Tenaris S.A. (NYSE and Mexico: TS and EXM Italy: TEN) (“Tenaris”)

today announced its results for the fourth quarter and year ended

December 31, 2024 in comparison with its results for the fourth

quarter and year ended December 31, 2023.

Summary of 2024 Fourth Quarter Results

(Comparison with third quarter of 2024 and fourth quarter of

2023)

|

|

4Q 2024 |

3Q 2024 |

4Q 2023 |

|

Net sales ($ million) |

2,845 |

2,915 |

(2%) |

3,415 |

(17%) |

|

Operating income ($ million) |

558 |

537 |

4% |

819 |

(32%) |

| Net

income ($ million) |

519 |

459 |

13% |

1,146 |

(55%) |

|

Shareholders’ net income ($ million) |

516 |

448 |

15% |

1,129 |

(54%) |

|

Earnings per ADS ($) |

0.94 |

0.81 |

16% |

1.92 |

(51%) |

|

Earnings per share ($) |

0.47 |

0.40 |

16% |

0.96 |

(51%) |

|

EBITDA* ($ million) |

726 |

688 |

6% |

975 |

(26%) |

|

EBITDA margin (% of net sales) |

25.5% |

23.6% |

|

28.6% |

|

|

|

|

|

|

|

|

*EBITDA in fourth quarter of 2024 includes a $67

million gain from the partial reversal of a provision for the

ongoing litigation related to the acquisition of a participation in

Usiminas. If this charge was not included EBITDA would have

amounted to $659 million, or 23.2% of sales

Net sales in the fourth quarter were more

resilient than expected as we were able to reduce inventories and

advance some shipments in the Middle East and Turkey, despite lower

demand in Mexico, Argentina and Saudi Arabia. Our EBITDA declined

4% on a comparable basis with the margin supported by a favorable

product mix which offset the effect of residual price declines in

North America. Net income increased due to the partial reversal of

the provision made in the second quarter for the ongoing litigation

related to the acquisition of a participation in Usiminas jointly

with our associate company, Ternium.

During the quarter, our free cash flow amounted

to $310 million and, after spending $299 million on dividends and

$454 million on share buybacks, our net cash position declined to

$3.6 billion at December 31, 2024.

Summary of 2024 Annual Results

|

|

12M 2024 |

12M 2023 |

Increase/(Decrease) |

| Net sales ($ million) |

12,524 |

14,869 |

(16%) |

| Operating income ($

million) |

2,419 |

4,316 |

(44%) |

| Net income ($ million) |

2,077 |

3,958 |

(48%) |

| Shareholders’ net income ($

million) |

2,036 |

3,918 |

(48%) |

| Earnings per ADS ($) |

3.61 |

6.65 |

(46%) |

| Earnings per share ($) |

1.81 |

3.32 |

(45%) |

| EBITDA* ($ million) |

3,052 |

4,865 |

(37%) |

| EBITDA margin (% of net

sales) |

24.4% |

32.7% |

|

| |

|

|

|

*EBITDA in 12M 2024 includes a $107 million loss

from the provision for the ongoing litigation related to the

acquisition of a participation in Usiminas. If this charge was not

included EBITDA would have amounted to $3,159 million, or 25.2% of

sales.

Our sales in 2024 amounted to $12.5 billion with

a decrease of 16% compared to 2023, primarily reflecting a decline

in market prices for our tubular products used in onshore drilling

applications in the Americas, lower drilling activity in Mexico and

Colombia, lower shipments for pipeline projects in Argentina and

lower sales of mechanical pipes in Europe. On the other hand, sales

in the Middle East reached a record level as Saudi Aramco

replenished OCTG stocks and increased gas drilling activity. EBITDA

and margins also declined to $3.1 billion, being further affected

by a $107 million loss from a provision for the ongoing litigation

related to the acquisition of a participation in Usiminas. Net

income amounted to $2.1 billion, or 17% of net sales, and was

affected by a reduction of $43 million from our participation in

Ternium related to the same case.

Cash flow provided by operating activities

amounted to $2.9 billion during 2024. This was used to fund capital

expenditures of $694 million, with the remainder distributed to

shareholders through dividend payments of $758 million and share

buybacks for $1,440 million in the year. We maintained a net cash

position of $3.6 billion at the end of December 2024.

