Bitcoin Trades Below Global Prices In South Korea, Erasing Long-Standing ‘Kimchi Premium’ – Here’s Why

18 Ottobre 2024 - 4:00AM

NEWSBTC

Bitcoin (BTC) is trading slightly lower in South Korea compared to

the global cryptocurrency markets due to a reverse ‘kimchi

premium,’ not seen since October 2023. Reverse ‘Kimchi Premium’

Makes Bitcoin Cheaper In South Korea According to a report by The

Korea Times, there is a price differential of more than $500

between Bitcoin’s price in South Korea and global markets. Analysts

attribute this to a negative ‘kimchi premium.’ Related Reading:

Analyst Warns Of Bitcoin Market Shift: Are We Near A Major

Sell-Off? For the uninitiated, kimchi premium refers to the price

difference where BTC trades at a higher price on South Korean

exchanges than on global markets. This premium is driven by local

demand, regulatory factors, and capital controls in South Korea,

leading to occasional price discrepancies. Currently, the kimchi

premium stands at -0.74%, leading to a lower market price for BTC

on South Korean exchanges than the rest of the world. Notably, the

kimchi premium has been negative since October 15. A positive

premium indicates strong demand for the underlying digital asset.

In contrast, a negative premium might suggest that investors may be

looking to trade on foreign exchanges due to South Korea’s

stringent regulations surrounding digital assets. A positive Kimchi

Premium is common on South Korean exchanges, which often experience

high trading volumes. When BTC briefly crossed $72,000 in March

2024, the kimchi premium surged as high as 10%. The report suggests

low domestic investor sentiment is a key factor behind the negative

premium. While global crypto trading volumes have surged due

to the upcoming US presidential elections and a Chinese stimulus

package, sentiment in South Korea remains lukewarm. KP Jang, head

of Xangle Research, commented: Korea prohibits foreign and

institutional investors from using domestic exchanges, which makes

the decline in retail investor demand a more direct factor.

Further, the preference for typically riskier altcoins in hopes of

extraordinary profits might influence the local South Korean crypto

market, driving attention away from BTC and leading to lower

trading volumes. That said, analysts expect the negative kimchi

premium to be a temporary phenomenon. Jang explained that,

historically, such price discrepancies have only persisted for a

short period. Will A Regulatory Overhaul Help South Korea? The

crypto regulatory framework in the peninsular country is witnessing

several changes to streamline digital asset trading and ensure

sufficient customer protection mechanisms are in place. Related

Reading: South Korean Authorities Investigate Lawmaker Over Alleged

Crypto Transfers In 2022, South Korea elected pro-crypto Yoon

Suk-Yeol as president. As part of his election campaign, Yoon

promised to reduce government interference in crypto markets,

calling existing regulations “far from reality and absurd.” In

contrast, neighboring Japan has openly embraced digital assets amid

evolving crypto regulations. For instance, earlier this year,

Japan’s Government Investment Pension Fund (GIPF), with $1.5

trillion in assets, expressed a desire to gain exposure to

BTC. BTC trades at $67,559 at press time, down 0.4% in the

past 24 hours. When writing, the leading cryptocurrency commands a

total market cap of $1.33 trillion. Featured image from Unsplash,

Chart from Tradingview.com

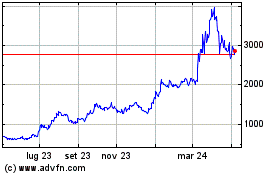

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Dic 2024 a Gen 2025

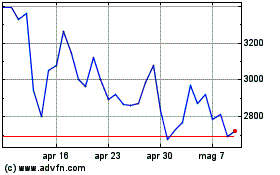

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Gen 2024 a Gen 2025