Solana On watch: SOL Price Could Crash To $90 If This Happens

07 Settembre 2024 - 8:30AM

NEWSBTC

As the first week of September concluded, the Solana (SOL) price

settled at $124, raising concerns for investors as the fifth

largest cryptocurrency risks breaching the critical $100

threshold. According to market analyst Ali Martinez, recent

technical analysis indicates that a sustained close below the

channel’s lower boundary at $126 could trigger a significant price

correction for Solana, potentially dropping to $110 or even $90.

Solana Price Challenges In a social media update, Martinez

elaborated on the current market conditions, noting that the TD

Sequential indicator had previously presented a buy signal on the

daily chart. This suggested a possible rebound for Solana from the

lower boundary of its trading channel towards higher levels at $154

and $187. However, the broader market’s ongoing selloff has

invalidated this bullish signal, causing Solana to suffer losses of

approximately 20% over the past two weeks and 13% in the last

month. Related Reading: Shiba Inu Recovery To $0.000081 ATH Levels

Still In Play Despite these challenges, there remains a glimmer of

hope for Solana’s recovery. Martinez pointed out a historical

pattern indicating that Solana typically experiences a price

upswing in the two weeks leading up to its “Breakpoint

event”. In 2021, the cryptocurrency surged by 35%, the

following year it increased by another 35%, and in 2023 it soared

by 60%. With only 16 days left until the 2024 “breakpoint event,”

the analyst suggests that this trend of the past few years could

continue, which would mean a significant recovery for the token. If

the historical pattern holds, Solana could potentially rally 35%

towards $167, but remain just below the upper limit of its current

channel at $187. However, as Martinez pointed out, the key is for

SOL to recover and consolidate above the $126 level in the coming

days to avoid further declines. Influx of Capital From FTX

Creditors And Historically Bullish Q4 Further adding some sense of

hope for SOL investors, the fourth quarter post-Bitcoin (BTC)

Halving events has historically shown bullish trends, suggesting a

potential market recovery that could also benefit SOL

significantly. Adding to this hopeful outlook, the

now-defunct crypto exchange FTX is set to distribute over $16

billion in cash to creditors affected by its collapse. This influx

of capital into the market could signal a substantial return,

particularly impacting four key cryptocurrencies. Analyst OxNobler

highlights that a majority of the affected FTX clients are retail

investors, indicating that a significant portion of the recovered

funds is likely to re-enter the crypto market. Related

Reading: Here’s How Cardano Price Will ‘Survive’ A US Recession:

Crypto Analyst The expectation is that a substantial share of these

funds will flow into Bitcoin and other dominant cryptocurrencies

such as Ethereum (ETH), Solana, and Binance Coin (BNB). The

anticipated return of capital not could stabilize the market but

also present an opportunity for price increases across these

assets. However, it remains to be seen if this is indeed the case,

but if it is, it could be a much-needed catalyst for the market

following the strong sell-off activity that the largest

cryptocurrencies on the market have experienced in recent

months. Featured image from DALL-E, chart from

TradingView.com

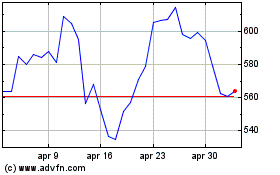

Grafico Azioni Binance Coin (COIN:BNBUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Binance Coin (COIN:BNBUSD)

Storico

Da Nov 2023 a Nov 2024