Change of Chief Financial Officer

Effective as of May 2, 2025, Mr. Carlos Gomez

Alzaga will assume the position of Chief Financial Officer,

replacing Ms. Alicia Mondolo, who will retire from this

role.

Mr. Gomez Alzaga, who has more than 20 years of

experience in Administration and Finance at Tenaris, previously

served as Regional CFO for Mexico and Central America, and Economic

and Financial Planning Director, among other positions, and

currently holds the position of Regional CFO for Argentina and

South America.

Ms. Mondolo will continue to serve as senior

advisor to our Chairman and CEO.

Paolo Rocca and the Board of Tenaris would like

to express their gratitude and appreciation for Alicia´s

contribution as CFO of Tenaris and her 41 years of service within

the Techint Group.

Market Background and Outlook

Oil prices remain relatively stable (as they

have done over the past two years) with OPEC+ maintaining their

voluntary production cuts in the face of limited global demand

growth. European and US natural gas prices have, however, risen as

relatively cold winter weather and the cutoff of Russian supply

have led to a rapid drawdown in inventories.

These prices and the continuing balance between

oil and gas demand and supply should continue to support overall

investment in oil and gas drilling activity, as well as OCTG

demand, at current levels, albeit with some regional nuances.

In North America, consolidation among major

operators and drilling efficiencies led to a drop in US drilling

activity last year, which has now stabilized, while OCTG

consumption per rig has been increasing. In Latin America, drilling

activity is increasing in Argentina, as investment in pipeline and

LNG infrastructure investment for the Vaca Muerta shale moves

forward, while, in Mexico, it has been affected by financial

constraints on Pemex. In the Middle East, some reduction in oil

drilling has taken place in Saudi Arabia while gas drilling has

risen, and, in Abu Dhabi, oil drilling is increasing.

OCTG reference prices in North America, which

fell steadily for two years until the second half of 2024, have so

far recovered by 9% from their August low and could rise further

following the US government’s announced reset of Section 232

tariffs on all imports of steel products without exception.

In this environment, we expect our sales and

EBITDA (excluding extraordinary effects) in the first quarter to be

in line with the previous one before rising moderately in the

second quarter. Beyond that, likely changes in US tariffs and their

possible ramifications on trade flows will introduce a new dynamic

with a high level of uncertainty for costs and prices to our

results.

Annual Dividend Proposal

Upon approval of the Company´s annual accounts

in April 2025, the board of directors intends to propose, for

approval of the annual general shareholders’ meeting to be held on

May 6, 2025, the payment of a dividend per share of $0.83 (in an

aggregate amount of approximately $0.9 billion), which would

include the interim dividend per share of $0.27 (approximately $0.3

billion) paid in November 2024. If the annual dividend is approved

by the shareholders, a dividend of $0.56 per share ($1.12 per ADS),

or approximately $0.6 billion, will be paid according to the

following timetable:

- Payment date: May 21, 2025

- Record date: May

20, 2025

- Ex-dividend for

securities listed in Europe and Mexico: May 19, 2025

-

Ex-dividend for securities listed in the United States: May 20,

2025

Analysis of 2024 Fourth Quarter Results

Tubes

The following table indicates, for our Tubes business segment,

sales volumes of seamless and welded pipes for the periods

indicated below:

| Tubes Sales volume

(thousand metric tons) |

4Q 2024 |

3Q 2024 |

4Q 2023 |

|

Seamless |

748 |

746 |

0% |

760 |

(2%) |

|

Welded |

164 |

191 |

(14%) |

246 |

(33%) |

|

Total |

913 |

937 |

(3%) |

1,006 |

(9%) |

|

|

|

|

|

|

|

The following table indicates, for our Tubes business segment,

net sales by geographic region, operating income and operating

income as a percentage of net sales for the periods indicated

below:

