AgeX Therapeutics, Inc. (“AgeX”; NYSE American: AGE), a

biotechnology company developing therapeutics for human aging and

regeneration, reported its financial and operating results for

fourth quarter and the full year ended December 31, 2023 and recent

highlights.

Recent Highlights

| |

● |

Stockholders approved

transactions for merger with Serina Therapeutics, Inc. |

| |

● |

Obtained $4.4 million addition to

line of credit from Juvenescence Limited |

| |

● |

Preferred Stock converted into

Common Stock |

| |

● |

Completed reverse stock split at

a ratio of 1 for 35.17 |

| |

|

|

Liquidity and Capital Resources

Issuance of Preferred Stock to Eliminate $36

Million of Indebtedness and Conversion to Common Stock

During July 2023, AgeX and Juvenescence Limited

entered into an Exchange Agreement pursuant to which AgeX issued

shares of Series A Preferred Stock and Series B Preferred Stock to

Juvenescence in exchange for the extinguishment of a total of $36

million of indebtedness under a loan agreement and certain

promissory notes. The Series A Preferred Stock and Series B

Preferred Stock automatically converted into shares of AgeX common

stock on February 1, 2024.

Increase in Line of Credit

On November 8, 2023, AgeX’s secured, convertible

line of credit from Juvenescence Limited was increased by

$4,400,000, subject to Juvenescence’s discretion to approve and

fund each of AgeX’s future loan draws.

On February 9, 2024, the repayment date of

AgeX’s borrowings under Juvenescence line of credit was extended

from February 14, 2024 to May 9, 2024.

Balance Sheet Information

Cash, cash equivalents, and restricted cash

totaled $0.3 million as of December 31, 2023. As of December 31,

2023, AgeX owed Juvenescence Limited $4.5 million in principal and

origination fees on account of loans extended to AgeX.

Fourth Quarter and Annual 2023 Operating

Results

Operating expenses: Operating expenses for the

three months ended December 31, 2023 were $3.6 million as compared

with $1.8 million for the same period of 2022. Operating expenses

for the full year 2023 were $10.1 million as compared with $7.0

million in the same period of 2022.

Research and development expenses for the year

ended December 31, 2022 decreased by more than $0.3 million to $0.7

million from approximately $1.0 million in 2022. The net decrease

was primarily attributable to reductions of $0.2 million in outside

research and services allocable to research and development

expenses and $0.1 million in salaries and payroll related expenses

allocated to research and development expenses.

General and administrative expenses for the year

ended December 31, 2023 increased by $3.3 million to $9.3 million

from approximately $6.0 million in 2022. The net increase is

attributable to increases of $2.5 million in professional fees for

legal services, professional fees for tax and accounting services,

and consulting expenses incurred in connection with due diligence

and other expenses related to the planned merger with Serina

Therapeutics, Inc (“Serina”), $0.4 million for the write off of

prepaid expenses incurred in prior periods related to a shelf

registration statement for an at-the-market offering of AgeX common

stock that expired in January 2024, $0.4 million estimated

litigation fees, $0.2 million in salaries, consulting fees, and

payroll related expenses, including severance related expenses

arising under a Transition Services and Separation Agreement with

our former Chief Executive Officer, $0.1 million in investor

relations related expenses, and $0.1 million in insurance expense,

allocated to general and administrative expenses. These increases

were offset to some extent by a $0.2 million decrease in minimum

royalty fees resulting from the termination of certain license and

sub-license agreements, $0.1 million net decrease in non-cash

stock-based compensation to employees, consultants and directors,

and a $0.1 million decrease in patent and license maintenance

related fees.

Other expense, net: Net other expense for the

year ended December 31, 2023 consists primarily of $5.4 million of

amortization of deferred debt costs on loans from Juvenescence,

write off of deferred debt cost upon $36 million debt exchanged for

preferred stock in July 2023, and other debt related expenses

included in interest expense, offset by $0.5 million net interest

income primarily earned from a promissory note from Serina. Other

expense, net in 2022 consists primarily of $3.3 million of

amortization of deferred debt issuance costs on loans from

Juvenescence to interest expense, and $0.2 million change in fair

value of warrants issued to Juvenescence in connection with

borrowings under the 2022 Secured Note.

