Dogecoin & Other Memecoins Seeing Less Interest Than Bitcoin: Data

30 Luglio 2024 - 8:00PM

NEWSBTC

Data shows social media users are currently not paying much

attention to memecoins like Dogecoin (DOGE) as compared to Bitcoin

(BTC) and other top caps. Bitcoin & Other Layer 1 Top Caps

Getting All The Investor Focus Right Now According to data from the

analytics firm Santiment, social media users are showing increased

focus on the top layer 1 assets as compared to memecoin and other

sectors. The indicator of relevance here is the “Social Dominance,”

which is based on another metric called the Social Volume. The

Social Volume basically tells us about the amount of discussion

that any given topic or term is receiving on the major social media

platforms. The indicator makes this measurement by counting up all

posts/threads/messages that make at least one mention of the

keyword. Related Reading: Dogecoin Ready For $0.3? Analysts Bullish

On DOGE Price Breakout Attempt The reason that the indicator

doesn’t simply count up the mentions themselves is so that just a

few posts with a large amount of mentions can’t skew the value by

themselves. When the Social Volume spikes, it means the users

across social media are talking about the term and not just niche

circles. Now, the Social Dominance, the actual indicator of

interest here, keeps track of the percentage of the combined Social

Volume of the top 100 cryptocurrencies by market cap that a given

coin or group of coins is occupying right now. Below is the chart

shared by the analytics firm that shows the trend in the Social

Dominance for four segments of the sector over the past month: As

displayed in the graph, the Social Dominance of the top 6 layer 1

assets has recently been the highest in the sector. “Layer 1”

networks refer to those blockchains that handle their own security

and aren’t built on top of another network. The networks that are

built on these primary chains are titled Layer 2. Some of the top

layer 1 coins are Bitcoin, Ethereum (ETH), and Solana (SOL). While

these layer 1 coins are enjoying a high dominance of discussions in

the sector now, this wasn’t the case just earlier in the month.

Back then, the other segments of the sector had been getting the

focus instead. From the chart, it’s visible that the top layer 2

coins, like Polygon (MATIC) and the top meme coins, like Dogecoin,

have been receiving notable talk on social media. While this does

mean that investors aren’t interested in assets like Dogecoin right

now, the fact that the focus is on Bitcoin and other top caps could

actually be a bullish development for the sector as a whole.

Related Reading: Minimal Bitcoin On-Chain Resistance Ahead: Price

Set For New ATH? “Crypto’s consistent rises occur most often when

there is a focus on top caps (a sign of caution) rather than more

speculative assets (a sign of greed),” explains Santiment. Dogecoin

Price At the time of writing, Dogecoin is trading around $0.129,

down more than 4% over the past week. Featured image from Dall-E,

Santimnet.net, chart from TradingView.com

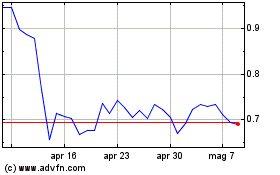

Grafico Azioni Polygon (COIN:MATICUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Polygon (COIN:MATICUSD)

Storico

Da Dic 2023 a Dic 2024