| Tubes |

4Q 2024 |

3Q 2024 |

4Q 2023 |

|

(Net sales - $ million) |

|

|

|

|

|

| North America |

1,131 |

1,273 |

(11%) |

1,501 |

(25%) |

| South America |

595 |

484 |

23% |

590 |

1% |

| Europe |

341 |

280 |

22% |

302 |

13% |

| Asia Pacific, Middle East and

Africa |

629 |

754 |

(17%) |

805 |

(22%) |

| Total net sales ($

million) |

2,695 |

2,790 |

(3%) |

3,198 |

(16%) |

|

Services performed on third party tubes ($ million) |

93 |

97 |

(4%) |

34 |

176% |

| Operating income ($

million) |

533 |

527 |

1% |

780 |

(32%) |

| Operating margin (% of

sales) |

19.8% |

18.9% |

|

24.4% |

|

| |

|

|

|

|

|

Net sales of tubular products and services

decreased 3% sequentially and 16% year on year. Sequentially

volumes sold decreased 3% while average selling prices decreased

less than 1% as a favorable product mix offset price declines in

North America. Sequentially, in North America sales declined due to

lower prices throughout the region and lower activity in Mexico. In

South America sales increased as higher sales in Brazil with

shipments to the Raia pipeline and a recovery of OCTG offset lower

sales for pipelines and the industrial market in Argentina. In

Europe sales increased due to shipments to the Sakarya offshore

line pipe project and higher sales of OCTG in Turkey. In Asia

Pacific, Middle East and Africa sales declined due to lower sales

in Saudi Arabia upon completion of inventory replenishment program

and lower activity, partially offset by an increase in sales to the

UAE.

Operating results from tubular products and

services amounted to a gain of $533 million in the fourth quarter

of 2024 compared to a gain of $527 million in the previous quarter

and a gain of $780 million in the fourth quarter of 2023. This

quarter’s operating income includes a $67 million gain from the

partial reversal of a provision for the ongoing litigation related

to the acquisition of a participation in Usiminas. Excluding this

gain Tubes operating income would have amounted to $467 million

(17.3% of sales) in the fourth quarter, a 12% sequential reduction

following the decline in sales and margins. Margins declined due to

the decline in prices and a more costly product mix.

Others

The following table indicates, for our Others

business segment, net sales, operating income and operating income

as a percentage of net sales for the periods indicated below:

| Others |

4Q 2024 |

3Q 2024 |

4Q 2023 |

|

Net sales ($ million) |

150 |

125 |

20% |

217 |

(31%) |

|

Operating income ($ million) |

25 |

10 |

156% |

39 |

(36%) |

|

Operating margin (% of sales) |

16.8% |

7.9% |

|

18.1% |

|

|

|

|

|

|

|

|

Net sales of other products and services

increased 20% sequentially and decreased 31% year on year.

Sequentially, sales increased mainly due to higher sales of oil

services in Argentina and coiled tubing.

Selling, general and administrative

expenses, or SG&A, amounted to $446

million, or 15.7% of net sales, in the fourth quarter of 2024,

compared to $454 million, 15.6% in the previous quarter and $471

million, 13.8% in the fourth quarter of 2023. Sequentially, the

decline in SG&A is mainly due to lower shipment costs due to a

reduction in volumes shipped.

Other operating results

amounted to a net gain of $81 million in the fourth quarter of

2024, compared to a gain of $11 million in the previous quarter and

a $5 million loss in the fourth quarter of 2023. The fourth quarter

of 2024 includes a $67 million gain from the partial reversal of a

provision for the ongoing litigation related to the acquisition of

a participation in Usiminas.

Financial results amounted to a

gain of $48 million in the fourth quarter of 2024, compared to a

gain of $48 million in the previous quarter and a gain of $93

million in the fourth quarter of 2023. Financial result of the

quarter is mainly attributable to a $42 million net finance income

from the net return of our portfolio investments.

Equity in earnings of non-consolidated

companies generated a gain of $35 million in the fourth

quarter of 2024, compared to a gain of $8 million in the previous

quarter and a gain of $57 million in the fourth quarter of 2023.

These results are mainly derived from our participation in Ternium

(NYSE:TX). During the fourth quarter of 2024 the result from

Ternium´s investment includes a $43 million gain from the partial

reversal of a provision for the ongoing litigation related to the

acquisition of a participation in Usiminas.

Income tax charge amounted to

$123 million in the fourth quarter of 2024, compared to $134

million in the previous quarter and $177 million in the fourth

quarter of 2023.