Net loss attributable to AgeX: The net loss

attributable to AgeX for the year ended December 31, 2023 was $14.8

million, or ($13.73) per share (basic and diluted), compared to

$10.5 million, or ($9.70) per share (basic and diluted), for

2022.

Going Concern Considerations

As required under Accounting Standards Update

2014-15, Presentation of Financial Statements-Going Concern (ASC

205-40), AgeX evaluates whether conditions and/or events raise

substantial doubt about its ability to meet its future financial

obligations as they become due within one year after the date its

financial statements are issued. Based on AgeX’s most recent

projected cash flows, AgeX believes that its cash and cash

equivalents and available sources of debt and equity capital would

not be sufficient to satisfy AgeX’s anticipated operating and other

funding requirements for the twelve months following the filing of

AgeX’s Annual Report on Form 10-K for the year ended December 31,

2023. These factors raise substantial doubt regarding the ability

of AgeX to continue as a going concern.

About AgeX Therapeutics

AgeX Therapeutics, Inc. (NYSE American: AGE) is

focused on developing and commercializing innovative therapeutics

to treat human diseases to increase healthspan and combat the

effects of aging. For more information, please visit

www.agexinc.com or connect with the company on Twitter, LinkedIn,

Facebook, and YouTube.

Cautionary Statement Regarding

Forward-Looking Statements

Certain statements contained in this

communication regarding matters that are not historical facts are

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended, and

the Private Securities Litigation Reform Act of 1995, known as the

PSLRA. These include statements regarding the anticipated

completion and effects of the planned merger with Serina (the

“Merger”) and other statements regarding management’s intentions,

plans, beliefs, expectations or forecasts for the future. All

forward-looking statements are based on assumptions or judgments

about future events and economic conditions that may or may not be

correct or necessarily take place and that are by their nature

subject to significant risks, uncertainties and contingencies. You

are cautioned not to place undue reliance on these forward-looking

statements. No forward-looking statement can be guaranteed, and

actual results may differ materially from those projected.

Statements that contain words such as “anticipates,” “believes,”

“plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,”

“should,” “could,” “estimates,” “predicts,” “potential,”

“continue,” “guidance,” and similar expressions to identify these

forward-looking statements that are intended to be covered by the

safe-harbor provisions of the PSLRA.

There are a number of risks and uncertainties

that could cause actual results to differ materially from the

forward-looking statements included in this communication. With

respect to the Merger, these risks and uncertainties include: one

or more conditions to consummating the Merger may not be satisfied;

one or more material agreements that may be entered into in

connection with the Merger may be terminated by a party to the

agreement; AgeX or the combined company after the Merger may be

unable to obtain approval to list on the NYSE American the shares

of AgeX common stock expected to be issued pursuant to the Merger;

and the closing of the Merger might be delayed or not occur at all.

