FET Price Under Pressure: RSI Flags Extended Bearish Move Toward $0.966

26 Ottobre 2024 - 4:30AM

NEWSBTC

FET is facing strong downward pressure as bearish signals take

hold, with the Relative Strength Index (RSI) suggesting further

weakness could be on the horizon. Recent declines have pushed FET’s

price closer to key support levels, and the RSI’s current reading

hints at a continuation of the bearish trend. With a potential drop

toward the $0.966 target, investors are left wondering if FET can

find a bottom or if additional losses lie ahead. This article

analyzes the recent downward pressure on FET’s price, with a

particular focus on the pessimistic signals indicated by the RSI.

By examining the current market conditions, key support and

resistance levels, and the RSI’s implications, we’ll explore

whether the token will likely continue its decline toward the

$0.966 target or if a potential reversal could be on the way.

What The RSI Reveals For FET On the 4-hour chart, FET has

demonstrated pronounced bearish momentum, slipping below the

100-day Simple Moving Average (SMA) as it approaches the $0.966

mark. This movement below the 100-day SMA signals that negative

forces are currently outweighing bullish attempts at price

recovery, possibly opening the door to further declines. An

analysis of the 4-hour chart reveals that the Relative Strength

Index (RSI) has now declined to the 34% level following an earlier

attempt to rally that stalled at 46%. An RSI near 30% often

suggests a potential reversal could be imminent. However, in this

context, it may also signal the continuation of a bearish path

unless buying interest returns to support a rebound. Related

Reading: FET Teeters At Trendline: Will A Breakout Fuel A Run To

$1.86? Meanwhile, on the daily chart, FET is displaying notable

pessimistic movement as it tries to fall below the 100-day SMA.

This downturn highlights rising selling pressure and negative

market sentiment, which collectively heightens the probability of

the asset dropping below the SMA and heading toward the $0.966

mark. A successful breach of the 100-day SMA could signal

additional declines, pushing the price down to this critical

support level. Finally, the 1-day RSI shows that negative pressure

on FET is intensifying as the signal line has recently dropped

below 50%, now settling at 39%. As the RSI remains in this lower

range, it suggests that sellers are gaining dominance, potentially

paving the way for further drops unless buying momentum can return

to shift the sentiment. Key Support Levels: Can $0.966 Hold Against

The Bears? As FET’s price remains under downward pressure, the

$0.966 mark stands out as a crucial support level. If the price

breaks below this threshold, it may signal a strong correction,

possibly resulting in more decrease toward the $0.459 level and

beyond. Related Reading: FET On Fire With 27% Rally, Analysts See

Bigger Gains Ahead Conversely, if the token manages to hold its

position above $0.966, it could indicate a potential reversal,

enabling bulls to reclaim some control in the market and driving

the price higher toward the $1.86 resistance level and beyond.

Featured image from Medium, chart from Tradingview.com

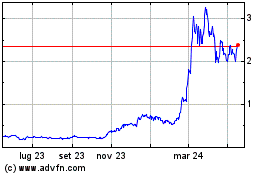

Grafico Azioni Fetch (COIN:FETUSD)

Storico

Da Feb 2025 a Mar 2025

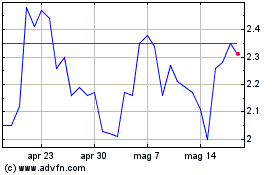

Grafico Azioni Fetch (COIN:FETUSD)

Storico

Da Mar 2024 a Mar 2025