Cash Flow and Liquidity of 2024 Fourth

Quarter

Net cash generated by operating activities

during the fourth quarter of 2024 was $492 million, compared to

$552 million in the previous quarter and $0.8 billion in the fourth

quarter of 2023. During the fourth quarter of 2024 cash generated

by operating activities includes a net working capital increase of

$37 million.

With capital expenditures of $182 million, our

free cash flow amounted to $310 million during the quarter.

Following a dividend payment of $299 million and share buybacks of

$454 million in the quarter, our net cash position amounted to $3.6

billion at December 31, 2024.

Analysis of 2024 Annual Results

The following table shows our net sales by business segment for

the periods indicated below:

| Net sales ($

million) |

12M 2024 |

12M 2023 |

Increase/(Decrease) |

|

Tubes |

11,907 |

95% |

14,185 |

95% |

(16%) |

| Others |

617 |

5% |

684 |

5% |

(10%) |

| Total |

12,524 |

|

14,869 |

|

(16%) |

| |

|

|

|

|

|

Tubes

The following table indicates, for our Tubes

business segment, sales volumes of seamless and welded pipes for

the periods indicated below:

|

Tubes Sales volume (thousand metric tons) |

12M 2024 |

12M 2023 |

Increase/(Decrease) |

| Seamless |

3,077 |

3,189 |

(4%) |

| Welded |

852 |

953 |

(11%) |

| Total |

3,928 |

4,141 |

(5%) |

| |

|

|

|

The following table indicates, for our Tubes business segment,

net sales by geographic region, operating income and operating

income as a percentage of net sales for the periods indicated

below:

|

Tubes |

12M 2024 |

12M 2023 |

Increase/(Decrease) |

| (Net sales - $ million) |

|

|

|

| North America |

5,432 |

7,572 |

(28%) |

| South America |

2,294 |

3,067 |

(25%) |

| Europe |

1,143 |

1,055 |

8% |

| Asia Pacific, Middle East and

Africa |

3,038 |

2,491 |

22% |

| Total net sales ($

million) |

11,907 |

14,185 |

(16%) |

|

Services performed on third party tubes ($ million) |

484 |

165 |

193% |

| Operating income ($

million) |

2,305 |

4,183 |

(45%) |

| Operating margin (% of

sales) |

19.4% |

29.5% |

|

| |

|

|

|

Net sales of tubular products and services

decreased 16% to $11,907 million in 2024, compared to $14,185

million in 2023 due to a 5% decrease in volumes and a 12% decrease

in average selling prices, primarily reflecting a decline in market

prices for our tubular products used in onshore drilling

applications in the Americas, lower drilling activity in Mexico and

Colombia, lower shipments for pipeline projects in Argentina and

lower sales of mechanical pipes in Europe. On the other hand, sales

in the Middle East reached a record level as Saudi Aramco

replenished OCTG stocks and increased gas drilling activity.

Operating results from tubular products and

services amounted to a gain of $2,305 million in 2024 compared to a

gain of $4,183 million in 2023. The decline in operating results is

mainly due to the decline in average selling prices and the

corresponding impact on sales and margins. Additionally, in 2024

our Tubes operating income includes a charge of $107 million from

the provision for the ongoing litigation related to the acquisition

of a participation in Usiminas, included in other operating

expenses.

Others

The following table indicates, for our Others

business segment, net sales, operating income and operating income

as a percentage of net sales for the periods indicated below:

|

Others |

12M 2024 |

12M 2023 |

Increase/(Decrease) |

| Net sales ($ million) |

617 |

684 |

(10%) |

| Operating income ($

million) |

113 |

133 |

(15%) |

| Operating margin (% of

sales) |

18.4% |

19.5% |

|

| |

|

|

|

Net sales of other products and services

decreased 10% to $617 million in 2024, compared to $684 million in

2023.

Operating results from other products and

services amounted to a gain of $113 million in 2024, compared to a

gain of $133 million in 2023.

Selling, general and administrative

expenses, or SG&A, amounted to $1,905 million in 2024,

representing 15.2% of sales, and $1,919 million in 2023,

representing 12.9% of sales. SG&A expenses increased as a

percentage of sales due to the 16% decline in revenues, mainly due

to lower Tubes average selling prices and an increase of fixed

costs.

