0000002178FALSE00000021782025-01-172025-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 17, 2025

ADAMS RESOURCES & ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 1-7908 | 74-1753147 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| Wortham Tower Building, 2727 Allen Parkway, 9th Floor, Houston, Texas | 77019 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 881-3600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.10 par value | | AE | | NYSE American LLC |

| | | | | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | Emerging growth company | ☐ |

| | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 8.01. Other Events.

As previously reported, on November 11, 2024, Adams Resources & Energy, Inc., a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) by and among the Company, Tres Energy LLC, a Texas limited liability company (“Parent”), and ARE Acquisition Corporation, a Delaware corporation and a direct, wholly owned subsidiary of Parent (“Merger Sub”), pursuant to which Merger Sub would merge with and into the Company, with the Company surviving the merger as a wholly owned subsidiary of Parent (the “Merger”). As permitted under Section 11.06(b) of the Merger Agreement, and as previously reported, Parent has assigned its rights and obligations under the Merger Agreement to ARE Equity Corporation, a Texas corporation and an affiliate of Parent, although under the Merger Agreement the assignment does not relieve Parent of its obligations under the Merger Agreement if ARE Equity Corporation does not fully and timely perform such obligations.

On December 20, 2024, the Company filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement in connection with the Merger (the “Proxy Statement”).

As of January 17, 2025, two complaints have been filed in connection with the Proxy Statement (collectively, the “Complaints”) by purported stockholders of the Company. These lawsuits include: Jones v. Adams Resources & Energy, Inc., et al., Index No. 650083/2025, filed on January 7, 2025, in the Supreme Court of the State of New York, County of New York, and Wright v. Adams Resources & Energy, Inc., et al., Index No. 650112/2025, filed on January 8, 2025, in the Supreme Court of the State of New York, County of New York.

The Complaints assert claims under New York common law challenging the adequacy of the disclosures relating to the proposed Merger. The Complaints seek, among other things, to enjoin the Company from consummating the Merger or, in the alternative, damages and attorneys’ fees.

Additionally, the Company has received demand letters from ten purported Company stockholders alleging similar insufficiencies in the disclosures in the Proxy Statement under Section 14(a) and Section 20(a) of the Exchange Act (such letters, the “Demands” and collectively with the Complaints, the “Litigation Matters”).

Additional lawsuits arising out of the Merger may also be filed in the future and the Company may also receive additional Demands related to the Merger. Absent new or different allegations that are material or create a disclosure obligation under the U.S. federal securities laws, the Company will not necessarily disclose such additional Complaints or Demands.

The Company believes that the claims asserted in the Litigation Matters are without merit and that no supplemental disclosure is required under applicable law. However, in order to avoid the risk that litigation may delay or otherwise adversely affect the consummation of the Merger, to avoid nuisance and possible transaction delays and to minimize the exposure and distraction of responding to the Litigation Matters, and without admitting any liability or wrongdoing, the Company has determined voluntarily to supplement the Proxy Statement as described in these supplemental disclosures. Nothing in these supplemental disclosures shall be deemed an admission of the legal necessity or materiality under applicable laws of any of the disclosures set forth herein. To the contrary, the Company specifically denies all allegations in the Litigation Matters that any additional disclosure was or is required or material.

These supplemental disclosures will not affect the merger consideration to be paid to stockholders of the Company in connection with the Merger or the timing of the special meeting of the Company’s stockholders, which will be held virtually via live webcast at 9:30 AM Central Time on January 29, 2025.

Supplemental Disclosures

The additional disclosures herein supplement the disclosures contained in, and should be read in conjunction with, the Proxy Statement, which should be read in its entirety and is available on the SEC’s website at www.sec.gov, along with periodic reports and other information the Company files with the SEC. To the extent that information in

these supplemental disclosures differs from, or updates information contained in, the Proxy Statement, the information in these supplemental disclosures shall supersede or supplement the information in the Proxy Statement. All page references in the information below are to pages in the Proxy Statement, and all terms used but not defined below shall have the meanings set forth in the Proxy Statement. New text within the amended and supplemented language from the Proxy Statement is indicated in bold and underlined text (e.g., bold, underlined text), and deleted text within the amended and supplemented language from the Proxy Statement is indicated in bold and strikethrough text (e.g., bold, strikethrough text).

