TIDMCIA

30 JUNE 2023

CLEAN INVEST AFRICA PLC

("Clean Invest Africa", the "Group" or the "Company")

AUDITED RESULTS FOR THE FINANCIAL YEARED 31 DECEMBER 2022

REVIEW OF BUSINESS AND FUTURE DEVELOPMENTS

Principal activity

The Group's primary strategy is to identify investment opportunities and

acquisitions in clean energy projects/companies or alternative technologies

that are used in a socially and environmentally responsible way on a global

basis, with the intention of building a diversified portfolio of assets.

The subsidiaries of the Company, CoalTech Limited ("CoalTech"), a company

registered in the United Kingdom with registered number 11368750, and Coal

Agglomeration South Africa (Pty) Ltd. ("CASA"), a company registered in South

Africa with registered number 2015/439393/07, and CoalTech's subsidiaries Coal

Tech LLC, a company registered in the United States of America with registered

number 5685936, Coaltech S. à r.l., a company registered in Grand Duchy of

Luxembourg with registered number B238812, and associates CoalTech Poland Sp. z

o.o., a company registered in the Republic of Poland with registered number

0000719690 and CoalTech Far East Pte. Ltd., a company registered in the

Republic of Singapore with registration number 202120135R (collectively

referred as "CoalTech Group"), are primarily engaged in agglomerating fines

waste (dust particles with a size of 1mm and below) into pellets through the

commercialisation of the Group's proprietary binding technology. The business

is now focusing on pelletising coal and ilmenite, but the Company has also

carried out successful tests on other minerals such as phosphate, chrome, and

manganese which are providing significant business opportunities.

Review of business and future developments

The Group's subsidiary in South Africa, CASA, has already generated revenues

during 2021 and in early 2022 by pelletising ilmenite fines at the Bulpan Plant

for a 10,000 tons trial project with a leading mining company in South Africa.

This project has led to the submission of a proposal for the development of a

dedicated pelletising plant for the Client which is currently under

negotiation. Currently, there is continuous testing happening at site,

preparing for the start of pellets production which will be sold in a 15kgs bag

under the CASA trademark, Chisa'Mina. The project is expected to start in

September 2023 with an output of 4,000 tons per month at full production and is

expected to have a significant positive impact on the profitability and the

cash flow of the business.

CoalTech, together with its Italian partner, ISS International S.P.A. ("ISS"),

will commence a Research and Development Project in Italy supported by the

Italian Government and with budget allocation of approximately ?8,000,000 which

is a combination of grant and low interest loan. Further, CoalTech will provide

consulting services, know-how and expertise on coal fines pelletising

technology, and assist and support ISS in the realisation of a mobile

pelletising unit with a proposed capacity of 1,000 tons per month that will

become the valuable asset in marketing and commercialising the technology

around the world.

The Directors are pleased to report that on 8 January 2023, the Company has

successfully raised additional funds of £40,000 to support the continuing

growth of the Group. A total of 8,000,000 ordinary shares of 0.25p nominal

value each have been subscribed by an investor at 0.5p per share. For every two

Subscribe Share issued, one warrant was granted equivalent to 4,000,000

warrants, exercisable at 1.5p, valid for a period of three (3) years from the

date of admission of the Subscribed Shares to the AQSE Growth Market. Further,

should the Subscriber exercise the 1.5p warrants in full, the Company shall

grant the Subscriber a further one warrant or equivalent to 4,000,000 warrants,

exercisable at 3p per share, for every two Subscribed Shares, valid for three

years from the date of grant. On 12 April 2023, the Company successfully raised

an additional £50,000. A total of 10,000,000 ordinary shares of 0.25p nominal

value each have been subscribed by an investor at 0.5p per share. For every two

Subscribed Share issued, one warrant was granted equivalent to 5,000,000

warrants, exercisable at 1.5p, valid for a period of three (3) years from the

date of admission of the Subscribed Shares to the AQSE Growth Market. Further,

should the Subscriber exercise the 1.5p warrants in full, the Company shall

grant the Subscriber a further one warrant or equivalent to 5,000,000 warrants,

exercisable at 3p per share, for every two Subscribed Shares, valid for three

years from the date of grant.

Furthermore, to support the continuing growth of the Group, on 23 May 2023, the

Company issued an unsecured Convertible Loan Note with a nominal amount of £1

each note or amounting to £60,300 at 10 per cent per annum interest and final

redemption date of 6 months from the date of issuance with option to extend for

an additional 6 months. And on 31 May 2023, the Company issued an unsecured

Convertible Loan Note with a nominal amount of £1 each note or amounting to £

200,000 at 10.50 per cent per annum interest and final redemption date of 12

months from the date of issuance.

