Breakout Alert! Chainlink (LINK) On Verge Of Major Surge, Analyst Says

16 Giugno 2024 - 4:02PM

NEWSBTC

After a period of consolidation, Chainlink (LINK), the oracle

network powering decentralized applications (dApps), is exhibiting

signs of a potential breakout. This bullish sentiment comes amidst

a broader recovery in the cryptocurrency market, with Bitcoin

regaining its footing above the crucial $65,000 support level.

Related Reading: NEAR Protocol: From Recent Dip To Google Search

Darling – Is $16 Next? Technical Indicators Look Verdant Renowned

crypto analyst Jonathan Carter is among those betting big on LINK’s

future. Chainlink’s price structure is forming a bullish pattern,

Carter remarked, pointing to the token’s recent rebound from the

middle line of a descending channel. #LINK ChainLink is showing a

bullish structure by bouncing off the middle line of a descending

channel🧐 A breakout above the MA 200 (around $16) could push price

towards the resistance zone near $25🎯 pic.twitter.com/SmlGnbHkku —

Jonathan Carter (@JohncyCrypto) June 14, 2024 A decisive break

above the 200-day moving average, currently hovering around $16,

could propel LINK towards a resistance zone near $25, according to

Carter’s analysis. This potential price surge is further bolstered

by various technical indicators. Mixed Market Sentiment With

Underlying Bullishness While the overall market sentiment leans

slightly bearish, there are pockets of optimism surrounding

Chainlink. The latest price forecast for LINK predicts a 4%

increase to approximately $16.53 in the next coming days.

Interestingly, some analysts highlight a dichotomy in investor

sentiment. Despite the recent price dip, a significant 30% of

market participants still hold bullish views on LINK. Market Smells

Greed Further fueling this optimism is the current reading of 74 on

the Fear & Greed Index, which suggests a dominant sentiment of

“greed” among investors. This indicates that despite short-term

price fluctuations, investor confidence in Chainlink’s long-term

potential remains strong. While the current outlook for Chainlink

is undeniably optimistic, experts urge investors to approach the

market with caution. Price predictions, particularly in the highly

volatile cryptocurrency space, are inherently subjective and

susceptible to unforeseen circumstances. The broader market

sentiment, currently reflecting “greed,” could also lead to a

correction if investor expectations are not met. Investors should

always conduct their own research before making any investment

decisions, advised a spokesperson for Chainlink. Understanding the

underlying technology, the project roadmap, and the risks involved

is crucial for navigating the dynamic world of cryptocurrencies.

Related Reading: XRP Whale Goes On Shopping Spree: 27 Million Coins

Snapped Up As Price Dips Chainlink’s Core Strength Despite the

inherent volatility, Chainlink’s core value proposition as a secure

and reliable oracle network for dApps remains a key driver of its

long-term potential. By bridging the gap between decentralized

networks and the real world, Chainlink plays a critical role in

enabling the growth and adoption of decentralized finance (DeFi).

With a potential breakout on the horizon and renewed optimism in

the crypto market, the coming weeks will be crucial in determining

the token’s future trajectory. As the DeFi space flourishes,

Chainlink’s ability to connect blockchains to external data feeds

will undoubtedly be a factor to watch. Featured image from Pexels,

chart from TradingView

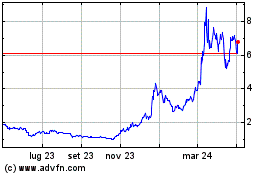

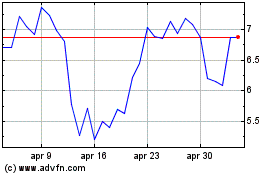

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni NEAR Protocol (COIN:NEARUSD)

Storico

Da Dic 2023 a Dic 2024