Solana Hits $170, Bullish Channel Formation Indicates Possible Rally

24 Luglio 2024 - 6:00PM

NEWSBTC

The cryptocurrency market has witnessed significant fluctuation,

with Solana (SOL) experiencing a notable retracement to $170.27,

creating a bullish channel in the process. This recent market

behavior happens after a period of a potential rally that has

previously pushed the price of SOL above the $170.27 level.

As the price of this digital asset continues to trend within the

channel, the question remains whether bulls will regain control and

push the price above the bullish channel or will the bears maintain

their dominance and drive the price below it. In this article, we

will examine Solana’s recent price movements using technical

indicators to forecast future trends and highlight key levels to

watch. Technical Examination On The Current Price Movement Of

Solana On the 4-hour chart, Solana’s price is currently above

the 100-day Simple Moving Average (SMA), suggesting a potential

resurgence of bullish momentum for SOL. Additionally, the price has

faced resistance at the $170 mark, as indicated by two bullish

candlesticks signaling this rejection. The signal line of the

4-hour Relative Strength Index (RSI) indicator, which recently

dipped slightly below 50%, is now attempting to cross back above

the 50% mark. If successful, this cross could indicate a potential

price increase for Solana. On the 1-hour chart, Solana is climbing

toward the 100-day Simple Moving Average (SMA), indicating a

potential upward movement as it may attempt to break above the

level. Also, SOL’s price has established a bullish channel pattern

on the 1-hour chart. A breakout and close above the channel’s upper

line could ignite positive sentiment, as the bulls may regain

control. Lastly, the signal line of the RSI indicator on the 1-hour

chart is also currently approaching the 50% mark, suggesting

possible upward momentum. Key Levels To Watch In The Event of A

Breakout Considering the current positive rebound at $170, if

the price of Solana breaks and closes above the upper boundary of

the bullish channel, it may continue its rally toward the $188

resistance range. Should Solana manage to surpass this resistance

level, it could lead to an additional upward move, pushing towards

$205 along with other resistance points beyond. Nonetheless, if

Solana’s price breaks and closes below the channel’s lower

boundary, it could decline to the $160 support level. Should the

price break and close below $160, it might trigger further bearish

momentum, pushing the price toward the $118 support range or even

lower. As of the time of writing, Solana’s price has decreased by

0.72%, trading at approximately $173 over the past 24 hours. The

cryptocurrency has a market capitalization of over $80 billion and

a trading volume exceeding $3 billion. There has been a 0.71%

decline in SOL’s market cap, accompanied by a 7.10% increase in

trading volume over the last 24 hours. Featured image from Adobe

Stock, chart from Tradingview.com

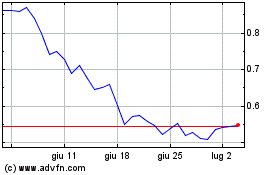

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Mina (COIN:MINAUSD)

Storico

Da Lug 2023 a Lug 2024