EUROTECH: BOARD OF DIRECTORS APPROVES THE 2011 DRAFT STATUTORY

AND CONSOLIDATED FINANCIAL STATEMENTS

Amaro, Italy, 15 March 2012 - - - - - - - - - - Consolidated

revenues: from 99.27 million to 93.81 million, -5.5% Consolidated

gross profit: from 50.41 million to 46.54 million Consolidate Adj

EBITDA: from 6.81 million to 4.0 million Consolidated EBITDA: from

7.39 million to 3.09 million Consolidated EBIT: from -0.74 million

to -4.87 million Consolidated pre-tax loss: from -3.81 million to

-6.61 million Group net loss: from -6.08 million to -7.25 million

Net financial debt: 14.33 million Group shareholders' equity: 135.0

million Eurotech S.p.A.: net loss from -0.52 million to 18.49

million

The Board of Directors of Eurotech S.p.A has today examined and

approved the draft Statutory Financial Statements and Consolidated

Financial Statements at 31 December 2011, which will be presented

to the Ordinary Shareholders' Meeting. The Group posted a decrease

in revenues of 5.5%, falling from 99.27 million in 2010 to 93.81

million in 2011. This decrease was the result of a combination of

factors and events, attributable to the adverse macroeconomic

situation and is explained below. Long-term, Eurotech's geographic

coverage of three continents has been an asset because it allows

the Group to maximise its chances of seizing business opportunities

wherever they arise and to balance out the effects of poor economic

performance in a given region. However, this was not evident in

2011 as each geographic segment in which we have a significant

operations was hit, although to different extent, by adverse

events: the US came close to defaulting, Europe suffered from a

debt and Euro crisis, and Japan experienced an earthquake and

subsequent devastating tsunami. Naturally, we could not have

foreseen such widespread negative scenarios across our three key

regions. Consequently, from March onwards Eurotech's management

dealt with an increasingly adverse global setting, one that was

markedly different from that projected at end-2010 and that had

been initially confirmed by good order levels in the first two

months of the year. The uniformly unfavourable macroeconomic

situation put strong constraints on our ability to generate sales

and this inevitably resulted in a small contraction in revenues of

5.5%.

EUROTECH spa Via F. Solari, 3/A 33020 Amaro (UD) - ITALY Tel. +39

0433 485411 Fax. +39 0433 485455 ir@eurotech.com

www.eurotech.com

In particular, the Group's fourth quarter was not as strong as in

2010. Historically, the last quarter of the year posts the major

part of revenues, which are concentrated in the month of December.

The recovery in the global macroeconomic situation noted at the end

of 2010 did not continue during 2011. In fact, it stalled further

in the important second and third quarters. The last quarter of

2011 was our strongest quarter, but revenues still fell below those

of the fourth quarter of 2010. Due to the fact that in our

operative model the majority of costs are fixed, it's important for

us to remain above the operating leverage activation threshold: for

a level of costs equal to that of 2011, the leverage is activated

above 100103 million, depending on gross profit margin. Therefore,

93.81 million in revenues was insufficient to generate significant

EBITDA, with inevitable consequences for the Group's final profit

margin.

Geographic performance North America posted a dip in both sales and

orders, particularly from July onwards, coinciding with the time in

which the attention paid to the nation's possible default reached

its zenith. The extensive political debate on the subject and the

last-minute corrective measures meant public and private investment

stalled until late autumn, affecting our ability to develop the

sales anticipated in the second half of the year. The situation now

seems to have returned to normal and we intend to confirm this

after in the coming months. The sector most affected by the risk of

default in the US was defence. Our business was affected by budgets

being shifted between programmes more than by the overall cut in

spending, which particularly affected operational missions and

large new projects. This resulted in the cancellation of some

deliveries scheduled for the second half of the year, forcing us to

go in search of new orders, with further effects on the likelihood

of Parvus generating the fourth-quarter sales that were initially

forecast. There is also some good news, as often happens following

a radical change in scenario: with the reallocation of

defence-programme budgets, many opportunities have returned and if

we can take advantage of them we will be able, in the coming years,

to recapture the success enjoyed by Parvus since we acquired it in

2003. Europe continued to feel the effects of the financial crisis

and the pressures on the Euro, limiting the ability and the will of

companies and governments to invest in new development programmes.

