Experts Predict Bitcoin Journey To $100,000 After Thanksgiving Rally

28 Novembre 2024 - 5:00AM

NEWSBTC

Despite a brief correction towards the $91,000 mark on Tuesday,

which represented a 7% drop from its all-time high of $99,500, the

market’s leading crypto, Bitcoin (BTC), has regained the strength

it has posted over the past three weeks since Donald Trump’s

election, on its way to the $100,000 milestone. Coinbase,

Robinhood, And MicroStrategy All Post Gains In the 24-hour time

frame, Bitcoin recorded gains of nearly 5%, regaining the $96,100

level as a key to reach a new record high in the last days of the

month. This bullish price action was expected by experts and

analysts throughout the year as a normal upward behavior during

Halving cycles, further boosted by Trump’s crypto agenda, which

notably include making BTC a strategic reserve for the US. Related

Reading: XRP Consolidates Below Crucial Resistance – Analyst Sets

$1.60 Target This week marked a notable divergence, as Bitcoin

decoupled from the tech-heavy Nasdaq Composite, which fell by 1%.

According to CNBC data, the Dow Jones Industrial Average and

S&P 500 also experienced declines, yet Bitcoin managed to

maintain its upward trajectory. This strength was reflected

in the performance of crypto-related stocks, with US-based crypto

exchange Coinbase (COIN) up more than 5%, Robinhood (HOOD) up 4%,

and MicroStrategy (MSTR) up 10%. Bitcoin Enters ‘Uncharted

Territory’ In addition to the bullish outlook provided by the data

and figures recorded over the past three weeks in crypto prices,

market analysts are optimistic about Bitcoin’s future, with Alex

Thorn, head of research at Galaxy Digital, claiming that “the

Bitcoin bull market has legs.” Thorn acknowledges the

possibility of corrections and “regulatory jitters” stemming from

the outgoing Biden administration but believes that increasing

adoption from institutional, corporate, and potentially

nation-state entities will drive Bitcoin’s price higher in the near

to medium term. Related Reading: BNB Eyes Recovery: $605 Support

Sets The Stage For A New Rally Katie Stockton of Fairlead

Strategies also highlighted that Bitcoin investors are currently in

“uncharted territory” regarding resistance levels, meaning there

are few historical price points to indicate potential pullbacks.

Support is identified around $74,000, suggesting a solid foundation

for future growth. Stockton further claimed: Bitcoin does tend to

stair step both to the downside and to the upside, meaning that it

sees these very sharp runups and then consolidates. People should …

be willing to give Bitcoin, and the cryptocurrencies in general,

more room because of the volatility there and also because of the

long-term potential. With a year-to-date gain of 124%, Bitcoin

remains on track to cross the $100,000 threshold before the end of

the year. By comparison, Ethereum (ETH), the second largest

cryptocurrency, has also performed well since the election but lags

behind BTC with a year-to-date gain of 55%. Featured image from

DALL-E, chart from TradingView.com

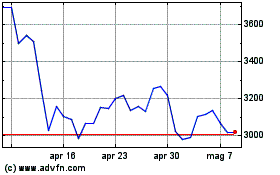

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Dic 2023 a Dic 2024