Board of Directors of Neurosoft SA approves 2013 First semester results

26 Settembre 2013 - 2:57PM

Annunci Borsa (Testo)

Press Release

26 September 2013

BoD of Neurosoft S.A. approves 2013 First Half Year Results

Consolidated revenues in the first half 2013 to 1,97 million ( 1,86

million at 2012 midyear, +5,90%)

Gross profit to 0,69 million ( 0,58 million at 2012 midyear,

+17,21%) EBITDA 0,23 million ( 0,18 million at 2012 midyear,

+30,95%) Profit before income taxes to 0,019 million ( 0,001

million at 2012 midyear) Net loss to 0,072 (net loss 0,064 million

at 2012 midyear, -12,53%) Net Financial Debt equal to 0,95 million

Positive Income expectation for the year ending 31 December

2013

Athens, 26 September 2013 - The Board of Directors of Neurosoft

S.A. met today and approved the first half year th results ended 30

June 2013, including the results for its subsidiaries Rockberg

Holdings Ltd, Kestrel Information Systems S.A.., Neurosoft, traded

on Milan's AIM Italia market (GRS802003004, Reuters NRST.MI,

Bloomberg NRST:IM), has Integrae SIM SpA as its Nominated Adviser.

Neurosoft's consolidated half year revenues were 1,97 million

showing an improvement to the prior-year period. The Group's Profit

before income taxes for the first half of 2013 was 19,018, compared

with of 1,459 the year before. Nick Vasilonikolidakis, CEO at

Neurosoft said: "As a result of a continued solid execution of our

strategy in the last difficult years, we achieved our targets in H1

2013. We continued investing in innovations in key areas of

activity such as the Sports Betting Unit with the successful

deployment, installation and launch of the new product Qualytor at

OPAP and the new mobile application for sports betting for iOS and

Android. The objective is to expand into new markets with all the

innovative products of our portfolio in all areas of activities.

Finally, in an environment that remains volatile, we confirm our

guidance for 2013. Given today's outlook we expect the Group to

record a profit for the year end 31 December 2013".

Performance by Business Unit

Neurosoft Sports Betting Unit Neurosoft completed the successful

deployment, installation and launch of the new product Qualytor at

OPAP. Qualytor is a product that through the use of a multilingual

and continuously updated database can provide information for

thousand teams in football, basketball and many other sports (ice

hockey, volley, tennis, F1 etc). Qualytor can be used either as a

standalone product or can be integrated into the risk management

system that the operator uses. The integration of Qualytor allows

for a direct comparison of the operators KPIs with the rest of the

market, thus achieving an efficient understanding of the current

market status. Neurosoft also launched its new mobile application

for sports betting for iOS and Android. The application provides,

sports-betting data such as odds, fixtures, live-scores, comparison

and statistical data in real-time. The new application is based on

its Qualytor and supports most sports on different languages

(Greek, English, Serbian, French, German, Italian, Spanish,

Chinese, Russian, Japanese and Arabic) Neurosoft is well under way

of developing the mathematical models and the software adaptations

in its Risk management platform, in order to support its unique

product Betting Only On Multiples (BOOM). This method

Page 1 of 6

and technology can apply to any sports book operator that handles

even a small percentage of multiple bets. The company is certain

that this method will change completely the way sports betting will

be conducted on multiples in the near future.

Neurosoft Factoring Unit National Bank of Greece EthoFactors went

live successfully having Proxima+ replacing its old factoring

platform. After that, all factoring units of NBG (Greece, Bulgaria,

Romania) are operating under Proxima+ in a single data centre.

Albanian AFS Factoring went live with Proxima+ under SaaS model in

Neurosoft's cloud computing new architecture Neurosoft is under

negotiations to install its system in various Balkan countries with

the SaaS (Software as a Service) model, hosting the application and

data on external Data Centers. Telecoms Unit The Service portfolio

was further expanded with deployments in Micro-wave technology and

3G/LTE installations. These activities are expected to peak in Q3

and Q4. A Parental Control application for security of

internet-related threats in households was launched in Q2 as a

revenue-sharing model with a local Fixed Telecommunications

Provider. The product was developed in-house and is continuously

expanding with more features. The services contracts for Equipment

Installations and Support were implemented according to the

Customers' requirements. New solutions are currently investigated

to further expand the Security portfolio while in parallel

extending activities in the GCC countries. ********** Neurosoft

S.A., a Greek company listed on the AIM Italia market, organised

and managed by the Italian Stock Exchange

(ISIN GRS802003004, Reuters NRST.MI, Bloomberg NRST:IM), today is a

software provider supplying solutions that optimize business and

operational processes with a view to maximize customer

profitability. Neurosoft's innovative integrated software systems

in factoring, sports betting, business intelligence, liability

management, transactional systems, and the implementation of

mission critical applications have provided tools to financial

institutions, stock exchanges, telecom companies and sports betting

operators to increase operating efficiencies, act on well-depicted

real-time risk and liability analysis, and increase revenues and

bottom line capitalizing on sophisticated predictive analytics.