Other operating results

amounted to a loss of $65 million in 2024, compared to a gain of

$36 million in 2023. In 2024 we recorded a $107 million loss from

provision for the ongoing litigation related to the acquisition of

a participation in Usiminas. In 2023 other operating income

includes a non-recurring gain of $33 million corresponding to the

transfer of the awards related to the Company’s Venezuelan

nationalized assets.

Financial results amounted to a

gain of $129 million in 2024, compared to a gain of $221 million in

2023. While net finance income increased due to a higher net

financial position, net foreign exchange results decreased

significantly in respect to the previous year.

Equity in earnings of non-consolidated

companies generated a gain of $9 million in 2024, compared

to a gain of $95 million in 2023. These results were mainly derived

from our equity investment in Ternium (NYSE:TX) and in 2024 were

negatively affected by a $43 million loss from the provision for

the ongoing litigation related to the acquisition of a

participation in Usiminas on our Ternium investment.

Income tax amounted to a charge

of $480 million in 2024, compared to $675 million in 2023. The

lower income tax charge mainly reflects the reduction in results at

several subsidiaries.

Cash Flow and Liquidity of 2024

Net cash provided by operating activities in

2024 amounted to $2.9 billion (including a reduction in working

capital of $287 million), compared to cash provided by operations

of $4.4 billion (including a reduction in working capital of $182

million) in 2023.

Capital expenditures amounted to $694 million in

2024, compared to $619 million in 2023. Free cash flow amounted to

$2.2 billion in 2024, compared to $3.8 billion in 2023.

Following dividend payments of $758 million and

share buybacks of $1.4 billion during 2024, our net cash position

amounted to $3.6 billion at December 31, 2024.

Conference call

Tenaris will hold a conference call to discuss

the above reported results, on February 20, 2025, at 08:00 a.m.

(Eastern Time). Following a brief summary, the conference call will

be opened to questions.

To listen to the conference please join through

one of the following options:

ir.tenaris.com/events-and-presentations or

https://edge.media-server.com/mmc/p/p836i5mj

If you wish to participate in the Q&A session please

register at the following link:

https://register.vevent.com/register/BIb7ae4609ff564d95a338d90813a3c8cc

Please connect 10 minutes before the scheduled start time.