The financial results of the Group for the year ended 31 December 2022 show a

loss after taxation of £163,318 (2021: £1,157,655) while the Company's

financial results for the year ended show a loss after taxation of £306,133

(2021: £298,061).

The outbreak of the Corona Virus (COVID-19) in early 2020, and the ongoing

effects of the virus, have had a negative effect on the development and,

possibly, finalization of the various initiatives which were reported during

2021 due to the various emergency measures implemented by each country. In

particular, COVID-19 pandemic has impacted the Group's progress on advanced

business opportunities in different geographies such as India, USA, Australia,

Colombia, Poland, as well as obviously, South Africa where the Group's

subsidiary, CASA, is operating. The discussions have only resumed in the middle

of 2022. Further to the business opportunity in Italy, on 23 March 2023, the

Group has successfully received the final approval of the application for a

Research and Development grant which includes the construction of movable plant

capable of producing 1,000 tons per month. For the operation of the Group's

subsidiary, CASA, mainly taking place at the Bulpan facility in Mpumalanga,

South Africa, the Directors are pleased that CASA has made excellent progress

during 2022 on various test work programs and commercial production projects

that had been previously planned. On 8 June 2023, CASA has signed a Consignment

Agreement granting the right to the consignor to display and sell Chisa'Mina

Coal Pellets.

Outlook

The Directors are pleased with the progress made in this initial period,

notwithstanding the challenging recovery from the 'COVID-19 pandemic that

slowed down the development of the business, exactly at the time when the

company was ready to implement its commercialisation strategy. They look

forward to continuing to update shareholders on the progress of the Group and

the exciting prospects ahead, some of which are developing reasonably fast. We

continue to seek new investment opportunities and will advise shareholders as

they come to fruition.

The Directors do not recommend the payment of a dividend for the period to 31

December 2022.

The audit opinion contains the following statement:

"We draw attention to note 2 in the financial statements, which indicates that

the group incurred a net loss of £163,318 during the year ended 31 December

2022. The revenue forecasted for the group is not certain and, in the event of

a shortfall in terms of timing and quantum, the group will be required to raise

additional funds by way of either equity or debt and the receipt of these

cannot be guaranteed. As stated in note 2, these events or conditions, along

with the other matters as set forth in note 2, indicate that a material

uncertainty exists that may cast significant doubt on the group and parent

company's ability to continue as a going concern. Our opinion is not modified

in respect of this matter."

The audited annual report is available on the Company's website https://

www.cleaninvestafrica.com/.

The Directors of the Company accept responsibility for the contents of this

announcement.

-S -

ENQUIRIES :

Clean Invest Africa plc

Filippo Fantechi (Executive Director) +973 3969 6273

Shaikh Mohamed Abdulla Khalifa AlKhalifa (Non-Executive Chairman) +973 3969

2299

Peterhouse Capital Limited

Corporate Adviser +44 20 7469 0930

Guy Miller/ Mark Anwyl

Clean Invest Africa Plc (Registered number: 10967142)

Consolidated Statement of Profit or Loss

for the year ended 31 December 2022

2022 2021

CONTINUING OPERATIONS £ £

Revenue 29,760 68,602

Cost of sales (129,444) (251,562)

GROSS LOSS (99,684) (182,960)

Other operating income 153,762 2,409

Impairment loss (5,564) -

Net foreign exchange revaluation (144,881) (92,773)

Administrative expenses (281,697) (867,892)

OPERATING LOSS (378,064) (1,141,216)

Other gains 238,997 -

Finance costs (24,251) (16,439)

LOSS BEFORE INCOME TAX (163,318) (1,157,655)

Income tax - -

LOSS FOR THE YEAR (163,318) (1,157,655)

Loss attributable to: (163,318) (1,157,655)

Owners of the parent

Basic earnings per share expressed (0.01) (0.10)

in pence per share:

Clean Invest Africa Plc (Registered number: 10967142)

Consolidated Statement of Profit or Loss and Other Comprehensive Income

for the year ended 31 December 2022

2022 2021

£ £

LOSS FOR THE

YEAR

(163,318) (1,157,655)

