Is The Bitcoin Bull Market Still On? STH Cost Basis Suggests So

11 Gennaio 2025 - 1:30PM

NEWSBTC

The Bitcoin price has been somewhat quiet since hitting its

all-time high of $108,135, struggling to hold a six-figure

valuation for long. Case in point — the premier cryptocurrency

barely lasted a day above $100,000 before crashing to under $92,000

in the past week. This sluggish price action has triggered

discussions about the likelihood of a top being in and the Bitcoin

bull market being over. However, the latest on-chain observation

suggests that the flagship cryptocurrency might still have room for

further upward price movement. What’s The Current Bitcoin

Short-Term Holders Cost Basis? In its latest post on the X

platform, blockchain analytics firm Glassnode revealed that the

Bitcoin bull market might not be over just yet. This on-chain

observation is based on the movement of the BTC price in relation

to the short-term holders (STH) cost basis. Related Reading: Is

Dogecoin’s 30% Decline A Chance To Buy On Discount? Here Is the

Pertinent Level To Watch The STH cost-basis metric tracks the

average price at which short-term holders (investors who have held

Bitcoin for less than 155 days) purchased their coins. It

represents a psychological level for BTC investors and could serve

as a technical point for analyzing prices, especially during bull

cycles. Typically, the price of Bitcoin floats above the STH cost

basis during bull markets, indicating significant buying interest

and positive sentiment from short-term traders. Conversely, when

the BTC price falls beneath this level — as often seen in bear

markets, this means that newer investors are in the red, leading to

substantial selling pressure. According to data from Glassnode,

Bitcoin’s price is roughly 7% above the STH cost basis, which

currently stands at around $88,135. While the premier

cryptocurrency is a little closer to the cost basis, the inkling is

still that short-term holders are less likely to offload their

assets. If the price of Bitcoin manages to sustain above the STH

cost basis, it means the potential continuation of the current bull

market. On the flip side, a move beneath $88,000 could set the

stage for a trend reversal, with the market shifting from a bull to

a bear phase. As of this writing, the price of BTC sits just above

$94,000, reflecting barely a 1% increase in the past 24 hours.

According to data from CoinGecko, the flagship cryptocurrency is

down by more than 3% in the last seven days. Is A Market Rebound

Imminent? The crypto market has been in terrible form over the past

week, with several large-cap assets dipping by double digits.

Unsurprisingly, many crypto traders have indicated interest in

offloading their assets on various social media platforms. Related

Reading: SUI Defies Odds With A Sharp Rebound Above $4.9: New Highs

Loom? However, this shift in investor sentiment increases the odds

of a market recovery, as prices tend to move in the crowd’s

opposite direction. On-chain intelligence firm Santiment noted in a

post on X that this was the case in the rally witnessed in 2024 Q4,

as higher prices followed increased bearish mentions. Featured

image from iStock, chart from TradingView

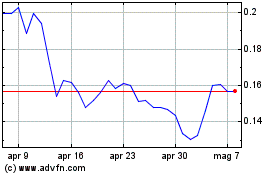

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Dogecoin (COIN:DOGEUSD)

Storico

Da Gen 2024 a Gen 2025