2nd UPDATE: Wattyl Recommends Higher Takeover Offer From Valspar

28 Giugno 2010 - 8:23AM

Dow Jones News

Australia's Wattyl Ltd. (WYL.AU) said Monday it will endorse a

A$142 million takeover offer from Valspar Corp. (VAL) after the

U.S. paintmaker increased its initial cash proposal by nearly

30%.

In a statement, Wattyl said that Valspar, a global leader in the

paint and coatings industry with extensive manufacturing and

distribution operations in Asia, has raised its initial May 25

offer of A$1.30 per share, to A$1.67 a share cash, and subject to

an independent expert's valuation, recommends shareholders accept

the deal.

"The proposed acquisition enables shareholders to realize cash

for their Wattyl shares at a significant premium to recent trading

levels," Wattyl Chairman John Ingram said. "With global expertise

and scale, Valspar will provide Wattyl's customers and employees

with significant benefits. Valspar is well positioned to support

Wattyl for the next phase of its growth."

Wattyl's largest shareholder, Hunter Hall Investment Management

Ltd., which holds around a 19% stake, has come out in support of

the new deal, a person familiar with the matter said Monday.

The shares, which have been trading at a slight discount to the

initial offer price, rose sharply Monday and were last up 28% at

A$1.615. Prior to the A$1.30 offer, the shares were trading around

78.5 cents, making the new offer price more than double that

value.

Competition concerns are not expected to be a major stumbling

block for the deal, said one trader at an international investment

bank in Sydney, despite Wattyl being the second largest paint

supplier in Australia, behind Orica Ltd.'s (ORI.AU) Dulux

division.

It's a pretty difficult company for the local companies to

takeover, for competition reasons, so it's pretty unlikely for

there to be a counter offer," said the trader, who declined to be

named.

"With all the people on board it's pretty much a done deal," he

added.

The deal is also subject to regulatory approval from Australia's

Foreign Investment Review Board and the New Zealand Overseas

Investment Office.

One analyst said the deal could help improve the market

penetration of Wattyl and Vaspar's other products into local

markets as part of a major shakeup of the local hardware market set

to begin in early 2011.

Valspar supplies paints and stains to U.S. home improvement

retailer Lowe's Cos. (LOW), which is in joint venture with

Australia's largest retailer Woolworths Ltd. (WOW.AU) to establish

a big-box, do-it-yourself retail chain in Australia to compete with

rival Wesfarmers Ltd.'s (WES.AU) Bunnings hardware stores.

"Wattyl is a market leader with excellent brands, high quality

products and broad distribution across all channels throughout

Australia and New Zealand," said William L. Mansfield, Valspar

Chairman and Chief Executive Officer in a statement.

"This latest acquisition builds on our increasing presence in

the Asia Pacific region and presents an outstanding opportunity for

growth."

-By Cynthia Koons & Bill Lindsay; Dow Jones Newswires;

+61-2-8272-4691; cynthia.koons@dowjones.com

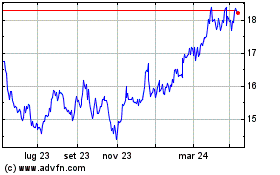

Grafico Azioni Orica (ASX:ORI)

Storico

Da Gen 2025 a Feb 2025

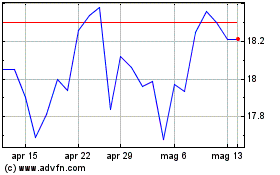

Grafico Azioni Orica (ASX:ORI)

Storico

Da Feb 2024 a Feb 2025