Neurosoft was founded in 1994 and became the first company to be

floated in the AIM Italia market of the Milan Stock Exchange in

2009. Based in Athens, Neurosoft has a multinational presence in

Romania, Albania, Serbia, Bulgaria and Cyprus. As of today Integrae

SIM S.p.A is Neurosoft's Nominated Adviser for the AIM Italia

market.

Neurosoft SA Press@neurosoft.gr Tel.: +30 210 6855061 Integrae SIM

Luigi Giannotta +390278625302 Luca di Liddo +390278625300

NEUROSOFT SOFTWARE PRODUCTIONS S.A. AND ITS SUBSIDIARIES

Unaudited Interim Condensed Consolidated Financial Statements for

the period ended June 30, 2013

(Amounts in Euro, unless otherwise stated)

INTERIM STATEMENT OF COMPREHENSIVE INCOME

01.01Notes R ev enues Cost of services Gr oss profit Selling and

distribution expenses Adminis trativ e expenses Other income

Financial income Financial costs Pr ofit (Loss) before income taxes

Income taxes Net loss (A) Other total comprehensive income after

tax (B) Total comprehensive losses after tax (A)+(B) Loss

attributable t: Equity holders of the parent Non-controlling

interests Losses per share (Basic) Losses per share (Diluted) W eig

hted Average Number of Shares (Basic and diluted) 3 3 0 .0 6 .2 0 1

3 Unaud ited 1.966.388 (1.280.283) 686.105 (330.316) (301.107)

3.650 (39.314) 19.018 (91.169) (72.150) (7 2 .1 5 0 )

0 1 .0 1 3 0 .0 6 .2 0 1 2 Unaud ited 1.856.875 (1.271.528) 585.347

(262.008) (285.294) 6.890 36 (43.511) 1.459 (65.577) (64.118)

(64.118)

4

(102.886) 30.735 (72.150) (0,0041) (0,0041) 25.000.000

(63.099) (1.019) (64.118) (0,0025) (0,0025) 25.000.000

The accompanying notes are an integral part of the Interim

Condensed Consolidated Financial Statements

3

NEUROSOFT SOFTWARE PRODUCTIONS S.A. AND ITS SUBSIDIARIES

Unaudited Interim Condensed Consolidated Financial Statements for

the period ended June 30, 2013

(Amounts in Euro, unless otherwise stated)

INTERIM STATEMENT OF FINANCIAL POSITION

30.06.2013 Notes ASSETS Non-Cur r ent Assets Property, plant and

equipment Intangible assets Investments in associates accounted

under the equity method Other non-current assets Deferred tax asset

Total Non-Current Assets Current Assets I nv entories Trade

accounts receivable Prepayments and other receivables Financial

assets at fair value through statement of comprehensive income Cash

and cash equivalents Total Current Assets TOTAL ASSETS EQUITY AND

LIABILITIES Eq uity attributable to equity holders of the parent

company S hare capital Share premium Other reserves Retained

earnings Minority interests Total Equity Non-Current Liabilities L

ong term finance lease obligations Reserve for staff retirement

indemnities Deferred tax liability Total Non-Current Liabilities

Current Liabilities T rade accounts payable Short-term borrowings

Short-term portion of finance lease obligations Income tax payable

Accrued and other current liabilities Total Current Liabilities

Total Liabilities TOTAL LIABILITIES AND EQUITY 527.570 1.172.702

54.336 969.005 2.723.613 2.838.951 4.602.462 90.939 24.399 115.338

8.750.000 600.000 163.330 (7.963.902) 1.549.428 214.083 1.763.511 7

359.407 1.520.116 948.061 220.165 3.047.749 4.602.462 6 5 145.162

973.677 37.000 34.032 364.843 1.554.714 Unaud ited

3 1 .1 2 .2 0 1 2 Aud ited

173.427 812.178 37.000 35.118 544.076 1.601.799 344.670 1.660.810

524.264 1.500 291.073 2.822.316 4.424.114

8.750.000 600.000 163.330 (7.898.433) 1.614.897 206.301 1.821.198

82.828 82.828 456.775 1.156.822 8.845 56.130 841.515 2.520.088

2.602.916 4.424.114

The accompanying notes are an integral part of the Interim

Condensed Consolidated Financial Statements

Page 4 of 6

NEUROSOFT SOFTWARE PRODUCTIONS S.A. AND ITS SUBSIDIARIES

Unaudited Interim Condensed Consolidated Financial Statements for

the period ended June 30, 2013

(Amounts in Euro, unless otherwise stated)

