Shareholders to Receive $127.50 Per Share in

Cash

Chase Corporation (“Chase” or the “Company”) (NYSE American:

CCF), a leading global manufacturer of protective materials for

high-reliability applications across diverse market sectors, today

announced that it has entered into a definitive agreement to be

acquired by an affiliate of investment funds managed by KKR, a

leading global investment firm (as applicable, “KKR”). The all-cash

transaction is valued at approximately $1.3 billion, including the

assumption of debt.

Under the terms of the agreement, KKR will acquire all

outstanding shares of Chase common stock for $127.50 per share in

cash, delivering substantial value to shareholders. The transaction

value implies a valuation of approximately 13 times

trailing-twelve-months EBITDA.

“At Chase, we have always been deeply committed to continuously

improving our operating performance while providing an outstanding

customer experience. In KKR, Chase has found the right strategic

partner with strong cultural alignment combined with the experience

and resources to help support our mission and drive future growth,”

said Adam P. Chase, President and Chief Executive Officer of Chase

Corporation.

“Over its nearly 80-year history, Chase has established itself

as a leader in highly-engineered protective materials and built a

portfolio of trusted brands, while delivering outstanding customer

service,” said Josh Weisenbeck, a KKR Partner who leads KKR’s

Industrials investment team. “We look forward to supporting Chase

on its next phase of growth through developing exciting new

products, executing upon strategic acquisitions, and serving

customers in growing end-markets, including critical applications

in electronics, fiber optics and electric grid infrastructure.”

KKR is making its investment in Chase through its North America

Fund XIII. The investment builds on KKR’s deep experience investing

in industrial businesses with technical, materials science

capabilities, including Minnesota Rubber and Plastics, Charter Next

Generation and Hyperion Materials & Technologies.

Following the close of the transaction, KKR will support Chase

in creating an equity ownership program to provide all employees

the opportunity to participate in the benefits of ownership of the

Company. This strategy is based on the belief that employee

engagement is a key driver in building stronger companies. Since

2011, KKR portfolio companies have awarded billions of dollars of

total equity value to over 60,000 non-management employees across

more than 30 companies.

Transaction Approvals and Timing

The Board of Directors of Chase Corporation (the “Board”) has

unanimously approved the transaction and recommends that

shareholders vote in favor of the transaction. The transaction is

expected to close in the fourth quarter of 2023, subject to the

receipt of approval from the Company’s shareholders and certain

required regulatory approvals, as well as the satisfaction of other

customary closing conditions. The all-cash transaction is not

subject to financing conditions.

Peter Chase, Adam Chase, Mary Chase and the Edward L. Chase

Trust, collectively holding approximately 26% of the outstanding

shares of Chase Corporation common stock, have entered into a

support agreement pursuant to which they have agreed, among other

things, to vote their shares in favor of the transaction.

Once the transaction is complete, Chase will be a privately held

company wholly owned by an affiliate of KKR’s investment funds and

will no longer have its common stock listed on any public

market.

Important Information For Investors And Shareholders

This communication does not constitute an offer to buy or sell

or the solicitation of an offer to buy or sell any securities or a

solicitation of any vote or approval. This communication relates to

a proposed transaction between Chase and KKR. In connection with

this proposed transaction, Chase may file one or more proxy

statements or other documents with the Securities and Exchange

Commission (the “SEC”). This communication is not a

substitute for any proxy statement or other document Chase may file

with the SEC in connection with the proposed transaction. INVESTORS

AND SECURITY HOLDERS OF CHASE ARE URGED TO READ THE PROXY STATEMENT

AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN

THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s)

(if and when available) will be mailed to shareholders of Chase as

applicable. Investors and security holders will be able to obtain

free copies of these documents (if and when available) and other

documents filed with the SEC by Chase through the website

maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with the SEC by Chase will be available free of

charge on Chase’s internet website at

https://chasecorp.com/investor-relations/ or by contacting Chase’s

primary investor relation’s contact by email at

investorrelations@chasecorp.com or by phone at 781-332-0700.

Participants in Solicitation

Chase, KKR, their respective directors and certain of their

respective executive officers may be considered participants in the

solicitation of proxies in connection with the proposed

transaction. Information about the directors and executive officers

of Chase is set forth in its Annual Report on Form 10-K for the

fiscal year ended August 31, 2022, which was filed with the SEC on

November 10, 2022, its proxy statement for its 2023 annual meeting

of shareholders, which was filed with the SEC on December 22, 2022,

certain of its Quarterly Reports on Form 10-Q and certain of its

Current Reports filed on Form 8-K.

These documents can be obtained free of charge from the sources

indicated above. Additional information regarding the participants

in the proxy solicitations and a description of their direct and

indirect interests, by security holdings or otherwise, will be

contained in the proxy statement and other relevant materials to be

filed with the SEC when they become available.

