Incitec Pivot Planning US Debt Non Deal Roadshow - Sources

20 Novembre 2009 - 6:53AM

Dow Jones News

Incitec Pivot Ltd. (IPL.AU), Australia's largest fertilizer

producer, is planning to meet debt investors in the U.S., market

participants said Friday.

The group is planning a non-deal roadshow, one person said, at

which companies typically meet investors to gauge appetite for a

possible follow-up issue of debt securities.

A company spokesman declined to comment on whether the group is

planning presentations in the U.S.

"Part of our strategy is to access global debt capital markets,

as for execution on that, we would never comment," the spokesman

said.

In October, the Melbourne based group attained a BBB long-term

and A-2 short-term corporate credit rating with a stable outlook

from ratings agency Standard & Poor's.

Beginning Monday, Incitec will begin a three day equity

presentation through Asia arranged by Macquarie Bank.

Incitec this week posted a full-year net loss of A$179.9

million, after an unexpected goodwill writedown of its Dyno Nobel

explosives business, compared with a net profit of A$604.6 million

a year earlier.

In 2008 Melbourne-based Incitec became the world's

second-largest explosive maker, after market leader Orica Ltd.,

with its A$2.3 billion acquisition of Dyno Nobel Ltd., the largest

explosives maker in the U.S.

-By Enda Curran, Dow Jones Newswires; 61-2-8272-4687; enda.curran@dowjones.com

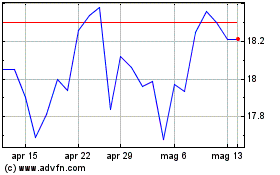

Grafico Azioni Orica (ASX:ORI)

Storico

Da Gen 2025 a Feb 2025

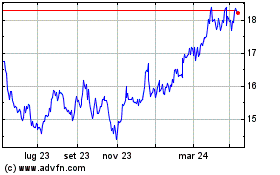

Grafico Azioni Orica (ASX:ORI)

Storico

Da Feb 2024 a Feb 2025

Notizie in Tempo Reale relative a Orica Limited (Borsa Australiana): 0 articoli recenti

Più Orica Articoli Notizie