The section of the Proxy Statement entitled “The Merger (Proposal 1)—Background of the Merger” is hereby amended and supplemented as follows:

On page 39, the seventh paragraph is amended and supplemented as follows:

“On August 30, 2024, Tres Energy sent a revised non-binding indication of interest in writing to the Adams Board of Directors, for a proposal to acquire 100% of the capital stock of Adams in an all-cash transaction at a price of $40 per share based on its initial due diligence. The letter indicated that Tres Energy anticipated funding the transaction through its existing cash resources and/or committed debt financing and that the transaction would not be subject to any financing contingency. The letter requested that Adams agree to a 45-day exclusivity period by signing a form of exclusivity agreement attached to the indication of interest. The letter also indicated that Tres Energy would expect the definitive agreement to contain a customary “no shop” provision with exceptions that would permit the Adams Board of Directors to comply with its fiduciary duties, but would not expect any definitive agreement to contain a “go shop” provision permitting the Company to actively seek alternative transactions after the execution of a definitive agreement. None of the June 20, June 27 or August 30 letters from Tres Energy contained any offer of post-transaction employment for Adams’s executive officers or directors.”

The section of the Proxy Statement entitled “The Merger (Proposal 1)—Opinion of Adams’s Financial Advisor” is hereby amended and supplemented as follows:

The third paragraph under the sub-heading “Financial Analyses—Selected Companies Analysis” beginning on page 51 is hereby revised as follows:

“The selected companies and, their corresponding data, and the resulting low, high, median and mean financial data included the following:

| | | | | | | | | | | | | | | | | | | | |

| Specialized Carrier Companies | | Enterprise Value to Adjusted EBITDA |

| LTM | | CY 2024E | | CY 2025E |

| Ardmore Shipping Corporation | | 3.0x | | 3.1x | | 3.9x |

| Marten Transport, Ltd. | | 9.2x | | 9.8x | | 8.3x |

| Mullen Group Ltd. | | 6.3x | | 6.1x | | 5.7x |

| Navios Maritime Partners L.P. | | 5.0x | | 4.5x | | 3.7x |

| Tsakos Energy Navigation Limited | | 4.9x | | 4.5x | | 3.7x |

| World Kinect Corporation | | 7.0x | | 6.2x | | 5.6x |

| | | | | | | | | | | | | | | | | | | | |

| Dry Van Truckload Companies | | Enterprise Value to Adjusted EBITDA |

| LTM | | CY 2024E | | CY 2025E |

| Covenant Logistics Group, Inc. | | 7.1x | | 7.4x | | 6.8x |

| Heartland Express, Inc. | | 7.4x | | 6.9x | | 5.1x |

| P.A.M. Transportation Services, Inc. | | 8.5x | | 7.3x | | 5.0x |

| Schneider National, Inc. | | 9.9x | | 9.5x | | 8.0x |

Specialized Carrier Companies:

•Ardmore Shipping Corporation

•Marten Transport, Ltd.

•Mullen Group Ltd.

•Navios Maritime Partners L.P.

•Tsakos Energy Navigation Limited

•World Kinect Corporation

Dry Van Truckload Companies:

•Covenant Logistics Group, Inc.

•Heartland Express, Inc.

•P.A.M. Transportation Services, Inc.

•Schneider National, Inc.”

The third paragraph under the sub-heading “Financial Analyses—Selected Transactions Analysis” beginning on page 52 is hereby revised as follows:

