Bitcoin Bearish Signal: Analyst Predicts Potential Dip To $52,000

10 Maggio 2024 - 3:00PM

NEWSBTC

As the price action of Bitcoin continues to attract crypto

investors’ interest, Michael Van De Poppe, a well-known market

analyst and trader in a bearish scenario has made a worrying

prediction, warning the community of a potential drop in price for

the crypto asset to the $52,000 level. Bitcoin Poised For A

Possible Decline Michael Van De Poppe’s prognosis explores the

factors that are driving the gloomy view of Bitcoin‘s price

trajectory, in the midst of market turbulence and uncertainty.

Related Reading: Bitcoin Bears Keeps Pushing, Why BTC Could Turn

Bearish Below $60K? Van De Poppe affirms that the largest crypto

asset by market cap is currently at the range low. For Bitcoin to

maintain the range and the upward momentum to persist, this is

technically the region it should probably hold. Should the asset

fail to sustain this position, Van De Poppe anticipates a potential

movement on the downside in the future. Thus, he has placed his

price targets at $55,000 or even further toward the $52,000

threshold. The post read: Bitcoin is at the range low. This is

technically the area where you’d prefer to see it hold, so the

upward momentum continues, and the range holds. If this doesn’t

hold, then we might expect $52-55K as a potential low on this

correction. Van De Poppe previously pointed out that Bitcoin is

gradually moving close to the lower bounds of the range, in

order to test support around $62,250 level. Consequently, it

appears likely that BTC will keep moving toward the upside,

following the breakout of the support level. However, since the

recently concluded Bitcoin Halving event, boredom has set in,

suggesting a possible price decline. Thus, should a correction on

the downside eventually take place, $52,000 and $55,000 are the two

levels Van De Poppe expects BTC to drop to. Despite the negative

outlook for BTC, the crypto expert thus far has urged investors to

acquire more of the coin. Opposite Sentiment On BTC’s Investment

While Poppe solicits investors to invest more in BTC, crypto critic

and gold advocate Peter Schiff, on the other hand, has urged

investors not to do so. Instead, Schiff has highlighted a possible

impending massive rally for assets like Gold, Silver, and mining

stocks. Related Reading: Analysts Bullish On Bitcoin Despite Peter

Schiff’s $20,000 Doom Scenario He claims that the charts and the

fundamentals have never looked this promising. Due to this, Schiff

implored investors to engage more with these assets, saying Bitcoin

is dead money and holders should sell before it is buried. “Take

advantage of what could be the biggest precious metals bull market

in history,” Schiff added. As of today, Bitcoin’s price has shown

resilience, fueling optimism of an upward movement. BTC has

recovered the $63,000 price level once again after falling to

nearly $60,700 on Thursday. The digital asset is trading at

$63,077, indicating a 3% rise in the last 24 hours. Data from

CoinMarketCap shows that both the market cap and trading volume

have also increased by 3.10% and 5.52%, respectively, in the past

day. Featured image from iStock, chart from Tradingview.com

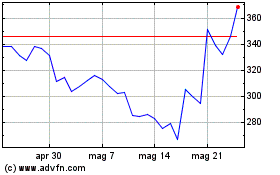

Grafico Azioni Gnosis (COIN:GNOUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Gnosis (COIN:GNOUSD)

Storico

Da Mar 2024 a Mar 2025