Bitcoin SV: Altcoin Boasts 10% Gains As Rest Of The Market Falters – Details

08 Agosto 2024 - 10:30PM

NEWSBTC

As the market rebound slows, Bitcoin SV captured some momentum and

gaining some ground against the bears today, August 8. The coin has

been up more than 10% since last month, a huge advantage in the

market’s hostile environment. Related Reading: Aave Protocol

Unfazed By Market Jitters, Surges 21% Bitcoin SV is a hard fork of

Bitcoin Cash which is also a fork of Bitcoin itself. BSV, however,

has traits unique to itself, unlike its close cousins that make it

more attractive to businesses. Solving Real World Problems

With On-Chain Solutions President of the Blockchain

Association Uganda Reginald Tumusiime discussed his organization’s

project, the KitePesa, a stablecoin backed by the Ugandan shilling.

According to him, most of the countries in Subsaharan Africa have

been exploring central bank digital currency (CBDC) projects as a

form of currency. This institutional interest in blockchain tech

and stablecoins are the factors that KitePesa will leverage for

further development. The project has its merits. The Ugandan

people have been switching to digital banking which offers the same

features as traditional banks but with convenience as mobile phones

become more and more prevalent. In 2023, customers of mobile money

providers reached 42.9 million with the figure expected to rise in

the coming decades. KitePesa will leverage institutional

interest to build a reliable blockchain infrastructure that

operates and functions much better than traditional mobile money

networks. With Uganda’s robust regulatory framework regarding

payments and the technologies involved, KitePesa has regulatory

backing to operate in a legal environment. The project will

be launched on the BSV Blockchain, integrating the somewhat local

project into the international market which may invest as they see

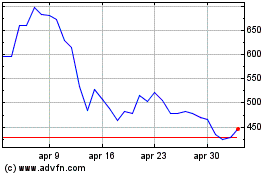

potential in KitePesa. Continuation Rally Might Happen At

These Levels BSV could be faced with a breakthrough and is

attempting to settle between $40.29 and $45.30. If the bulls are

successful in taking this position, we might see further upward

movement in the coming days or weeks. However, the market still has

its doubts with the total market cap of the crypto market seeing a

measly 0.2% gain in the past 24 hours as Bitcoin and Ethereum

recover at a snail’s pace. In private equity, indices, futures, and

commodities are experiencing hiccups as the market expects more

volatility ahead and after the release of several macro

indicators. Related Reading: Polkadot Developments Show

Strength, Despite Coin’s 18% Loss This will hamper BSV’s short term

to long-term gain as the coin moves with the broader market. The

current movement is part of the outlying group of cryptocurrencies

that outpaced the whole crypto market. If BSV can stabilize

at the $40.29-$45.30 price range, we might see a continuation rally

in the long term. But this move is still highly dependent on the

broader market’s movement that is currently grinding to a

halt. Investors and traders should still treat BSV with

caution as it can be susceptible to any market swing both upward

and downward. Featured image from Pexels, chart from

TradingView

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Bitcoin Cash (COIN:BCHUSD)

Storico

Da Dic 2023 a Dic 2024