Forward Looking Statements

This communication contains “forward-looking statements” within

the Private Securities Litigation Reform Act of 1995. Any

statements contained in this communication that are not statements

of historical fact, including statements about Chase’s ability to

consummate the proposed transaction and the expected benefits of

the proposed transaction, may be deemed to be forward-looking

statements. All such forward-looking statements are intended to

provide management’s current expectations for the future of the

Company based on current expectations and assumptions relating to

the Company’s business, the economy and other future conditions.

Forward-looking statements generally can be identified through the

use of words such as “believes,” “anticipates,” “may,” “should,”

“will,” “plans,” “projects,” “expects,” “expectations,”

“estimates,” “forecasts,” “predicts,” “targets,” “prospects,”

“strategy,” “signs,” and other words of similar meaning in

connection with the discussion of future performance, plans,

actions or events. Because forward-looking statements relate to the

future, they are subject to inherent risks, uncertainties and

changes in circumstances that are difficult to predict. Such risks

and uncertainties include, among others: (i) the failure to obtain

the required vote of Chase’s shareholders, (ii) the timing to

consummate the proposed transaction, (iii) the risk that a

condition of closing of the proposed transaction may not be

satisfied or that the closing of the proposed transaction might

otherwise not occur, (iv) the risk that a regulatory approval that

may be required for the proposed transaction is not obtained or is

obtained subject to conditions that are not anticipated, (v) the

diversion of management time on transaction-related issues, (vi)

risks related to disruption of management time from ongoing

business operations due to the proposed transaction, (vii) the risk

that any announcements relating to the proposed transaction could

have adverse effects on the market price of the common stock of

Chase, (viii) the risk that the proposed transaction and its

announcement could have an adverse effect on the ability of Chase

to retain customers and retain and hire key personnel and maintain

relationships with its suppliers and customers, (ix) the occurrence

of any event, change or other circumstance or condition that could

give rise to the termination of the Merger Agreement, including in

circumstances requiring the Company to pay a termination fee, (x)

unexpected costs, charges or expenses resulting from the Merger,

(xi) potential litigation relating to the Merger that could be

instituted against the parties to the Merger Agreement or their

respective directors, managers or officers, including the effects

of any outcomes related thereto, worldwide economic or political

changes that affect the markets that the Company’s businesses serve

which could have an effect on demand for the Company’s products and

impact the Company’s profitability, (xii) challenges encountered by

the Company in the execution of restructuring programs, (xiii)

disruptions in the global credit and financial markets, including

diminished liquidity and credit availability, changes in

international trade agreements, including tariffs and trade

restrictions, cyber-security vulnerabilities, foreign currency

volatility, swings in consumer confidence and spending, raw

material pricing and supply issues, retention of key employees,

increases in fuel prices, and outcomes of legal proceedings, claims

and investigations. Accordingly, actual results may differ

materially from those contemplated by these forward-looking

statements. Investors, therefore, are cautioned against relying on

any of these forward-looking statements. They are neither

statements of historical fact nor guarantees or assurances of

future performance. Additional information regarding the factors

that may cause actual results to differ materially from these

forward-looking statements is available in Chase’s filings with the

SEC, including the risks and uncertainties identified in Part I,

Item 1A - Risk Factors of Chase’s Annual Report on Form 10-K for

the year ended August 31, 2022 and in the Company’s other filings

with the SEC.

These forward-looking statements speak only as of the date of

this communication, and Chase does not assume any obligation to

update or revise any forward-looking statement made in this

communication or that may from time to time be made by or on behalf

of the Company.

Advisors

Perella Weinberg Partners LP and Davis Polk & Wardwell LLP

are serving as advisors to Chase. KKR is advised by Goldman Sachs

and Kirkland & Ellis LLP.

About Chase Corporation

Chase Corporation, a global specialty chemicals company that was

founded in 1946, is a leading manufacturer of protective materials

for high-reliability applications throughout the world. More

information can be found on our website https://chasecorp.com/

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people and supporting growth in its portfolio companies

and communities. KKR sponsors investment funds that invest in

private equity, credit and real assets and has strategic partners

that manage hedge funds. KKR’s insurance subsidiaries offer

retirement, life and reinsurance products under the management of

Global Atlantic Financial Group. References to KKR’s investments

may include the activities of its sponsored funds and insurance

subsidiaries. For additional information about KKR & Co. Inc.

(NYSE: KKR), please visit KKR’s website at www.kkr.com and on

Twitter @KKR_Co.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230721456342/en/

For Chase Corporation Investor & Media Contact:

Jackie Marcus or Ashley Gruenberg Alpha IR Group Phone: (617)

466-9257 E-mail: CCF@alpha-ir.com

Shareholder & Investor Relations Department: Phone: (781)

332-0700 E-mail: investorrelations@chasecorp.com

For KKR Liidia Liuksila or Miles Radcliffe-Trenner (212)

750-8300 media@kkr.com

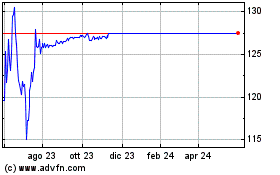

Grafico Azioni Chase (AMEX:CCF)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Chase (AMEX:CCF)

Storico

Da Feb 2024 a Feb 2025