19 Million Chainlink Tokens Transferred To Exchanges – More Downside For LINK Price?

23 Giugno 2024 - 11:30AM

NEWSBTC

The cryptocurrency market witnessed severe bearish pressure over

the past week, and the price of Chainlink (LINK) wasn’t an

exception. The altcoin has continued to struggle with its torrid

form, losing nearly 10% of its value in the last seven days.

Interestingly, the bears seem to still be in control at the moment,

with the latest on-chain revelation suggesting that there might be

further downside for the LINK price over the next few days. Are

Chainlink Investors Offloading Their Assets? Popular crypto analyst

Ali Martinez revealed in a post on the X platform that huge amounts

of the Chainlink token have made their way to centralized exchanges

in the past day. This on-chain observation is based on Santiment’s

“Supply on Exchanges” metric, which tracks the amount of a

particular cryptocurrency being held on centralized exchanges.

Related Reading: Little-Known But Important Dogecoin Indicator Goes

Off, How High Can It Drive Price? When this metric’s value

increases, it implies that investors are making more deposits than

withdrawals of a cryptocurrency (Chainlink, in this case) into

centralized exchanges. A decrease in the metric’s value, on the

other hand, indicates that holders are moving their coins out of

the trading platforms. According to data from Santiment, more than

18.77 million LINK (worth roughly $256.2 million) were transferred

to cryptocurrency exchanges in the past day. This substantial

transfer represents one of the largest single-day movements for the

Chainlink token in recent months. Interestingly, a report

from SpotOnChain revealed that 21 million tokens were unlocked from

Chainlink’s non-circulating supply contracts on Friday, June 21.

Specifically, the contract transferred 2.25 LINK tokens were sent

to the multi-sig wallet 0xD50f More notably, 18.25 million LINK

tokens were sent to Binance, the world’s largest cryptocurrency

exchange. This significant token unlock presents a case of supply

inflation, which can impact the value of the token especially if a

sell-off occurs. Moreover, these fund movements can precipitate an

increase in market volatility and possibly lead to price

fluctuations. Given the magnitude and destination of these

transfers, there is a greater likelihood of increased selling

pressure, which can drive down the price of LINK. Is A Return

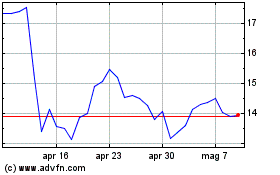

To $12 On The Cards? As of this writing, the price of Chainlink is

barely holding above $13.6, having declined by more than 3% in the

past day. Meanwhile, the altcoin slumped 9% from about $15 to $13.5

over the past week, according to data from CoinGecko. If the recent

selling pressure continues, then further decline might be on the

horizon for LINK’s price. This could see the cryptocurrency make a

return to around the $12 price zone for the first time in more than

a month. Related Reading: Toncoin Transfer Volume Hits $10 Billion,

Social Appeal Soars Nevertheless, the Chainlink token ranks amongst

the top 20 largest cryptocurrencies in the sector, with a market

capitalization of over $8.27 billion. Featured image from Binance

Academy, chart from TradingView

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni ChainLink Token (COIN:LINKUSD)

Storico

Da Gen 2024 a Gen 2025