We believe that, in principle, Europe is still a market with a good

potential for our solutions, even if this potential is currently

struggling to be seen, with inevitable negative effects on the

revenues generated by Eurotech in the region. The Japanese market

was greatly affected by the blow inflicted upon the nation by the

tsunami. An economic blackout of the Japanese economy in spring

2011 caused orders to be postponed, some to the following year. As

a result, Japan's contribution to total sales was lower than

expected. However, the outlook for the Japanese economy in 2012 is

good. The reconstruction is underway and, as happened in the past,

this should generate GDP growth that more than offsets the lack of

growth in 2011 caused by the earthquake and subsequent tsunami.

HPC Business Unit With regard to the HPC (High Performance

Computing) business unit, in July Selex Elsag placed a large order

for an Aurora solution to be used in cybersecurity applications.

Not only is the order worth around 4 million, but it is also

important because it demonstrates other possible uses for the

Aurora platform besides the university and researchinstitute

applications that have characterised our HPC business in the past.

From the very start, the Aurora architecture was conceived to be

effectively used also in industrial and service sectors, and the

application in the field of

cybersecurity confirms that our initial vision was correct. The HPC

strategic business unit's contribution to total sales increased in

2011 compared to 2010 and we expect this trend to continue in

2012.

In summary, the level of sales in 2011 is not attributable to a

single factor or event but to the combined effect of a number of

factors and events, in confirmation of the general unfavourable

environment during the year. Management is continuing to monitor

the macroeconomic situation closely. As it did in 2011, in the

first months of 2012 management is taking steps to make the

structure more efficient and thereby lower the operating leverage

activation threshold. Specific initiatives are also underway to

find new business opportunities and increase sales beyond this

threshold. We are therefore working on two fronts so that the

operating leverage can eventually give the desired results in terms

of profit margins. The considerable efforts made over the last

three years to create an integrated and cohesive Group have been

crucial in this respect, and the recent inclusion of Dynatem Inc.

as a catalyst for further technical and commercial synergies

between the United States and Japan is just one more reason to take

a positive view of the future.

Financial performance Gross profit was 49.6%, just few fractions of

percentage point under management's 50% benchmark. The change

compared to the previous year, when gross profit was 50.8%, is due

to the diverse mix of products sold, which have different profit

margins depending on their type as well as the sectors and

geographical markets in which they are sold. In particular, this

was influenced by the lower contribution of US defence sales, which

have margins considerably higher than the Group average. A

low-margin one-off order of around $1.5 million placed in the

fourth quarter and not offset, as initially forecast, by an

equivalent higher margin delivery in the defence sector was also a

drag. The greater contribution of the HPC strategic business unit

also had an impact, since generally, sales being equal, HPC SBU has

higher COGS and lower OPEX than the NanoPC SBU; however, this gross

profit margin of less than 50% is offset by a recovery of margins

at the EBITDA level. Before adjustments for internal increases and

non-recurring costs, operating costs fell by 1.7 million, from

47.25 million (with operating costs as a percentage of revenues at

47.6%) to 45.55 (with operating costs as a percentage of revenues

at 48.6%), not accounting for non-recurring costs, and to 46.46

million accounting for non-recurring costs. This considerable

reduction in costs is the result of a path undertaken several years

ago. The 2009 crisis was an opportunity for Eurotech to learn how

to considerably streamline its structure, mainly preserving two

fundamental pillars of our business model: the ability to generate

innovations and the ability to sustain rapid growth in sales when

opportunities arise. We did not act blindly, taking drastic cost

cutting measures, because it was essential that we preserve the

pillars on which our competitiveness is founded. But, with great

determination and consistency, we gradually and inexorably

implemented a streamlining strategy that we can now say, looking

back over the past three years, has worked. Cost reductions of 1.7

million in 2011 alone in tangible proof of that. The management

remains focused on the streamlining of the operating structure,

carried out in 2011 and that will also produce benefits in 2012.

Meanwhile, in parallel with cost cutting we have also invested in

activities that are expected to provide returns in the coming

years, always with the aim of keeping the pace on the innovative

drive that is our hallmark. With reference to our capability to

generate revenues, the current structure can sustain higher sales

than current levels with only minor changes to the workforce and

without making any changes to infrastructure. EBITDA fell from 6.81

million in 2010 to 4.0 million (gross of adjustments for 0.91

million resulting from non-recurring costs linked to the recall of

a custom product). Adjusted EBITDA as a percentage of revenues was

4.3% in 2011,

compared with EBITDA as a percentage of revenues of 6.9% in 2010.

