Press Release

The Board of Directors of Piquadro S.p.A. Consolidated interim

report as of December 31, 2012 approved

· Consolidated revenue of 40.5 million (-12.34% compared to the

year ended December 31, 2012); · EBITDA of 6.5 million equal to

16.12% of consolidated turnover (10.5 million and 22.78% of

revenues of previous year); · Consolidated net profit of 2.9

million, down 52.16% compared to 5.9 million of the previous year;

· At present, there are 47 DOSs and 48 franchises for a total of 95

Piquadro brand boutiques around the world

Milan, February 11, 2013 ­ Today the Board of Directors of Piquadro

S.p.A., which designs, manufactures and distributes professional

and travel leather goods featuring innovative designs and cutting

edge technology, approved the Consolidated Quarterly report as of

December 31, 2012 for the first nine months of financial year

2012/2013. For the first nine months of the year as of December 31,

2012 consolidated revenue amounted to 40.5 million, down 12.34%

compared to about 46.2 million for the same period of the previous

year. Sales volumes, in terms of quantities sold in the reporting

period, decreased about 16.6% compared to the same period of

2011/2012. Average prices increased about 2.6% compared to the same

period of 2011/2012 mainly following the growth in the DOS channel,

of overall Group sales. The decrease in consolidated revenues in

the first nine months of the year 2012/2013 was driven by the

19.97% drop of the Wholesale channel which represents 65.64% of

overall sales and therefore was only partially balanced by the

increase of sales in the DOS channel (+7,18%). The Same Store Sales

Growth (SSSG) data, calculated as average global growth rates of

profits registered in the existing DOS on April 1, 2011, was

positive and equal to 5.1% growth in the quarter at current

exchange rates (equal to the opening days and at constant exchange

rates, it was equal to a 3.2% growth rate). The area where the

highest growth rate was registered is Europe which reported sales

for 7.8 million equal to about 19.16% of consolidated revenues

(+5.48% compared to the first nine months of year 2011/2012). The

highest increase was reported in Germany (+13.7%) and Russia

(+26.5%). The Far East, on the contrary, paid the toll of a

reorganization of the retail system which led to a 14.77% decrease

in local sales as a consequence of the closing of two shops in Hong

Kong and six in China, only partially balanced by the opening of

three new Piquadro branded stores in Taiwan. As to the earning

results, the Piquadro Group reported an EBITDA of 6.5 million

compared to 10.5 million registered during the first nine months of

the year ended December 31, 2011. EBITDA margin was 16.12%. EBIT

stood at 4.6 million compared to 8.9 million registered as of

December 31, 2011. EBIT margin was 11.43%. Consolidated Net Profit

was 2.9 million, and 7.05% of sales.

Net Financial Debt, as of December 31, 2012, was approximately 13.2

million. Compared to December 31, 2011 Net Financial Debt rose by

about 1.7 million due to greater investments made during the period

(about 1.4 million more than in the first nine months of 2011/2012)

