Bitcoin Spot ETF Inflows Eye New Record As BTC Price Touches $57,000

27 Febbraio 2024 - 3:00PM

NEWSBTC

Bitcoin Spot ETFs are gunning for a new record after an incredible

start to the new week. The price of BTC has risen 8% in the last

day, and this has caused euphoria in the market. There could be a

number of factors behind this; however, institutional investors

seem to be playing a big role as daily inflows continue to rise.

Spot Bitcoin ETF Inflows Cross $400 Million According to Bloomberg

analyst James Seyffart, the Spot BTC ETF inflows are not slowing

down. In a screenshot shared by the analyst on Tuesday, Seyffart

reveals that inflows into Spot BTC ETFs climbed above $400 million.

Related Reading: VeChain Ready For Blast-Off: Crypto Analyst

Predicts VET Price To Rally 14,600% The image shows that the

Fidelity Wise Origin Bitcoin Fund is leading the charge with $243.3

million in inflows, which accounts for more than 50% of the total

inflow. The ARK 21Shares Bitcoin ETF follows behind with

significant inflows of $130.6 million. The third-largest inflow to

a single fund for the day was recorded in the Bitwise Bitcoin ETF,

which saw $37.2 million in inflows. Source: X Other funds,

including the Franklin Bitcoin ETF, VanEck Bitcoin Trust, and the

WisdomTree Bitcoin Fund, all saw minor inflows of $7.9 million,

$6.2 million, and $0.9 million, respectively. In total, the inflows

to all six funds came out to $426 million. However, the Grayscale

Bitcoin Trust (GBTC) continues to bleed during this time, with

outflows of $22.4 million in the 24-hour period. This brought the

total net flows to $403.6 million. At the same time, funds such as

the iShares Bitcoin Trust, the Invesco Galaxy Bitcoin ETF, and The

Valkyrie Bitcoin Fund all saw negligible inflows during this time

frame. Gunning For A New Record The inflows into the Bitcoin Spot

ETFs over the last day are a testament to the demand that these

products are getting from the market. With institutional investors

gaining more exposure to BitBTCcoin, demand is expected to rise,

especially as the BTC price continues to do well. Related Reading:

Crypto Analyst Predicts Dogecoin Parabolic Breakout Above $3.5,

Here’s When The inflow volumes, while not the largest single-day

inflows so far, are significant when measured up to others. For

example, Seyffart points out that the daily record was from the

first day of trading when inflows climbed as high as $655 million.

The second-largest single-day net flow was then recorded earlier in

the month on February 13 with $631 million. “A big day from $IBIT

could push us beyond that Day 1 record,” Seyffart declared. At the

time of writing, the BTC price is experiencing a retracement after

reaching a new 2-year high of $57,000. It has seen 8.58% gains in

the last 24 hours to trade at $55.900, according to data from

CoinMarketCap. BTC price establishes support above $56,000 |

Source: BTCUSD on Tradingview.com Featured image from U.Today,

chart from Tradingview.com

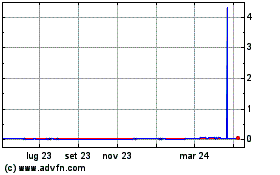

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Feb 2024 a Feb 2025