A replay of the conference call will also be available on our

webpage at: ir.tenaris.com/events-and-presentations

Some of the statements contained in this press

release are “forward-looking statements”. Forward-looking

statements are based on management’s current views and assumptions

and involve known and unknown risks that could cause actual

results, performance or events to differ materially from those

expressed or implied by those statements. These risks include but

are not limited to risks arising from uncertainties as to future

oil and gas prices and their impact on investment programs by oil

and gas companies.Consolidated Income

Statement

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended December 31, |

Twelve-month period ended December 31, |

|

|

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

Net sales |

2,845,226 |

3,414,930 |

12,523,934 |

14,868,860 |

|

Cost of sales |

(1,922,263) |

(2,120,591) |

(8,135,489) |

(8,668,915) |

|

Gross profit |

922,963 |

1,294,339 |

4,388,445 |

6,199,945 |

|

Selling, general and administrative expenses |

(445,988) |

(470,542) |

(1,904,828) |

(1,919,307) |

|

Other operating income |

18,483 |

1,468 |

60,650 |

53,043 |

|

Other operating expenses |

62,919 |

(6,302) |

(125,418) |

(17,273) |

|

Operating income |

558,377 |

818,963 |

2,418,849 |

4,316,408 |

|

Finance income |

51,331 |

63,621 |

242,319 |

213,474 |

|

Finance cost |

(8,928) |

(19,759) |

(61,212) |

(106,862) |

|

Other financial results |

5,777 |

49,249 |

(52,051) |

114,365 |

|

Income before equity in earnings of non-consolidated

companies and income tax |

606,557 |

912,074 |

2,547,905 |

4,537,385 |

|

Equity in earnings of non-consolidated companies |

35,283 |

56,859 |

8,548 |

95,404 |

|

Income before income tax |

641,840 |

968,933 |

2,556,453 |

4,632,789 |

|

Income tax |

(122,709) |

176,848 |

(479,680) |

(674,956) |

|

Income for the period |

519,131 |

1,145,781 |

2,076,773 |

3,957,833 |

|

|

|

|

|

|

|

Attributable to: |

|

|

|

|

|

Shareholders' equity |

516,213 |

1,129,098 |

2,036,445 |

3,918,065 |

|

Non-controlling interests |

2,918 |

16,683 |

40,328 |

39,768 |

|

|

519,131 |

1,145,781 |

2,076,773 |

3,957,833 |

| |

|

|

|

|

Consolidated Statement of Financial

Position

| (all amounts in thousands of

U.S. dollars) |

At December 31, 2024 |

|

At December 31, 2023 |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

Property, plant and equipment, net |

6,121,471 |

|

|

6,078,179 |

|

|

Intangible assets, net |

1,357,749 |

|

|

1,377,110 |

|

|

Right-of-use assets, net |

148,868 |

|

|

132,138 |

|

|

Investments in non-consolidated companies |

1,543,657 |

|

|

1,608,804 |

|

|

Other investments |

1,005,300 |

|

|

405,631 |

|

|

Deferred tax assets |

831,298 |

|

|

789,615 |

|

|

Receivables, net |

205,602 |

11,213,945 |

|

185,959 |

10,577,436 |

|

Current assets |

|

|

|

|

|

|

Inventories, net |

3,709,942 |

|

|

3,921,097 |

|

|

Receivables and prepayments, net |

179,614 |

|

|

181,368 |

|

|

Current tax assets |

332,621 |

|

|

256,401 |

|

|

Contract assets |

50,757 |

|

|

47,451 |

|

|

Trade receivables, net |

1,907,507 |

|

|

2,480,889 |

|

|

Derivative financial instruments |

7,484 |

|

|

9,801 |

|

|

Other investments |

2,372,999 |

|

|

1,969,631 |

|

|

Cash and cash equivalents |

675,256 |

9,236,180 |

|

1,637,821 |

10,504,459 |

|

Total assets |

|

20,450,125 |

|

|

21,081,895 |

|

EQUITY |

|

|

|

|

|

|

Shareholders' equity |

|

16,593,257 |

|

|

16,842,972 |

|

Non-controlling interests |

|

220,578 |

|

|

187,465 |

|

Total equity |

|

16,813,835 |

|

|

17,030,437 |

|

LIABILITIES |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

Borrowings |

11,399 |

|

|

48,304 |

|

|

Lease liabilities |

100,436 |

|

|

96,598 |

|

|

Derivative financial instruments |

- |

|

|

255 |

|

|

Deferred tax liabilities |

503,941 |

|

|

631,605 |

|

|

Other liabilities |

301,751 |

|

|

271,268 |

|

|

Provisions |

82,106 |

999,633 |

|

101,453 |

1,149,483 |

|

Current liabilities |

|

|

|

|

|

|

Borrowings |

425,999 |

|

|

535,133 |

|

|

Lease liabilities |

44,490 |

|

|

37,835 |

|

|

Derivative financial instruments |

8,300 |

|

|

10,895 |

|

|

Current tax liabilities |

366,292 |

|

|

488,277 |

|

|

Other liabilities |

585,775 |

|

|

422,645 |

|

|

Provisions |

119,344 |

|

|

35,959 |

|

|

Customer advances |

206,196 |

|

|

263,664 |

|

|

Trade payables |

880,261 |

2,636,657 |

|

1,107,567 |

2,901,975 |

|

Total liabilities |

|

3,636,290 |

|

|

4,051,458 |

|

Total equity and liabilities |

|

20,450,125 |

|

|