“The selected transactions, their corresponding data, and the resulting low, high, median and mean data included the following:

| | | | | | | | | | | | | | | | | | | | |

| Date Announced | | Target | | Acquiror | | Enterprise Value / LTM Adjusted EBITDA |

| 10/03/24 | | Martin Midstream Partners L.P. | | Martin Resource Management Corporation | | 5.3x |

| 06/03/24 | | Navig8 TopCo Holdings Inc. | | ADNOC Logistics & Services plc | | 4.8x |

| 05/20/24 | | Overseas Shipholding Group, Inc. | | Saltchuk Resources, Inc. | | 5.3x |

| 03/20/24 | | Buckshot Trucking LLC | | Enservco Corporation | | 2.2x |

| 12/22/23 | | Daseke, Inc. | | TFI International Inc. | | 4.9x |

| 11/01/23 | | Patriot Transportation Holding, Inc. | | Blue Horizon Partners, Inc. | | 6.1x |

| 04/27/23 | | Lew Thompson & Son Trucking, Inc. | | Covenant Logistics Group, Inc. | | 5.2x |

| 03/21/23 | | U.S. Xpress Enterprises, Inc. | | Knight-Swift Transportation Holdings Inc. | | 5.5x |

| 08/22/22 | | Transportation Resources, Inc. | | Heartland Express, Inc. | | 5.6x |

| 06/24/22 | | USA Truck, Inc. | | Schenker, Inc. | | 4.9.x |

| 06/15/22 | | Substantially All Assets of Metropolitan Trucking, Kiwi Leasing, Hoya Leasing, Metropolitan Freight | | Costar Equipment, Inc; Met Express, Inc | | 3.5x |

| 06/01/22 | | Smith Transport, Inc. | | Heartland Express, Inc. | | 5.0x |

| 02/10/22 | | Aat Carriers, Inc. | | Covenant Logistics Group, Inc. | | 5.5x |

| | | | | | | | | | | | | | | | | | | | |

| 08/26/21 | | Navios Maritime Acquisition Corporation | | Navios Maritime Partners L.P. | | 5.7x |

| 01/25/21 | | UPS Ground Freight, Inc. (nka:TForce Freight, Inc.) | | TFI International Inc. | | 5.7x |

| 05/18/20 | | Delek US Holdings Inc | | Delek Logistics Partners | | 5.6x |

| 07/13/18 | | Three Star Trucking Ltd. | | Vertex Resources Group Ltd. | | 2.6x |

| 07/05/18 | | Landair Holdings, Inc. | | Covenant Transportation Group, Inc. (nka:Covenant Logistics Group, Inc.) | | 5.3x |

| 02/04/18 | | Higman Marine Services, Inc. | | Kirby Corporation | | 7.0x |

| 05/25/17 | | Estenson Logistics, LLC (nka:Hub Group Dedicated) | | Hub Group Trucking, Inc. | | 6.8x |

| 04/10/17 | | Swift Transportation Company | | Knight Transportation, Inc. (nka:Knight-Swift Transportation Holdings Inc.) | | 6.7x” |

The first paragraph under the sub-heading “Financial Analyses—Discounted Cash Flow Analysis” beginning on page 53 is hereby revised as follows:

“Discounted Cash Flow Analysis. Houlihan Lokey performed a discounted cash flow analysis of the Company by calculating the estimated present value of the projected unlevered, after-tax free cash flows of the Company based on the Company Projections. Houlihan Lokey calculated the following terminal values for the Company by applying a range of perpetuity growth rates of 1.0% to 3.0% to the Company’s estimated terminal unlevered free cash flow (figures are in millions).

| | | | | | | | | | | | | | |

| Present Value of Cash Flows

(2024-2029) | PV of Terminal Value Based on Perpetual Growth Rate for 2029 Unlevered Free Cash Flow |

| Discount Rate | | 1.00% | 2.00% | 3.00% |

| 14.00% | $43.6 | $59.6 | $65.2 | $71.8 |

| 14.50% | $43.0 | $56.2 | $61.3 | $67.3 |

| 15.00% | $42.4 | $53.1 | $57.8 | $63.2 |

| 15.50% | $41.8 | $50.2 | $54.5 | $59.4 |

| 16.00% | $41.2 | $47.6 | $51.5 | $56.0” |

The section of the Proxy Statement entitled “The Merger (Proposal 1)—GulfStar Fees” on page 56 is hereby amended and supplemented as follows:

“Pursuant to its engagement agreement with Adams, at the effective time of the Merger and conditional thereon, GulfStar will be entitled to a success fee of one percent (1%) of the consideration to be paid by Parent in the Merger, or approximately $1.0 million. Adams has also agreed to reimburse GulfStar for reasonable and documented expenses and to indemnify GulfStar and certain related parties against certain liabilities and expenses arising out of or related to GulfStar’s engagement. GulfStar was not asked to, was not engaged to, and did not, render an opinion on the fairness, from a financial point of view, of the Merger Consideration to be received by holders of Adams Common Stock. For more information on GulfStar’s role in the contacts and negotiations leading to the execution of the Merger Agreement, see “The Merger (Proposal 1) — Background of the Merger” beginning on page 34 of this proxy statement. Since 2021, GulfStar has provided investment banking and financial advisory services to the Company unrelated to the Merger, including in connection with the acquisition of Firebird and Phoenix in August 2022, the repurchase by the Company of KSAI’s and its affiliates’ shares of

Adams Common Stock in October 2022, the placement of debt relating to such share repurchase, and other assignments, for which it was paid total fees of approximately $1,050,000. Neither GulfStar nor its affiliates have in the past two years provided advisory or other services to Parent or its affiliates. Neither the Company nor GulfStar currently expect that GulfStar or its affiliates will provide future services to the Company, the Surviving Corporation, Parent, or their respective subsidiaries and affiliates.”

The section of the Proxy Statement entitled “The Merger (Proposal 1)—Interests of Adams’s Directors and Executive Officers in the Merger” is hereby amended and supplemented as follows:

The first paragraph under the sub-heading “Arrangements with Parent” beginning on page 59 is hereby revised as follows:

“As of the date of this proxy statement, no executive officer of Adams has entered into any agreement with Parent or any of its affiliates regarding individual employment arrangements with, or the right to participate in any equity or benefit plans of, the Surviving Corporation or one or more of its affiliates following the consummation of the Merger. Prior to and following the Closing, however, Parent intends to have discussions with certain executive officers of Adams regarding employment with the Surviving Corporation or one or more of its affiliates and certain executive officers of Adams may enter into agreements with, Parent or Merger Sub, their subsidiaries or their respective affiliates regarding employment with the Surviving Corporation or one or more of its affiliates. As of January 17, 2025, no such agreements have been reached and no substantive discussions of potential employment terms have taken place.”

Important Information For Investors And Stockholders

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed transaction between Adams, Parent, ARE Equity Corporation and Merger Sub. In connection with this proposed transaction, Adams filed the definitive Proxy Statement with the Securities and Exchange Commission (the “SEC”) on December 20, 2024 and mailed the Proxy Statement to stockholders of the Company entitled to vote at the special meeting of stockholders in connection with the proposed Merger (the “Special Meeting”) on or around December 23, 2024. Adams may file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for the Proxy Statement or any other document Adams may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ADAMS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the Proxy Statement and other documents filed with the SEC by Adams through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Adams will be available free of charge on Adams internet website at www.adamsresources.com/sec-filings or by contacting Adams’s Chief Financial Officer by email at tohmart@adamsresources.com or by phone at 713-881-3609.

Participants in Solicitation

Adams and its officers, directors and certain other employees may be soliciting proxies from Adams’s stockholders in favor of the Merger and may be deemed to be “participants in the solicitation” of proxies under the rules of the SEC. Information regarding Adams’s directors and executive officers and their respective interests in the Company by security holdings or otherwise is available in (i) the Company's Annual Report on Form 10-K for the year ended December 31, 2023, including under the headings “Item 10. Directors, Executive Officers and Corporate Governance”, “Item 11. Executive Compensation”, “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” and “Item 13. Certain Relationships and Related Transactions, and Director Independence”, which was filed with the SEC on March 13, 2024, (ii) the Company's definitive Proxy Statement on Schedule 14A for its 2024 annual meeting of stockholders, including under the headings “Item 1 -- Election of Directors”, “Executive Officers”, “Summary Compensation Table”, “Compensation Overview”, “2023 Director Compensation”, “Transactions with Related Persons” and “Security Ownership of

Certain Beneficial Owners and Management”, which was filed with the SEC on April 1, 2024, (iii) the Company’s definitive Proxy Statement on Schedule 14A filed with the SEC on December 20, 2024 in connection with the Special Meeting, including under the headings “The Merger—Interests of Adams’s Directors and Executive Officers in the Merger” and (iv) subsequent statements of changes in beneficial ownership on file with the SEC. Additional information regarding the interests of such potential participants may be included in other relevant materials to be filed with the SEC. These documents may be obtained free of charge from the SEC's website at www.sec.gov and the Company’s website at www.adamsresources.com/sec-filings.

