Current Report Filing (8-k)

08 Giugno 2023 - 10:06PM

Edgar (US Regulatory)

0001708599

false

0001708599

2023-06-02

2023-06-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): June 2, 2023

AgeX

Therapeutics, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-38519 |

|

82-1436829 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

1101

Marina Village Parkway

Suite

201

Alameda,

California 94501

(Address

of principal executive offices)

(510)

671-8370

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

AGE |

|

NYSE

American |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Forward-Looking

Statements

Any

statements that are not historical fact (including, but not limited to statements that contain words such as “may,” “will,”

“believes,” “plans,” “intends,” “anticipates,” “expects,” “estimates”)

should also be considered to be forward-looking statements. Additional factors that could cause actual results to differ materially from

the results anticipated in these forward-looking statements are contained in AgeX’s periodic reports filed with the Securities

and Exchange Commission (the “SEC”) under the heading “Risk Factors” and other filings that AgeX may make with

the SEC. Undue reliance should not be placed on these forward-looking statements which speak only as of the date they are made, and the

facts and assumptions underlying these statements may change. Except as required by law, AgeX disclaims any intent or obligation to update

these forward-looking statements.

References

in this Report to “AgeX,” “we” or “us” refer to AgeX Therapeutics, Inc.

The

description or discussion in this Form 8-K of any contract or agreement is a summary only and is qualified in all respects by reference

to the full text of the applicable contract or agreement.

Item

1.01 – Entry in Material Definitive Agreement.

On

June 2, 2023 AgeX and Juvenescence Limited (“Juvenescence”) entered into an amendment to the Amended and Restated Secured

Convertible Promissory Note (the “Secured Note”), as previously amended by an Allonge and Second Amendment to Amended and

Restated Convertible Promissory Note (the “Second Amendment”), to provide that (i) AgeX may draw on the available portion

of the line of credit under the Secured Note until the earlier of the date a Qualified Offering as defined in the Secured Note is consummated

by AgeX or October 31, 2023 (subject to Juvenescence’s discretion to approve each loan draw as provided in the Secured Note), (ii)

AgeX will not be obligated to issue additional common stock purchase warrants to Juvenescence in connection with the receipt of loan

funds made available pursuant to the Second Amendment, and (iii) the definition of Reverse Financing Condition is amended to extend to

June 20, 2023 the referenced deadline for fulfillment of the condition to permit borrowing or other incurrence of indebtedness by Reverse

Bioengineering, Inc.

The

terms of the June 2, 2023 amendment of the Secured Note are set forth in a Third Amendment to Amended and Restated Convertible Promissory

Note (the “Third Amendment’). The description or discussion of the Third Amendment in this Form 8-K is a summary only, does

not purport to be a complete statement of the terms and conditions of the Third Amendment, and is qualified in all respects by reference

to the full text of the Third Amendment which is filed as an Exhibit to this Report and is incorporated by reference into this Report.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On

June 7, 2023, AgeX drew $500,000 of its credit available under the Secured Note as most recently amended by the Third Amendment.

The

Repayment Date on which the outstanding principal balance of the Secured Note will become due and payable shall be February 14, 2024.

The other material terms of the Secured Note are summarized in AgeX’s Quarterly Report on Form 10-Q filed with the SEC on May 12,

2023 and in Item 1.01 of this Report.

Item

9.01 - Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

AGEX

THERAPEUTICS, INC. |

| |

|

|

| Date:

June 8, 2023 |

By: |

/s/

Andrea E. Park |

| |

|

Chief

Financial Officer |

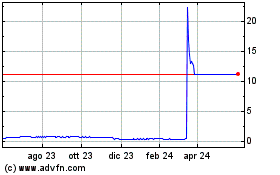

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

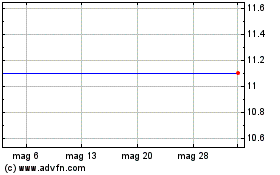

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024