and to the increased net working capital. Compared to March 31,

2012 Net Financial Position rose by about 7 million due to the

seasonal effect, the dividend of 3 million paid in the month of

July 2012 and to the investments of the period which totaled over

4.5 million. "The results of the first nine months of the fiscal

year continue to confirm the difficult situation in the domestic

market where consumption is at an all-time low", comments Marco

Palmieri, President and CEO of Piquadro. "The turnover dynamics

were also affected by the repositioning of the Piquadro brand. This

required a revision of the number of sales locations and their

quality, especially in reference to the Italian market, with the

elimination of around 25% of multi-brand dealers. For this reason,

the company is committed to a strong investment strategy aimed at

developing our foreign markets. With this in mind, the Milan

showroom was opened, the export team was enhanced and considerable

resources were allocated to direct retail in order to give maximum

visibility to the brand on the international level through the

opening of shops like the upcoming one in Paris in Rue Saint Honoré

and the one planned in London. Collaboration with an

internationally renowned designer like Antonio Marras is also an

integral part of this strategy since it involves an investment

aimed at increasing global awareness of Piquadro and its brand

image. The positive trend of the DOS shops (with its positive SSSG

rates even in Italy) already confirms the validity of this retail

development strategy through single-brand shops. We will continue

to head in this direction, concentrating our investments in

projects and human resources aimed at retail development and the

internationalisation of the Piquadro brand" Outlook 2012/13 In the

first nine months of year 2012/2013 the development of the Piquadro

Group was influenced by the economic scenario in which it operates,

mainly Italy where the Group reports about 73% of its revenues. The

expectations for the 2012/2013 financial year, in terms of both

turnover and profitability, will probably match the results of the

first nine months because of the persistent Italian situation. The

results achieved in directly operated shops in the first nine

months go against the negative trend described above and provide

comfort to management regarding its growth strategy which hinges on

the opening of directly-operated shops also with a view to

improving distribution and positioning. The Group is also focusing

on global development and is consistently pursuing a strategy to

increase the visibility and awareness of the Piquadro brand

internationally. In this perspective, the plan to open the Paris

shop on Rue Saint Honoré by the end of 2012/2013 is an important

aspect which is to be followed by the flagship store in London;

these are places where there is the greatest concentration of the

target consumers (travel and business) and where the flow of Asian,

Russian, Middle-Eastern and American tourists is constantly

increasing; these will represent the greatest areas of expansion

for the Group in the immediate future. In this context, the

management will be and is engaged in constantly monitoring

operating costs in order to maintain gross profit margins higher

than the averages in the sector, which will allow the Company to

make greater commitments to research and development as well as

marketing and in retail, with the aim of further raising awareness

of the Piquadro brand around the world. In today's meeting, the

Board of Directors decided to adapt its corporate governance system

to the provisions in the new version of the Self-regulatory Code

that was updated by the Committee for Corporate

Governance of Borsa Italiana S.p.A. in December 2011. The Company

will present the changes to the market in the next Corporate

Governance Report that will be published during the 2013/2014

fiscal year. The Board of Directors also decided today on certain

changes to the regulations of the "Piquadro S.p.A. Stock Option

Plan 2012-2017" approved by the Board on September 26, 2011 in

order to clarify some of the conditions regarding vesting of the

options granted. These changes, which are required by the

regulations, were adopted with the consent of holders of a number

of options greater than the majority of the existing options, with

it being understood that the changes will be communicated to all

optionees in writing. The Company will make the new version of the

plan regulations and disclosure document set forth in Article

84-bis of the Issuers' Regulations available to the public in

accordance with the law. With reference to Legislative Decree

231/2001 regarding administrative liability of corporations

regarding a crime, the Board decided to add a new part (i) to the

Code of Ethics regarding relationships between private

organisations (corruption among private parties) and add another

special part (ii) to the Organisational model to reflect not only

the introduction of the criminal cases listed as "Computer-related

Crimes and unlawful handling of data" but also crimes against the

public administration listed in Articles 24 and 25 of Legislative

Decree 231/2001. The manager responsible for preparing the Piquadro

S.p.A.'s, financial reports, Roberto Trotta, declares ­ pursuant to

paragraph 2 of Article 154-bisof Italy's Legislative Decree 58/1998

­ that the accounting information contained in this press release,

corresponds to the documented results, books, and accounting

records. The interim consolidated financial report as of December

31, 2012 will be made available to the public at the company's

Registered Office and through the NIS circuit at the Italian Stock

Market as well as on the website www.piquadro.com in the Investor

Relations section within today.

Piquadro S.p.A. Piquadro is an Italian brand of professional and

travel leather goods characterized by innovative design and

technological content. The company was born in 1987 out of the

perception of Marco Palmieri, the current Chairman and Chief

Executive Officer. The headquarters is near Bologna where the new

executive offices are located along with an efficient logistics

base for the gathering and fulfillment of orders from around the

world in 24/48 hours. The company has also offices and a showroom

in Milan. In the fiscal year ended on March 31, 2012 Piquadro

registered consolidated revenues of 64.4 million and Consolidated

Net Profit of 7.8 million. Piquadro sells its products in over 50

countries worldwide through a distribution network which includes

95 single brand boutiques (57 in Italy and 38 abroad, 47 directly

operated stores and 48 franchises). Piquadro has been listed on the

Italian Stock Exchange since October 2007.