OTHER COMPREHENSIVE INCOME

Items that may be reclassified to profit or loss

Currency translation

differences

(214,291) 64,358

TOTAL COMPREHENSIVE INCOME FOR

THE YEAR (377,609) (1,093,297)

Total comprehensive income attributable to:

Owners of the

parent

(377,609) (1,093,297)

Clean Invest Africa Plc (Registered number: 10967142)

Consolidated Statement of Financial Position

31 December 2022

2022 2021

£ £

ASSETS

NON-CURRENT ASSETS

Right-of-use

assets

122,552 25,230

Property, plant and

equipment

394,113 409,498

Investments

11,653 11,653

528,318 446,381

CURRENT ASSETS

Inventories

- 7,120

Trade and other

receivables

3,983,439 3,575,497

Cash and cash

equivalents

80,222 31,253

4,063,661 3,613,870

TOTAL

ASSETS

4,591,979 4,060,251

EQUITY

SHAREHOLDERS' EQUITY

Called up share

capital

4,534,658 3,000,526

Share

premium

28,579,597 24,990,187

Shares to be

issued

332,294 332,294

Convertible

loans

746,658 215,000

Share based payment

reserve

3,243,556 3,243,556

Currency translation

reserve

24,656 238,947

Reserve takeover

reserve

(23,050,570) (23,050,570)

Accumulated

losses

(12,733,170) (12,569,852)

TOTAL

EQUITY

1,677,679 (3,599,912)

LIABILITIES

NON-CURRENT LIABILITIES

Lease liability 122,292 12,765

CURRENT LIABILITIES

Trade and other

payables

2,783,160 7,630,790

Lease liability 8,848 16,608

2,792,008 7,647,398

TOTAL

LIABILITIES

2,914,300 7,660,163

TOTAL EQUITY AND

LIABILITIES

4,591,979 4,060,251

The financial statements were approved by the Board of Directors and authorised

for issue on 30 June 2023 and were signed on its behalf by:

........................................................................

F Fantechi - Director

Clean Invest Africa Plc (Registered number: 10967142)

Company Statement of Financial Position

31 December 2022

2022 2021

Notes £

£

ASSETS

NON-CURRENT ASSETS

Investments

4,744,225 4,744,225

4,744,225 4,744,225

CURRENT ASSETS

Trade and other

receivables

5,417,776 246,292

Cash and cash

equivalents

76,227 14,068

5,494,003 260,360

TOTAL

ASSETS

10,238,228 5,004,585

EQUITY

SHAREHOLDERS' EQUITY

Called up share

capital

4,534,658 3,000,526

Share

premium

28,579,597 24,990,187

Shares to be

issued

332,294 332,294

Convertible

loans

746,658 215,000

Share based payment

reserve

3,243,556 3,243,556

Accumulated

losses

(27,497,661) (27,191,528)

TOTAL

EQUITY

9,939,102 4,590,035

LIABILITIES

CURRENT LIABILITIES

Trade and other

payables

299,126 414,550

TOTAL

LIABILITIES

299,126 414,550

TOTAL EQUITY AND

LIABILITIES

10,238,228 5,004,585

A separate income statement for the parent company has not been presented, as

permitted by section 408 of the Companies Act 2006. The loss for the parent

company for the year was £306,133 (2021: loss of £298,061)

The financial statements were approved by the Board of Directors and authorised

for issue on 30 June 2023 and were signed on its behalf by:

........................................................................

Mr F Fantechi - Director

Clean Invest Africa Plc (Registered number: 10967142)

Consolidated Statement of Changes in Equity

For the year ended 31 December 2022

GBP Share Share Shares to Convertible Share-based Reverse Currency Accumulated Total

capital premium be issued loans payment takeover Translation losses equity

reserve reserve reserve

1 January 2021 2,949,388 24,938,863 332,294 155,000 3,243,556 (23,050,570) 174,589 (11,412,197) (2,669,077)

Loss for the year - - - - - - - (1,157,655) (1,157,655)

Other comprehensive - - - - - - - - -

income

Currency translation - - - - - - 64,358 - 64,358

reserve

Total comprehensive - - - - - - 64,358 (1,157,655) (1,093,297)

income

Interest bearing loans - - - 60,000 - - - - 60,000

and

borrowings during the

year

Shares issued during the 51,138 51,324 - - - - - - 102,462

year

Total transactions with 51,138 51,324 - 60,000 - - - - 162,462

owners recognised in

equity

Balance as at 3,000,526 24,990,187 332,294 215,000 3,243,556 (23,050,570) 238,947 (12,569,852) (3,599,912)