Non-adjusted EBITDA as a percentage of revenues was 3.3%. The

year-on-year change is mainly attributable to the reduction in

sales, as well as to the decrease in other revenues, which in 2010

included a capital gain on sales of shareholdings of 0.6 million,

grants of 0.2 million and the greater impact of adjustments to

costs for capitalisation. EBIT fell from -0.74 in 2010 to -4.87

million in 2011. EBIT as a percentage of revenues was -5.2% in 2011

compared to -0.7% in 2010. EBIT in 2011 was affected by the EBITDA

already commented on above and the depreciation & amortisation

posted to the income statement in 2011. The non-monetary impact of

the price allocation relating to the acquisition of Eurotech Inc.

(formerly Applied Data Systems Inc. and formerly Arcom Control

Systems Inc.), Dynatem Inc. and the Advanet Group on EBIT was 3.45

million in 2011, compared to 3.37 million in 2010.

The pre-tax loss in 2011 was -6.61 million (vs. a loss of -3.81

million in 2010). This performance was influenced by the factors

outlined above. The price allocation and the evaluation of the put

option (the latter relating to 2010 only) had an impact on the

pre-tax result of 3.45 million in 2011 and 4.57 million in

2010.

The Group net loss came to -7.25 million in 2011, compared with a

net loss of -6.08 million in 2010. This performance reflects not

only the pre-tax result, but also the tax burden on the various

units. Price allocation had a 0.84million effect on Group net

results in 2011 (2010: 3.03 million).

At 31 December 2011 the Group had net financial debt of 14.33

million compared to 8.64 million at end-2010. Despite this trend,

the company generated a positive cash flow from operating

activities, which were more than offset by use of financial

resources for investments.

Group shareholders' equity amounted to 135.04 million (2010: 131.52

million) and is equal to the consolidated shareholders' equity,

since there are no more minority interests to take into

consideration (in 2010, the consolidated shareholders' equity was

135.48 million).

Statutory Financial Statements of the Eurotech S.p.A. Parent

Company Revenues totalled 13.36 million, compared to 11.19 million

in 2010, an increase of 19.4%. The net result was -18.49 million,

compared with -0.52 million in 2010. 2011 net result was affected

by depreciation of shereholdings for 13.54 million. Shareholders'

equity at 31 December 2011 was 89.19 million, compared with 107.71

million in 2010. The Parent Company had a net debt of 7.5 million,

compared with 0.7 million at end-2010.

Pursuant to Article 154-bis, Paragraph 2, of the Italian

Consolidated Finance Act, the Financial Reporting Manager, Sandro

Barazza, hereby declares that the financial disclosure contained in

this press release corresponds to the Company's documentary

evidence, corporate books, and accounting records. *** The Board

has also approved the Corporate Governance Report containing

information on the ownership structure pursuant to Article 123-bis

of the Italian Consolidated Finance Act which will be published

within the deadlines and in accordance with the methods provided

for by current regulations. *** In accordance with the new

provisions of Article 154-ter, Paragraphs 1 and 1-bis, of the

Italian Consolidated Finance Act, the annual financial report

including the draft statutory and consolidated financial

statements, the management report, the corporate governance report

and the declaration of the Financial Reporting Manager, together

with the reports of the Independent Auditor and the Board of

Statutory Auditors, will be published no later than 30 March

2012.

THE EUROTECH GROUP Eurotech is a global company (ETH.MI) that

integrates hardware, software, services and expertise to deliver

embedded computing platforms and sub-systems to leading OEMs,

system integrators and enterprise customers for successful and

efficient deployment of their products and services. Drawing on

concepts of minimalist computing, Eurotech lowers power draw,

minimizes physical size and reduces coding complexity to bring

sensors, embedded platforms, subsystems, ready-to-use devices and

high performance computers to market, specializing in defense,

transportation, industrial and medical segments. By combining

domain expertise in wireless connectivity as well as communications

protocols, Eurotech architects platforms that simplify data

capture, processing and transfer over unified communications

networks. Our customers rely on us to simplify their access to

state-of-art embedded technologies so they can focus on their core

competencies. Learn more about Eurotech at www.eurotech.com.

