Injective Generated More Revenue Than BNB Chain, Avalanche In Q3 2024, Next $50?

09 Ottobre 2024 - 2:30AM

NEWSBTC

Injective Protocol, a DeFi-centric platform using Cosmos tech, is

gaining traction, looking at the gas fee revenue distributed to its

validators in Q3 2024. While INJ, the native currency of the

protocol, is under pressure, cooling off after rallying to as high

as $52 early this year, the recent development is a huge confidence

boost. Looking at trends may signal that more users are flowing to

Injective, a net positive for INJ in the coming sessions. Injective

Generates More Revenue Than The BNB Chain, Avalanche According to

CryptoRank data, Injective Protocol generated $4 million in revenue

derived from gas fees. Every transfer or smart contract deployment

attracts a gas fee like every other public ledger like Bitcoin or

Solana. This fee is distributed to the winning validator or miner

as an incentive to operate a node. With $4 million in revenue,

Injective created more than the BNB Chain, one of the largest

blockchains by market cap, and Avalanche, a network in the top 20,

according to CoinMarketCap. These platforms generated $3.4 million

and $2.1 million, respectively. Related Reading: Bitcoin Price

Forecast: This Week’s Trends And Historical Patterns For Q4 At this

level, Injective also surpassed what some of the top Ethereum

layer-2 solutions like Arbitrum, Optimism, and Blast generated over

this period. For comparison, Arbitrum, despite being the largest

and managing over $13.2 billion, according to L2Beat. Ethereum,

Tron, Solana, and Base churned more revenue than Injective.

Ethereum funneled $159 million to its validators from July through

September, while Tron and Solana cumulatively moved over $200

million. The expansion of revenue, mostly from Tron, a scalable

platform, is due to the meme coin activity on its network following

the launch of SunPump in August. At the same time, Solana also

benefited from meme coins and an uptick in decentralized exchange

(DEX) volume over this period. Will INJ Rise To $50? It remains to

be seen whether the recovery of DeFi activities while boosting

Injective and its total value locked (TVL). As of October 8, the

protocol manages over $40 million, looking at DeFiLlama data. At

the same time, the platform has processed over 1 billion onchain

transactions. Related Reading: Short-Term Bitcoin Holders Panic

Sell: Here’s Why It Might Be Great News For BTC In early October,

Injective announced the launch of Injective 3.0. This upgrade

allows the protocol to change its tokenomics and make INJ

deflationary. With this activation, a portion of INJ will be

removed from circulation, making it more scarce. Presently, INJ is

inside a descending channel, finding support at $15. While buyers

of Q1 2024 are still in the picture, the token is down 60% from

March highs. A break above this descending channel could see the

coin soar to 2024 highs of around $52. Feature image from iStock,

chart from TradingView

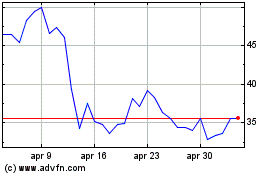

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Avalanche (COIN:AVAXUSD)

Storico

Da Mar 2024 a Mar 2025