31 December 2021

Loss for the year - - - - - - - (163,318) (163,318)

Other comprehensive - - - - - - - - -

income

Currency translation - - - - - - (214,291) - (214,291)

reserve

Total comprehensive - - - - - - (214,291) (163,318) (377,609)

income

Interest bearing loans - - - 531,658 - - - - 531,658

and

borrowings during the

year

1,534,132 3,589,410 - - - - - 5,123,542

Shares issued during the -

year

Total transactions with 1,534,132 3,589,410 - 531,658 - - - - 5,655,200

owners recognised in

equity

Balance as at 4,534,658 28,579,597 332,294 746,658 3,243,556 (23,050,570) 24,656 (12,733,170) 1,677,679

31 December 2022

Clean Invest Africa Plc (Registered number: 10967142)

Company Statement of Changes in Equity

For the year ended 31 December 2022

GBP Share Share Shares Convertible Share-based Accumulated Total

capital premium to be loans payment losses equity

issued reserve

2,949,388 24,938,863 332,294 155,000 3,243,556 (26,893,467) 4,725,634

1 January 2021

Loss for the - - - - - (298,061) (298,061)

year

Other - - - - - - -

comprehensive

income

Total - - - - - (298,061) (298,061)

comprehensive

income

Interest bearing - - - 60,000 - - 60,000

loans and

borrowings

Shares issued by 51,138 51,324 - - - - 102,462

the Company

during the year

Total 51,138 51,324 - 60,000 - - 162,462

transactions

with owners

recognised in

equity

Balance as at 3,000,526 24,990,187 332,294 215,000 3,243,556 (27,191,528) 4,590,035

31 December 2021

Loss for the - - - - - (306,133) (306,133)

year

Other - - - - - - -

comprehensive

income

Total - - - - - (306,133) (306,133)

comprehensive

income

Interest bearing - - - 531,658 - - 531,658

loans and

borrowings

Shares issued by 1,534,132 3,589,410 - - - 5,123,542

the Company -

during the year

Total 1,534,132 3,589,410 - 531,658 - - 5,655,200

transactions

with owners

recognised in

equity

Balance as at 4,534,658 28,579,597 332,294 746,658 3,243,556 (27,497,661) 9,939,102

31 December 2022

Clean Invest Africa Plc (Registered number: 10967142)

Consolidated Statement of Cash Flows

for the year ended 31 December 2022

2022 2021

£ £

Cash flows from operating activities

Cash used in

operations

(282,958) (190,903)

Interest

paid

(24,251) (17,088)

Exchange

gains

14,068 64,802

Net cash from operating

activities

(293,141) (143,189)

Cash flows from financing activities

Payment of lease

liabilities

(12,890) (11,031)

Proceeds from issue of

shares

355,000 102,462

Funding received from related

parties

- 69,147

Net cash from financing

activities

342,110 160,578

Increase in cash and cash equivalents 48,969 17,389

Cash and cash equivalents at

beginning of year 31,253 13,864

Cash and cash equivalents at 80,222 31,253

end of year

Clean Invest Africa Plc (Registered number: 10967142)

Company Statement of Cash Flows

for the year ended 31 December 2022

2022 2021

£ £

Cash flows from operating activities

Cash used in

operations

(275,641) (76,083)

Interest

paid

(17,200) (13,807)

Net cash from operating

activities

(292,841) (89,890)

Cash flows from financing activities

Share

issue

355,000 102,462

Net cash from financing

activities

355,000 102,462

Increase in cash and cash equivalents 62,159 12,572

Cash and cash equivalents at

beginning of year 14,068 1,496

Cash and cash equivalents at 76,227 14,068

end of year

END

(END) Dow Jones Newswires

June 30, 2023 11:45 ET (15:45 GMT)

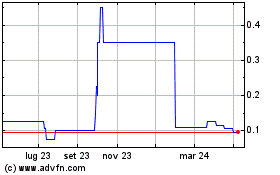

Grafico Azioni Clean Invest Africa (AQSE:CIA)

Storico

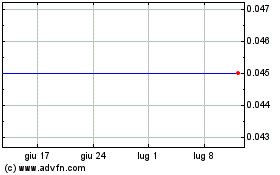

Da Apr 2024 a Mag 2024

Grafico Azioni Clean Invest Africa (AQSE:CIA)

Storico

Da Mag 2023 a Mag 2024