Company contacts: Investor relations Andrea Barbaro Tel. +39 0433

485411 e-mail: andrea.barbaro@eurotech.com Corporate Press Office

Cristiana della Zonca Tel. +39 0433 485411 e-mail:

cristiana.dellazonca@eurotech.com International Press Office Jana

Sanchez, CitySavvy Tel. +44 20 7395 1000 or +44 7985 917 060

e-mail: jana@citysavvy.com

ANNEXES FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT

OPERATING RESULTS (/ 000) Re ve nue s from sales of products and

services Cos t of materials Gr os s profit Ser v ic e costs Leas e

& hire costs Pay r oll costs Other provisions and other costs

Other revenues EBITDA ADJ (*) Non recurrent (costs) revenues EBITDA

(**) Depr ec iation & amortisation A s s et impairment Ope r at

ing profit (EBIT) Shar e of associates' profit of equity Financ e

expense Financ e income Pr of it before taxes Inc ome tax Ne t

profit (loss) before m inor it y inerest M inor it y interest Gr

oup net profit (loss) for period Bas e earnings (losses) per share

Dilut e d earnings (losses) per share

F Y 2011

%

F Y 2010

%

93,806 ( 47,266) 46,540 ( 16,483) ( 2,464) ( 25,378) ( 1,229) 3,014

4,000 ( 910) 3,090 ( 7,708) ( 257) ( 4,875) 123 ( 7,840) 5,979 (

6,613) ( 633) ( 7,246) 0 ( 7,246) ( 0.206) ( 0.206)

100.0% - 50.4% 49.6% - 17.6% - 2.6% - 27.1% - 1.3% 3.2% 4.3% - 1.0%

3.3% - 8.2% - 0.3% - 5.2% 0.1% - 8.4% 6.4% - 7.0% - 0.7% - 7.7%

0.0% - 7.7%

99,269 ( 48,863) 50,406 ( 17,042) ( 2,377) ( 26,447) ( 1,385) 3,654

6,809 585 7,394 ( 7,851) ( 284) ( 741) ( 1,630) ( 4,822) 3,380 (

3,813) ( 2,200) ( 6,013) 66 ( 6,079) ( 0.173) ( 0.173)

100.0% - 49.2% 50.8% - 17.2% - 2.4% - 26.6% - 1.4% 3.7% 6.9% 0.6%

7.4% - 7.9% - 0.3% - 0.7% - 1.6% - 4.9% 3.4% - 3.8% - 2.2% - 6.1%

0.1% - 6.1%

( *) Profit before non recurrent cost, depreciation, amortization,

interests and tax (EBITDA) ( **) Profit before depreciation,

amortization, interests and tax (EBITDA)

CONSOLIDATED BALANCE SHEET & STATEMENT OF FINANCIAL

POSITION

('000) at December 31, 2011 at Decem b er 31, 2010

ASSETS Intangible assets Pr oper ty , Plant and equipment Inv es

tments in affiliate companies Inv es tments in other companies Def

er r ed tax assets Other non current financial assets Medium/long

term borrow ing allow ed to affiliates companies and other Group

companies Other non-current assets To t al non-current assets Inv

entor ies Contr ac ts in progress Tr ade receivables Inc ome tax

receivables Other current assets Rec eiv ables from affiliates

companies Shor t term borrow ing allow ed to affiliates companies

and other Group companies Cas h & cash equivalents To t al

current assets To t al assets 125,922 5,897 278 270 1,439 226 0 843

134,875 23,734 2,356 26,724 938 2,569 1,163 178 13,596 71,258

206,133 120,328 6,582 308 230 1,658 236 636 1,018 130,996 21,587

257 28,962 1,879 3,305 9 0 23,751 79,750 210,746

LIABILIT IES AND EQUITY Shar e capital Shar e premium reserve Other

reserves Gr o up shareholders' equity Eq u it y attributable to m

ino r it y interest To t al shareholders' equity Medium- /long- ter

m borrow ing Employ ee benefit obligations Def er r ed tax

liabilities Other non-current liabilities To t al non-current

liabilities Tr ade payables Shor t- ter m borrow ing Der iv ativ e

instruments Inc ome tax liabilities Other current liabilities Bus

ines s combination liabilities To t al current liabilities To t al

liabilities To t al liabilities and equity 8,879 136,400 ( 10,236)

135,043 0 135,043 10,482 1,718 12,111 1,586 25,897 18,388 17,253

376 1,731 7,229 216 45,193 71,090 206,133 8,879 136,400 ( 13,761)

