Uniswap Could Slide Below Support Zone – No Demand For UNI This Week?

30 Settembre 2022 - 11:27AM

NEWSBTC

On Thursday, the $6.7 price range of Uniswap was rebuffed once

again. The momentum has slowed on the shorter time frames, which is

a bearish indicator for traders and investors. It’s possible that

the recent decline in Bitcoin’s value is responsible for UNI’s lag.

Statistics show that there is a moderately high relationship

between UNI and Bitcoin. Recent price changes for both coins show a

strong correlation between them. UNI has been closely following

Bitcoin’s price action. As the bearish slump in Uniswap continues

into its second day, the currency pair may be retracing its recent

gains. As of this writing, UNI is trading at $6.45, up 12% in the

last seven days, data from Coingecko show, Friday. Related Reading:

ApeCoin Performance Could Attract The Whales – How About The Bulls?

Uniswap Indicator: Bearish UNI fell to a closing price of $6.379

yesterday, 7.62% lower than its September 28 closing price of

$6.555. Price action in the past is also suggestive of a developing

bearish momentum. The momentum indicator is at a bearish low at the

moment. Daily and 4-hourly trends tell the same pattern as well.

The amount of UNI currency on hand is at an all-time high, per

CryptoQuant statistics. Foreign exchange reserves on the rise

portend worse conditions. As of this writing, daily UNI transaction

volume in the shorter time frames from September 27 to now has been

volatile. During this time range on September 27, UNI rallied and

tested the $6.7 resistance level. This price trend mirrored that of

Bitcoin. Although demand for UNI is not very great, both BTC and

UNI are currently exhibiting indications of recovery. A Retreat, Or

Advance? A recent research predicted that UNI would decline to

$5.50, a volatile region that might spark a bigger sell-off in the

crypto. A decline of this nature could prompt investors and

purchasers to acquire a position inside the aforementioned price

range, restoring the currency to its current value. However, UNI’s

technological aspects are relatively neutral. On the charts, this

appears as a near-stabilization of the price, which is supported by

the 38.20 Fibonacci level. This neutrality of the technical

indicators and the relatively stable price range can assist the

bulls in gaining strength for a breakout. However, UNI has

struggled to surpass the $6.49 level of resistance. A breach of

this resistance might initiate a gradual rally toward the $6.7

price level. As the price trend wanes, UNI has a same chance of

falling to $5.5 or rising to $6.7. Related Reading: QUANT Basks In

Green As QNT Coin Surges 35% On 7-Day Rally UNI total market cap at

$4.95 billion on the daily chart | Source: TradingView.com Featured

image from Brightnode, Chart: TradingView.com

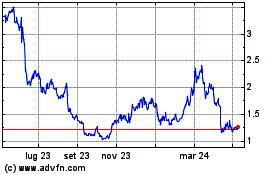

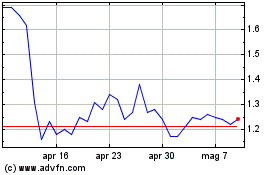

Grafico Azioni ApeCoin (COIN:APEUSD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni ApeCoin (COIN:APEUSD)

Storico

Da Apr 2023 a Apr 2024