Medarex at a premium of close to 90%.

Biotech ETF Options

Because the success of biotech firms often depends on unproven revenue streams, companies in this industry can be extremely risky. As such, many investors have prefer to gain diversified exposure to the sector through ETFs that maintain well-diversified holdings. Currently, there are five primary options for U.S. investors looking to achieve exposure to biotechnology companies.

Below, we profile these five biotech ETFs, highlighting potential strengths and weaknesses of each.

SPDR S&P Biotech ETF (XBI)

This fund is linked to the S&P Biotechnology Select Industry Index, a benchmark that represents the biotechnology sub-industry portion of the U.S. market. XBI includes biotech stocks traded on the NYSE, AMEX, and NASDAQ exchanges.

Pros: Because the index underlying XBI is an equal-weighted benchmark, XBI avoids excessive exposure to any one biotech company (as evidenced by the lowest aggregate allocation given to the top ten holdings). XBI is also the cheapest biotech ETF option, charging an expense ratio of just 0.35%.

Cons: With 28 component companies, XBI offers less depth of exposure than the PowerShares and iShares biotech ETFs.

PowerShares Dynamic Biotechnology & Genome Portfolio (PBE)

This ETF is based on the Dynamic Biotechnology & Genome Intellidex Index, an “intelligent” benchmark that seeks to identify stocks poised for outperformance. The Intellidex methodology analyzes potential index constituents on a variety of investment merit criteria, including fundamental growth, stock valuation, investment timeliness and risk factors.

Pros: This ETF is based on a modified equal-weighted index, meaning that the largest companies don’t necessarily receive the biggest weightings. PBE has also delivered strong performance over the last year, adding more than 15% during that period.

Cons: PBE’s expense ratio is at the high end of the range for biotech ETFs, 25 basis points above XBI.

iShares Nasdaq Biotechnology Index Fund (IBB)

This ETF is linked to the NASDAQ Biotechnology Index, a benchmark that includes biotechnology and pharmaceutical companies listed on the NASDAQ exchange.

Pros: This ETF offers by far the most depth of exposure, investing in more than 125 individual stocks. With average daily volume of about 700,000 shares, IBB is also the most liquid of the group.

Cons: Despite its broad base, IBB is relatively top-heavy: the top ten components account for almost half of total holdings while 60 companies have an allocation of 0.25% or less.

First Trust NYSE Arca Biotechnology Index Fund (FBT)

This ETF seeks to replicate the performance of the NYSE Arca Biotechnology Index, an equal dollar weighted benchmark composed of companies primarily involved in the use of biological processes to develop products or provide services. Such processes include recombinant DNA technology, molecular biology, genetic engineering, monoclonal antibody-based technology, lipid/liposome technology, and genomics.

Pros: This ETF has outperformed the other biotech ETFs by a wide margin over the last year, adding about 35% during this period.

Cons: The expense ratio of 0.60% is higher than both IBB and XBI. Although FBT has the lowest average daily volume of the group, the liquidity shouldn’t be a concern for most traders.

Biotech HOLDRS (BBH)

Like most other HOLDRS products, BBH concentrates its assets in a handful of individual stocks. At present Amgen, Gilead Sciences, and Biogen account for more than 80% of holdings, with the remainder of assets spread across fewer than ten stocks.

Pros: For investors looking to make a bet on some of the bigger names in the biotech industry, BBH may be the way to go.

Cons: For investors seeking diversified exposure to biotech companies, BBH may be too concentrated, and the price of this ETF may be impacted significantly by movements in its major component stocks.

Verdict

As shown by the wildly-diverging performances of these funds over the last year, biotechnology ETFs are far from identical products, and no one fund will be right for every investor. Because each ETF tracks a unique index, these funds have unique risk and return characteristics (see our Index Database for a way to browse through all the benchmarks available through ETFs).

Those looking to minimize costs will likely zero in on XBI, while those looking to diversify across the most individual components will be attracted to XBI. Investors who believe in the benefits of quantitative analysis may like PowerShares PBE, while those considering recent historical performance will likely be impressed by FBT.

Disclosure: No positions at time of writing

http://seekingalpha.com/article/187691-which-biotech-etf-is-best-five-ideas