131,518 3,966 135,484 22,873 1,681 12,307 2,225 39,086 18,824 8,985

339 1,214 5,748 1,066 36,176 75,262 210,746

STATEMENT OF CHANGES IN EQUITY

Sh ar e capital ('000) B al an ce as at December 31, 2010 8,879

L eg al reserve

Sh ar e premium reserve

C o n ver si o n reserve

Oth er reserves

C ash flow hedge reserve

Exch an g e rate differences reserve ( 777) ( 1,340) ( 6,079) Tr

easu r y shares Pr o fi t (loss) for period

Gr o u p shareholders' equity

M i n o r i ty interest capital & reserves 3,900

Pr o fi t third parties 66

Eq u i ty to Minority interest 3,966

(loss) of attributable

To tal shareholders' equity

39

136,400

25,938

( 31,203)

( 339)

131,518

135,484

2010 Result allocation Profit (loss) as at December 31, 2011

Comprehens i ve other profit (loss) - Hedge transactions - Foreign

balance sheets conversion diff erenc e - Exchange diff erenc es on

equity method - Exchange diff erenc es on equity investments in f

oreign companies Comprehensive result Minority purchase

-

-

-

-

( 6,079)

-

-

-

6,079

-

66

( 66)

-

-

-

-

-

-

-

-

-

-

( 7,246)

( 7,246)

-

-

-

( 7,246)

-

-

-

8,576 8,576 -

( 18) ( 18) 1,597

( 37)

-

-

( 7,246) -

( 37) 8,576 ( 18) 653 1,928 1,597

( 3,966)

-

( 3,966)

( 37) 8,576 ( 18) 653 1,928 ( 2,369)

( 37) -

653 653 -

B al an ce as at September 30, 2011

8,879

39

136,400

34,514

( 35,703)

( 376)

( 124)

( 1,340)

( 7,246)

135,043

-

-

-

135,043

NET FINANCIAL POSITION

at December 31, at December 31, ('000) Cas h & cash equivalents

Cas h equivalent Shor t term borrow ing allow ed to affiliates

companies Der iv ativ e instruments Shor t- ter m borrow ing Bus

ines s aggregation liabilities Shor t - t e r m financial position

Shor t - t e r m net financial position Medium/long term borrow ing

allow ed to affiliates companies Bus ines s aggregation liabilities

Other non current financial assets Medium/long term borrow ing M e

dium - /long- t e r m net financial position A B=A C D E F

G=C+D+E+F H=B+G I J K L M =I+J+K+L 2011 ( 13,596) ( 13,596) ( 178)

376 17,253 216 17,667 4,071 0 0 ( 226) 10,482 10,256 2010 ( 23,751)

( 23,751) 0 339 8,985 1,066 10,390 ( 13,361) ( 636) 0 ( 236) 22,873

22,001

( NET FINANCIAL POSITION) NET DEBT

N=H+M

14,327

8,640

WORKING CAPITAL

at Decem b er at December 31, ('000) 31, 2011 (b ) 2010 (a) C h an

g es (b -a)

Inventories Contr ac ts in progress Tr ade receivables Rec eiv

ables from affiliates companies Inc ome tax receivables Other

current assets Cur r ent assets Tr ade payables Inc ome tax

liabilities Other current liabilities Cur r ent liabilities Ne t w

or k ing capital

23,734 2,356 26,724 1,163 938 2,569 57,484 ( 18,388) ( 1,731) (

7,229) ( 27,348) 30,136

21,587 257 28,962 9 1,879 3,305 55,999 ( 18,824) ( 1,214) ( 5,748)

( 25,786) 30,213

2,147 2,099 ( 2,238) 1,154 ( 941) ( 736) 1,485 436 ( 517) ( 1,481)

( 1,562) ( 77)

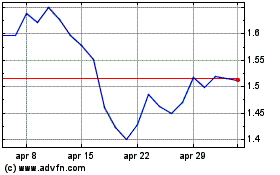

Grafico Azioni Eurotech (BIT:ETH)

Storico

Da Giu 2024 a Lug 2024

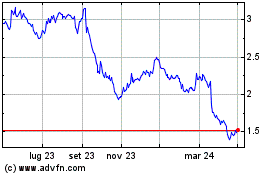

Grafico Azioni Eurotech (BIT:ETH)

Storico

Da Lug 2023 a Lug 2024