Piquadro SpA Ufficio relazioni con i media ­ Paola Di Giuseppe Tel

+39 02 37052501 paoladigiuseppe@piquadro.com

Piquadro SpA Investor relationship - Roberto Trotta Tel +39 0534

409001 investor.relator@piquadro.com

Interim Consolidated statement of financial position as at December

31 , 2012 st and March 31 , 2012 st st December 31 , 2012 March 31

, 2012 (in thousands of Euro) NON-CURRENT ASSETS Intangible assets

Tangible fixed assets Other receivables Deferred tax assets TOTAL

NON-CURRENT ASSETS CURRENT ASSETS Inventories Trade receivables

Other current assets Tax receivables Receivables for derivative

financial instruments Cash and cash equivalents TOTAL CURRENT

ASSETS TOTAL ASSETS 14,590 24,960 995 1,328 12 15,528 57,413 76,257

11,911 23,113 1,437 714 12,813 49,988 66,086 4,095 12,350 886 1,513

18,844 1,528 12,132 977 1,461 16,098

st

LIABILITIES AND SHAREHOLDERS' EQUITY st (in thousands of Euro)

December 31 , 2012 SHAREHOLDERS' EQUITY Share capital 1,000 Share

premium reserve 1,000 Other reserves 661 Retained earnings 23,278

Group profit for the year 2,856 Total Group shareholders' equity

28,795 Minority interest capital and reserves 40 Net profit( loss)

pertaining to minority interests (4) Total minority interest share

36 SHAREHOLDERS' EQUITY 28,831 NON-CURRENT LIABILITIES Financial

payables Payables to other lenders for leasing contracts Provisions

for employee benefits Provisions for risks and charges Deferred tax

liabilities TOTAL NON-CURRENT LIABILITIES CURRENT LIABILITIES

Financial payables Payables to other lenders for leasing contracts

Liabilities for derivative financial instruments Trade payables

Other current liabilities Tax payables TOTAL CURRENT LIABILITIES

TOTAL LIABILIITES TOTAL LIABILITIES & SHAREHOLDERS' EQUITY

14,471 3,340 248 859 244 19,162 10,394 561 13,732 2,459 1,118

28,264 47,426 76,257

March 31

st

2012

1,000 1,000 512 18,499 7,779 28,790 28,790

2,628 3,706 261 785 327 7,707 11,997 709 3 13,856 3,024 29,589

37,296 66,086

Interim Consolidated income statement for the period ended December

31 , 2012 and st December 31 , 2011 st st (in thousands of euro)

December 31 , 2012 December 31 , 2011 REVENUE Revenues from sales

Other income TOTAL REVENUE (A) OPERATING COSTS Change in

inventories Purchases Service costs and rents, leases and similar

costs Personnel costs Amortization, depreciation and write-downs

Other operating costs TOTAL OPERATING COSTS (B) OPERATING PROFIT

(A-B) FINANCIAL INCOME AND CHARGES Financial income Financial

charges TOTAL FINANCIAL INCOME AND CHARGES PROFIT BEFORE TAXES

Income Taxes NET PROFIT attributable to: SHAREHOLDERS OF THE PARENT

COMPANY EARNINGS PER SHARE (basic ) in Euro EARNINGS PER SHARE

(diluted ) in Euro 2,856 0.05712 0.05514 5,970 0.11940 0.11570

(237) 4,395 (1,539) 2.856 155 9,019 (3,049) 5,970 467 (704) 1,235

(1,080) 18,197 9,173 2,249 58 36,489 4,632 21,390 8,475 1,865 177

37,831 8,864 (2,649) 9,461 (4,390) 10,314 40,509 612 41,121 46,212

483 46,695

st

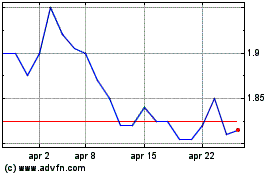

Grafico Azioni Piquadro (BIT:PQ)

Storico

Da Giu 2024 a Lug 2024

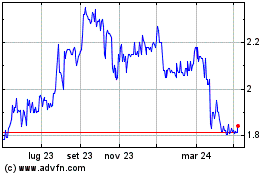

Grafico Azioni Piquadro (BIT:PQ)

Storico

Da Lug 2023 a Lug 2024