In addition, the Merger could cause AgeX to face additional risks,

including risks associated with conducting and financing Serina’s

current or future research and product development programs,

including risks that those research and development programs will

not result in the development of products or technologies with the

desired clinical utility, benefits, or market acceptance; risks

associated with conducting clinical trials of Serina product

candidates and obtaining Food and Drug Administration or other

regulatory approvals to market product candidates, including risks

with respect to the timing of initiation of Serina’s planned

clinical trials, the timing of the availability of data or other

results from clinical trials, and the timing of any planned

investigational new drug application or new drug application; risks

associated with the combined company’s ability to identify

additional products or product candidates with significant

commercial potential; risks associated with AgeX’s, Serina’s or the

combined company’s ability to protect its intellectual property

position; product liability risks; the risk that the cash balance

of the combined company following the closing of the Merger will be

lower than expected or reduced; the risk that the combined

company’s anticipated sources and related timing of financing

following the closing of the Merger will not provide proceeds

necessary to fund the operations of the combined company for as

long as anticipated; the risk that the transactions contemplated by

the Side Letter entered into by AgeX, Serina and Juvenescence

Limited on August 29, 2023 are not completed in a timely manner or

at all; risks associated with AgeX’s or Serina’s estimates

regarding future revenue, expenses, capital requirements, and need

for additional financing following the Merger; risks associated

with the ability of AgeX and the combined company to remain listed

on the NYSE American; the risk that products may not be

successfully commercialized or that the combined company might not

otherwise be able to generate sufficient revenues to operate at a

profit; potential adverse changes to business or employee

relationships, including those resulting from the announcement or

completion of the Merger; the risk that changes in AgeX’s capital

structure, management, business, and governance following the

Merger could have adverse effects on the market value of its common

stock; the ability of AgeX and Serina to retain customers and

retain and hire key personnel and maintain relationships with their

suppliers and customers; risks associated with Serina’s or the

combined company’s ability to successfully collaborate with

Serina’s existing collaborators or enter into new collaborations,

or to fulfill its obligations under any such collaboration

agreements; risks associated with the combined company’s

commercialization, marketing and manufacturing capabilities and

strategy; the risk that pursuing and completing the Merger and

related transactions could distract AgeX and Serina management from

their respective ongoing business operations or cause AgeX and

Serina to incur substantial costs; risks associated with

competition and developments in the industry in which the combined

company will operate; the impact of world health events and any

related economic downturn; the risk of changes in governmental

regulations or enforcement practices; AgeX’s and Serina’s ability

to meet guidance, market expectations, and internal projections;

the impact of AgeX stockholders having their percentage ownership

interests in AgeX reduced by the issuance of AgeX common stock to

Serina stockholders in the Merger and by the issuance of shares of

AgeX common stock upon the exercise of pre-merger warrants by

Juvenescence, and other important factors that could cause actual

results to differ materially from those projected or expected by

AgeX management or stockholders. The effects of many of such

factors are difficult to predict and may be beyond AgeX’s or

Serina’s control.

New factors emerge from time to time, and it is

not possible for us to predict all such factors, nor can we assess

the impact of each such factor on the business or the extent to

which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any

forward-looking statements. Additional factors that could cause

actual results to differ materially from the results anticipated in

these forward-looking statements are contained in the AgeX’s Annual

Report on Form 10-K for the twelve months ended December 31, 2023,

in AgeX’s other periodic reports filed with the SEC, and in AgeX’s

most recent Proxy Statement/Prospectus/Information Statement, under

the heading “Risk Factors,” and in other filings that AgeX may make

with the SEC. Forward-looking statements included in this

communication are based on information available to AgeX and Serina

as of the date of this communication. Undue reliance should not be

placed on these forward-looking statements that speak only as of

the date they are made, and except as required by law, AgeX and

Serina each disclaims any intent or obligation to update these

forward-looking statements.

Contact for AgeX:

Andrea E. Parkapark@agexinc.com(510) 671-8620

AGEX THERAPEUTICS, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(In thousands, except par value amounts)

| |

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

345 |

|

|

$ |

645 |

|

|

Accounts and grants receivable, net |

|

|

57 |

|

|

|

4 |

|

|

Prepaid expenses and other current assets |

|

|

352 |

|

|

|

1,804 |

|

| Total current assets |

|

|

754 |

|

|

|

2,453 |

|

| |

|

|

|

|

|

|

|

|

| Restricted cash |

|

|

50 |

|

|

|

50 |

|

| Intangible assets, net |

|

|

607 |

|

|

|

738 |

|

| Convertible note

receivable |

|

|

10,554 |

|

|

|

- |

|

| TOTAL ASSETS |

|

$ |

11,965 |

|

|

$ |

3,241 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES,

CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’

