Injective Poised For Breakout? Unlock Event Sparks $60 INJ Price Surge Forecasts

08 Gennaio 2024 - 11:50AM

NEWSBTC

Injective (INJ), the native token of the decentralized exchange

protocol Injective Protocol, stands poised for a pivotal moment. On

January 21st, a final tranche of 3.66 million INJ tokens will be

unlocked, bringing the total circulating supply to a definitive 100

million. Injective Token Unlock: Market Dynamics Shift This marks

the culmination of a phased release schedule outlined in

Injective’s token distribution plan, and will see the remaining 16%

of token supply flood the market. Analysts remain divided on the

potential impact of this event. Some anticipate increased selling

pressure due to the sudden influx of tokens, potentially leading to

a price dip. Others view the unlock as a positive catalyst for

liquidity, making INJ easier to trade and potentially attracting

new investors. 🚨 Final Cliff Unlocks Alert 🚨 Mark your calendars

for January 21, 2024$INJ will be fully unlocked (100%) Get ready

for the massive cliff unlocks. 🪙 3.66 m tokens 💰 132.4 m dollars 🌀

4.35% of cir. supply Allocations: – Advisors: $12.04 m – Team:

$120.37 m$INJ was… pic.twitter.com/EYCyv4hsuC — Token Unlocks

(@Token_Unlocks) January 7, 2024 Related Reading: Akash Who?

Lesser-Known Altcoin Rules Weekend’s Top 100 List With 40% Rally

INJ market cap currently at $3.19 billion. Chart: TradingView.com

Regardless of the short-term price action, the full token unlock

undeniably represents a turning point for Injective, marking the

complete transition from initial distribution to sustained market

dynamics. It will be fascinating to observe how the community and

market respond to this milestone event, and whether it paves the

way for further growth and adoption of the Injective Protocol. $INJ

Bullish Flag Formation..!! Seems lie Ready for Another Bullish

Rally.#Crypto #InjectiveNetwork #INJ pic.twitter.com/OcPsNJ7laX —

Captain Faibik (@CryptoFaibik) January 6, 2024 Some market

participants, such as analyst Captain Faibik, believe that

Injective may be ready for another rally in anticipation of the

impending event. According to Faibik, INJ has established a bullish

flag and might see a rise beyond $60. Faibik examines the chart and

finds two rallies that are joined by a brief period of

consolidation. These might potentially lead to a continuing upswing

with higher highs and lowers. However, given that the market

crashed on January 3 and that INJ price originally dropped to

$33.55, selling pressure could be imminent. The 4-hour chart shows

rising volatility, and the Bollinger Bands point to overbought

circumstances following INJ’s prior surge to $40.28. INJ Price

Analysis Source: TradingView The price of INJ has been trending

downwards over the past 24 hours. It is currently trading at

$37.412, down from a high of $37.875 earlier in the day. The

Bollinger Bands (BB) are also trending downwards. This suggests

that volatility is decreasing, as the price is staying closer to

the moving average. The Chaikin Money Flow (CMF) is negative. This

indicates that bears are currently in control of the market. The

volume is relatively low. This suggests that the recent price

decline is not due to a large amount of selling pressure. Overall,

the chart suggests that INJ is in a bearish trend. However, the low

volume suggests that this trend may not be sustained. It is

important to note that this is just a snapshot of the market and

that conditions can change quickly. Source: Santiment The ongoing

unlocking of the token holds the promise of bolstering INJ’s social

metrics, indirectly contributing to a positive influence on its

price. This is particularly crucial as increased community

engagement often aligns with higher social metrics, reinforcing the

token’s popularity. The sustained high Social Dominance of INJ

signifies robust community support, a vital factor in navigating

the unpredictable cryptocurrency market. Related Reading: Cardano

Surges Nearly 250% In Development Activity, Whale Buying Appetite –

Details Simultaneously, the improvement in INJ’s Weighted Sentiment

indicates a prevailing bullish sentiment within the market. This

positive outlook among investors sets the stage for heightened

trading activity, potentially triggering an uptrend in the token’s

valuation. Both Social Dominance and Weighted Sentiment serve as

valuable indicators, providing insights into the token’s current

state and the prevailing market sentiment. Featured image from

Shutterstock

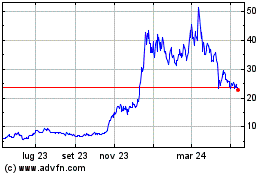

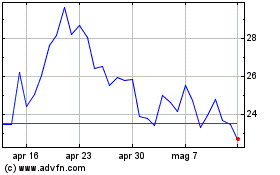

Grafico Azioni Injective Token (COIN:INJUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Injective Token (COIN:INJUSD)

Storico

Da Dic 2023 a Dic 2024