Crypto Expert Predicts: These 8 Altcoins ‘Will Make You Rich’

21 Maggio 2024 - 1:00PM

NEWSBTC

In a new YouTube analysis released to his 502,000 followers, crypto

strategist Miles Deutscher shared his insights on the evolving

landscape of crypto investments. Deutscher’s discourse delved deep

into the inefficacies of traditional venture capital (VC)

investment models in the crypto space and proposed an alternative

strategy focusing on certain altcoins which he believes are poised

for significant growth. Deutscher criticized the conventional

VC-backed token launches, stating, “VCs get in at super low

valuations […] Then, when these tokens launch, they’re incentivized

to launch them as high as possible in fully diluted valuation

terms.” This practice, he argued, results in launch prices that are

too steep, blocking effective price discovery mechanisms essential

for healthy market participation by retail investors.The subsequent

overvaluation typically leads to rapid price declines as initial

investors quickly sell off their holdings to realize gains.

Highlighting a shift in market dynamics, Deutscher pointed out that

meme coins have gained popularity as a form of retaliation against

the VC-dominated ecosystem. “People do feel like the game has been

rigged and they want to gain an edge,” he explained. According to

him, the success of meme coins can be attributed to their generally

fairer launch processes compared to traditional VC-funded tokens.

To 8 Altcoins To Buy Now Throughout his video, Deutscher listed

eight altcoins that align with this new investment “meta,”

emphasizing tokens that are “fully diluted and have equally good

narratives.” Each coin is selected based on its tokenomics, Fully

Diluted Valuation” (FDV), market position, and potential for growth

without significant sell pressure from initial large holders:

Related Reading: BitMEX Founder Predicts The Dawn Of ‘Crypto

Valhalla’: When Will It Start? Solana (SOL): Deutscher views Solana

as a leader due to its technological prowess and significant

community backing. It has shown resilience and innovation, making

it one of his largest holdings due to consistent outperformance.

“Solana has climbed to be one of my biggest holdings due to its

outperformance. It’s a leader in the market for a reason, and

congrats to everyone that’s gotten on board the Solana train with

me.” Ton (TON): TON’s attractive FDV ratio suggests a stable market

entry with less speculative risk compared to other high-valuation

launches. Deutscher highlights its potential for growth without

overwhelming sell pressure. He stated: “TON, being another layer

one, is not just another blockchain. Okay, it’s relatively highly

valued, but it’s mostly diluted in the market, which is good. Its

FDV ratio is actually 68, so it’s a stable investment.” NEAR

Protocol (NEAR): NEAR is emphasized as a strong AI proxy due to its

technological foundation and leadership. Its high level of dilution

(91% FDV) means most tokens are in circulation, reducing sell

pressure. “NEAR comes in at a whopping 91% fully diluted, which

means there isn’t much sell pressure. I do think NEAR is one of the

top L1s, especially acting as a very strong AI proxy because the

founder has his roots in AI,” Deutscher remarked. Injective

Protocol (INJ): With a 94% market cap to FDV ratio, INJ is seen as

having robust market health and less price suppression from

unlocks. Deutscher believes it is poised for resurgence based on

its strong fundamentals and recent market behaviors. “Injective has

a 94% market cap to FDV ratio, which is really impressive and is

one that outperformed earlier in the year but has just started to

stagnate a bit. I think at some point, this is definitely going to

rear its head again as a narrative,” he stated. Related Reading:

Cardano Founder Predicts Crypto As Election Game-Changer: Impact On

Price Arweave (AR): Deutscher praises Arweave as one of the top

infrastructure plays, not just for data storage but also for its

potential integration with AI. The fact that it’s fully diluted

means minimal sell pressure moving forward. “Arweave positions

itself as one of the top infrastructure plays. It’s still not a

crazy FDV at 3.1, considering it has a 100% circulating market cap,

which means all of the unlocks have taken place.” AIOZ Network

(AIOZ): AIOZ fits into the AI and decentralized content narrative

with its unique offering in decentralized streaming and storage

solutions. The fully diluted status of AIOZ tokens makes them

particularly appealing.”AIOZ is another coin that is fully diluted

in the market. It’s a coin in the deep tech/AI sector. I like what

they’re building and it also includes decentralized storage, but

also it’s decentralized AI compute network,” Deutscher explained.

WIF: Dogwifhat’s fair launch process and full dilution are major

pluses, helping it to achieve strong price performance without the

usual VC-induced sell pressure, according to Deutscher. PEPE:

Deutscher has personally seen substantial returns from Pepe, noting

its recent “healthy cool off” as an opportune time for

accumulation. The coin’s community-driven approach and meme status

offer unique market resilience. “Pepe is another leading meme coin

in my opinion. Very healthy cool off and one that I’m welcoming as

someone that would like to get more exposure,” he revealed. High

Potential Cryptos With Low Float, High FDV Deutscher also discussed

the potential of investing in low float, high FDV tokens under

specific conditions. Using Ondo Finance (ONDO) as a case study, he

detailed how a deep understanding of tokenomics could reveal hidden

opportunities. “ONDO’s vesting schedule is public, showing that

most insiders are locked till 2025, minimizing sell pressure and

allowing for price appreciation,” he noted. Concluding his

analysis, Deutscher urged his viewers to adopt a nuanced investment

strategy that leverages both market trends and in-depth token

analysis. He emphasized the importance of buying during periods of

“extreme fear” and selling during “extreme greed” to maximize

returns. At press time, SOL traded at $183.33. Featured image

created with DALL·E, chart from TradingView.com

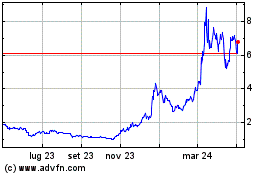

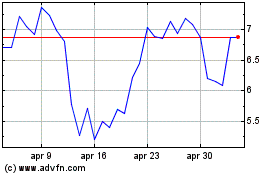

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Dic 2023 a Dic 2024