Bitcoin Open Interest Is Shooting Up: Will Shorts Be Rekt This Time?

30 Agosto 2024 - 5:30PM

NEWSBTC

Data shows the Bitcoin Open Interest on exchanges has been heading

up while the Funding Rate has turned negative recently. Bitcoin

Open Interest Trend Suggests Speculators Are Back As pointed out by

CryptoQuant community manager Maartunn in a new post on X, things

appear to be heating up on the derivatives side of the market.

There are two indicators of relevance here: Open Interest and

Funding Rate. Related Reading: XRP Whales Are Depositing To

Exchanges: Price To Drop Further? The first of these, the Open

Interest, keeps track of the total amount of derivatives contracts

related to Bitcoin, whether short or long positions, that are

currently open on all exchanges. When the value of this metric goes

up, it means the investors are opening up fresh positions on the

market right now. As new positions generally come with an increase

in the overall leverage present in the sector, this kind of trend

can lead to higher volatility for the asset. On the other hand, the

indicator’s value observing a decline implies investors either are

closing up positions of their own volition or are getting

liquidated by their platform. The coin’s price may become more

stable following this trend. Now, here is a chart that shows the

trend in the Bitcoin Open Interest over the past few days: As

displayed in the above graph, the Bitcoin Open Interest had taken a

plunge earlier as a result of the cryptocurrency’s decline towards

the $58,000 level, which had induced the liquidation of a

significant amount of long positions. After observing some sideways

movement, the metric has been on its way back up again, suggesting

investors have been opening new positions. This speculative

activity can naturally lead to more volatility for the asset. In

theory, such volatility can take the asset in either direction, but

depending on the composition of the positions present on the

derivatives market, one direction may be more probable than the

other. The indicator that sheds light on the structure of the

sector is the second metric of interest here: the Funding Rate.

This indicator basically keeps track of the amount of periodic fee

that traders on the derivatives market are exchanging between each

other. From the chart, it’s visible that the Bitcoin Funding Rate

has been negative during this recent Open Interest increase. When

the metric has a negative value, it means the short holders are

paying a premium to the longs in order to hold onto their

positions, so the new positions that have appeared in the sector

recently would be short ones. Related Reading: Polygon On-Chain

Activity Lights Up: MATIC Reversal Incoming? Because of the

short-heavy market, it’s more likely that these investors betting

on a bearish outcome get caught up in a mass liquidation event,

thus taking Bitcoin is a more bullish direction. It only remains to

be seen, though, as to how BTC’s price action would play out in the

coming days. BTC Price Bitcoin had seen a brief rebound above

$61,000 yesterday, but the coin appears to be back down under

$60,000 today. Featured image from Dall-E, Coinalyze.net, chart

from TradingView.com

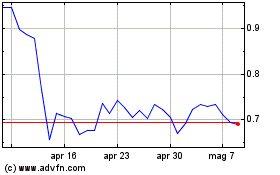

Grafico Azioni Polygon (COIN:MATICUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Polygon (COIN:MATICUSD)

Storico

Da Dic 2023 a Dic 2024