21,081,895 |

| |

|

|

|

|

|

Consolidated Statement of Cash Flows

| |

Three-month period ended December 31, |

Twelve-month period ended December 31, |

|

(all amounts in thousands of U.S. dollars) |

2024 |

2023 |

2024 |

2023 |

|

|

|

|

|

|

|

Cash flows from operating activities |

|

|

|

|

|

Income for the period |

519,131 |

1,145,781 |

2,076,773 |

3,957,833 |

|

Adjustments for: |

|

|

|

|

|

Depreciation and amortization |

167,781 |

156,347 |

632,854 |

548,510 |

|

Bargain purchase gain |

- |

- |

(2,211) |

(3,162) |

|

Income tax accruals less payments |

(160) |

(277,559) |

(222,510) |

(143,391) |

|

Equity in earnings of non-consolidated companies |

(35,283) |

(56,859) |

(8,548) |

(95,404) |

|

Interest accruals less payments, net |

7,246 |

(8,554) |

(1,067) |

(53,480) |

|

Provision for the ongoing litigation related to the acquisition of

participation in Usiminas |

(87,975) |

- |

89,371 |

- |

|

Changes in provisions |

(19,808) |

(651) |

(25,155) |

21,284 |

|

Reclassification of currency translation adjustment reserve |

- |

(878) |

- |

(878) |

|

Changes in working capital |

(36,604) |

(65,697) |

286,917 |

182,428 |

|

Others, including net foreign exchange differences |

(22,100) |

(56,195) |

39,794 |

(18,667) |

|

Net cash provided by operating activities |

492,228 |

835,735 |

2,866,218 |

4,395,073 |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

Capital expenditures |

(181,870) |

(166,820) |

(693,956) |

(619,445) |

|

Changes in advance to suppliers of property, plant and

equipment |

5,092 |

834 |

(10,391) |

1,736 |

|

Acquisition of subsidiaries, net of cash acquired |

- |

(161,238) |

31,446 |

(265,657) |

|

Other investments at fair value |

- |

(1,126) |

- |

(1,126) |

|

Additions to associated companies |

- |

- |

- |

(22,661) |

|

Loan to joint ventures |

(1,414) |

(1,092) |

(5,551) |

(3,754) |

| Proceeds from disposal of

property, plant and equipment and intangible assets |

9,646 |

3,858 |

28,963 |

12,881 |

|

Dividends received from non-consolidated companies |

20,674 |

25,268 |

73,810 |

68,781 |

|

Changes in investments in securities |

458,407 |

740,153 |

(821,478) |

(1,857,272) |

|

Net cash provided by (used in) investing

activities |

310,535 |

439,837 |

(1,397,157) |

(2,686,517) |

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

| Dividends paid |

(299,230) |

(235,128) |

(757,786) |

(636,511) |

| Dividends paid to

non-controlling interest in subsidiaries |

- |

- |

(5,862) |

(18,967) |

| Changes in non-controlling

interests |

28 |

- |

1,143 |

3,772 |

| Acquisition of treasury

shares |

(454,462) |

(213,739) |

(1,439,589) |

(213,739) |

| Payments of lease

liabilities |

(17,248) |

(15,524) |

(68,574) |

(51,492) |

| Proceeds from borrowings |

344,222 |

365,455 |

1,870,666 |

1,723,677 |

| Repayments of borrowings |

(382,656) |

(406,774) |

(1,999,427) |

(1,931,747) |

|

Net cash used in financing activities |

(809,346) |

(505,711) |

(2,399,429) |

(1,125,007) |

|

|

|

|

|

|

|

(Decrease) increase in cash and cash

equivalents |

(6,583) |

769,861 |

(930,368) |

583,549 |

|

|

|

|

|

|

|

Movement in cash and cash equivalents |

|

|

|

|

| At the beginning of the

year |

681,306 |

864,012 |

1,616,597 |

1,091,433 |

| Effect of exchange rate

changes |

(13,925) |

(17,276) |

(25,431) |

(58,385) |

| (Decrease) increase in cash

and cash equivalents |

(6,583) |

769,861 |

(930,368) |

583,549 |

|

At December 31, |

660,798 |

1,616,597 |

660,798 |

1,616,597 |

| |

|

|

|

|

Exhibit I – Alternative performance

measures

Alternative performance measures should be

considered in addition to, not as substitute for or superior to,

other measures of financial performance prepared in accordance with

IFRS.

EBITDA, Earnings before interest, tax, depreciation and

amortization.

EBITDA provides an analysis of the operating

results excluding depreciation and amortization and impairments, as

they are recurring non-cash variables which can vary substantially

from company to company depending on accounting policies and the

accounting value of the assets. EBITDA is an approximation to

pre-tax operating cash flow and reflects cash generation before

working capital variation. EBITDA is widely used by investors when

evaluating businesses (multiples valuation), as well as by rating

agencies and creditors to evaluate the level of debt, comparing

EBITDA with net debt.

EBITDA is calculated in the following manner:

EBITDA = Net income for the period + Income tax

charges +/- Equity in Earnings (losses) of non-consolidated

companies +/- Financial results + Depreciation and amortization +/-

Impairment charges/(reversals).