Forward Looking Statements

This communication contains “forward-looking statements” within the Private Securities Litigation Reform Act of 1995. Any statements contained in this communication that are not statements of historical fact, including statements about the timing of the proposed transaction, Adams’s ability to consummate the proposed transaction and the expected benefits of the proposed transaction, may be deemed to be forward-looking statements. All such forward-looking statements are intended to provide management’s current expectations for the future of the Company based on current expectations and assumptions relating to the Company’s business, the economy and other future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “signs,” and other words of similar meaning in connection with the discussion of future performance, plans, actions or events. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Such risks and uncertainties include, among others: (i) the failure to obtain the required vote of Adams’s stockholders, (ii) the risk that a condition of closing of the proposed transaction may not be satisfied or that the closing of the proposed transaction might otherwise not occur, (iii) risks related to disruption of management time from ongoing business operations due to the proposed transaction, (iv) the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of Adams, (v) the risk that the proposed transaction and its announcement could have an adverse effect on the ability of Adams to retain customers and retain and hire key personnel and maintain relationships with its suppliers and customers, (vi) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger Agreement, including in circumstances requiring the Company to pay a termination fee, (vii) unexpected costs, charges or expenses resulting from the Merger, (viii) potential litigation relating to the Merger that could be instituted against the parties to the Merger Agreement or their respective directors, managers or officers, including the effects of any outcomes related thereto, (ix) worldwide economic or political changes that affect the markets that the Company’s businesses serve which could have an effect on demand for the Company’s products and services and impact the Company’s profitability, and (x) disruptions in the global credit and financial markets, including diminished liquidity and credit availability, cyber-security vulnerabilities, crude oil pricing and supply issues, retention of key employees, increases in fuel prices, and outcomes of legal proceedings, claims and investigations. Accordingly, actual results may differ materially from those contemplated by these forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in Adams’s filings with the SEC, including the risks and uncertainties identified in Part I, Item 1A - Risk Factors of Adams’s Annual Report on Form 10-K for the year ended December 31, 2023 and in the Company’s other filings with the SEC.

These forward-looking statements speak only as of the date of this communication, and Adams does not assume any obligation to update or revise any forward-looking statement made in this communication or that may from time to time be made by or on behalf of the Company, whether in response to new information, future events, or otherwise, except as required by applicable law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | ADAMS RESOURCES & ENERGY, INC. |

| | | |

| | | |

| | | |

| Date: | January 17, 2025 | By: | /s/ Tracy E. Ohmart |

| | | Tracy E. Ohmart |

| | | Chief Financial Officer |

| | | (Principal Financial Officer and |

| | | Principal Accounting Officer) |

v3.24.4

Cover Page

|

Jan. 17, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 17, 2025

|

| Entity Registrant Name |

ADAMS RESOURCES & ENERGY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-7908

|

| Entity Tax Identification Number |

74-1753147

|

| Entity Address, Address Line One |

Wortham Tower Building

|

| Entity Address, Address Line Two |

2727 Allen Parkway

|

| Entity Address, Address Line Three |

9th Floor

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77019

|

| City Area Code |

713

|

| Local Phone Number |

881-3600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 par value

|

| Trading Symbol |

AE

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000002178

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

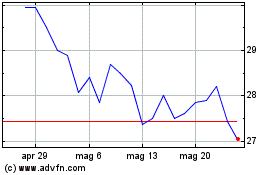

Grafico Azioni Adams Resources and Energy (AMEX:AE)

Storico

Da Dic 2024 a Gen 2025

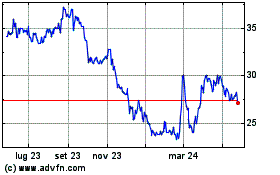

Grafico Azioni Adams Resources and Energy (AMEX:AE)

Storico

Da Gen 2024 a Gen 2025