EQUITY/(DEFICIT) |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

2,176 |

|

|

$ |

1,034 |

|

|

Loans due to Juvenescence, net of debt issuance costs, current

portion |

|

|

3,672 |

|

|

|

7,646 |

|

|

Related party payables, net |

|

|

66 |

|

|

|

141 |

|

|

Warrant liability |

|

|

- |

|

|

|

180 |

|

|

Insurance premium liability and other current liabilities |

|

|

- |

|

|

|

1,077 |

|

| Total current liabilities |

|

|

5,914 |

|

|

|

10,078 |

|

| |

|

|

|

|

|

|

|

|

| Loans due to Juvenescence, net

of debt issuance costs, net of current portion |

|

|

693 |

|

|

|

10,478 |

|

| TOTAL LIABILITIES |

|

|

6,607 |

|

|

|

20,556 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

equity/(deficit): |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value, 5,000 shares authorized: |

|

|

|

|

|

|

|

|

|

Series A preferred stock; no par value; stated value $100 per

share; 212 and nil shares issued and outstanding, respectively |

|

|

- |

|

|

|

- |

|

|

Series B preferred stock; no par value; stated value $100 per

share; 148 and nil shares issued and outstanding, respectively |

|

|

- |

|

|

|

- |

|

|

Common stock, $0.0001 par value, 200,000 shares authorized, 1,079

shares issued and outstanding |

|

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

136,482 |

|

|

|

98,998 |

|

|

Accumulated deficit |

|

|

(131,013 |

) |

|

|

(116,210 |

) |

|

Total AgeX Therapeutics, Inc. stockholders’ equity/(deficit) |

|

|

5,469 |

|

|

|

(17,212 |

) |

|

Noncontrolling interest |

|

|

(111 |

) |

|

|

(103 |

) |

| Total stockholders’

equity/(deficit) |

|

|

5,358 |

|

|

|

(17,315 |

) |

| TOTAL LIABILITIES, CONVERTIBLE

PREFERRED STOCK AND STOCKHOLDERS’ EQUITY/(DEFICIT) |

|

$ |

11,965 |

|

|

$ |

3,241 |

|

AGEX THERAPEUTICS, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except per share data)

| |

|

Year Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| REVENUES |

|

|

|

|

|

|

|

|

|

Grant revenues |

|

$ |

77 |

|

|

$ |

- |

|

|

Other revenues |

|

|

65 |

|

|

|

34 |

|

|

Total revenues |

|

|

142 |

|

|

|

34 |

|

| Cost of sales |

|

|

(40 |

) |

|

|

(13 |

) |

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

102 |

|

|

|

21 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

734 |

|

|

|

1,025 |

|

|

General and administrative |

|

|

9,328 |

|

|

|

5,971 |

|

|

Total operating expenses |

|

|

10,062 |

|

|

|

6,996 |

|

| |

|

|

|

|

|

|

|

|

| Gain on disposition of fixed

assets |

|

|

73 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(9,887 |

) |

|

|

(6,975 |

) |

| |

|

|

|

|

|

|

|

|

| OTHER EXPENSE,

NET |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(4,900 |

) |

|

|

(3,335 |

) |

|

Change in fair value of warrants |

|

|

(35 |

) |

|

|

(225 |

) |

|

Other income, net |

|

|

11 |

|

|

|

13 |

|

|

Total other expense, net |

|

|

(4,924 |

) |

|

|

(3,547 |

) |

| |

|

|

|

|

|

|

|

|

| NET LOSS |

|

|

(14,811 |

) |

|

|

(10,522 |

) |

|

Net loss attributable to noncontrolling interest |

|

|

8 |

|

|

|

60 |

|

| |

|

|

|

|

|

|

|

|

| NET LOSS ATTRIBUTABLE

TO AGEX |

|

$ |

(14,803 |

) |

|

$ |

(10,462 |

) |

| |

|

|

|

|

|

|

|

|

| NET LOSS PER COMMON

SHARE: |

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED |

|

$ |

(13.72 |

) |

|

$ |

(9.70 |

) |

| |

|

|

|

|

|

|

|

|

| WEIGHTED-AVERAGE NUMBER OF

COMMON SHARES OUTSTANDING: |

|

|

|

|

|

|

|

|

|

BASIC AND DILUTED |

|

|

1,079 |

|

|

|

1,079 |

|

AGEX THERAPEUTICS, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(In thousands)

| |

|

Year Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net loss attributable to

