MARKET COMMENT: S&P/ASX 200 Hits 4 1/2 Year High on Earnings

18 Febbraio 2013 - 1:31AM

Dow Jones News

0001 GMT [Dow Jones] S&P/ASX 200 is up 0.3% at 5049.7,

touching hitting a fresh 4 1/2 year high of 5056.3 intraday as

domestic earnings reports mostly beat expectations and market

sentiment improves after the index broke through 5000 last week.

Strength in banks, industrials, consumer discretionary, consumer

staples and healthcare stocks is easily absorbing ex-dividend falls

in CBA (CBA.AU) and Telstra (TLS.AU). "Australian share market

sentiment has been quite negative for the past two years that it's

now seeing a significant mood shift in response to an improving

economic landscape, particularly in China," says RBS Morgans

investment adviser Christopher Macdonald. "We are seeing some

excellent results coming out of this reporting season, and even

average results are being rewarded as money is flowing out of cash

and bonds in search of capital growth and higher yields." CBA

(CBA.AU) is down 1.6% ex-dividend, while other major banks are up

1.5%-1.7%, and Bendigo (BEN.AU) has jumped 2.9% on improved

margins. Amcor (AMC.AU), BlueScope (BSL.AU) and Pacific Brands

(PBG.AU) are up 2.9%-7.4% after reporting Monday. BHP (BHP.AU),

Woodside (WPL.AU), QBE (QBE.AU) and AMP (AMP.AU) are up 0.4%-1.8%

amid short covering before they report this week.

(david.rogers1@wsj.com)

Write to Shani Raja at shani.raja@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

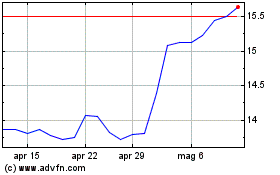

Grafico Azioni Amcor (ASX:AMC)

Storico

Da Mag 2024 a Giu 2024

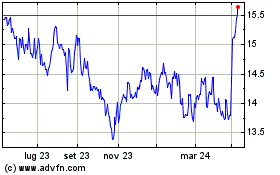

Grafico Azioni Amcor (ASX:AMC)

Storico

Da Giu 2023 a Giu 2024

Notizie in Tempo Reale relative a Amcor PLC (Borsa Australiana): 0 articoli recenti

Più Amcor Articoli Notizie