ConocoPhillips Selling Northern Australia Assets for $1.39 Billion -- Update

14 Ottobre 2019 - 12:49AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--ConocoPhillips (COP) has struck a deal to

sell its operations in northern Australia for at least US$1.39

billion as the oil giant seeks to shift capital to other projects

it believes will generate the highest longer-term value.

The assets being sold to Australia's Santos Ltd. (STO.AU)

include ConocoPhillips's controlling stake in the Darwin LNG

gas-export project and cover production of about 50,000 barrels of

oil equivalent a day and proved reserves of about 39 million

barrels as of the end of 2018.

The deal adds to other asset-exits agreed by ConocoPhillips in

recent months, including an agreement in April to sell two

subsidiaries focused on production in the U.K.'s North Sea for

about US$2.68 billion in cash. Also in April, the company closed

the sale of its 30% interest in the Greater Sunrise gas-fields to

the government of East Timor for US$350 million.

ConocoPhillips has been divesting some of resources and focusing

in part on projects in Alaska and Louisiana, as well as in Canada

and Asia. Asia Pacific and the Middle East together are the

second-largest segment in ConocoPhillips portfolio by production,

and include the assets in Australia as well as producing fields in

China, Indonesia, Malaysia and Qatar.

The deal with Santos covers the company's 56.9% interest in the

Darwin liquefied natural gas facility and the Bayu-Undan field that

feeds it, a 37.5% stake in the Barossa gas project, its 40% in the

Poseidon field and 50% in the Athena field.

ConocoPhillips said it will hold on to its 37.5% stake in the

Australia Pacific LNG project on Australia's east coast, and will

remain the operator of the project's LNG facility.

Proceeds from the sale to Santos, which may include an

additional US$75 million contingent on a final investment decision

being taken on the Barossa project, will be used for general

corporate purposes, it said.

For Santos, one of Australia's largest independent oil and gas

producers, the assets it is picking up will lift its earnings per

share by about 16% in 2020 and increase pro-forma production by

about 25%, it said. Santos already is a partner of ConocoPhillips

in the north, and has an 11.5% stake in the Darwin LNG project's

infrastructure and a 25% interest in the Barossa development that

is set to supply the LNG operation in the future.

Santos said it expects a final investment decision on the

roughly US$4.7 billion Barossa project early next year, with first

LNG anticipated in 2024. The gas from the Barossa field is expected

to extend the life of the Darwin LNG operation by more than 20

years.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 13, 2019 18:34 ET (22:34 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

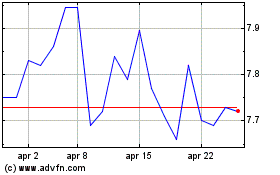

Grafico Azioni Santos (ASX:STO)

Storico

Da Ott 2024 a Nov 2024

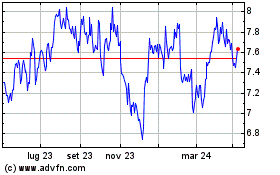

Grafico Azioni Santos (ASX:STO)

Storico

Da Nov 2023 a Nov 2024