AgeX |

|

$ |

(14,803 |

) |

|

$ |

(10,462 |

) |

| Net loss attributable to

noncontrolling interest |

|

|

(8 |

) |

|

|

(60 |

) |

| Adjustments to reconcile net

loss attributable to AgeX to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Change in fair value of warrants |

|

|

35 |

|

|

|

225 |

|

|

Amortization of intangible assets |

|

|

131 |

|

|

|

132 |

|

|

Amortization of debt issuance costs |

|

|

5,285 |

|

|

|

3,137 |

|

|

Stock-based compensation |

|

|

648 |

|

|

|

760 |

|

|

Gain on disposition of fixed assets |

|

|

(73 |

) |

|

|

- |

|

|

Write off of prepaid shelf registration statement related

expenses |

|

|

360 |

|

|

|

- |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts and grants receivable |

|

|

(53 |

) |

|

|

21 |

|

|

Prepaid expenses and other current assets |

|

|

1,092 |

|

|

|

896 |

|

|

Interest on convertible note receivable |

|

|

(554 |

) |

|

|

- |

|

|

Accounts payable and accrued liabilities |

|

|

1,150 |

|

|

|

144 |

|

|

Related party payables |

|

|

69 |

|

|

|

255 |

|

|

Insurance premium liability |

|

|

(1,075 |

) |

|

|

(983 |

) |

|

Other current liabilities |

|

|

(4 |

) |

|

|

(4 |

) |

| Net cash used in operating

activities |

|

|

(7,800 |

) |

|

|

(5,939 |

) |

| |

|

|

|

|

|

|

|

|

| INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Cash advanced on convertible note receivable |

|

|

(10,000 |

) |

|

|

- |

|

| Net cash used in investing

activities |

|

|

(10,000 |

) |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Draw down on loan facilities from Juvenescence |

|

|

17,500 |

|

|

|

6,000 |

|

| Net cash provided by financing

activities |

|

|

17,500 |

|

|

|

6,000 |

|

| |

|

|

|

|

|

|

|

|

| NET CHANGE IN CASH,

CASH EQUIVALENTS AND RESTRICTED CASH |

|

|

(300 |

) |

|

|

61 |

|

| |

|

|

|

|

|

|

|

|

| CASH, CASH EQUIVALENTS

AND RESTRICTED CASH: |

|

|

|

|

|

|

|

|

|

At beginning of the year |

|

|

695 |

|

|

|

634 |

|

|

At end of the year |

|

$ |

395 |

|

|

$ |

695 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE OF

CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

|

Cash paid during the year for interest |

|

$ |

27 |

|

|

$ |

14 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL SCHEDULE OF

NONCASH FINANCING AND INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Issuance of preferred stock in exchange for debt |

|

$ |

36,000 |

|

|

$ |

- |

|

|

Issuance of common stock upon vesting of restricted stock

units |

|

$ |

2 |

|

|

$ |

8 |

|

|

Issuance of warrants for debt issuance under the 2020 Loan

Agreement |

|

$ |

- |

|

|

$ |

178 |

|

|

Fair value of liability classified warrants at debt inception

date |

|

$ |

663 |

|

|

$ |

4,148 |

|

|

Debt refinanced with new debt |

|

$ |

- |

|

|

$ |

7,160 |

|

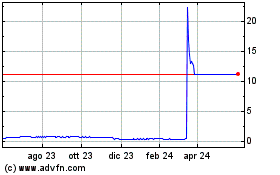

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024