Form DEF 14A - Other definitive proxy statements

15 Novembre 2023 - 3:38PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant

to §240.14a-12 |

AgeX

Therapeutics, Inc.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment of Filing Fee (Check the appropriate

box): |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SUPPLEMENT

TO PROXY STATEMENT

ANNUAL

MEETING OF STOCKHOLDERS

To

Be Held on Wednesday, December 13, 2023

The

following information updates, supplements, and modifies information presented in the PRINCIPAL STOCKHOLDERS AND SECURITY OWNERSHIP OF

MANAGEMENT section of our November 7, 2023 Proxy Statement for our Annual Meeting of Stockholders to be held on Wednesday, December 13,

2023 and should be read in conjunction with the entire Proxy Statement.

2022

Secured Convertible Promissory Note and Security Agreement

Increase

in Secured Note Line of Credit

On

November 9, 2023, AgeX and Juvenescence entered into an Allonge and Fifth Amendment to Amended and Restated Convertible Promissory Note

(the “Fifth Amendment”) that increases the amount of the line of credit available to AgeX by $4,400,000, subject to the terms

of the Secured Note and Juvenescence’s discretion to approve and fund each of AgeX’s future draws of that additional amount

of credit. Concurrently with the execution of the Fifth Amendment, AgeX also entered into an additional Pledge Agreement to add shares

of a subsidiary to the collateral under the Security Agreement, and AgeX’s subsidiaries ReCyte Therapeutics, Inc., Reverse Bioengineering,

Inc., and UniverXome Bioengineering, Inc. each entered into a Guaranty Agreement and Joinder Agreement pursuant to which each of them

agreed to guaranty AgeX’s obligations to Juvenescence pursuant to the Secured Note, as amended by the Fifth Amendment, and to grant

Juvenescence a security interest in their respective assets pursuant to the Security Agreement to secure their obligations to Juvenescence.

Debt

Exchanged for Preferred Stock and Remediation of Stock Exchange Listing Deficiency

Amendment

of Preferred Stock and Remediation of Stock Exchange Listing Deficiency

On

July 24, 2023, AgeX issued shares of AgeX Series A Preferred Stock and AgeX Series B Preferred Stock to Juvenescence in exchange for

the extinguishment of $36 million of indebtedness owed to Juvenescence with the intent of adding $36 million to stockholders equity to

eliminate a stockholders equity deficiency that caused AgeX to be out of compliance with the NYSE American continued listing standards.

However, upon subsequent consideration in consultation with AgeX’s independent registered public accountants, AgeX determined that,

in accordance with applicable guidance to GAAP, the deemed liquidation preference provisions of the Preferred Stock could be considered

contingent redemption provisions that are not solely within AgeX’s control, requiring that the Preferred Stock be presented outside

of permanent equity in the mezzanine section of the condensed consolidated balance sheets for the three and nine months ended September

30, 2023. To comply with the NYSE American listing requirement by permitting the Preferred Stock to qualify now as permanent equity,

on November 7, 2023 Section 3(b) of the terms of the Series A Preferred Stock and Series B Preferred Stock was amended (i) to clarify

that certain change of control or disposition of asset transactions would be treated as a deemed liquidation if the applicable transaction

is approved by the Board of Directors or stockholders of AgeX, and (ii) to provide that in case of such a deemed liquidation transaction

holders of Preferred Stock would receive the same type of consideration as that distributed or paid to holders of AgeX common stock.

AgeX has informed the NYSE American of the accounting issue and the remedy that has been implemented and AgeX believes it is in compliance

with NYSE American’s continued listing standards.

November

14, 2023

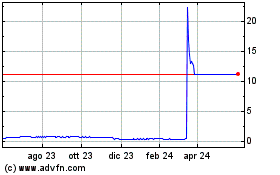

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024