This Week’s Crypto Watchlist: Top Coins Poised For Gains

07 Maggio 2024 - 3:00PM

NEWSBTC

In a post on X, crypto analyst Miles Deutscher laid out his

strategic predictions for high-performing cryptocurrencies in the

upcoming week to his 501,700 followers. His analysis delved deep

into Bitcoin’s trading patterns, the surging AI-driven altcoin

sector, and specific tokens that are displaying considerable

potential due to recent developments and broader market dynamics.

Bitcoin And AI Crypto Tokens Are Set To Dominate This Week At the

forefront of Deutscher’s analysis, Bitcoin has recently returned to

its previous trading range between $60,000 and $69,400 after

experiencing a sharp drop. This movement was characterized as a

significant deviation, suggesting manipulation or a shakeout of

weak hands before a potential rally. “Bitcoin is at the top of my

watchlist for this week. Had a big fakeout/deviation to the

downside, and now back within the range,” Deutscher stated. He

pointed out that the key factor to watch is whether the current

range’s lower boundary will hold, which could serve as a strong

foundation for an upward trajectory. Moreover, the AI sector has

been particularly resilient and robust recently, bouncing back

significantly amidst broader market recoveries. Deutscher

highlighted the sector’s potential for outperformance, driven by

several upcoming major events. These include Apple’s Worldwide

Developers Conference (WWDC), NVIDIA’s earnings announcement, and

the anticipated release of ChatGPT 5. “AI is one of those unique

narratives that retains constant mindshare due to its endless

real-life news flow/hype,” Deutscher explained. Related Reading:

Here’s Why This Crypto Analyst Believes Bitcoin Is At A ‘Prime Buy

Zone’ One specific AI token which Deutscher watches closely due to

its alleged partnership with Apple is Render (RNDR), making it a

prime candidate for speculation around the upcoming Apple event.

Historically, RNDR has also led the AI token sector during market

rotations. Furthermore, Deutsches focuses on Near Protocol (NEAR),

Fetch.ai (FET), AIOZ Network (AIOZ). He grouped these tokens

together due to their correlation but noted their recent technical

performance, where they bounced cleanly off daily support levels

and established higher lows. More Altcoins To Watch TON: Recently

the center of attention, TON experienced a drop after the Token2049

event in what Deutscher described as a “sell-the-news” scenario.

However, recent investments by firms like Pantera signal continued

interest and potential undercurrents of growth. Ethena (ENA): With

the market sentiment turning bullish again, Deutscher anticipates a

return to positive funding rates, which typically benefit tokens

like Ethena. Recent activity from the Ethena team, including

increased reward boosts and optimistic social media posts from its

founders, further bolster the bullish case. “Also hearing rumors of

a T1 exchange listing,” Deutscher added, suggesting an impending

increase in liquidity and exposure. Related Reading: Crypto Analyst

Reveals 6 Must-Buy Altcoins With The Most Potential Jito (JTO):

Jito is reportedly developing what Deutscher referred to as the

“Eigen Layer of Solana,” aiming to replicate the success and hype

surrounding the Eigen project’s layer solutions. Despite the

challenges of a recent airdrop, Deutscher sees potential if the

team executes well, particularly as the restaking narrative has not

yet fully penetrated the market. PopCat (POPCAT): Despite facing

some fear, uncertainty, and doubt (FUD) related to copyright issues

over the weekend, POPCAT continues to exhibit strong price action,

pushing toward new highs. “POPCAT seems the best contender, for

now, not a single cat meme coin has yet to hit a $1B market cap,”

noted Deutscher, highlighting its standout performance. Ethereum

Finance (ETHFI): In the realm of liquidity reward tokens (LRT),

ETHFI remains a notable mention despite a broader sector sell-off

post-Eigen. Deutscher believes the selling may have been

overreactive, and with total value locked (TVL) still on the rise,

a reversion to mean on prices could be imminent. SEI Network (SEI):

As anticipation builds for the launch of the new layer one

blockchain, Monad, later this year, SEI is seen as a strategic

play. Categorized within the parallelized Ethereum Virtual Machine

(EVM) narrative, SEI experienced a substantial sell-off but is

poised for recovery as the market focus shifts towards upcoming

launches. Friend (FRIEND): After recommending FRIEND at $1.30,

Deutscher continues to see upside potential, particularly as it

approaches more significant centralized exchange listings. He

advises keeping an eye out for major pullbacks as opportunities to

buy. Featured image from Matt Paul Catalano / Unsplash, chart from

TradingView.com

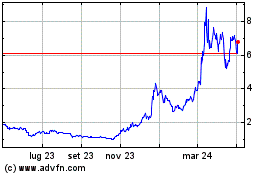

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Nov 2024 a Dic 2024

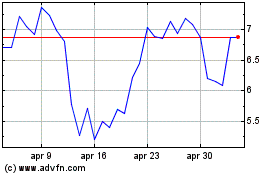

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Dic 2023 a Dic 2024