How Will The US Upcoming Fed Rate Cut Impact Bitcoin? QCP Analysts Weigh In

31 Agosto 2024 - 2:30AM

NEWSBTC

As the United States Federal rate cut is fast approaching, analysts

at QCP Capital, a global digital asset trading firm and market

maker has now shared their prediction on how this development could

impact Bitcoin price. According to the analysts, the upcoming U.S.

non-farm payroll report and Friday’s GDP data will play crucial

roles in shaping Bitcoin market sentiment. Notably, these economic

indicators are expected to offer greater clarity on whether the

Federal Reserve will commence a rate-cutting cycle in its next

Federal Open Market Committee (FOMC) meeting on September 18.

Related Reading: Bitcoin Open Interest Is Shooting Up: Will Shorts

Be Rekt This Time? Economic Data To Influence Bitcoin’s Market

Movements The QCP analysts has revealed that the anticipation of

these events has led to cautious positioning among market

participants, therefore this signals a potential “subdued

volatility” for Bitcoin in the near term. Scheduled for release by

September 6, the United States non-farm payrolls report is one the

major economic metric that could very well influence the Federal

Reserve’s interest rate decisions. The previous report earlier this

month showed a rise in the US unemployment rate from 4.1% to 4.3%,

which triggered a noticeable plunge in the global financial market.

Notably, this increase raised concerns that the Fed might be

falling behind in its efforts to adjust rates accordingly. In

addition to the payroll data, today’s upcoming US GDP report could

also affect Bitcoin’s price performance, although QCP Capital

analysts believe its impact on the cryptocurrency market may be

limited. The analysts noted: Tonight’s US GDP report is likely to

be a non-event for crypto, especially if it reinforces the ongoing

narrative of a slowing US economy. Bitcoin Market Performance And

Price Action Outlook Amid these upcoming economic developments,

Bitcoin has returned to a bearish trend after briefly recovering to

over $61,000 yesterday. Currently, Bitcoin is trading at $58,285,

marking a 4.3% decline in the past 24 hours. This drop has prompted

various market analysts to offer their updated insights on the

asset’s short-term prospects. For instance, Elja Boom, a well-known

crypto analyst on X, commented on the ongoing consolidation,

stating: No signs of breakout yet. Consolidation could happen till

October before breakout. I’m confident of a breakout in Q4 but

before that, there’ll be some more choppiness. Meanwhile, another

analyst, known as ‘Titan of Crypto’ on X, provided a short-term

update, highlighting a key resistance level. The analyst

highlighted the $59,600 price mark as a major level for Bitcoin.

Related Reading: Bitcoin ‘Must Do This Now’, Says Crypto Analyst

According to the analyst, should Bitcoin reclaim this price levels

and breaks through the cloud twist, “the clouds would flip from

resistance to support” and this might just result in a major rally

to the upside for Bitcoin. #Bitcoin Short Term Update 💥 If #BTC

reclaims $59,600 and breaks through the cloud twist, the clouds

would flip from resistance to support. This might trigger an upward

move. 📈 pic.twitter.com/1XdS3zeBCZ — Titan of Crypto (@Washigorira)

August 30, 2024 Featured image created with DALL-E, Chart from

TradingView

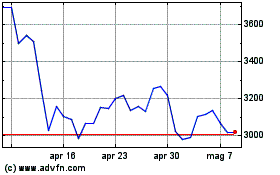

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Nov 2023 a Nov 2024