EBITDA is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended December 31, |

Twelve-month period ended December 31, |

|

|

2024 |

2023 |

2024 |

2023 |

|

Income for the period |

519,131 |

1,145,781 |

2,076,773 |

3,957,833 |

|

Income tax charge / (credit) |

122,709 |

(176,848) |

479,680 |

674,956 |

|

Equity in earnings of non-consolidated companies |

(35,283) |

(56,859) |

(8,548) |

(95,404) |

|

Financial results |

(48,180) |

(93,111) |

(129,056) |

(220,977) |

|

Depreciation and amortization |

167,781 |

156,347 |

632,854 |

548,510 |

|

EBITDA |

726,158 |

975,310 |

3,051,703 |

4,864,918 |

|

|

|

|

|

|

Free Cash Flow

Free cash flow is a measure of financial performance, calculated

as operating cash flow less capital expenditures. FCF represents

the cash that a company is able to generate after spending the

money required to maintain or expand its asset base.

Free cash flow is calculated in the following manner:

Free cash flow = Net cash (used in) provided by operating

activities - Capital expenditures.

Free cash flow is a non-IFRS alternative performance

measure.

|

(all amounts in thousands of U.S. dollars) |

Three-month period ended December 31, |

Twelve-month period ended December 31, |

|

|

2024 |

2023 |

2024 |

2023 |

| Net cash provided by operating

activities |

492,228 |

835,735 |

2,866,218 |

4,395,073 |

| Capital expenditures |

(181,870) |

(166,820) |

(693,956) |

(619,445) |

|

Free cash flow |

310,358 |

668,915 |

2,172,262 |

3,775,628 |

|

|

|

|

|

|

Net Cash / (Debt)

This is the net balance of cash and cash

equivalents, other current investments and fixed income investments

held to maturity less total borrowings. It provides a summary of

the financial solvency and liquidity of the company. Net cash /

(debt) is widely used by investors and rating agencies and

creditors to assess the company’s leverage, financial strength,

flexibility and risks.

Net cash/ debt is calculated in the following manner:

Net cash = Cash and cash equivalents + Other investments

(Current and Non-Current)+/- Derivatives hedging borrowings and

investments - Borrowings (Current and Non-Current).

Net cash/debt is a non-IFRS alternative performance measure.

|

(all amounts in thousands of U.S. dollars) |

At December 31, |

|

|

2024 |

2023 |

| Cash

and cash equivalents |

675,256 |

1,637,821 |

| Other

current investments |

2,372,999 |

1,969,631 |

|

Non-current investments |

998,251 |

398,220 |

|

Current borrowings |

(425,999) |

(535,133) |

|

Non-current borrowings |

(11,399) |

(48,304) |

|

Net cash / (debt) |

3,609,108 |

3,422,235 |

|

|

|

|

Operating working capital days

Operating working capital is the difference

between the main operating components of current assets and current

liabilities. Operating working capital is a measure of a company’s

operational efficiency, and short-term financial health.

Operating working capital days is calculated in

the following manner:

Operating working capital days = [(Inventories +

Trade receivables – Trade payables – Customer advances) /

Annualized quarterly sales ] x 365.

Operating working capital days is a non-IFRS alternative

performance measure.

| (all amounts in thousands of

U.S. dollars) |

Three-month period ended December 31, |

|

|

2024 |

2023 |

| Inventories |

3,709,942 |

3,921,097 |

| Trade receivables |

1,907,507 |

2,480,889 |

| Customer advances |

(206,196) |

(263,664) |

| Trade payables |

(880,261) |

(1,107,567) |

| Operating working

capital |

4,530,992 |

5,030,755 |

| Annualized quarterly

sales |

11,380,904 |

13,659,720 |

| Operating working capital |

145 |

134 |

| |

|

|

Giovanni

Sardagna Tenaris

1-888-300-5432www.tenaris.com

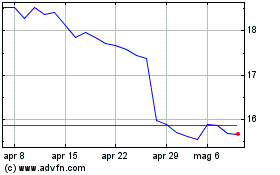

Grafico Azioni Tenaris (BIT:TEN)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Tenaris (BIT:TEN)

Storico

Da Feb 2024 a Feb 2025