INTERIM STATEMENT OF CHANGES IN SHAREHOLDERS EQUITY

Noncontr olling Attr ib utab le to equity holders of the parent

company S h ar e Share premium Other reserves Retained earnings

Total interest Total Equity

GROUP

capital

Balance at 1 January 2012 L os s for the period Other comprehensive

income Total comprehensive income Balance at 30 June 2012 Balance

at 1 January 2013 L os s for the period Total comprehensive income

Balance at 30 June 2013

8 .7 5 0 .0 0 0 8 .7 5 0 .0 0 0 8 .7 5 0 .0 0 0 8 .7 5 0 .0 0 0

6 0 0 .0 0 0 6 0 0 .0 0 0 6 0 0 .0 0 0 6 0 0 .0 0 0

1 6 3 .3 3 1 1 6 3 .3 3 1 1 6 3 .3 3 1 1 6 3 .3 3 1

(7 .8 3 5 .3 3 5 ) (63.099) (7.898.434) (7 .8 6 1 .0 1 8 )

(102.886) (7.963.904)

1 .6 7 7 .9 9 6 ( 63. 099) 0 1 .6 1 4 .8 9 7 1 .6 5 2 .3 1 3 ( 102.

886) 1 .5 4 9 .4 2 7

2 0 7 .3 2 0 (1.019) 2 0 6 .3 0 1 1 8 3 .3 4 8 30.735 2 1 4 .0 8

3

1 .8 8 5 .3 1 6 ( 64. 118) 0 1 .8 2 1 .1 9 8 1 .8 3 5 .6 6 1

(72.150) 1 .7 6 3 .5 1 1

Page 5 of 6

INTERIM CASH FLOW STATEMENT

01.013 0 .0 6 .2 0 1 3 Cash flows from Operating Activities Los s

before income taxes Adjustments for: Depreciation and amortisation

Provisions Financial (income)/expenses Decrease/(increase) in

financial assets Operating loss before working capital changes

(Increase)/Decrease in: Inventories Trade accounts receivable and

prepayments and other Other non current assets Increase/(Decrease)

in: T rade accounts payable Accrued and other current liabilities

Interes t paid T ax paid Net cash from/(used in) Operating

Activities Cash flows from Investing Activities Capital expenditure

for property, plant and equipment Purchas e/dev elopment of

intangible assets Interest and related income received Net cash

used in Investing Activities Cash flows from Financing Activities

Net change in short-term borrowings Net Change in finance leases

Net cash from Financing Activities Net decrease in cash and cash

equivalents Cash and cash equivalents at the beginning of period

Cash and cash equivalents at the end of the period 19.018 1.459 0 1

.0 1 3 0 .0 6 .2 0 1 2

175.359 (42.964) 1 5 1 .4 1 3 (14.737) (244.068) 1.500 70.794

127.490 (39.314) 5 3 .0 7 8 -

130.741 43.475

175.676

(5.184) 2.231 100.848 (131.377) (43.511) (30.514) 68.169

(2.131) 3.650 1 .5 1 9

(9.131) 36 (9.095)

15.880 (8.845) 7 .0 3 5 6 1 .6 3 3 1 5 8 .5 3 2 2 2 0 .1 6 5

(25.276) (7.009) (32.285) 26.789 264.284 2 9 1 .0 7 3

The accompanying notes are an integral part of the Interim

Condensed Consolidated Financial Statements

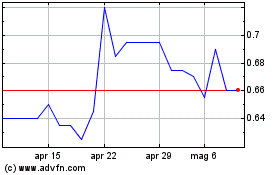

Grafico Azioni Neurosoft S A (BIT:NRST)

Storico

Da Giu 2024 a Lug 2024

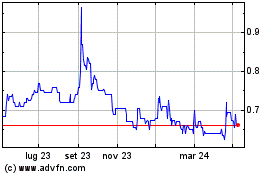

Grafico Azioni Neurosoft S A (BIT:NRST)

Storico

Da Lug 2023 a Lug 2024