Adams Resources & Energy, Inc. Stockholders Approve Acquisition by an Affiliate of Tres Energy LLC

29 Gennaio 2025 - 8:12PM

Adams Resources & Energy, Inc. (NYSE AMERICAN: AE) (“Adams” or

the “Company”) announced today that its stockholders have voted at

a special meeting of the Company’s stockholders (the “Special

Meeting”) to approve the pending acquisition of the Company by an

affiliate of Tres Energy LLC. Under the terms of the merger

agreement that was approved at the Special Meeting, Adams

stockholders will receive $38.00 per share in cash for each share

of Adams common stock they own immediately prior to the effective

time of the merger.

Approximately 77% of the Company's outstanding

shares were voted at the Special Meeting, and the merger was

approved by over 76% of the Company's outstanding shares. The final

voting results on the proposals voted on at the Special Meeting

will be set forth in a Form 8-K that will be filed by the Company

with the U.S. Securities and Exchange Commission (the “SEC”).

The merger is expected to close in early

February 2025, subject to customary closing conditions.

Forward-Looking Statements and

Information

This communication contains “forward-looking

statements” within the Private Securities Litigation Reform Act of

1995. Any statements contained in this communication that are not

statements of historical fact, including statements about the

timing of the proposed transaction, Adams’s ability to consummate

the proposed transaction and the expected benefits of the proposed

transaction, may be deemed to be forward-looking statements. All

such forward-looking statements are intended to provide

management’s current expectations for the future of the Company

based on current expectations and assumptions relating to the

Company’s business, the economy and other future conditions.

Forward-looking statements generally can be identified through the

use of words such as “believes,” “anticipates,” “may,” “should,”

“will,” “plans,” “projects,” “expects,” “expectations,”

“estimates,” “forecasts,” “predicts,” “targets,” “prospects,”

“strategy,” “signs,” and other words of similar meaning in

connection with the discussion of future performance, plans,

actions or events. Because forward-looking statements relate to the

future, they are subject to inherent risks, uncertainties and

changes in circumstances that are difficult to predict. Such risks

and uncertainties include, among others: (i) the risk that a

condition of closing of the proposed transaction may not be

satisfied or that the closing of the proposed transaction might

otherwise not occur, (ii) risks related to disruption of management

time from ongoing business operations due to the proposed

transaction, (iii) the risk that any announcements relating to the

proposed transaction could have adverse effects on the market price

of the common stock of Adams, (iv) the risk that the proposed

transaction and its announcement could have an adverse effect on

the ability of Adams to retain customers and retain and hire key

personnel and maintain relationships with its suppliers and

customers, (v) the occurrence of any event, change or other

circumstance or condition that could give rise to the termination

of the Merger Agreement, including in circumstances requiring the

Company to pay a termination fee, (vi) unexpected costs, charges or

expenses resulting from the Merger, (vii) potential litigation

relating to the Merger that could be instituted against the parties

to the Merger Agreement or their respective directors, managers or

officers, including the effects of any outcomes related thereto,

(viii) worldwide economic or political changes that affect the

markets that the Company’s businesses serve which could have an

effect on demand for the Company’s products and services and impact

the Company’s profitability, and (ix) disruptions in the global

credit and financial markets, including diminished liquidity and

credit availability, cyber-security vulnerabilities, crude oil

pricing and supply issues, retention of key employees, increases in

fuel prices, and outcomes of legal proceedings, claims and

investigations. Accordingly, actual results may differ materially

from those contemplated by these forward-looking statements.

Investors, therefore, are cautioned against relying on any of these

forward-looking statements. They are neither statements of

historical fact nor guarantees or assurances of future performance.

Additional information regarding the factors that may cause actual

results to differ materially from these forward-looking statements

is available in Adams’s filings with the SEC, including the risks

and uncertainties identified in Part I, Item 1A - Risk Factors of

Adams’s Annual Report on Form 10-K for the year ended December 31,

2023 and in the Company’s other filings with the SEC.

These forward-looking statements speak only as

of the date of this communication, and Adams does not assume any

obligation to update or revise any forward-looking statement made

in this communication or that may from time to time be made by or

on behalf of the Company, whether in response to new information,

future events, or otherwise, except as required by applicable

law.

There can be no assurance that the proposed

transaction will in fact be consummated. We caution investors not

to unduly rely on any forward-looking statements. The

forward-looking statements speak only as of the date of this

communication. The Company undertakes no obligation or duty to

update or revise any of these forward-looking statements after the

date of this communication, whether in response to new information,

future events, or otherwise, except as required by applicable

law.

About Adams Resources & Energy,

Inc.

Adams Resources & Energy, Inc. is engaged in

crude oil marketing, transportation, terminalling and storage, tank

truck transportation of liquid chemicals and dry bulk and recycling

and repurposing of off-spec fuels, lubricants, crude oil and other

chemicals through its subsidiaries, GulfMark Energy, Inc., Service

Transport Company, Victoria Express Pipeline, L.L.C., GulfMark

Terminals, LLC, Phoenix Oil, Inc., and Firebird Bulk Carriers, Inc.

For more information, visit www.adamsresources.com.

About Tres Energy LLC

Tres Energy LLC is a privately held limited

liability company that invests in and operates strategic energy

assets across the United States. For more information, visit

www.tres-energy.com.

Company Contact

Tracy E. Ohmart EVP, Chief Financial Officer

tohmart@adamsresources.com (713) 881-3609

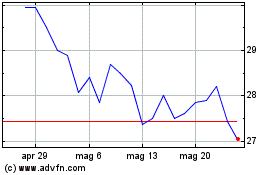

Grafico Azioni Adams Resources and Energy (AMEX:AE)

Storico

Da Gen 2025 a Feb 2025

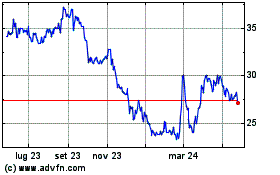

Grafico Azioni Adams Resources and Energy (AMEX:AE)

Storico

Da Feb 2024 a Feb 2025